- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

Global Stocks Estimated Below Intrinsic Value In September 2025

Reviewed by Simply Wall St

In September 2025, global markets are experiencing a mixed performance, with U.S. stocks showing declines amid cautious commentary from Federal Reserve officials and stable inflation figures. As investors navigate this challenging environment, identifying undervalued stocks becomes crucial; these are companies whose market prices may not fully reflect their intrinsic value, offering potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK41.84 | SEK82.51 | 49.3% |

| SRE Holdings (TSE:2980) | ¥3260.00 | ¥6495.93 | 49.8% |

| Qt Group Oyj (HLSE:QTCOM) | €44.02 | €86.04 | 48.8% |

| Pansoft (SZSE:300996) | CN¥17.42 | CN¥33.84 | 48.5% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| NexTone (TSE:7094) | ¥2284.00 | ¥4465.50 | 48.9% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.40 | NOK59.87 | 49.2% |

| HAESUNG DS (KOSE:A195870) | ₩30750.00 | ₩60389.69 | 49.1% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.60 | CN¥77.70 | 49% |

| Aker BioMarine (OB:AKBM) | NOK84.30 | NOK168.11 | 49.9% |

Here's a peek at a few of the choices from the screener.

Dongfeng Motor Group (SEHK:489)

Overview: Dongfeng Motor Group Company Limited is involved in the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and auto parts in China with a market cap of approximately HK$73.78 billion.

Operations: Revenue segments for the company include CN¥56.02 billion from passenger vehicles, CN¥46.96 billion from commercial vehicles, and CN¥5.61 billion from financing services.

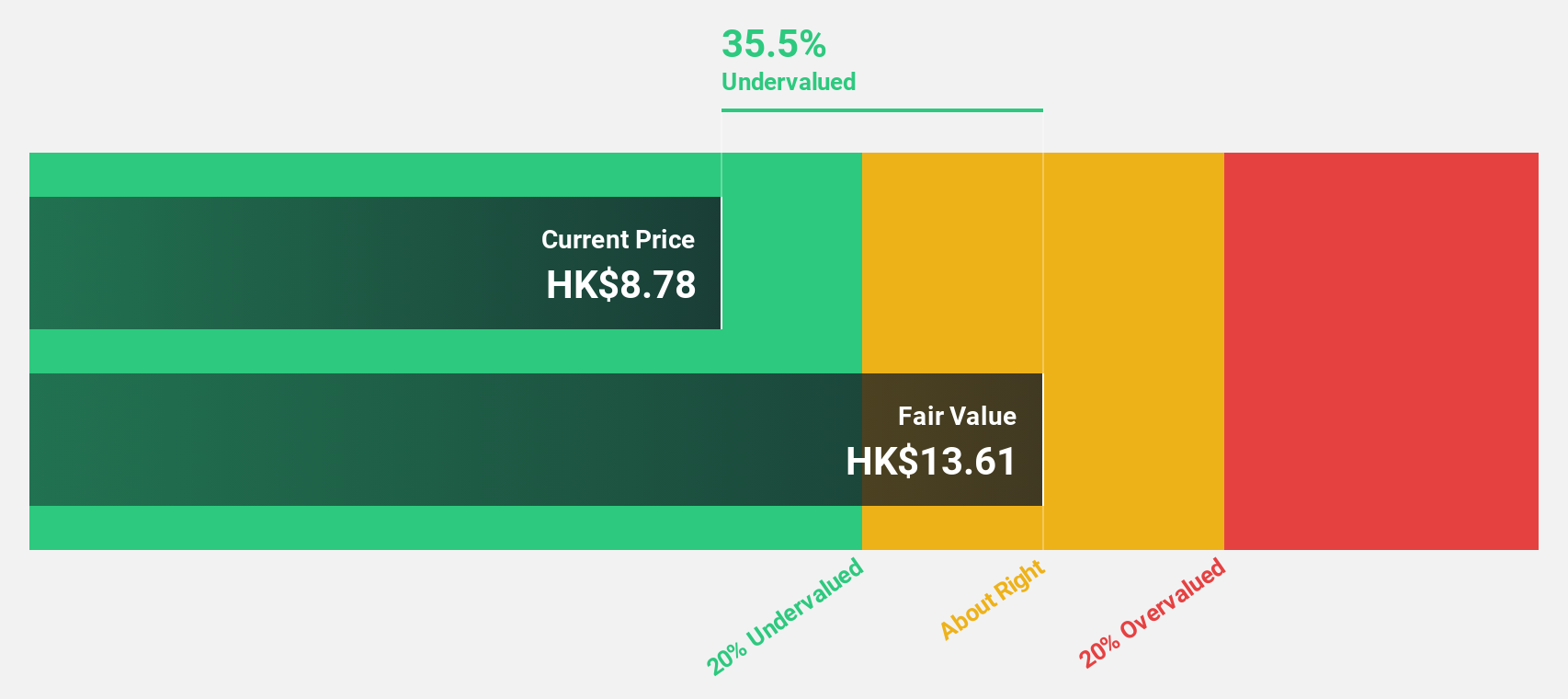

Estimated Discount To Fair Value: 34.3%

Dongfeng Motor Group's shares are trading at HK$8.94, significantly below the estimated fair value of HK$13.61, indicating potential undervaluation based on discounted cash flow analysis. Despite a volatile share price and declining net income, the company is expected to achieve above-average market profit growth over the next three years. Recent strategic alliances for manufacturing intelligent off-road vehicles could bolster future revenue streams, although current return on equity forecasts remain low at 1.2%.

- The analysis detailed in our Dongfeng Motor Group growth report hints at robust future financial performance.

- Dive into the specifics of Dongfeng Motor Group here with our thorough financial health report.

Shanghai Aohua Photoelectricity Endoscope (SHSE:688212)

Overview: Shanghai Aohua Photoelectricity Endoscope Co., Ltd. specializes in the development and manufacturing of medical endoscopic equipment, with a market cap of CN¥6.62 billion.

Operations: The company generates revenue primarily from its Diagnostic Kits / Equipment segment, totaling CN¥656.37 million.

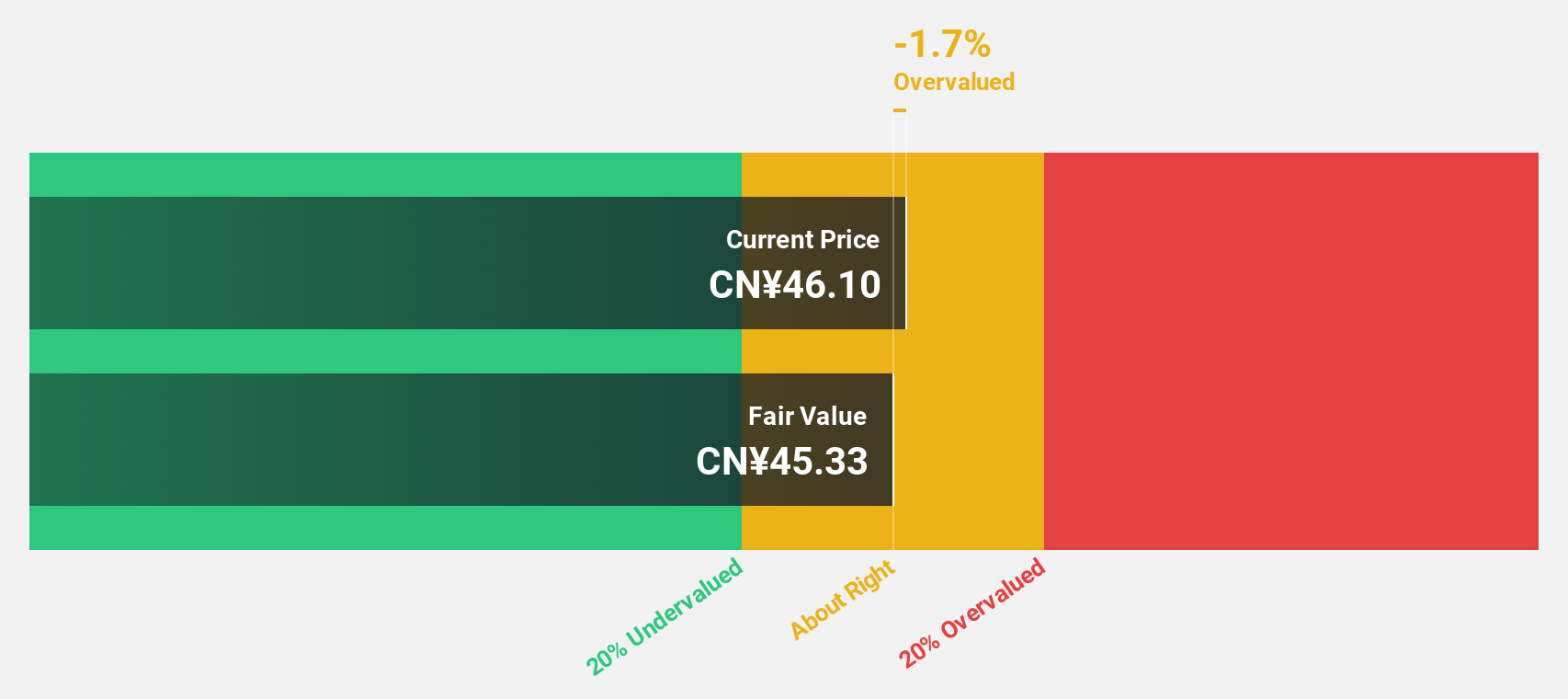

Estimated Discount To Fair Value: 41.3%

Shanghai Aohua Photoelectricity Endoscope is trading at CN¥50.25, significantly below its estimated fair value of CN¥85.61, suggesting potential undervaluation based on discounted cash flow analysis. Despite reporting a net loss of CNY 40.77 million for the first half of 2025, the company is forecasted to achieve profitability within three years and expects revenue growth to exceed the Chinese market average at 20.8% per year, although return on equity forecasts remain modest at 8.4%.

- Our growth report here indicates Shanghai Aohua Photoelectricity Endoscope may be poised for an improving outlook.

- Take a closer look at Shanghai Aohua Photoelectricity Endoscope's balance sheet health here in our report.

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants globally, with a market cap of ₪5.99 billion.

Operations: The company's revenue is primarily derived from its Internet Software and Services segment, totaling $348.66 million.

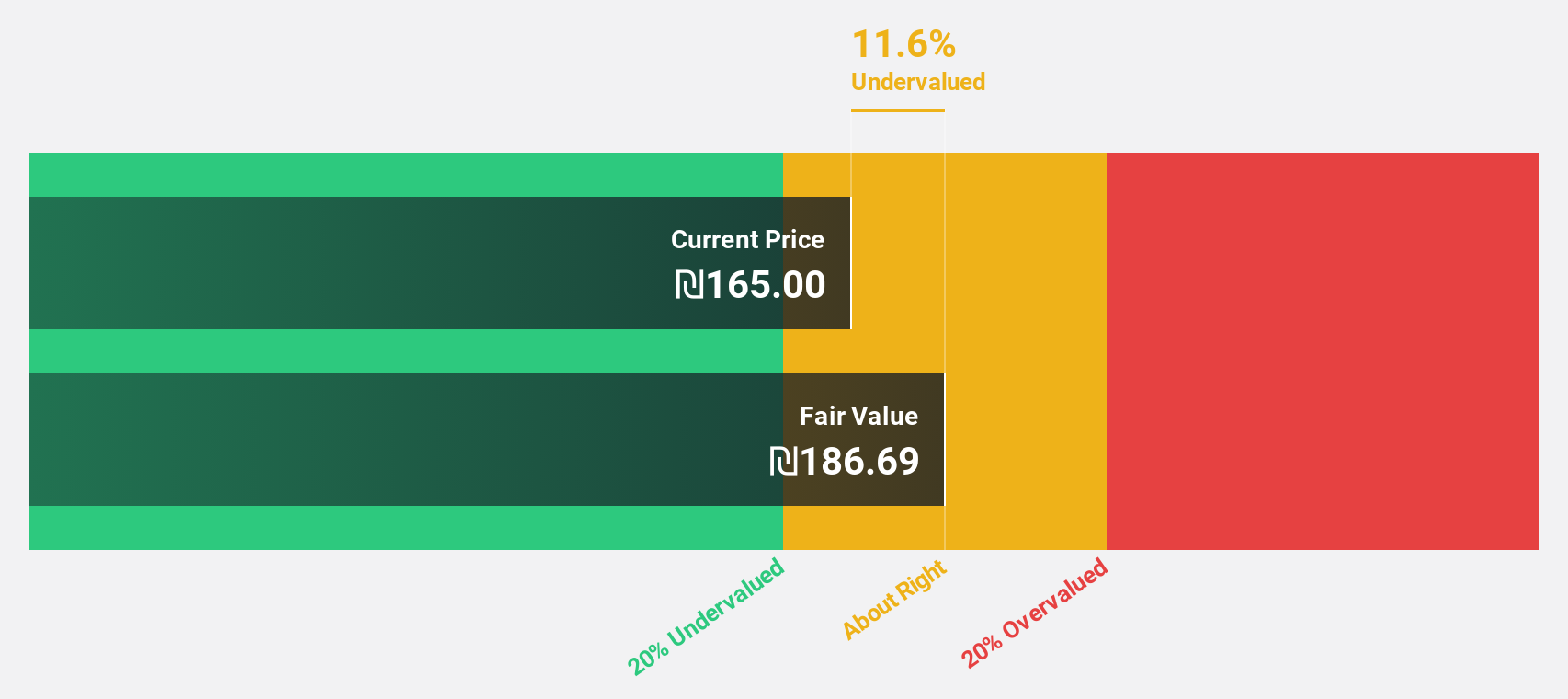

Estimated Discount To Fair Value: 18.4%

Nayax Ltd. is trading at ₪162.1, below its estimated fair value of ₪198.64, indicating it may be undervalued based on cash flows despite not being significantly so. The company recently turned profitable, reporting a net income of US$11.65 million for Q2 2025 from a previous loss and forecasts earnings growth of 38.8% annually over the next three years, outpacing the IL market's average growth rate.

- Upon reviewing our latest growth report, Nayax's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nayax with our comprehensive financial health report here.

Seize The Opportunity

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 525 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives