- South Korea

- /

- Machinery

- /

- KOSE:A010140

Global Market Highlights 3 Companies Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have demonstrated resilience amidst a U.S. government shutdown and mixed economic signals, with equities gaining ground on expectations of potential interest rate cuts by the Federal Reserve. As investors navigate this uncertain landscape, identifying undervalued stocks can present opportunities for those seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Profoto Holding (OM:PRFO) | SEK17.80 | SEK35.06 | 49.2% |

| Nexam Chemical Holding (OM:NEXAM) | SEK3.76 | SEK7.47 | 49.7% |

| Micro Systemation (OM:MSAB B) | SEK62.40 | SEK122.50 | 49.1% |

| Meitu (SEHK:1357) | HK$9.33 | HK$18.35 | 49.2% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.19 | 49.1% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.30 | €12.55 | 49.8% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥61.70 | CN¥121.84 | 49.4% |

| GigaVis (KOSDAQ:A420770) | ₩40850.00 | ₩80571.70 | 49.3% |

| Essex Bio-Technology (SEHK:1061) | HK$4.81 | HK$9.49 | 49.3% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.25 | CN¥59.60 | 49.2% |

Here's a peek at a few of the choices from the screener.

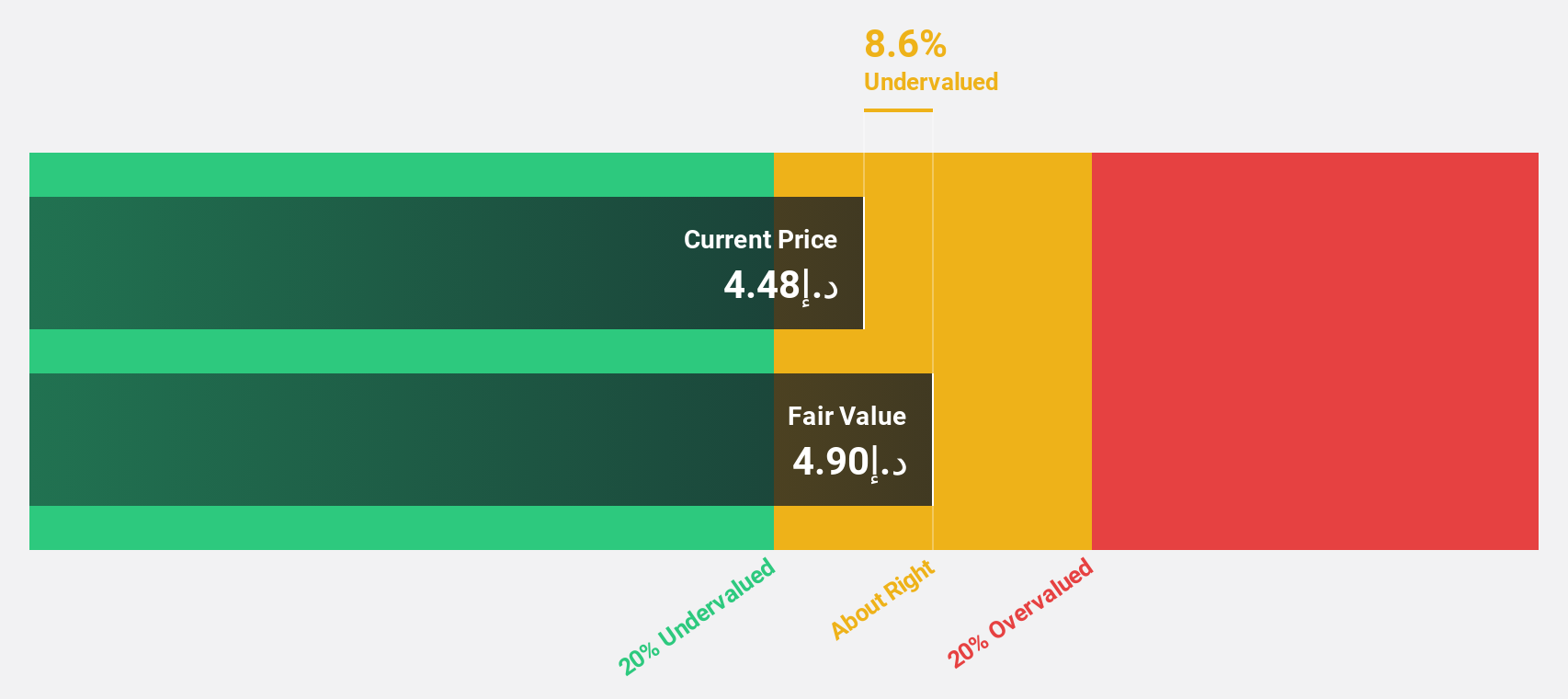

Taaleem Holdings PJSC (DFM:TAALEEM)

Overview: Taaleem Holdings PJSC operates in the education sector by providing and investing in educational services in the United Arab Emirates, with a market capitalization of AED4.25 billion.

Operations: The company's revenue primarily comes from its school operations, totaling AED1.10 billion.

Estimated Discount To Fair Value: 19.7%

Taaleem Holdings PJSC is trading at AED 4.25, below its estimated fair value of AED 5.29, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow at 16.5% per year, outpacing the AE market's growth rate of 6.6%. Recent financials show robust performance with net income rising to AED 164.51 million from AED 138 million last year, supporting its potential for future profitability and value realization.

- Insights from our recent growth report point to a promising forecast for Taaleem Holdings PJSC's business outlook.

- Click here to discover the nuances of Taaleem Holdings PJSC with our detailed financial health report.

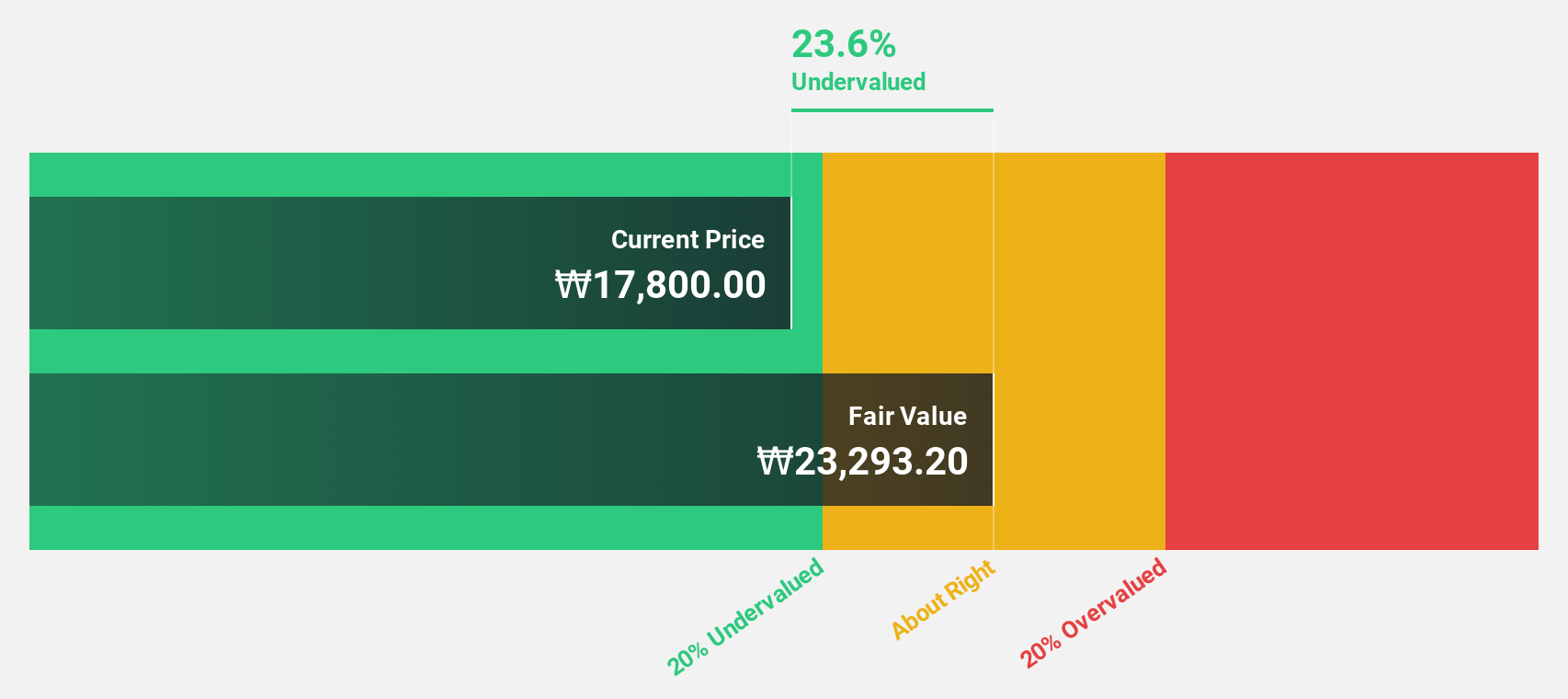

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy and infrastructure sectors with a market cap of ₩18.66 trillion.

Operations: The company's revenue primarily comes from its Shipbuilding & Marine Engineering segment, generating ₩9.89 billion, followed by the Construction segment at ₩513.68 million.

Estimated Discount To Fair Value: 25.6%

Samsung Heavy Industries, trading at ₩22,400 and below its estimated fair value of ₩30,125, appears undervalued based on cash flows. Recent earnings demonstrate a substantial increase in net income to ₩214.11 billion from ₩76.56 billion year-on-year. With forecasted annual earnings growth of 38.8%, surpassing the KR market's 24.1%, the company is positioned for significant profitability despite a high debt level and low future return on equity projections at 18%.

- Our comprehensive growth report raises the possibility that Samsung Heavy Industries is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Samsung Heavy Industries' balance sheet health report.

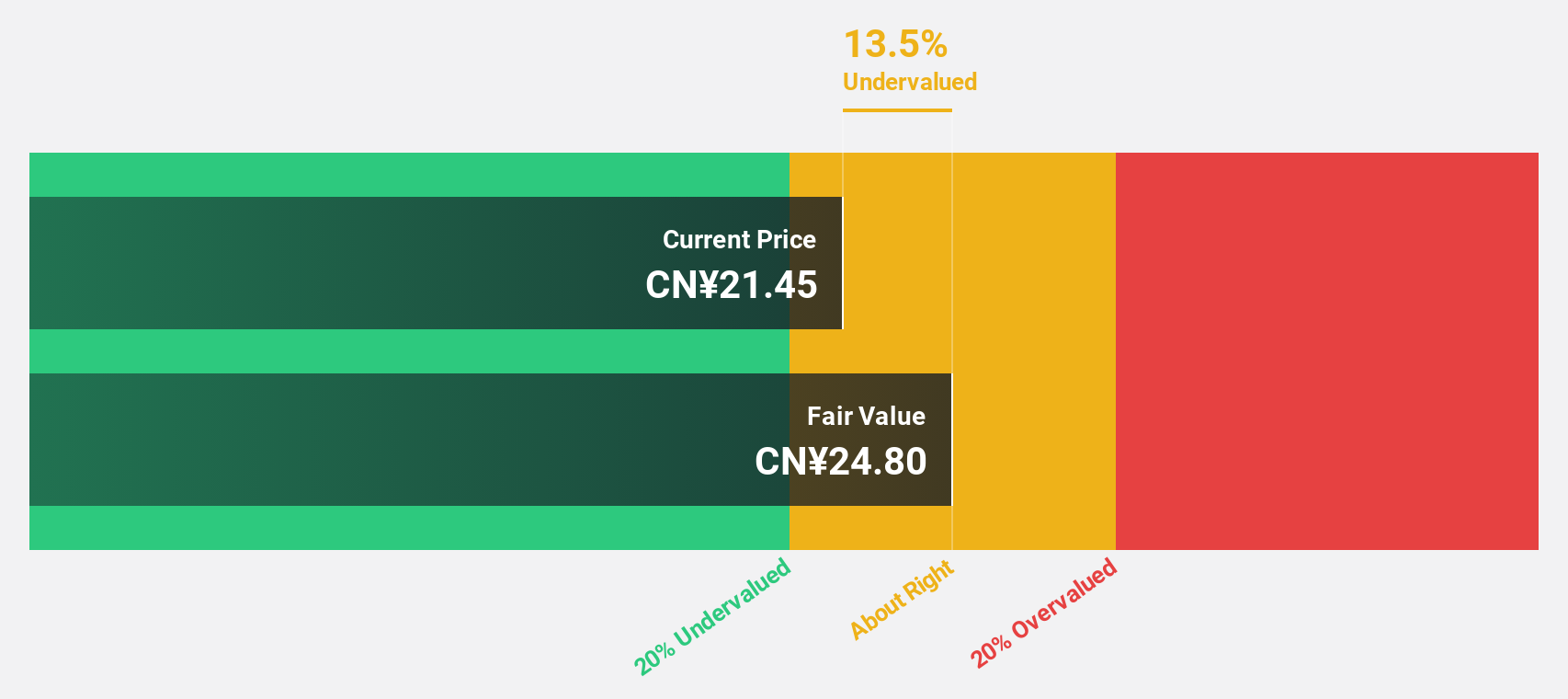

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector, focusing on the production and sale of bio-based products, with a market cap of approximately CN¥8.64 billion.

Operations: The company's revenue is primarily derived from its Dietary Fiber Series at CN¥684.78 million, followed by the Prebiotics Series at CN¥361.07 million, Healthy Sweetener Series at CN¥189.47 million, and Other Starch Sugar (Alcohol) at CN¥4.37 million.

Estimated Discount To Fair Value: 14.1%

Shandong Bailong Chuangyuan Bio-Tech, trading at CN¥21.42, is undervalued based on cash flows with an estimated fair value of CN¥24.94. Recent earnings showed sales increasing to CN¥649.76 million from CN¥531.35 million year-on-year, and net income rising to CN¥170.59 million from CN¥119.56 million a year ago. Although earnings are forecasted to grow significantly at 24.63% annually, the dividend yield of 0.68% is not well covered by free cash flows.

- The analysis detailed in our Shandong Bailong Chuangyuan Bio-Tech growth report hints at robust future financial performance.

- Get an in-depth perspective on Shandong Bailong Chuangyuan Bio-Tech's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click here to access our complete index of 508 Undervalued Global Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives