- United Kingdom

- /

- Trade Distributors

- /

- AIM:FLO

Flowtech Fluidpower Among 3 UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market concerns, certain investment opportunities remain attractive to those willing to explore smaller companies. Penny stocks, though an older term, continue to capture interest for their potential affordability and growth prospects when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £445.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.45 | £184.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.864 | £1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.75 | £63.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.39 | £423.22M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.875 | £12.05M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 409 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Flowtech Fluidpower (AIM:FLO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flowtech Fluidpower plc, with a market cap of £40.62 million, operates in the fluid power industry by distributing engineering components and assemblies across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is primarily generated from Great Britain (£80.45 million), Ireland (£21.84 million), and Benelux (£10.38 million).

Market Cap: £40.62M

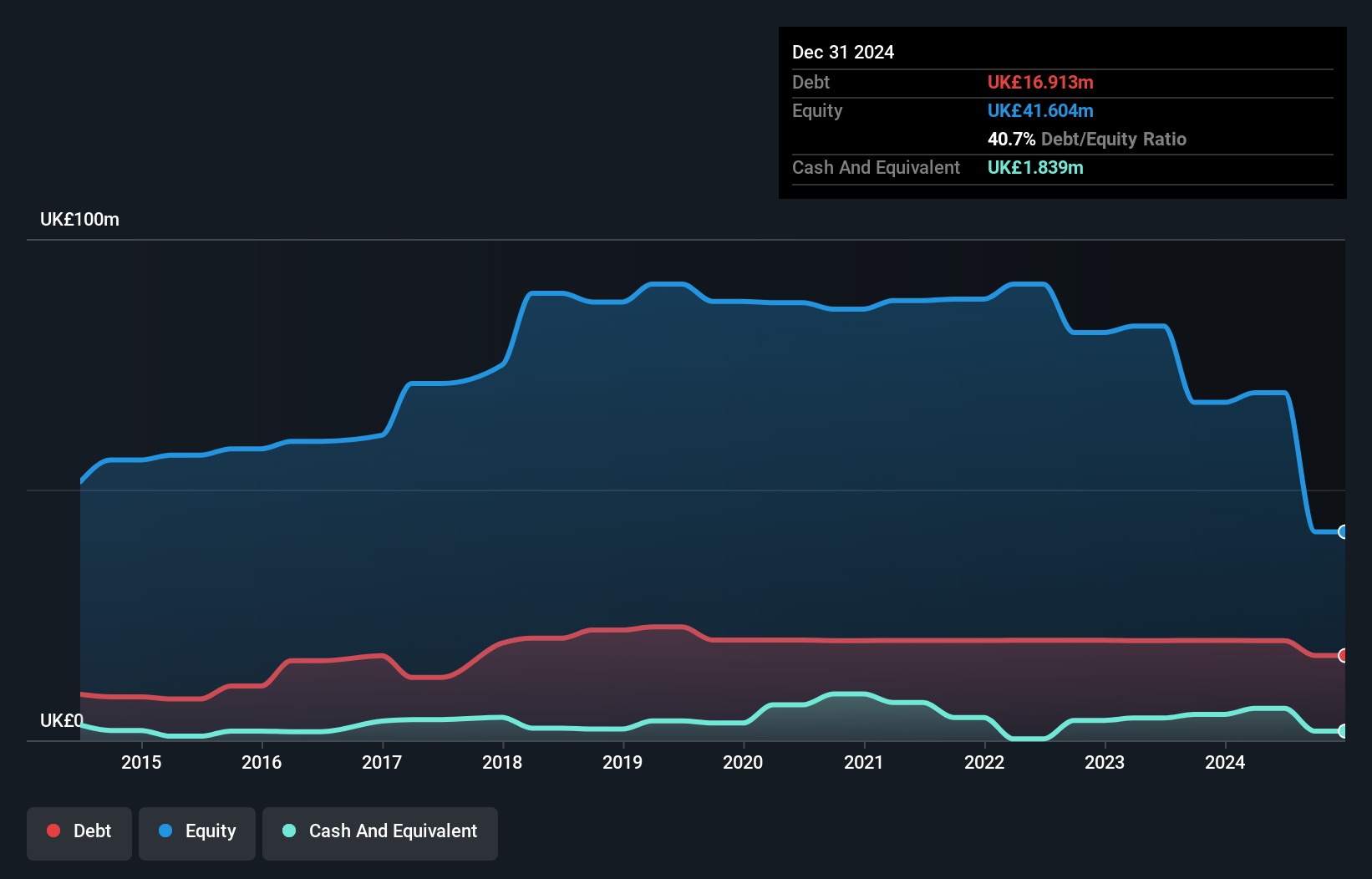

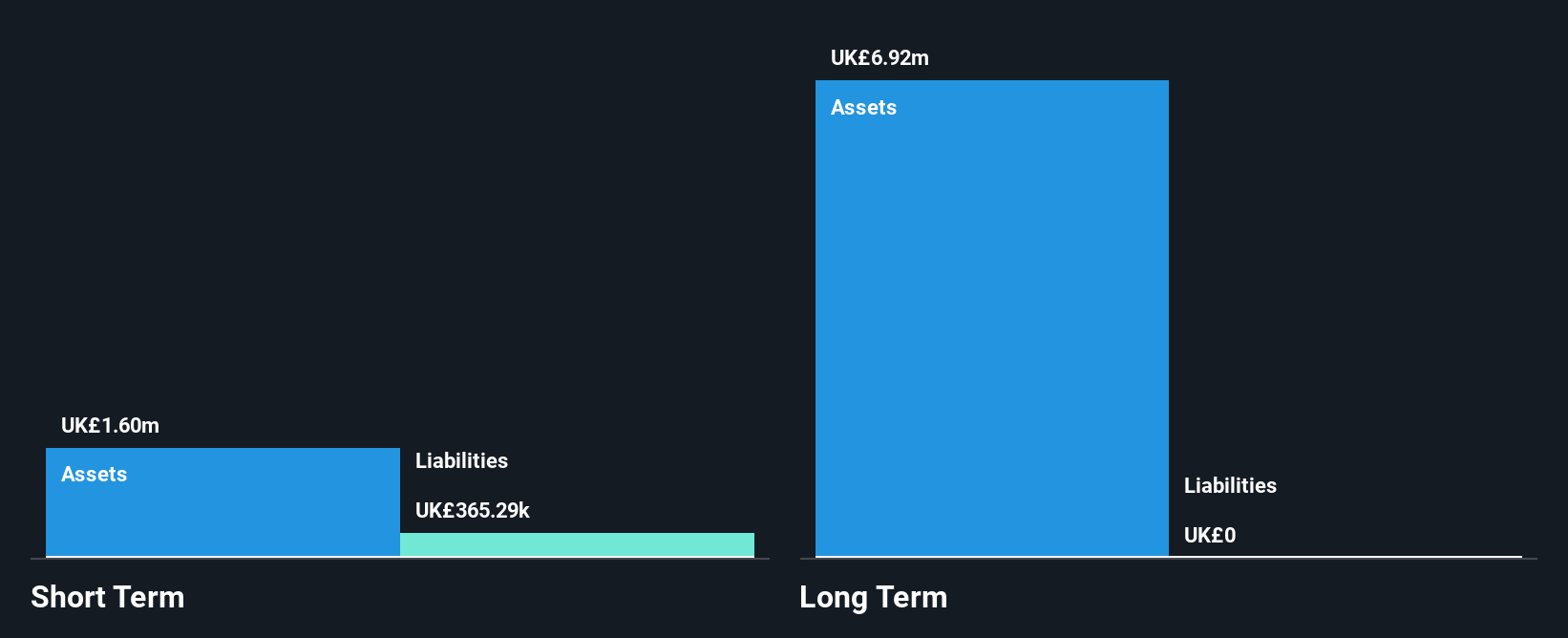

Flowtech Fluidpower plc, with a market cap of £40.62 million, faces challenges typical of penny stocks, such as unprofitability and increased net losses (£26.41M in 2024). While its short-term assets exceed liabilities and debt is well-covered by operating cash flow (51.5%), interest payments are not adequately covered by EBIT (0.5x). The company has omitted dividends to conserve cash for reducing leverage and maintaining capital flexibility. Despite trading at good value relative to peers, the negative return on equity (-63.47%) highlights ongoing financial struggles amidst forecasts of significant earnings growth (109.65% per year).

- Click here to discover the nuances of Flowtech Fluidpower with our detailed analytical financial health report.

- Learn about Flowtech Fluidpower's future growth trajectory here.

Braemar (LSE:BMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braemar Plc is a company that offers shipbroking services across various regions including the United Kingdom, Singapore, Australia, Switzerland, the United States, and Germany with a market cap of £75.50 million.

Operations: The company generates revenue from three primary segments: Chartering (£89.35 million), Risk Advisory (£22.34 million), and Investment Advisory (£30.17 million).

Market Cap: £75.5M

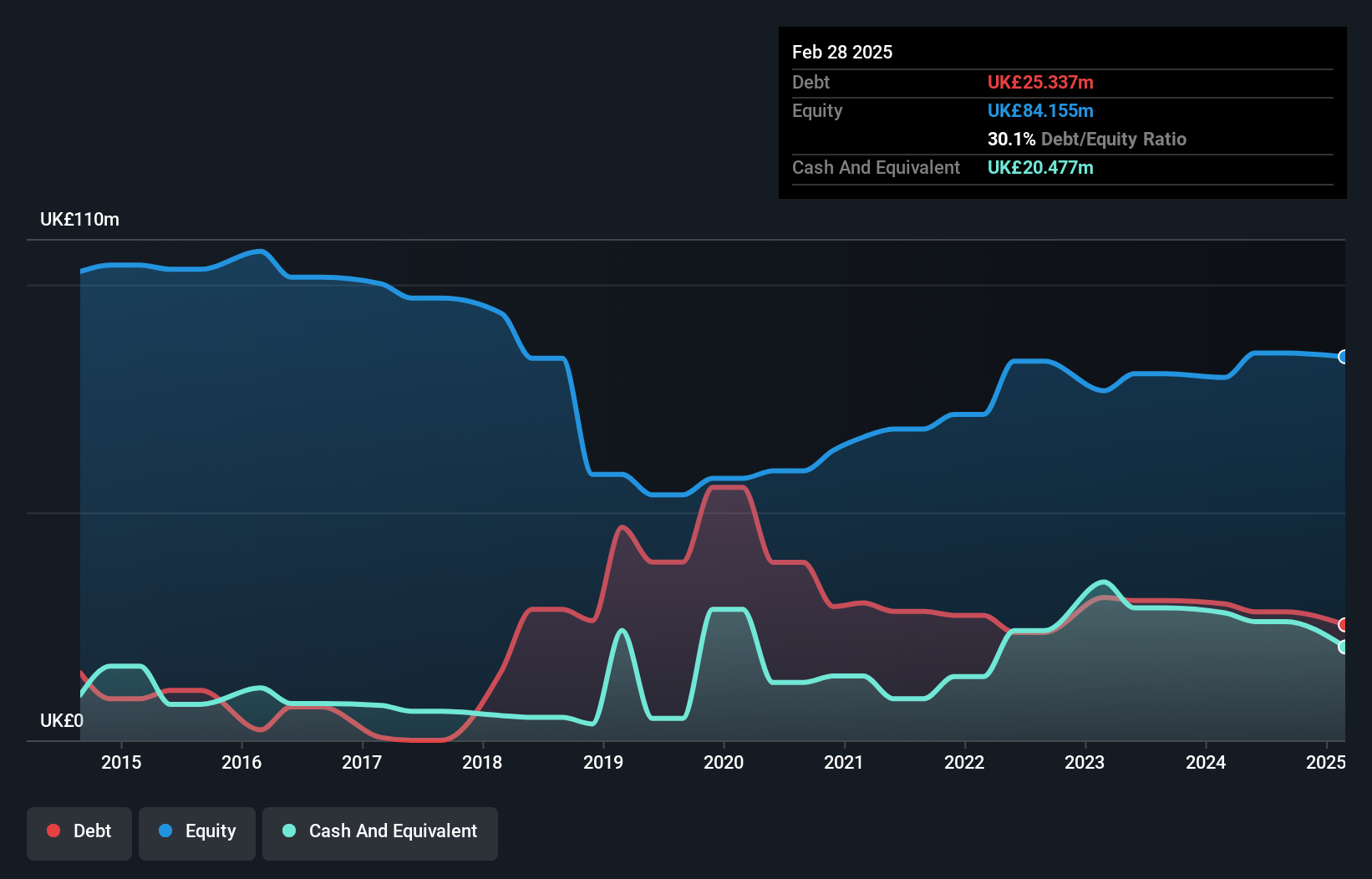

Braemar Plc, with a market cap of £75.50 million, presents both opportunities and challenges typical of penny stocks. The company trades significantly below its estimated fair value and has successfully reduced its debt to equity ratio from 96.5% to 30.1% over five years, indicating improved financial health. Earnings growth is robust at 33.1%, outpacing the industry average, yet return on equity remains low at 7.3%. Recent initiatives include a £2 million share buyback program aimed at enhancing earnings per share and strategic acquisitions for growth acceleration, though regulatory scrutiny persists with an account freezing order by the NCA related to past transactions.

- Take a closer look at Braemar's potential here in our financial health report.

- Assess Braemar's future earnings estimates with our detailed growth reports.

SulNOx Group (OFEX:SNOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SulNOx Group PLC manufactures and develops fuel conditioners and emulsifiers aimed at decarbonizing liquid hydrocarbon fuels globally, with a market cap of £76.91 million.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, totaling £0.85 million.

Market Cap: £76.91M

SulNOx Group PLC, with a market cap of £76.91 million, remains intriguing yet challenging within the penny stock arena. The company is pre-revenue, generating £849K from its Specialty Chemicals segment and is currently unprofitable with a negative return on equity of -26.52%. Despite being debt-free and having short-term assets exceeding liabilities, its cash runway is limited to 3-4 months without further capital infusion. Management's average tenure of 0.4 years suggests inexperience, though the board shows stability with an average tenure of 4.1 years. Recent volatility underscores investor caution despite no shareholder dilution over the past year.

- Jump into the full analysis health report here for a deeper understanding of SulNOx Group.

- Examine SulNOx Group's past performance report to understand how it has performed in prior years.

Where To Now?

- Click through to start exploring the rest of the 406 UK Penny Stocks now.

- Curious About Other Options? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FLO

Flowtech Fluidpower

Distributes engineering components and assemblies in the areas of fluid power industry in the United Kingdom, rest of Europe, internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives