- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Launches FICO Marketplace Enhancing Data Analytics

Reviewed by Simply Wall St

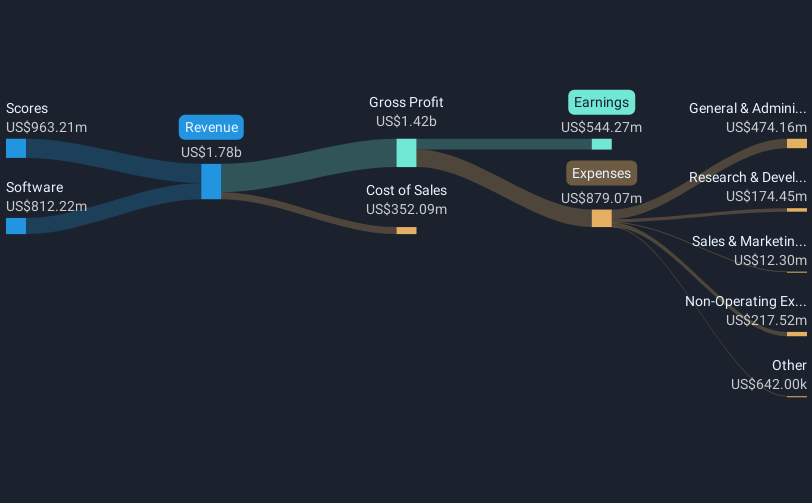

Fair Isaac (NYSE:FICO) experienced a 16% price increase over the past week, coinciding with key announcements such as its partnership with Vitality, which enhances service operations through FICO's platform, and the launch of the FICO Marketplace to support data analytics. Additionally, the company's refinancing activities, including a new revolving credit facility, bolster its financial capacity. Despite a generally flat market over the same period, these developments may have supported the company's positive price movement, aided by anticipated annual earnings growth. The integration of advanced AI technologies across operations underscores Fair Isaac's commitment to efficiency and service improvement.

Fair Isaac has 1 weakness we think you should know about.

The recent announcements about Fair Isaac's partnership with Vitality and the launch of the FICO Marketplace could provide a positive influence on their ongoing efforts to expand internationally and diversify beyond traditional finance. These developments indicate a potential uplift in revenue by enhancing service operations and tapping into previously underserved markets. The company's use of advanced AI technologies in these initiatives further supports revenue growth forecasts, alongside robust earnings projections.

Over the past five years, Fair Isaac's total return for shareholders, including dividends, reached 315.14%. In the past year, Fair Isaac's share performance outpaced the US Software industry, which had a 24.1% return. This performance comparison against the industry highlights Fair Isaac's strong position and effective execution of growth strategies.

The new revolving credit facility enhances Fair Isaac's financial flexibility, which could impact future earnings positively if leveraged strategically. Analysts' revenue growth expectations of 15.5% annually over three years underscore an optimistic outlook. However, the share price's current proximity to the consensus price target of US$2,116.96—just 2.6% above the present US$2,060.86 price—suggests the stock may be fairly valued based on these growth projections.

Learn about Fair Isaac's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives