- Romania

- /

- Hospitality

- /

- BVB:SFG

European Stocks Trading Below Estimated Value In August 2025

Reviewed by Simply Wall St

As European markets navigate a period of economic stagnation and trade uncertainties, the pan-European STOXX Europe 600 Index recently experienced a decline of 2.57%, reflecting investor disappointment with the U.S.-EU trade deal framework. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK178.50 | NOK352.47 | 49.4% |

| Rheinmetall (XTRA:RHM) | €1783.50 | €3480.42 | 48.8% |

| LEM Holding (SWX:LEHN) | CHF603.00 | CHF1202.14 | 49.8% |

| Kuros Biosciences (SWX:KURN) | CHF27.42 | CHF54.72 | 49.9% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.86 | €23.21 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.381 | €0.75 | 49.4% |

| doValue (BIT:DOV) | €2.442 | €4.82 | 49.3% |

| Comet Holding (SWX:COTN) | CHF189.80 | CHF372.94 | 49.1% |

| Aquila Part Prod Com (BVB:AQ) | RON1.488 | RON2.93 | 49.2% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.875 | €3.64 | 48.5% |

We're going to check out a few of the best picks from our screener tool.

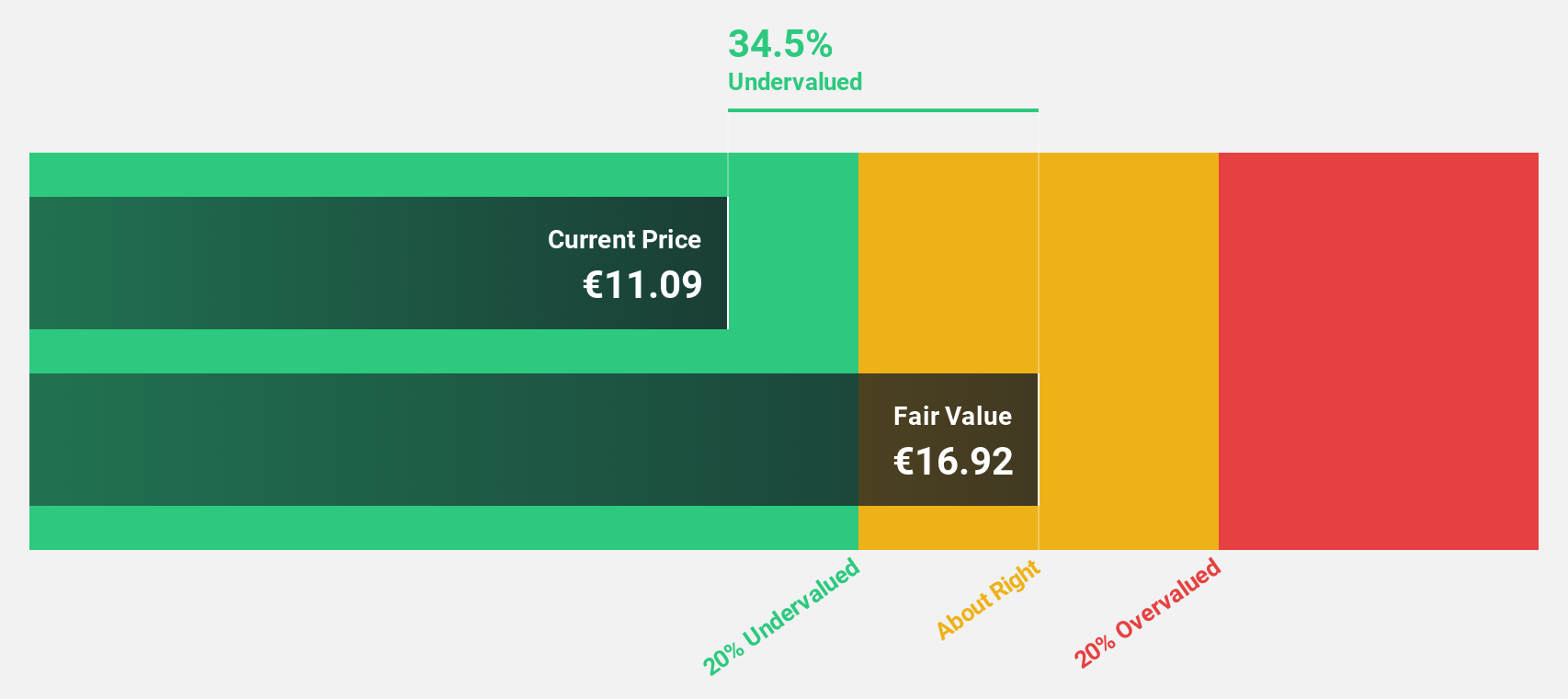

Maire (BIT:MAIRE)

Overview: MAIRE S.p.A. develops and implements solutions for the energy transition, with a market cap of €3.98 billion.

Operations: The company's revenue primarily comes from its Integrated E&C Solutions segment, which generated €6.33 billion.

Estimated Discount To Fair Value: 11.9%

Maire S.p.A. appears undervalued, trading at €12.13, below its estimated fair value of €13.76 and 11.9% under our valuation estimate. Despite a slower revenue growth forecast of 6.2% annually, earnings are expected to rise by 10.8%, outpacing the Italian market's growth rate of 8.3%. Recent earnings showed significant improvement with net income rising to €126.7 million from €90.89 million last year, indicating robust cash flow potential despite an unstable dividend record.

- Upon reviewing our latest growth report, Maire's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Maire stock in this financial health report.

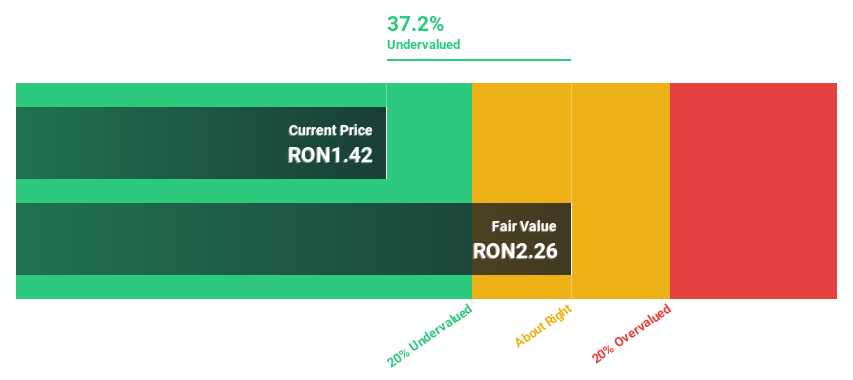

Aquila Part Prod Com (BVB:AQ)

Overview: Aquila Part Prod Com S.A. operates as a provider of distribution and logistics services across Romania, Moldova, Poland, the Netherlands, Germany, and internationally with a market capitalization of RON1.79 billion.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for RON2.90 billion, followed by Logistics at RON101.37 million and Transport at RON61.49 million.

Estimated Discount To Fair Value: 49.2%

Aquila Part Prod Com is trading at RON1.49, significantly below its estimated fair value of RON2.93, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow 19.4% annually, outpacing the market's 5.2%, although revenue growth is slower at 11.2%. Recent earnings showed stable sales growth but a slight decline in net income to RON19.02 million from RON19.64 million last year, with dividends not well covered by earnings or free cash flows.

- Our expertly prepared growth report on Aquila Part Prod Com implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Aquila Part Prod Com here with our thorough financial health report.

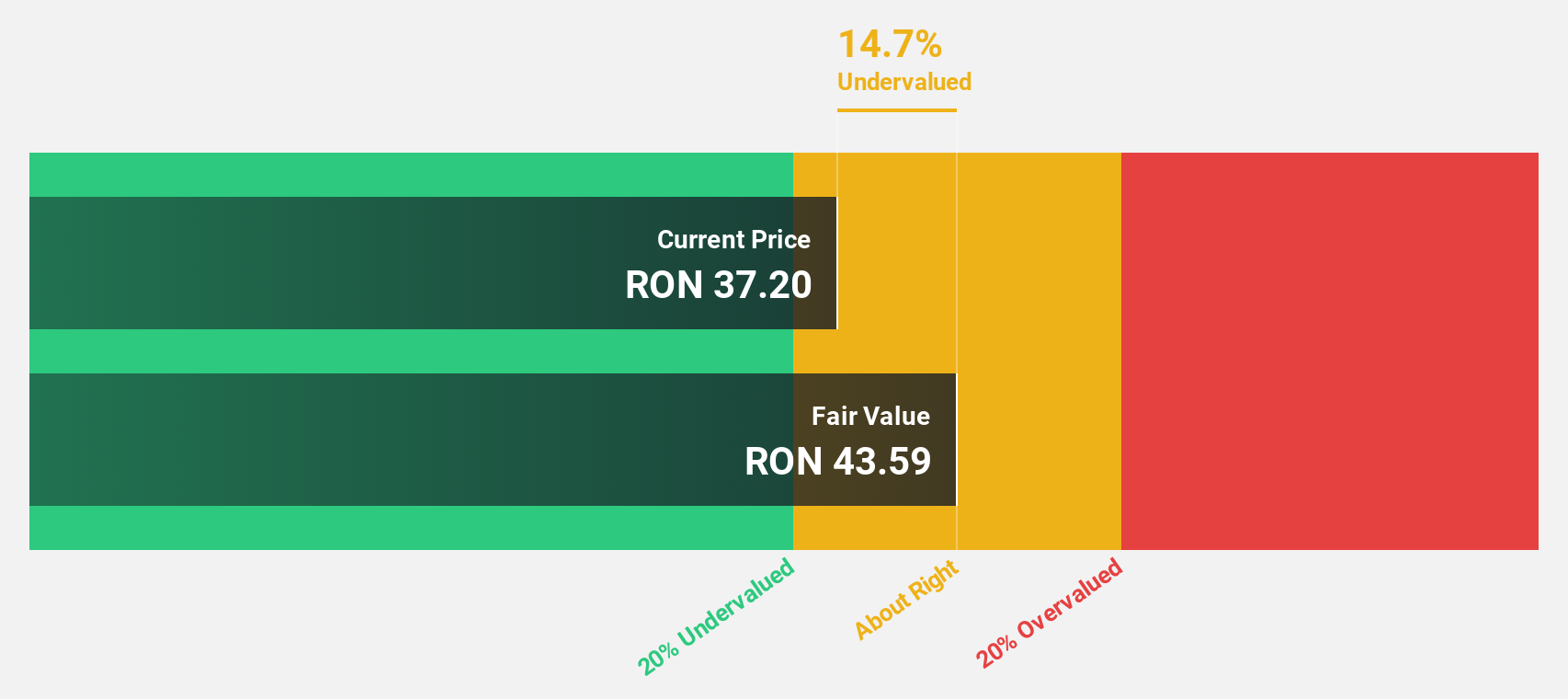

Sphera Franchise Group (BVB:SFG)

Overview: Sphera Franchise Group S.A., along with its subsidiaries, operates quick service and takeaway restaurants and has a market cap of RON1.55 billion.

Operations: The company's revenue segments include RON1.34 billion from Kentucky Fried Chicken (KFC), RON108.93 million from Pizza Hut, and RON95.23 million from Taco Bell.

Estimated Discount To Fair Value: 11.7%

Sphera Franchise Group, trading at RON40, is modestly undervalued compared to its fair value estimate of RON45.31. Earnings are projected to grow 13.65% annually, surpassing the Romanian market's growth rate of 5.2%, though revenue growth remains moderate at 8.7%. Despite a high forecasted return on equity of 56%, the company reported a significant drop in net income for Q1 2025 to RON6.44 million from RON22.43 million last year, and its dividend track record is unstable.

- In light of our recent growth report, it seems possible that Sphera Franchise Group's financial performance will exceed current levels.

- Take a closer look at Sphera Franchise Group's balance sheet health here in our report.

Key Takeaways

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 188 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SFG

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)