European Stocks Estimated To Be Up To 38.9% Undervalued Offering A Discount Of At Least 16.1%

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively flat and major stock indexes show mixed returns, investors are keenly observing economic indicators such as inflation rates and labor market stability across the eurozone. In this context, identifying undervalued stocks becomes crucial, as these investments may offer potential value amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trøndelag Sparebank (OB:TRSB) | NOK113.70 | NOK222.46 | 48.9% |

| Sulzer (SWX:SUN) | CHF142.80 | CHF278.49 | 48.7% |

| Sonova Holding (SWX:SOON) | CHF231.20 | CHF451.88 | 48.8% |

| Lectra (ENXTPA:LSS) | €25.25 | €49.34 | 48.8% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.30 | €110.26 | 49.8% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.84 | €23.17 | 48.9% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.94 | 49.6% |

| Ependion (OM:EPEN) | SEK115.40 | SEK225.30 | 48.8% |

| Camurus (OM:CAMX) | SEK669.00 | SEK1317.33 | 49.2% |

| ATEME (ENXTPA:ATEME) | €5.20 | €10.34 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Netcompany Group (CPSE:NETC)

Overview: Netcompany Group A/S delivers business critical IT solutions to both private and public sectors across various countries including Denmark, Norway, the United Kingdom, and others, with a market cap of DKK12.85 billion.

Operations: The company's revenue is comprised of DKK4.64 billion from public sector clients and DKK2.04 billion from private sector clients.

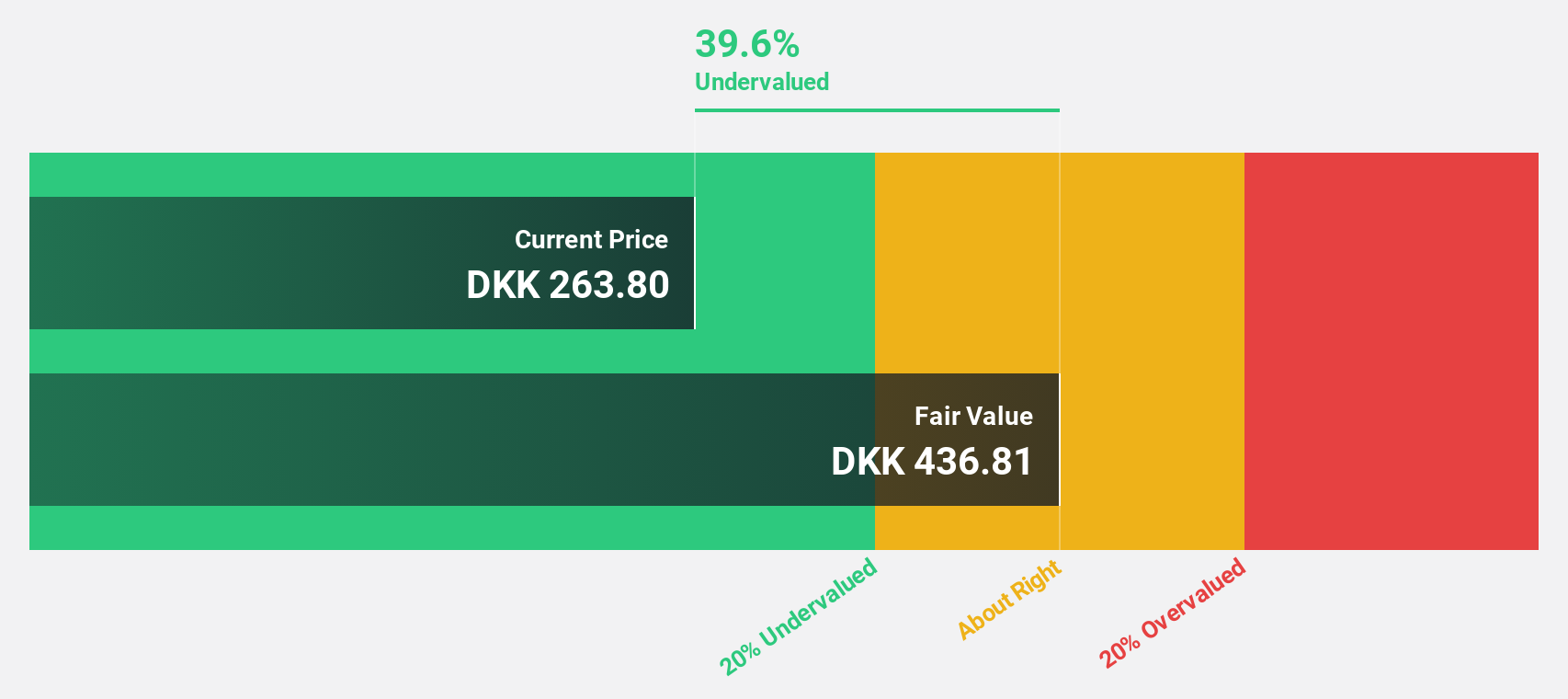

Estimated Discount To Fair Value: 38.9%

Netcompany Group is trading at DKK 272.6, significantly below its estimated fair value of DKK 446.15, suggesting it is undervalued based on cash flows. The company's earnings grew by 70% last year and are forecast to grow at a significant rate of 21.3% annually over the next three years, outpacing the Danish market's growth rate of 7.9%. Recent innovations like Feniks AI could enhance operational efficiency and cost-effectiveness in IT system modernization across Europe.

- Our earnings growth report unveils the potential for significant increases in Netcompany Group's future results.

- Click to explore a detailed breakdown of our findings in Netcompany Group's balance sheet health report.

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company engaged in the production and development of resources supporting the energy transition towards net zero across Norway, Denmark, the Netherlands, and the United Kingdom, with a market cap of NOK13.83 billion.

Operations: The company's revenue segment is primarily derived from Oil & Gas - Exploration & Production, amounting to $704.90 million.

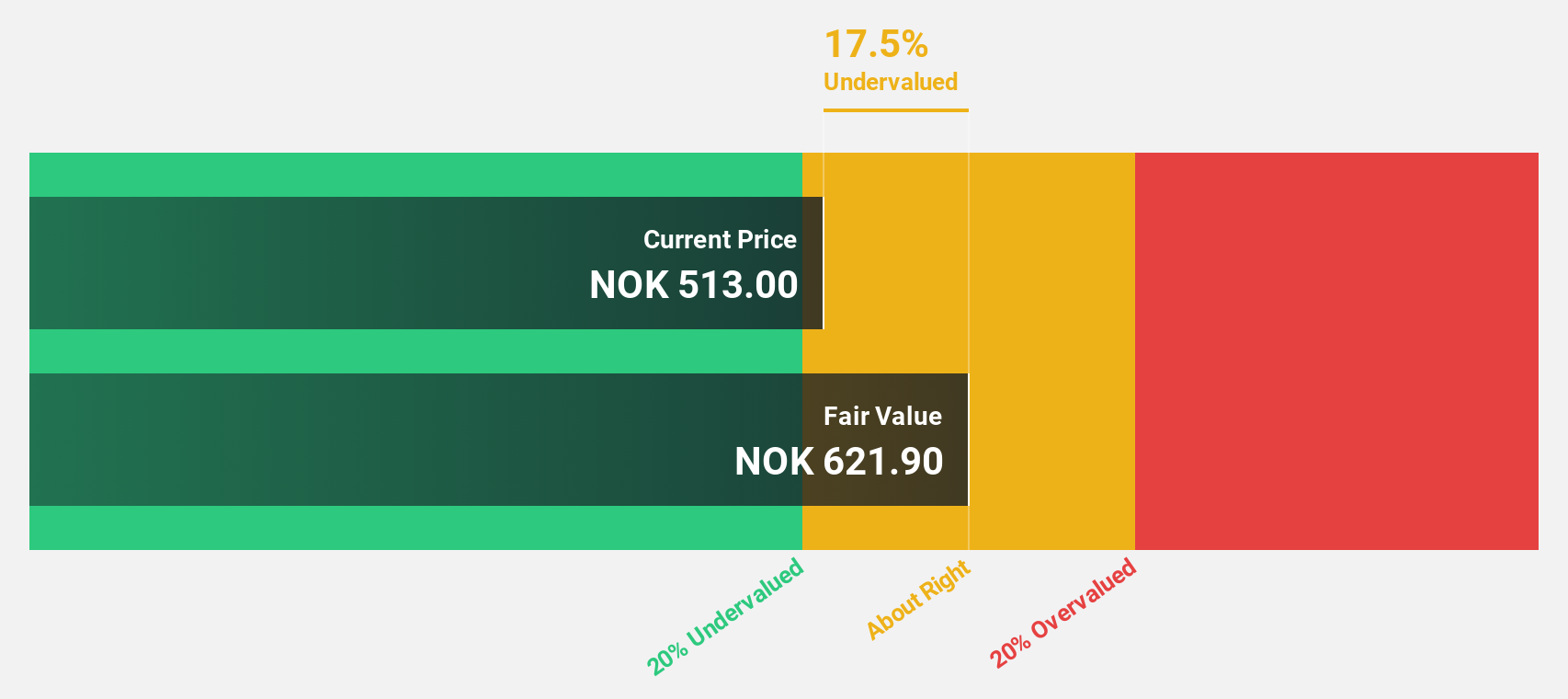

Estimated Discount To Fair Value: 16.1%

BlueNord is trading at NOK 522, below its estimated fair value of NOK 622.22, indicating it is undervalued based on cash flows. Earnings are forecast to grow annually by 26.82%, with profitability expected within three years, surpassing market averages. Despite high production levels and a proposed USD 49 million dividend for Q2 2025, interest payments remain poorly covered by earnings, highlighting potential financial challenges despite strong operational performance.

- Insights from our recent growth report point to a promising forecast for BlueNord's business outlook.

- Delve into the full analysis health report here for a deeper understanding of BlueNord.

Atal (WSE:1AT)

Overview: Atal S.A. is involved in the development and sale of residential buildings in Poland, with a market cap of PLN2.92 billion.

Operations: The company's revenue primarily comes from its real estate development activity, generating PLN1.22 billion, while rental services contribute PLN11.16 million.

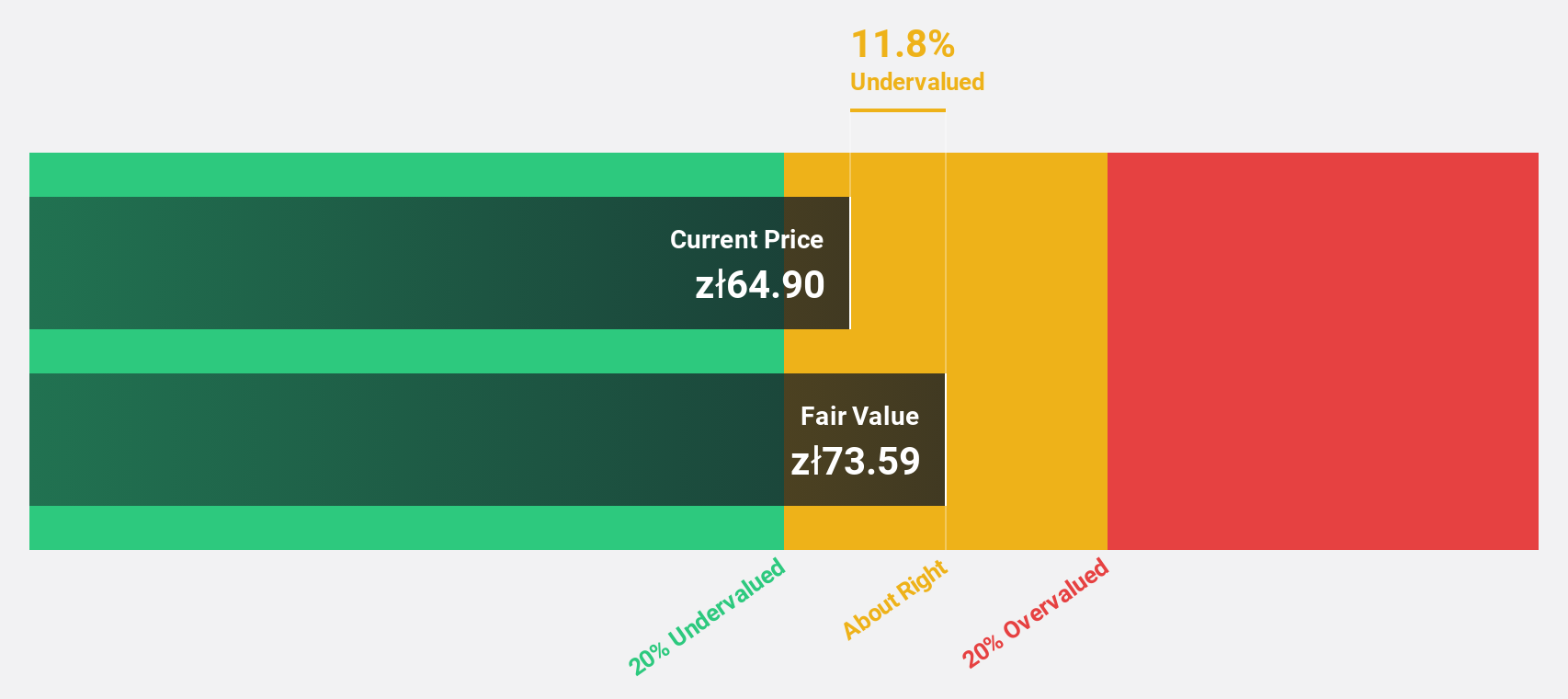

Estimated Discount To Fair Value: 17.7%

Atal is trading at PLN 67.6, below its estimated fair value of PLN 82.1, reflecting undervaluation based on cash flows. Earnings are expected to grow significantly by 21.9% annually, outpacing the Polish market average of 14.1%. However, recent earnings showed a decline with Q1 net income at PLN 17.07 million compared to PLN 96.52 million last year, and dividends remain unsustainable due to insufficient coverage by earnings or free cash flow.

- The analysis detailed in our Atal growth report hints at robust future financial performance.

- Take a closer look at Atal's balance sheet health here in our report.

Seize The Opportunity

- Click through to start exploring the rest of the 176 Undervalued European Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netcompany Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NETC

Netcompany Group

Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives