As European markets navigate a landscape of mixed economic signals, with major indices showing varied performances, investors are keenly observing opportunities amid evolving monetary policies. Penny stocks may seem like a throwback term, but they continue to represent intriguing potential for growth at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, investors can uncover hidden gems in the penny stock arena that might offer promising returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.23 | €1.46B | ✅ 4 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.96 | €40.22M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.486 | RON16.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.20 | €10.15M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.50 | €397.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.05 | €283.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.902 | €30.42M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellularline S.p.A. is a company that manufactures and sells smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €61.35 million.

Operations: The company's revenue is primarily generated from its Electronic Components & Parts segment, amounting to €162.15 million.

Market Cap: €61.35M

Cellularline S.p.A. presents a mixed picture for penny stock investors. While the company maintains strong short-term asset coverage over its liabilities and has a satisfactory net debt to equity ratio of 10.6%, it faces challenges with declining earnings, forecasted to decrease by an average of 4.6% annually over the next three years. Recent earnings reports show consistent net losses, with €1.35 million reported for the first half of 2025, mirroring last year's performance. The experienced management team contrasts with an inexperienced board, while dividends remain unstable and profit margins have declined slightly from the previous year.

- Unlock comprehensive insights into our analysis of Cellularline stock in this financial health report.

- Gain insights into Cellularline's outlook and expected performance with our report on the company's earnings estimates.

Itway (BIT:ITW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Itway S.p.A. specializes in designing, creating, and distributing technologies and solutions in cybersecurity, artificial intelligence, and cloud computing, with a market cap of €14.52 million.

Operations: The company generates revenue primarily through its Cyber Security Products segment, which includes VAD and PS, accounting for €53.11 million, alongside contributions from the Parent Company and Other Activities Sector totaling €12.91 million.

Market Cap: €14.52M

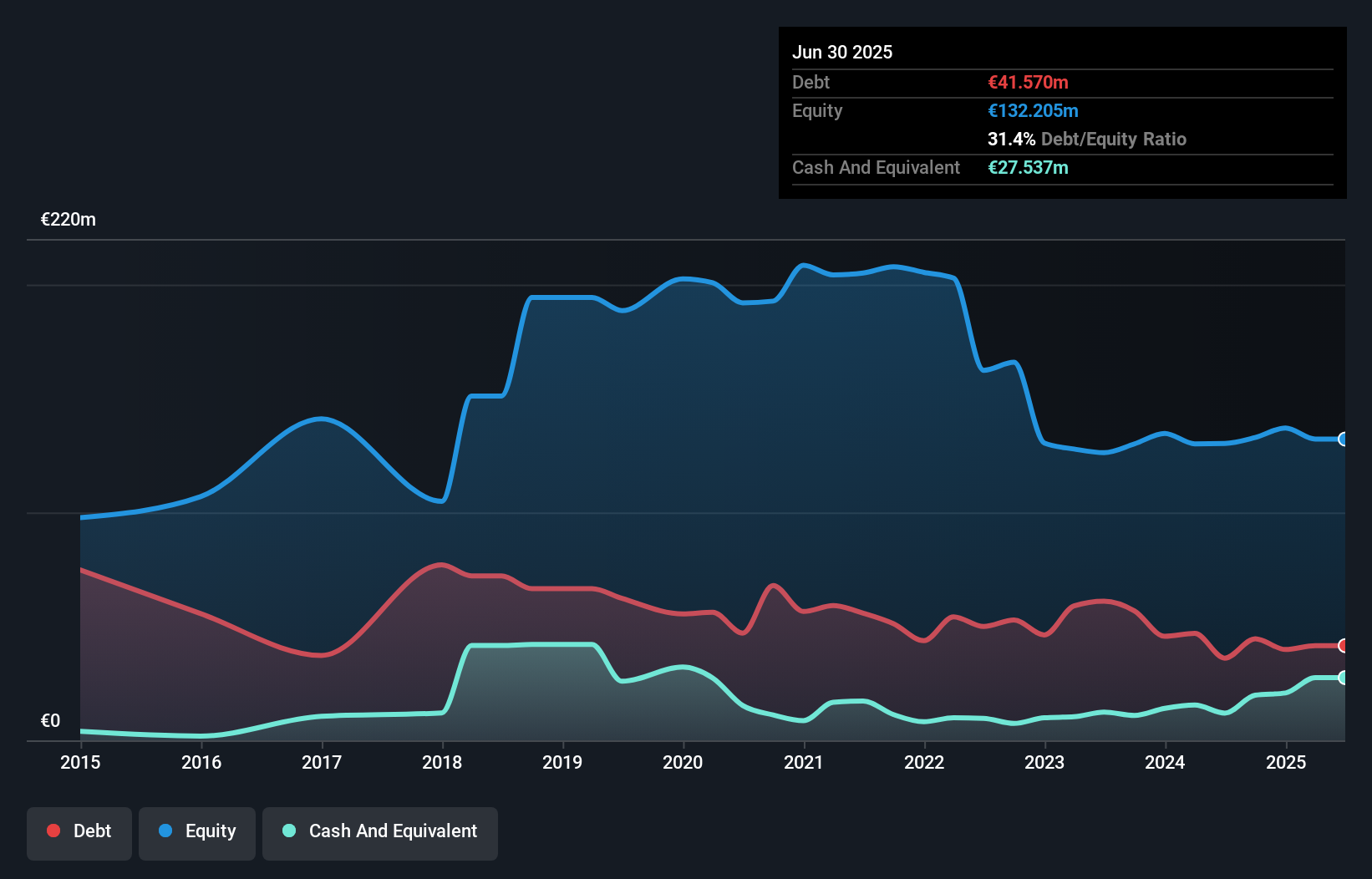

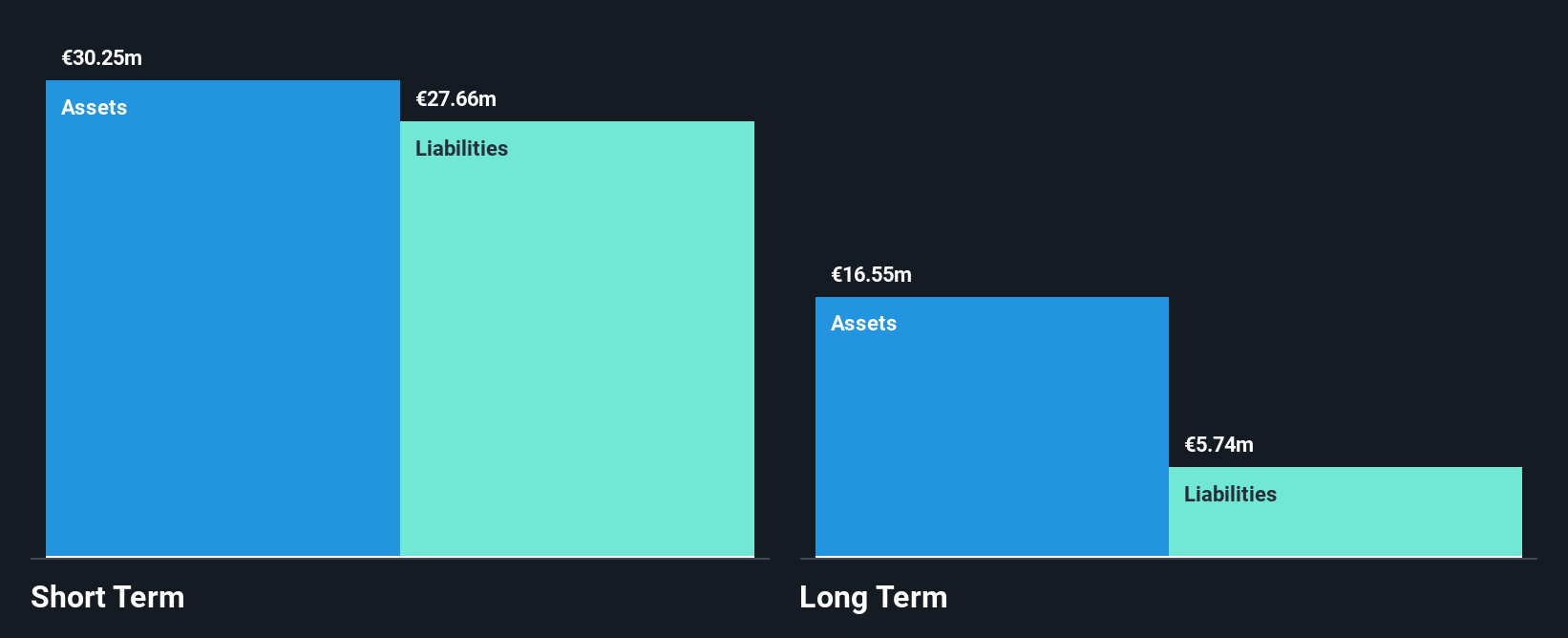

Itway S.p.A. offers a complex investment profile as a penny stock. The company has transitioned to profitability recently, despite declining earnings over the past five years. Itway's short-term assets comfortably cover both its short and long-term liabilities, and it maintains a satisfactory net debt to equity ratio of 29.1%. However, its operating cash flow inadequately covers debt obligations, and interest payments are not fully covered by EBIT. While the board lacks experience with an average tenure of 1.7 years, shareholders have not faced significant dilution recently, though share price volatility remains high.

- Get an in-depth perspective on Itway's performance by reading our balance sheet health report here.

- Gain insights into Itway's historical outcomes by reviewing our past performance report.

Hawick Data (ENXTAM:HWK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hawick Data N.V. operates in the media advertising industry in the Netherlands with a market capitalization of €10.54 million.

Operations: The company generates revenue of €5.14 million from its Online Financial Information Providers segment.

Market Cap: €10.54M

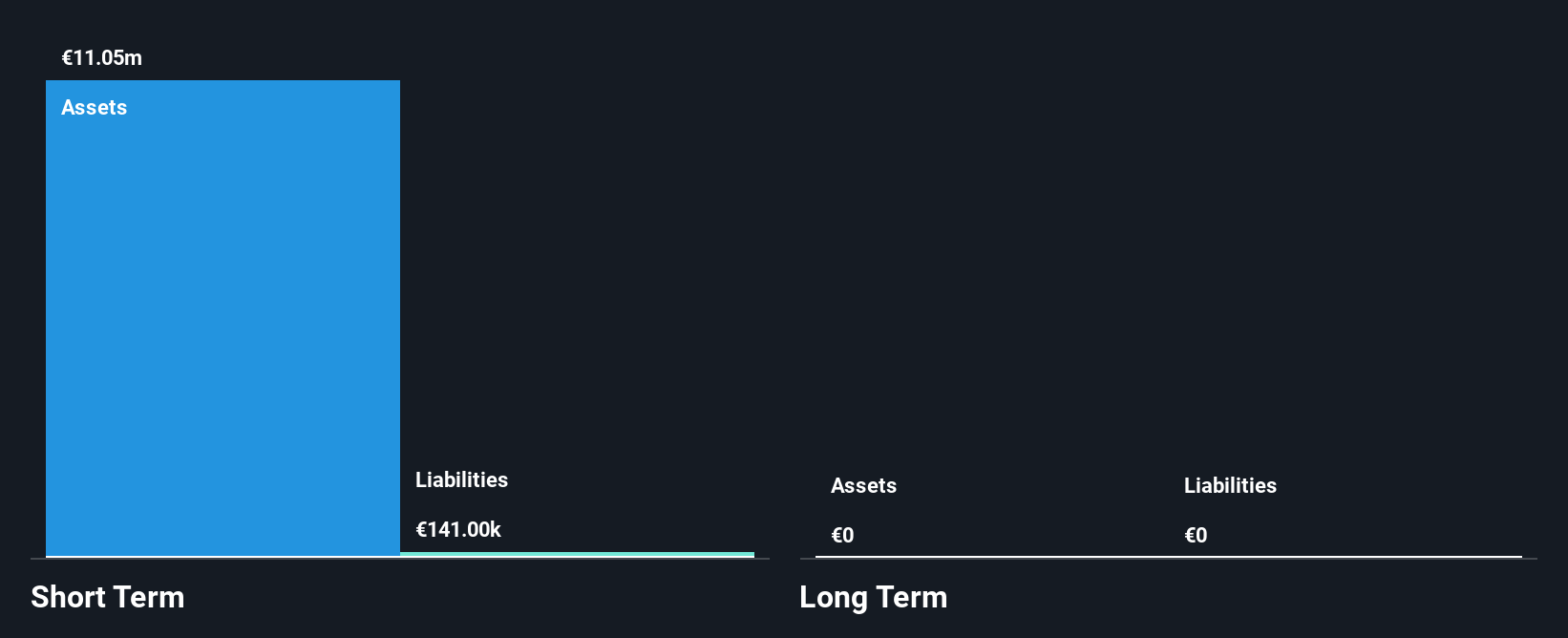

Hawick Data N.V. presents a compelling investment case with its strong earnings growth of 574.9% over the past year, significantly outpacing the media industry's decline. The company operates debt-free, eliminating concerns about interest or debt coverage, while its short-term assets comfortably exceed liabilities. With a return on equity of 85.6%, Hawick demonstrates high profitability and value trading at 60.8% below estimated fair value. Despite lacking detailed management and board tenure data, shareholders have not experienced dilution recently, and volatility has remained stable over the past year, enhancing its profile as a penny stock in Europe.

- Click to explore a detailed breakdown of our findings in Hawick Data's financial health report.

- Evaluate Hawick Data's historical performance by accessing our past performance report.

Key Takeaways

- Jump into our full catalog of 328 European Penny Stocks here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ITW

Itway

Engages in designing, creation, and distribution of technologies and solutions in cybersecurity, artificial intelligence, and cloud computing.

Adequate balance sheet with low risk.

Market Insights

Community Narratives