- Poland

- /

- Healthtech

- /

- WSE:SNT

European Equities Estimated Below Fair Value In September 2025

Reviewed by Simply Wall St

As the European markets navigate a challenging landscape marked by concerns over U.S. Federal Reserve independence, renewed tariff uncertainties, and political instability in France, the pan-European STOXX Europe 600 Index has recently experienced a decline of 1.99%. Despite these headwinds, opportunities may arise for discerning investors who seek equities that are estimated to be trading below their fair value; identifying such stocks requires careful consideration of intrinsic value amidst current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.58 | SEK86.14 | 49.4% |

| Trifork Group (CPSE:TRIFOR) | DKK89.60 | DKK175.24 | 48.9% |

| SKAN Group (SWX:SKAN) | CHF60.70 | CHF120.14 | 49.5% |

| Pluxee (ENXTPA:PLX) | €17.06 | €33.90 | 49.7% |

| Norconsult (OB:NORCO) | NOK45.80 | NOK90.65 | 49.5% |

| Hanza (OM:HANZA) | SEK111.40 | SEK220.59 | 49.5% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 49% |

| BHG Group (OM:BHG) | SEK25.08 | SEK49.92 | 49.8% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.875 | €3.66 | 48.8% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €35.80 | €70.87 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Metrovacesa (BME:MVC)

Overview: Metrovacesa S.A. is a real estate development company operating in Spain with a market cap of €1.57 billion.

Operations: The company's revenue is primarily derived from its residential segment at €516.37 million, with an additional contribution of €38.88 million from the tertiary sector.

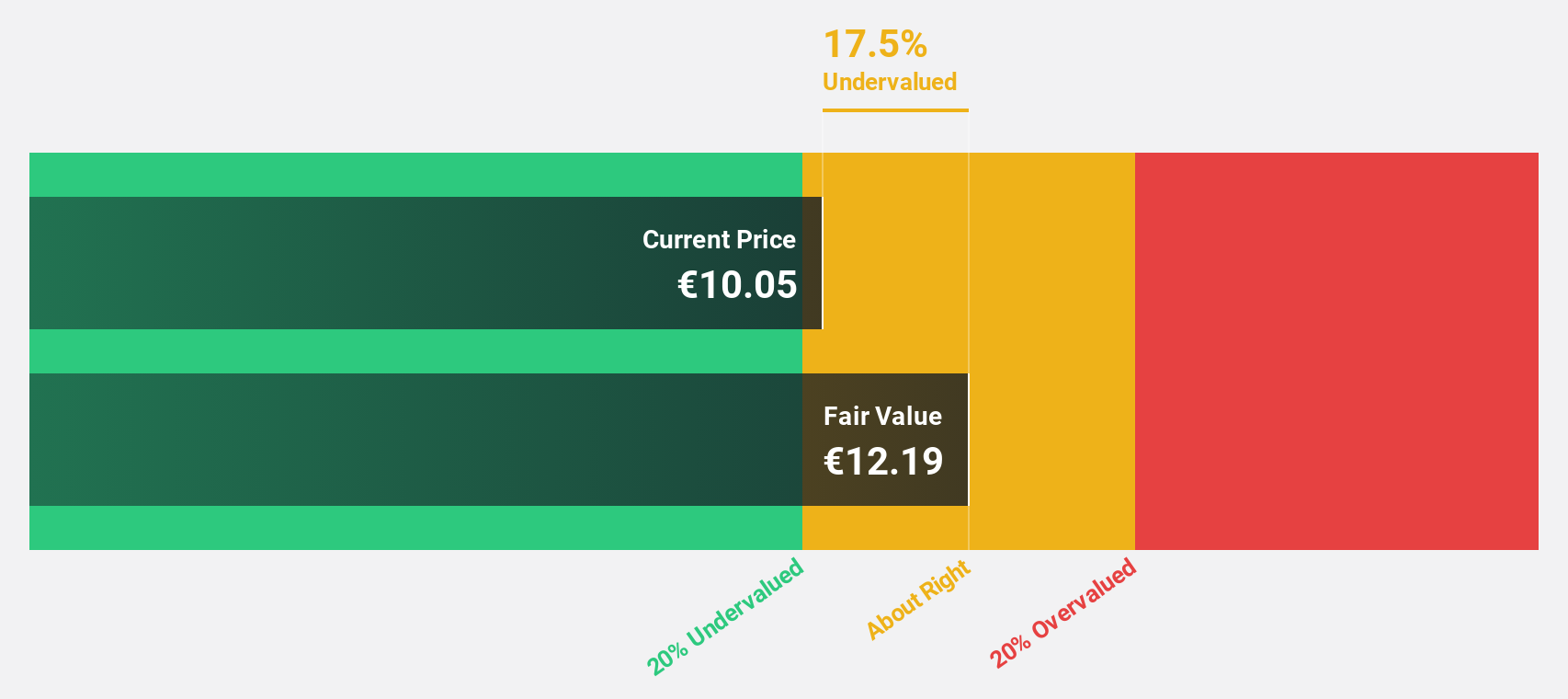

Estimated Discount To Fair Value: 14.0%

Metrovacesa appears undervalued, trading at €10.35, which is 14% below its estimated fair value of €12.03. Despite a recent net loss of €15.49 million for the first half of 2025, revenue growth is expected to outpace the Spanish market at 8% annually. While earnings are forecast to grow significantly at nearly 47% per year, return on equity remains low with future profitability anticipated within three years amidst challenging financial results.

- The analysis detailed in our Metrovacesa growth report hints at robust future financial performance.

- Dive into the specifics of Metrovacesa here with our thorough financial health report.

LINK Mobility Group Holding (OB:LINK)

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK9.31 billion.

Operations: The company's revenue is derived from four main segments: Central Europe (NOK1.68 billion), Western Europe (NOK2.25 billion), Northern Europe (NOK1.56 billion), and Global Messaging (NOK1.43 billion).

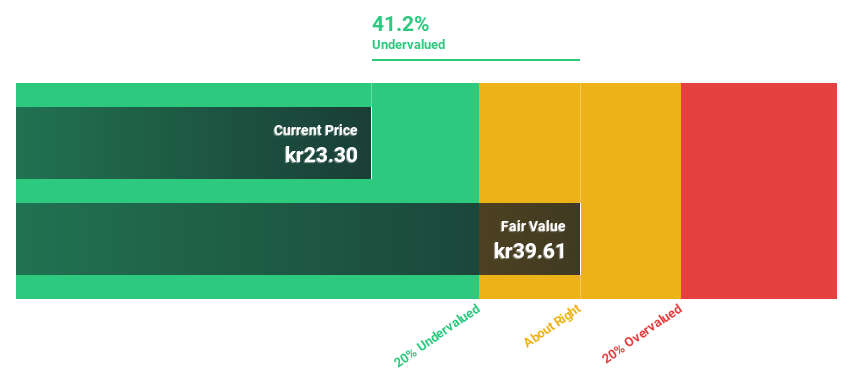

Estimated Discount To Fair Value: 46.2%

LINK Mobility Group Holding, trading at NOK 32.8, is significantly undervalued with a fair value estimate of NOK 60.99. Despite reporting a net loss for Q2 2025 and lower profit margins compared to last year, the company's earnings are projected to grow substantially at over 59% annually, outpacing the Norwegian market. Revenue growth is expected at 16.2% per year, driven by strategic M&A activities and debt refinancing efforts to enhance operational efficiency and market position in Europe.

- Upon reviewing our latest growth report, LINK Mobility Group Holding's projected financial performance appears quite optimistic.

- Navigate through the intricacies of LINK Mobility Group Holding with our comprehensive financial health report here.

Synektik Spólka Akcyjna (WSE:SNT)

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market cap of PLN1.97 billion.

Operations: The company's revenue segments include PLN57.92 million from Diagnostic and IT Equipment and PLN4.67 million from the Production of Radio Pharmaceuticals.

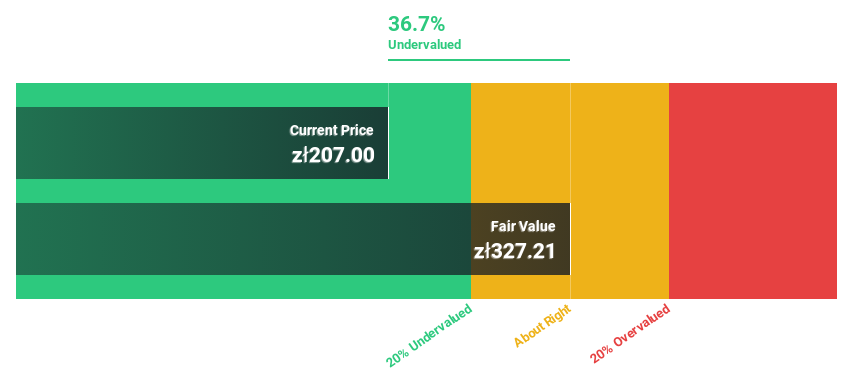

Estimated Discount To Fair Value: 30.2%

Synektik Spólka Akcyjna, with a current trading price of PLN 231, is undervalued against its estimated fair value of PLN 330.77. Recent earnings reports show net income growth to PLN 23.71 million for Q3 2025, up from PLN 16.74 million the previous year, reflecting robust cash flow performance despite revenue stagnation over nine months. However, high non-cash earnings and share price volatility pose risks amidst strong profit growth forecasts exceeding Polish market averages at over 21% annually.

- In light of our recent growth report, it seems possible that Synektik Spólka Akcyjna's financial performance will exceed current levels.

- Click here to discover the nuances of Synektik Spólka Akcyjna with our detailed financial health report.

Taking Advantage

- Reveal the 216 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SNT

Synektik Spólka Akcyjna

Provides products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives