Easy Come, Easy Go: How Tri-Star Resources (LON:TSTR) Shareholders Got Unlucky And Saw 78% Of Their Cash Evaporate

Tri-Star Resources plc (LON:TSTR) shareholders will doubtless be very grateful to see the share price up 69% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 78% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

View our latest analysis for Tri-Star Resources

We don't think Tri-Star Resources's revenue of UK£6,000 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Tri-Star Resources finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Tri-Star Resources investors have already had a taste of the bitterness stocks like this can leave in the mouth.

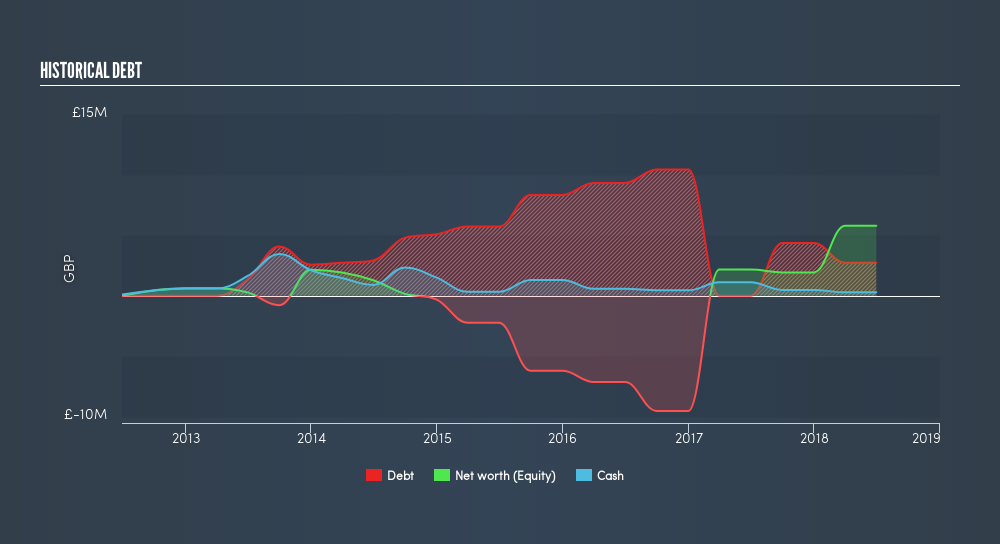

Our data indicates that Tri-Star Resources had net debt of UK£2,668,000 when it last reported in June 2018. That makes it extremely high risk, in our view. But with the share price diving 26% per year, over 5 years, it's probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how Tri-Star Resources's cash and debt levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

It's good to see that Tri-Star Resources has rewarded shareholders with a total shareholder return of 30% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 26% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of Tri-Star Resources's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)