- United States

- /

- Pharma

- /

- NasdaqGM:PRTK

Earnings Update: Paratek Pharmaceuticals, Inc. Just Reported And Analysts Are Trimming Their Forecasts

Paratek Pharmaceuticals, Inc. (NASDAQ:PRTK) just released its latest third-quarter report and things are not looking great. The numbers were fairly weak, with sales of US$3.9m missing analyst predictions by 4.9%, and losses of US$1.00 per share being slightly larger than what analysts had expected. Earnings are an important time for investors, as they can track a company's performance, look at what top analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see analysts' latest post-earnings forecasts for next year.

See our latest analysis for Paratek Pharmaceuticals

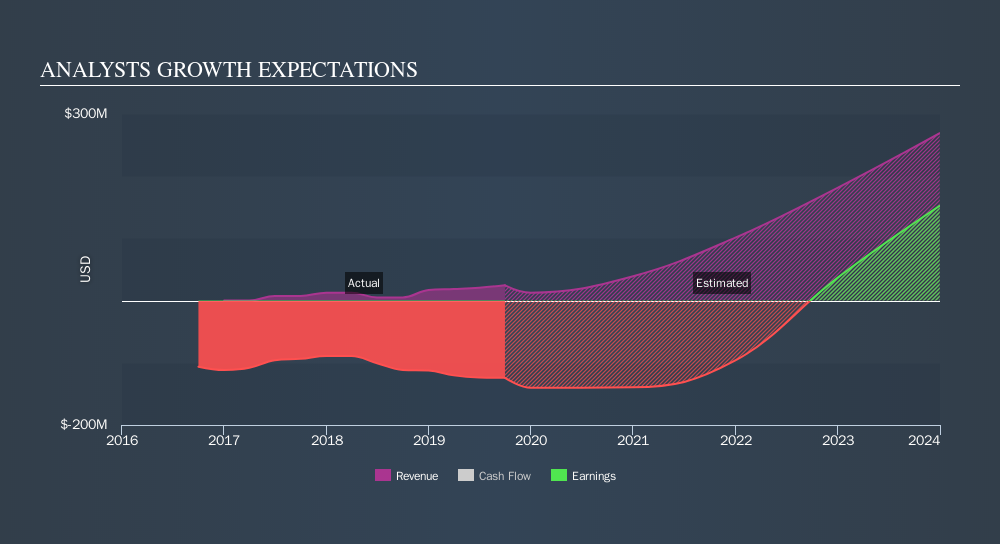

Following the latest results, Paratek Pharmaceuticals's five analysts are now forecasting revenues of US$39m in 2020. This would be a sizeable 59% improvement in sales compared to the last 12 months. Per-share losses are expected to see a sharp uptick, reaching US$3.29. Yet prior to the latest earnings, analysts had been forecasting revenues of US$44m and losses of US$3.28 per share in 2020. So there's been quite a change-up of views after the latest results, with analysts making a serious cut to their revenue forecasts while also granting a to the earnings per share numbers.

The consensus price target was broadly unchanged at US$19.80, implying that the business is performing roughly in line with expectations, despite a downwards adjustment to forecast sales next year. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Paratek Pharmaceuticals at US$36.00 per share, while the most bearish prices it at US$6.00. With such a wide range in price targets, analysts are almost certainly baking in outcomes as diverse as total success and probable failure in the underlying business. With this in mind, we wouldn't assign too much meaning to the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether analysts are more or less bullish relative to other companies in the market. Analysts are definitely expecting Paratek Pharmaceuticals's growth to accelerate, with the forecast 59% growth ranking favourably alongside historical growth of 40% per annum over the past five years. Compare this with other companies in the same market, which are forecast to grow their revenue 5.5% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that Paratek Pharmaceuticals is expected to grow much faster than its market.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for next year. Unfortunately analysts also downgraded their revenue estimates, although industry data suggests that Paratek Pharmaceuticals's revenues are expected to grow faster than the wider market. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Paratek Pharmaceuticals going out to 2023, and you can see them free on our platform here..

You can also see whether Paratek Pharmaceuticals is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:PRTK

Paratek Pharmaceuticals

Paratek Pharmaceuticals, Inc., a commercial-stage biopharmaceutical company, focuses on the development and commercialization of life-saving therapies for life-threatening diseases or other public health threats for civilian, government, and military use.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)