- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

Does Orient Green Power Company Limited's (NSE:GREENPOWER) CEO Salary Compare Well With Others?

Venkatachalam Ayyar became the CEO of Orient Green Power Company Limited (NSE:GREENPOWER) in 2013. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Orient Green Power

How Does Venkatachalam Ayyar's Compensation Compare With Similar Sized Companies?

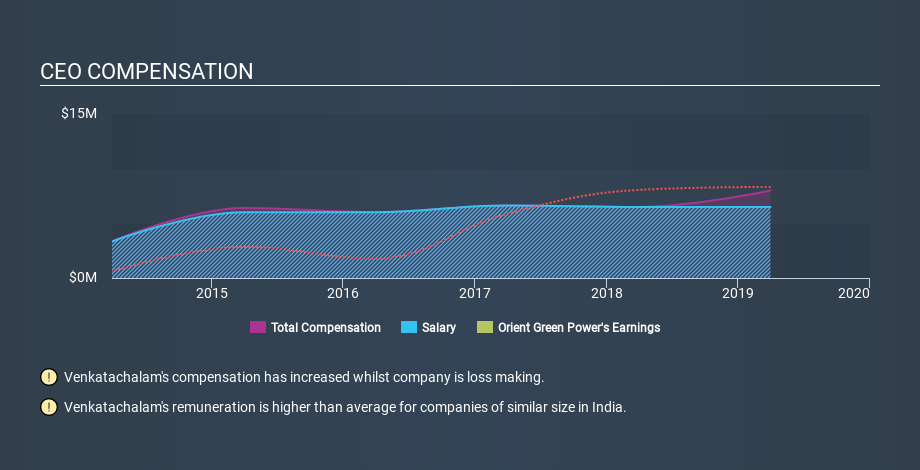

At the time of writing, our data says that Orient Green Power Company Limited has a market cap of ₹1.5b, and reported total annual CEO compensation of ₹8.0m for the year to March 2019. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at ₹6.5m. We examined a group of similar sized companies, with market capitalizations of below ₹15b. The median CEO total compensation in that group is ₹3.6m.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. On a sector level, around 75% of total compensation represents salary and 25% is other remuneration. So it seems like there isn't a significant difference between Orient Green Power and the broader market, in terms of salary allocation in the overall compensation package.

As you can see, Venkatachalam Ayyar is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Orient Green Power Company Limited is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance. You can see, below, how CEO compensation at Orient Green Power has changed over time.

Is Orient Green Power Company Limited Growing?

On average over the last three years, Orient Green Power Company Limited has seen earnings per share (EPS) move in a favourable direction by 37% each year (using a line of best fit). Its revenue is up 3.2% over last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Orient Green Power Company Limited Been A Good Investment?

With a three year total loss of 79%, Orient Green Power Company Limited would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We examined the amount Orient Green Power Company Limited pays its CEO, and compared it to the amount paid by similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

However, the earnings per share growth over three years is certainly impressive. On the other hand returns to investors over the same period have probably disappointed many. One might thus conclude that it would be better if the company waited until growth is reflected in the share price, before increasing CEO compensation. Shifting gears from CEO pay for a second, we've picked out 3 warning signs for Orient Green Power that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:GREENPOWER

Orient Green Power

An independent power producer of renewable power, engages in the generation and sale of wind energy in India and Croatia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)