Does It Make Sense To Buy KONE Oyj (HEL:KNEBV) For Its Yield?

Dividend paying stocks like KONE Oyj (HEL:KNEBV) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

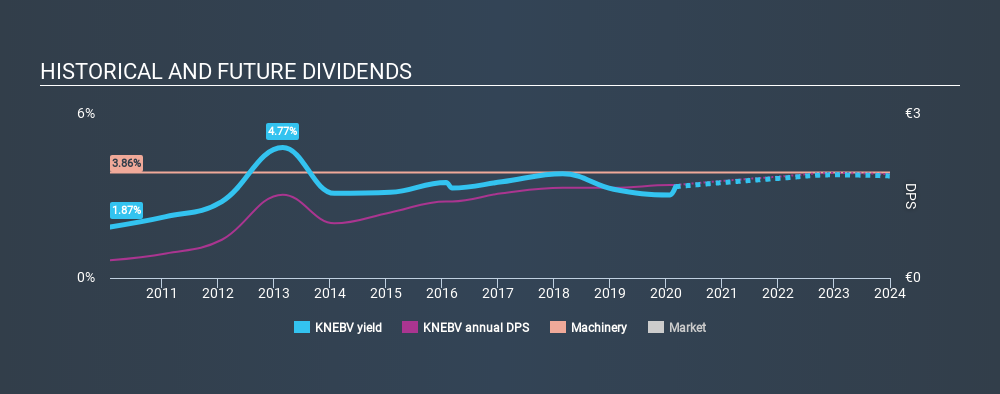

With KONE Oyj yielding 3.3% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can reduce the risk of holding KONE Oyj for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on KONE Oyj!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. KONE Oyj paid out 94% of its profit as dividends, over the trailing twelve month period. This is quite a high payout ratio that suggests the dividend is not well covered by earnings.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. KONE Oyj paid out 73% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. While the dividend was not well covered by profits, at least they were covered by free cash flow. Even so, if the company were to continue paying out almost all of its profits, we'd be concerned about whether the dividend is sustainable in a downturn.

With a strong net cash balance, KONE Oyj investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of KONE Oyj's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of KONE Oyj's dividend payments. Its dividend payments have declined on at least one occasion over the past ten years. During the past ten-year period, the first annual payment was €0.33 in 2010, compared to €1.70 last year. This works out to be a compound annual growth rate (CAGR) of approximately 18% a year over that time. The dividends haven't grown at precisely 18% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? KONE Oyj has grown its earnings per share at 4.1% per annum over the past five years. Still, the company has struggled to grow its EPS, and currently pays out 94% of its earnings. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

Conclusion

To summarise, shareholders should always check that KONE Oyj's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're not keen on the fact that KONE Oyj paid out such a high percentage of its income, although its cashflow is in better shape. Second, earnings growth has been ordinary, and its history of dividend payments is chequered - having cut its dividend at least once in the past. Overall, KONE Oyj falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 24 KONE Oyj analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:KNEBV

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)