- Sweden

- /

- Commercial Services

- /

- OM:INTRUM

Does Intrum (STO:INTRUM) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Intrum (STO:INTRUM). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Intrum

How Fast Is Intrum Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Intrum's EPS soared from kr14.41 to kr19.57, over the last year. That's a impressive gain of 36%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Intrum's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. On the one hand, Intrum's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

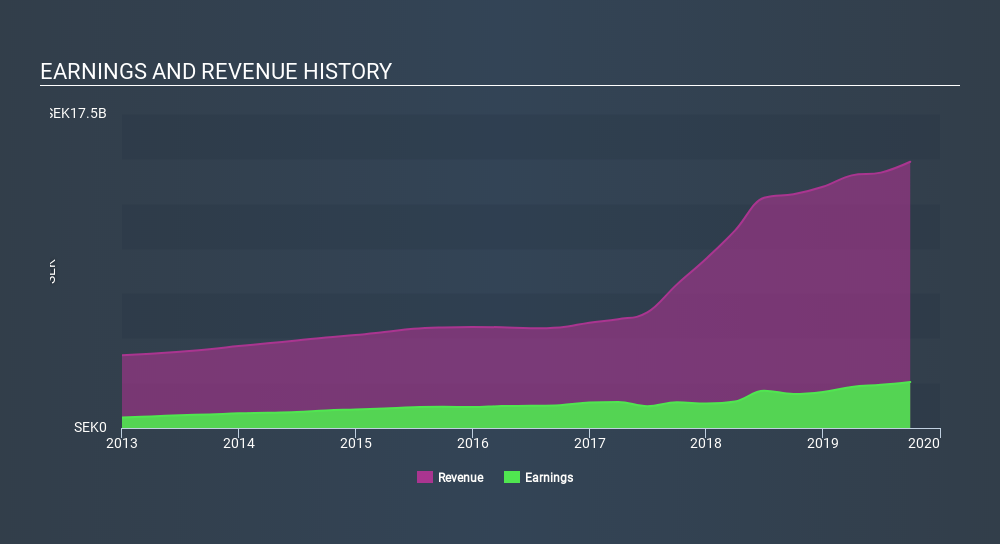

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Intrum's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Intrum Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Intrum shares worth a considerable sum. Indeed, they hold kr139m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Intrum Deserve A Spot On Your Watchlist?

You can't deny that Intrum has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Of course, just because Intrum is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:INTRUM

Intrum

Provides payment solutions, and credit and collection services in Europe and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks