- South Korea

- /

- Electrical

- /

- KOSE:A103590

Discovering Hanall Biopharma And Two Other Asian Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period of cautious investor sentiment and mixed economic signals, Asian stock markets have shown resilience, with some indices recording gains despite broader uncertainties. In this environment, identifying stocks that may be undervalued relative to their intrinsic value can offer intriguing opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.89 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Meitu (SEHK:1357) | HK$9.16 | HK$18.08 | 49.3% |

| Kolmar Korea (KOSE:A161890) | ₩77300.00 | ₩154237.33 | 49.9% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.51 | HK$18.77 | 49.3% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95425.56 | 49.5% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥91.11 | 48.2% |

| Cosmax (KOSE:A192820) | ₩212000.00 | ₩414369.67 | 48.8% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥28.43 | CN¥54.90 | 48.2% |

Here we highlight a subset of our preferred stocks from the screener.

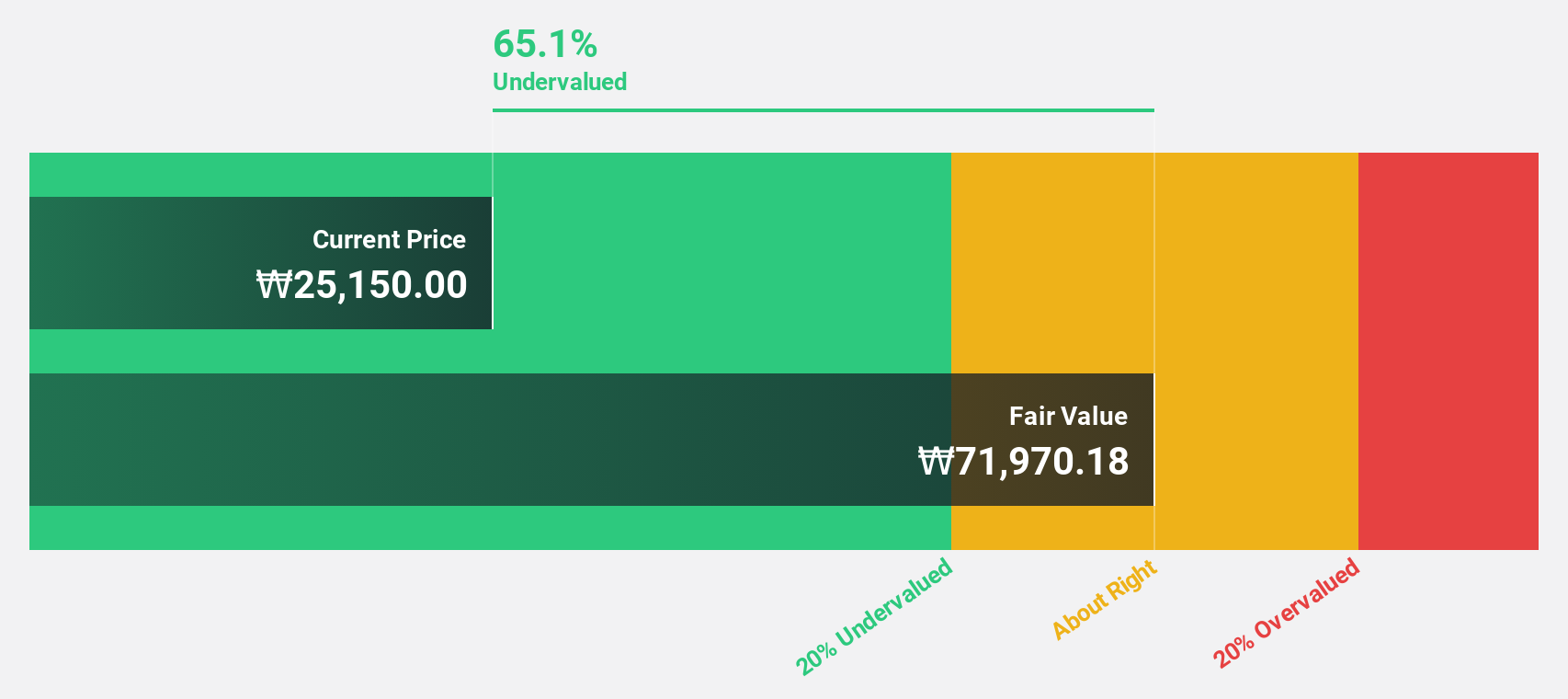

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩1.75 trillion.

Operations: The company's revenue from the manufacture and sale of pharmaceuticals amounts to ₩150.09 billion.

Estimated Discount To Fair Value: 40.8%

Hanall Biopharma is trading at ₩34,500, significantly below its estimated fair value of ₩58,260.49, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow substantially at 50% annually over the next three years, outpacing the Korean market's average growth rate of 23.6%. Although revenue growth is projected at a slower pace of 13.5%, it still surpasses the broader market's anticipated rate of 7.5%.

- Insights from our recent growth report point to a promising forecast for Hanall Biopharma's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Hanall Biopharma.

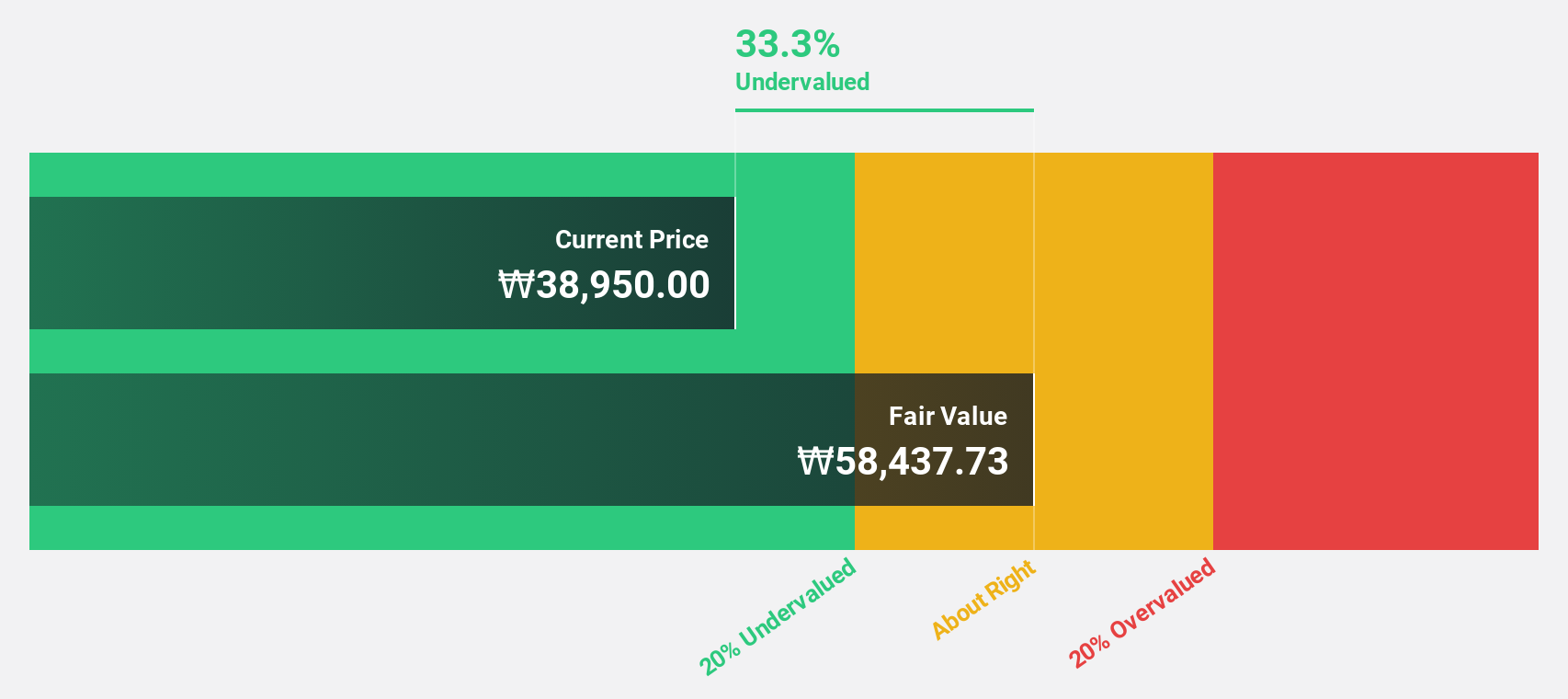

Iljin ElectricLtd (KOSE:A103590)

Overview: Iljin Electric Co., Ltd is involved in the production of power transmission and distribution equipment, with a market cap of ₩1.76 trillion.

Operations: The company's revenue is primarily derived from its Wire segment, generating ₩1.43 billion, and its Power System segment, contributing ₩512.70 million.

Estimated Discount To Fair Value: 37.9%

Iljin Electric Ltd. is currently trading at ₩36,850, which is 37.9% below its estimated fair value of ₩59,316.85, highlighting significant undervaluation based on cash flows. The company's earnings are projected to grow significantly at 25.8% annually over the next three years, surpassing the Korean market's average growth of 23.6%. However, its revenue growth forecast of 9.8% per year lags behind the higher earnings growth expectations and a low future Return on Equity of 19%.

- The growth report we've compiled suggests that Iljin ElectricLtd's future prospects could be on the up.

- Take a closer look at Iljin ElectricLtd's balance sheet health here in our report.

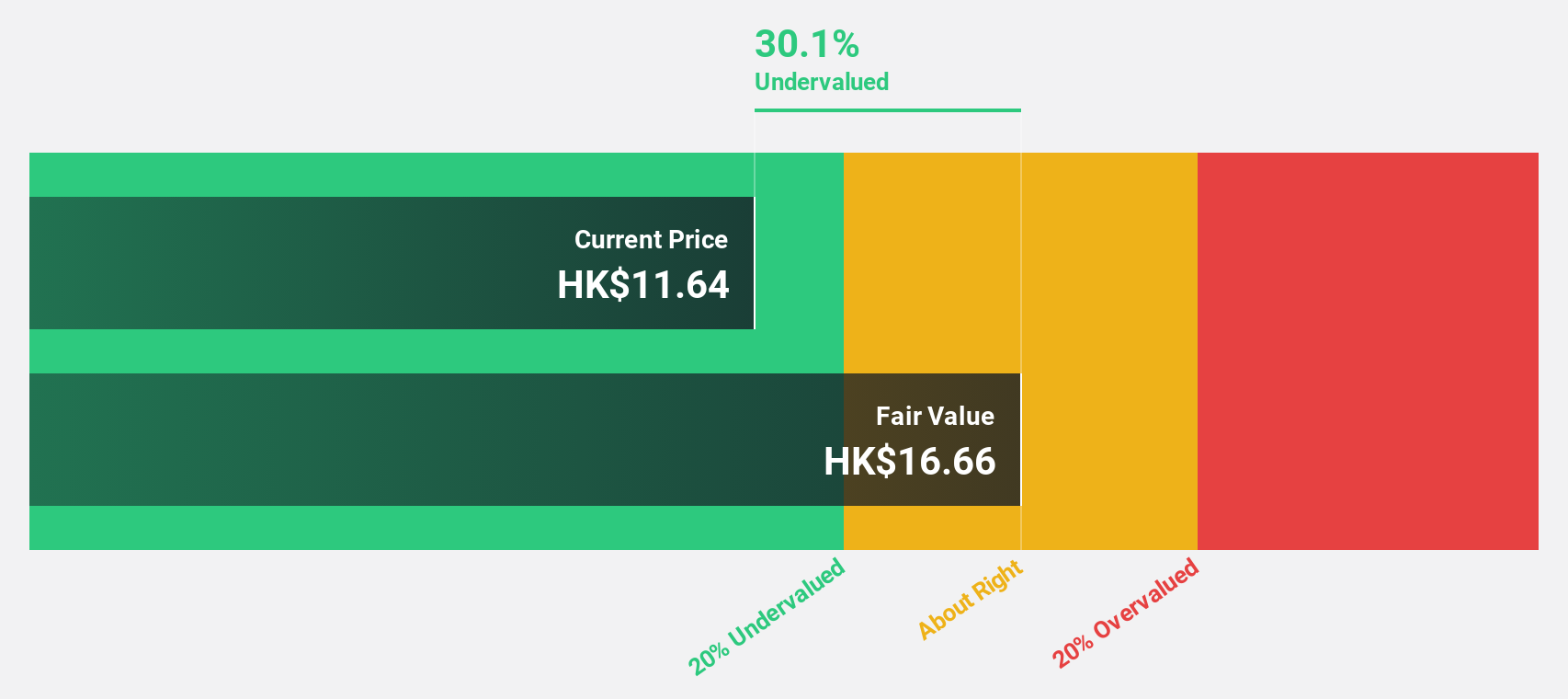

YSB (SEHK:9885)

Overview: YSB Inc. operates a digital pharmaceutical platform serving pharmaceutical companies, distributors, vendors, pharmacies, and primary healthcare institutions in China, with a market cap of HK$7.85 billion.

Operations: The company's revenue is primarily derived from its wholesale drug segment, which amounts to CN¥18.93 billion.

Estimated Discount To Fair Value: 30.7%

YSB Inc. is trading at HK$11.54, significantly below its estimated fair value of HK$16.66, indicating undervaluation based on cash flows. The company recently reported a substantial increase in net income to CNY 78.12 million for the first half of 2025, driven by strong demand for high-margin products and improved operational efficiency. Forecasts suggest earnings growth of 68.7% annually over the next three years, outpacing the Hong Kong market's average growth rate.

- Upon reviewing our latest growth report, YSB's projected financial performance appears quite optimistic.

- Navigate through the intricacies of YSB with our comprehensive financial health report here.

Turning Ideas Into Actions

- Delve into our full catalog of 296 Undervalued Asian Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A103590

Iljin ElectricLtd

Engages in the production of transmission and distribution of power equipment.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives