- United States

- /

- Logistics

- /

- NasdaqCM:CRGO

Discover May 2025's Top Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, but it has risen by 9.1% over the past year, with earnings expected to grow by 14% per annum in the coming years. In light of these conditions, investors might find value in exploring lesser-known opportunities that offer solid financial foundations and potential for growth. Penny stocks, often representing smaller or newer companies, remain a relevant area of investment; despite their historical connotations, they can present unique opportunities for those seeking hidden value and robust balance sheets.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.81 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.01 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.74 | $364.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.78 | $95.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.70 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.8283 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.22 | $72.17M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.922 | $28.94M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.06 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.877 | $78.88M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CPS Technologies (NasdaqCM:CPSH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CPS Technologies Corporation offers advanced material solutions across various sectors including transportation, automotive, energy, and defense in the United States, Europe, and Asia with a market cap of $42.42 million.

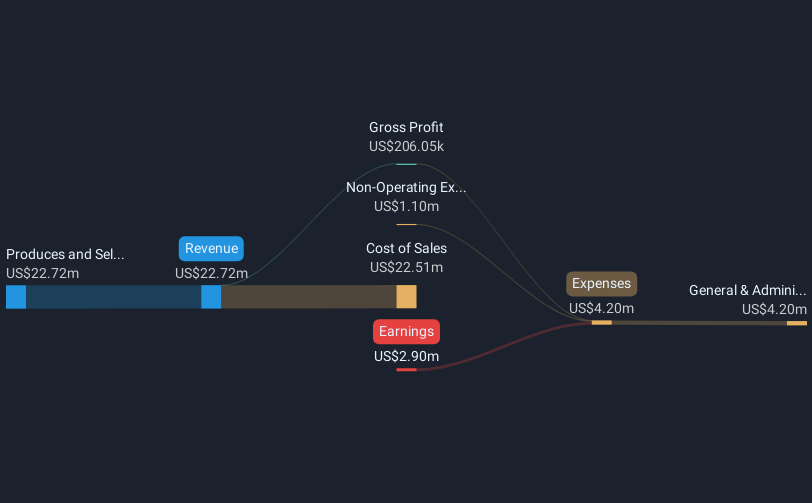

Operations: The company's revenue of $22.72 million is derived from producing and selling advanced material solutions.

Market Cap: $42.42M

CPS Technologies Corporation, with a market cap of US$42.42 million, has shown some promising developments despite its challenges as a penny stock. Recent earnings reports indicate an improvement in financial performance with first-quarter revenue rising to US$7.51 million and achieving a net income of US$0.096 million, reversing the previous year's loss for the same period. The company's strategic focus on innovation is evident through multiple U.S. Army contracts aimed at advancing military vehicle technology and radiation shielding materials development, potentially enhancing future revenue streams despite current unprofitability and declining earnings over five years by 32% annually.

- Click here to discover the nuances of CPS Technologies with our detailed analytical financial health report.

- Evaluate CPS Technologies' historical performance by accessing our past performance report.

Freightos (NasdaqCM:CRGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Freightos Limited operates a vendor-neutral booking and payment platform for international freight, with a market cap of $122.60 million.

Operations: Freightos Limited does not report any specific revenue segments.

Market Cap: $122.6M

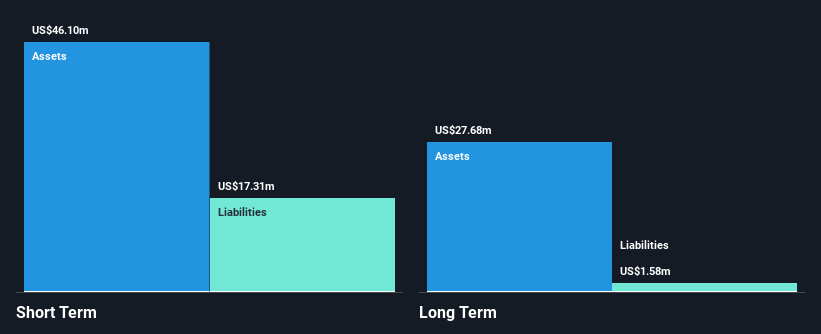

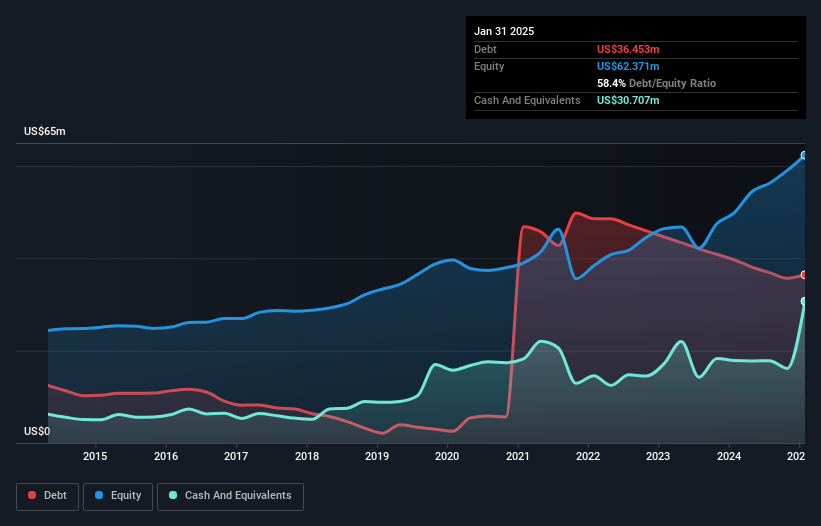

Freightos Limited, with a market cap of US$122.60 million, has recently reported first-quarter sales of US$6.95 million, reflecting growth from the previous year despite ongoing unprofitability and a net loss of US$4.5 million. The company has launched Freightos Enterprise, an advanced logistics procurement suite designed to optimize freight operations amid industry volatility. Its short-term assets significantly exceed long-term liabilities, highlighting financial stability in the near term. Analysts expect revenue to grow by 21.13% annually, though the stock remains highly volatile and trades well below its estimated fair value according to analyst consensus.

- Unlock comprehensive insights into our analysis of Freightos stock in this financial health report.

- Learn about Freightos' future growth trajectory here.

Butler National (OTCPK:BUKS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Butler National Corporation, with a market cap of $102.08 million, operates internationally by designing, engineering, manufacturing, and servicing aerostructures and aircraft components along with avionics and related systems.

Operations: The company's revenue is derived from several segments, including Gaming ($38.59 million), Aircraft Modifications ($30.43 million), Special Mission Electronics ($13.38 million), and Aircraft Avionics ($2.59 million).

Market Cap: $102.08M

Butler National Corporation, with a market cap of US$102.08 million, is showing strong financial performance with revenue across various segments such as Gaming (US$38.59 million) and Aircraft Modifications (US$30.43 million). The company has achieved significant earnings growth, reporting an 83% increase over the past year, surpassing industry averages. Despite a relatively inexperienced management and board team, Butler National's short-term assets cover both short- and long-term liabilities effectively. Recent organizational changes include restructuring sales teams to enhance operational efficiency while maintaining high-quality earnings and stable weekly volatility at 9%.

- Click to explore a detailed breakdown of our findings in Butler National's financial health report.

- Explore historical data to track Butler National's performance over time in our past results report.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 728 more companies for you to explore.Click here to unveil our expertly curated list of 731 US Penny Stocks.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 29 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CRGO

Freightos

Operates a vendor-neutral booking and payment platform for international freight.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives