- United States

- /

- Metals and Mining

- /

- NYSE:CDE

Did Coeur Mining, Inc. (NYSE:CDE) Insiders Buy Up More Shares?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Coeur Mining, Inc. (NYSE:CDE).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.

View our latest analysis for Coeur Mining

The Last 12 Months Of Insider Transactions At Coeur Mining

Over the last year, we can see that the biggest insider purchase was by Senior VP & CFO Thomas Whelan for US$71k worth of shares, at about US$2.84 per share. Even though the purchase was made at a significantly lower price than the recent price (US$6.30), we still think insider buying is a positive. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

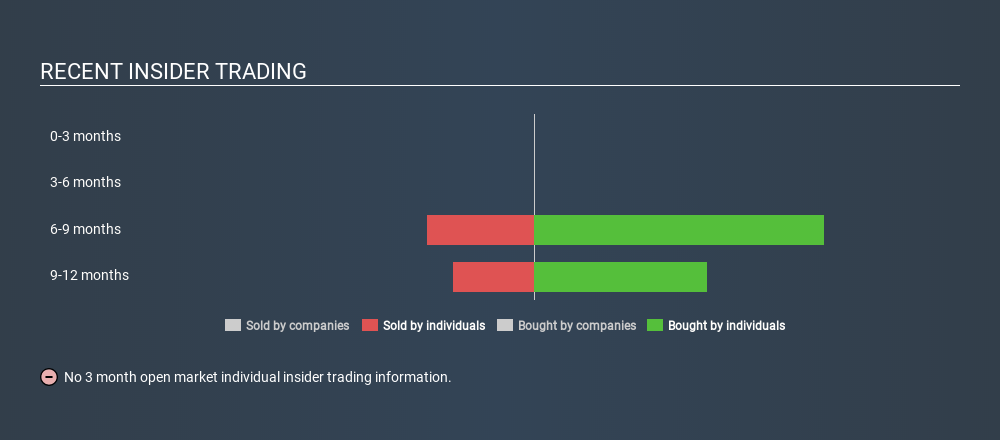

Over the last year, we can see that insiders have bought 42.75k shares worth US$125k. But they sold 17391 for US$90k. In the last twelve months there was more buying than selling by Coeur Mining insiders. The chart below shows insider transactions (by individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Coeur Mining is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Coeur Mining Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Coeur Mining insiders own about US$23m worth of shares. That equates to 1.5% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Coeur Mining Tell Us?

The fact that there have been no Coeur Mining insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. Insiders do have a stake in Coeur Mining and their transactions don't cause us concern. Of course, the future is what matters most. So if you are interested in Coeur Mining, you should check out this free report on analyst forecasts for the company.

But note: Coeur Mining may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CDE

Coeur Mining

Explores for precious metals in the United States, Canada, and Mexico.

Undervalued with reasonable growth potential.