- United States

- /

- Machinery

- /

- NYSE:DE

Deere (DE) Launches Operations Center PRO Service at US$195 Annually

Reviewed by Simply Wall St

Deere (DE) recently introduced Operations Center PRO Service, a new digital tool designed to enhance equipment maintenance and diagnostics, which could significantly bolster customer engagement. This announcement coincides with a 5.8% increase in the company's share price over the last quarter, aligning with general market trends marked by strong earnings reports from tech giants like Microsoft and Meta. Despite financial results showing a decline in revenue and net income for Q2 2025, Deere's product innovations and steady dividend payments provided stability, counterbalancing broader market movements and contributing to the firm's overall resilient performance.

Be aware that Deere is showing 1 risk in our investment analysis.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

Deere's introduction of Operations Center PRO Service is poised to enhance their product suite, potentially strengthening customer relationships, especially in markets like Brazil where precision agriculture is gaining traction. This could positively influence revenue and earnings forecasts, as it aligns with Deere's efforts to improve margins through high-value products and better inventory management. Despite challenges such as high interest rates and currency headwinds, the company remains focused on cost reductions and operational efficiencies to bolster net margins and stabilize earnings.

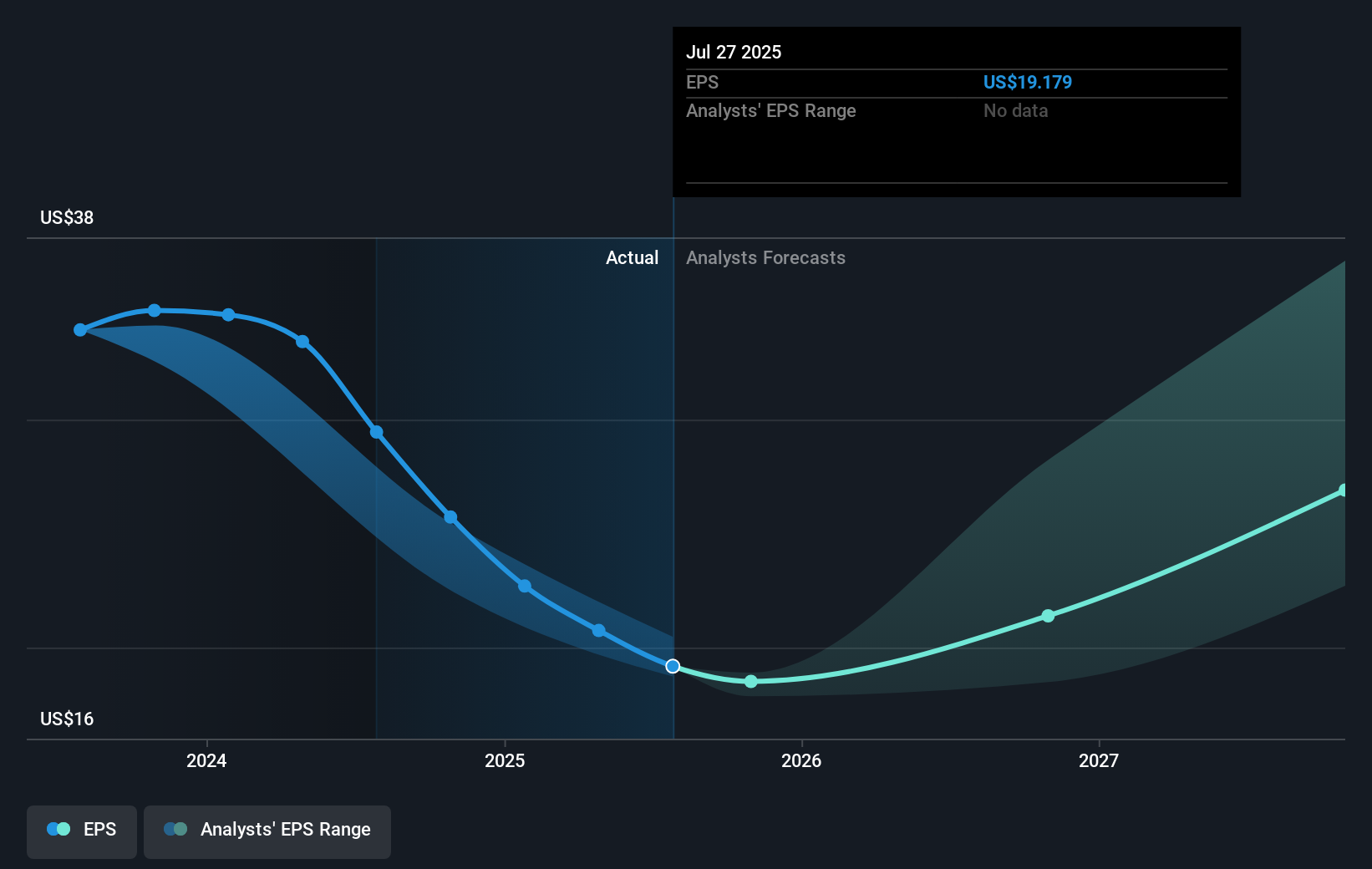

Over the past five years, Deere's total shareholder return, including both share price appreciation and dividends, was 196.34%, demonstrating significant value creation. Over the last year, Deere has outperformed the US Machinery industry, which saw a return of 13%. However, there has been a negative earnings growth of 40.3% in the same period, indicating some short-term challenges. The current share price of US$507.87 reflects a 5.7% discount to the consensus analyst price target of US$543.65, suggesting limited upside potential based on these projections. Investors might weigh the potential for future growth against the current pricing, with consideration for the improving market sentiment and product innovation driven by Deere's digital advancements.

Learn about Deere's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives