- United States

- /

- Banks

- /

- NYSE:CFG

Citizens Financial Group (NYSE:CFG) Announces Redemption Of 4.35% Notes Due August 2025

Reviewed by Simply Wall St

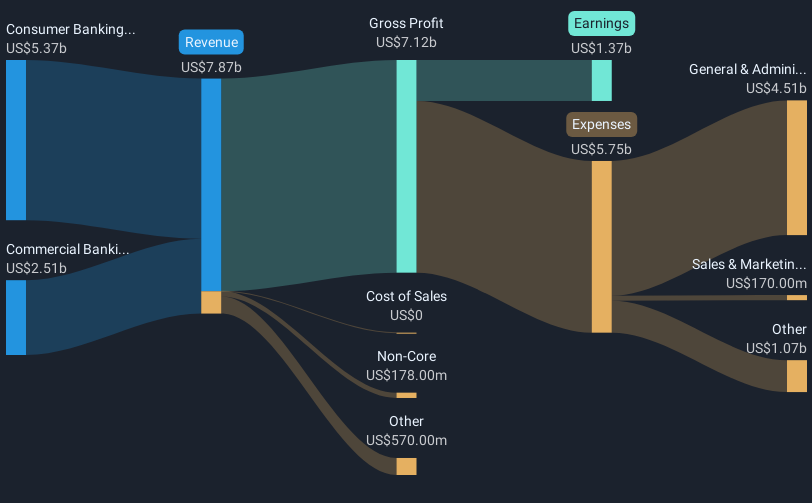

Citizens Financial Group (NYSE:CFG) recently announced the redemption of its 4.35% fixed-rate subordinated notes, which contributed to the stock's 7% rise last month. During the same period, the market remained buoyant, with significant gains in major indexes, including the S&P 500 and Nasdaq, as investor sentiment was bolstered by easing inflation expectations and strong performances from certain sectors. Although the overall market supported positive momentum, Citizens' move could have reinforced confidence among its shareholders, counteracting broader uncertainties from geopolitical and trade tensions, such as tariffs. Additionally, Brendan Coughlin's appointment as President has strengthened the company's executive leadership.

The positive market reaction to Citizens Financial Group's redemption of its 4.35% fixed-rate subordinated notes and the appointment of Brendan Coughlin as President aligns with analysts' expectations for a trajectory of growth. Over the past five years, Citizens' total return, including share price and dividends, was 77.11%. This long-term performance context highlights the confidence investors may have in the company's strategies despite uncertainties such as geopolitical tensions and market volatility.

In the past year, Citizens' performance fell short of the US Banks industry, which had a return of 21.5%. However, the company's initiatives in private banking and wealth management could bolster revenue growth and offset broader economic uncertainties. The sale of $1.9 billion in student loans is expected to enhance net interest margins and support future earnings growth, with analysts forecasting earnings to hit US$2.6 billion by 2028. In terms of price targets, currently trading at US$40.42, its price remains approximately 14.1% below the consensus analyst price target of US$47.05. Investors should balance this price trajectory with the enhanced earnings potential from strategic asset sales and management actions.

Gain insights into Citizens Financial Group's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives