- United States

- /

- Consumer Finance

- /

- NYSE:QD

Cango And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

The market is up 3.4% over the last week and has seen a 14% increase over the past year, with earnings forecasted to grow by 15% annually. For those looking beyond established names, penny stocks—often representing smaller or newer companies—offer unique opportunities in today's market landscape. While the term may seem outdated, these stocks can provide growth potential at lower price points when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.33 | $481.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8688 | $146.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.18 | $222.03M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.69 | $377.52M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.95 | $62.61M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8399 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.35 | $97.5M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.53 | $469.75M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 445 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cango (CANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cango Inc. operates an automotive transaction service platform connecting dealers, original equipment manufacturers, car buyers, and other industry participants in various regions including the People’s Republic of China and the British Virgin Islands, with a market cap of $463.13 million.

Operations: Cango Inc. has not reported any specific revenue segments.

Market Cap: $463.13M

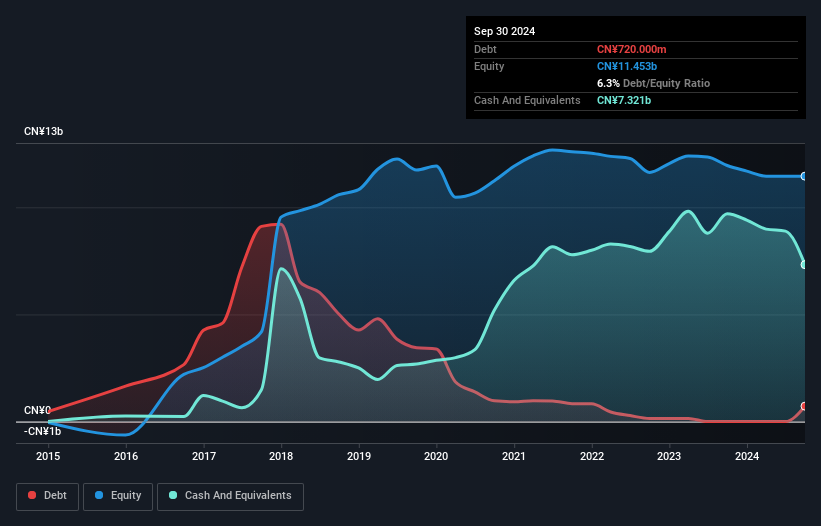

Cango Inc. recently reported a net loss of CN¥207.36 million for Q1 2025, despite achieving profitability in the past year, which complicates comparisons with industry growth rates. The company's short-term assets of CN¥4.4 billion comfortably cover both its short and long-term liabilities, suggesting strong liquidity. However, Cango's operating cash flow remains negative, indicating potential challenges in covering debt through operations alone. Recent executive changes and the disposal of its PRC business could impact future strategy and stability. Additionally, Cango's involvement in crypto mining adds a volatile element to its revenue streams amidst evolving regulatory landscapes.

- Get an in-depth perspective on Cango's performance by reading our balance sheet health report here.

- Assess Cango's future earnings estimates with our detailed growth reports.

NET Power (NPWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET Power Inc. is an energy technology company based in the United States with a market cap of approximately $543.29 million.

Operations: There are no reported revenue segments for NPWR.

Market Cap: $543.29M

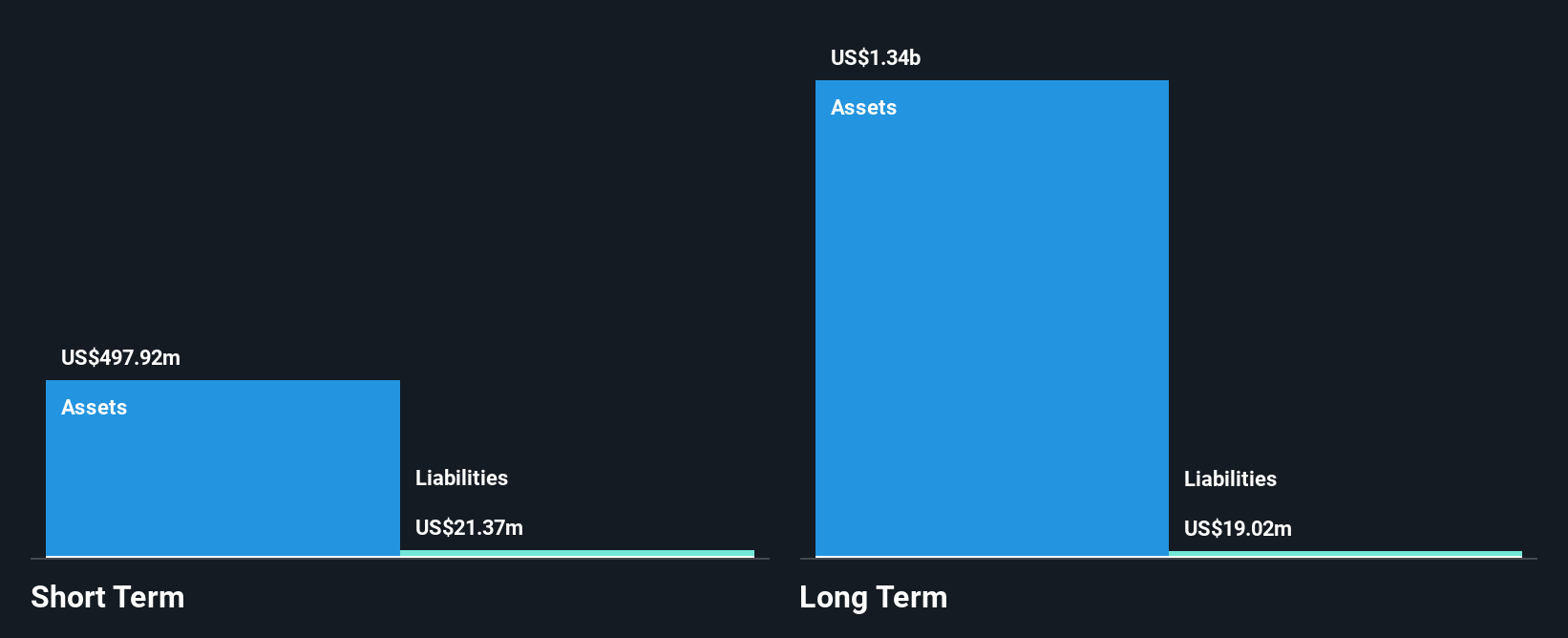

NET Power Inc., with a market cap of US$543.29 million, operates as a pre-revenue company, generating less than US$1 million annually. Despite being debt-free and having short-term assets of US$497.9 million that exceed liabilities, the company faces significant challenges. Its share price has been highly volatile, with increased losses reported in Q1 2025 at US$119.35 million compared to the previous year. Recent executive changes and legal issues surrounding Project Permian's delays and cost overruns have further impacted investor confidence, compounded by management's limited experience and ongoing operational uncertainties related to future project completions and timelines.

- Dive into the specifics of NET Power here with our thorough balance sheet health report.

- Gain insights into NET Power's future direction by reviewing our growth report.

Qudian (QD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Qudian Inc. is a consumer-oriented technology company based in the People's Republic of China, with a market cap of approximately $510.24 million.

Operations: Qudian generates revenue primarily from its Installment Credit Services, which contributed CN¥186.37 million.

Market Cap: $510.24M

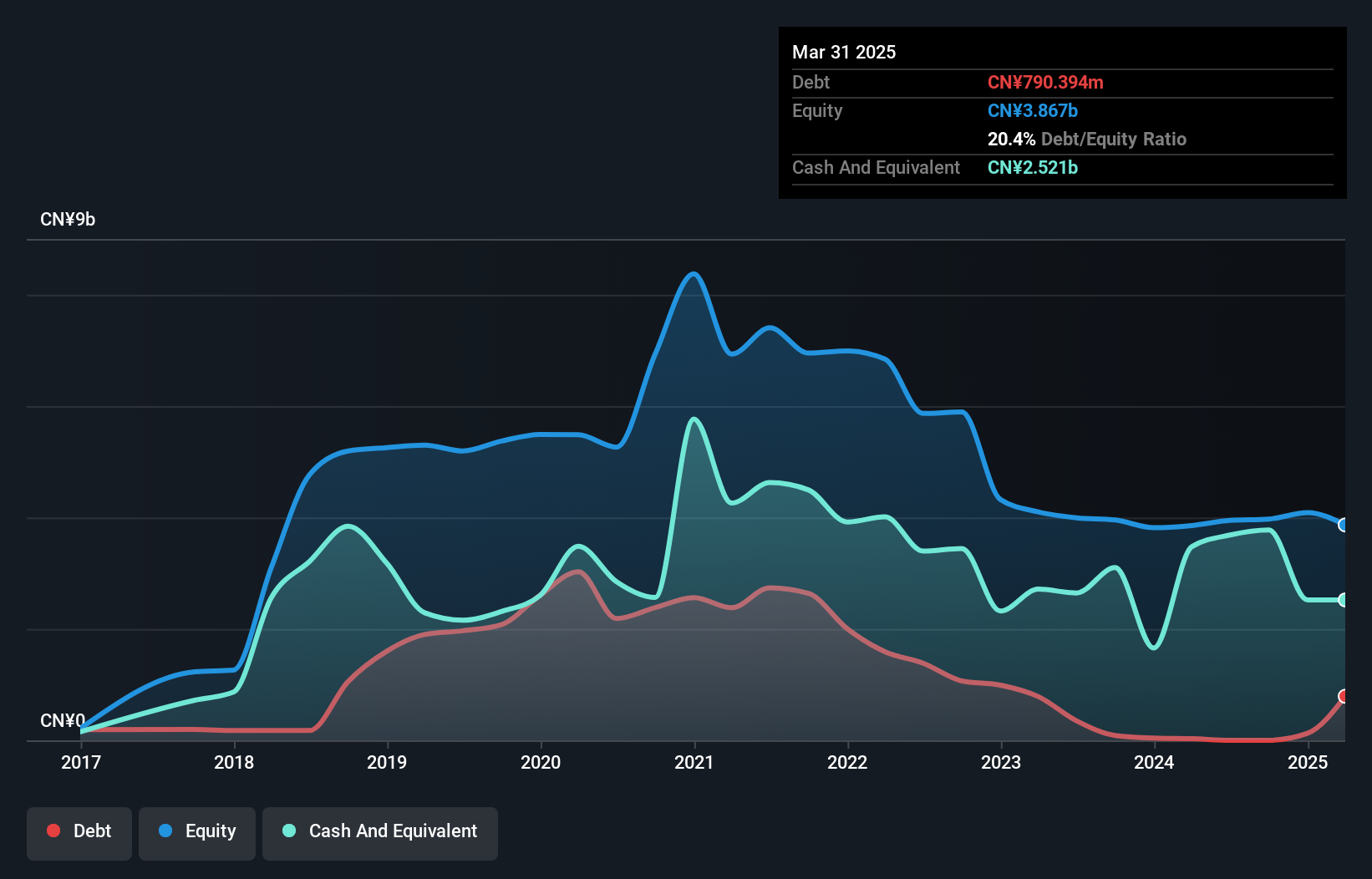

Qudian Inc., with a market cap of approximately $510.24 million, has shown recent profitability, reporting net income of CN¥150.11 million for Q1 2025 compared to a net loss the previous year. Despite declining revenues from CN¥55.85 million to CN¥25.79 million year-over-year, the company has strengthened its financial position by reducing its debt-to-equity ratio and maintaining more cash than total debt. The company's short-term assets significantly exceed both short- and long-term liabilities, indicating solid liquidity management. Additionally, Qudian's share buyback program reflects confidence in its valuation amidst low return on equity and volatile earnings history.

- Take a closer look at Qudian's potential here in our financial health report.

- Review our historical performance report to gain insights into Qudian's track record.

Key Takeaways

- Navigate through the entire inventory of 445 US Penny Stocks here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qudian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QD

Qudian

Operates as a consumer-oriented technology company in the People’s Republic of China.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026