- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Canadian Natural Resources (TSX:CNQ) Signs 15-Year Gas Deal with Cheniere Marketing

Reviewed by Simply Wall St

Canadian Natural Resources (TSX:CNQ) saw its share price rise by 6% over the past month, a period during which it secured a significant long-term gas supply agreement with Cheniere Marketing, a subsidiary of Cheniere Energy. Although the broader market remained relatively stable, up 11% over the past year, the company's earnings report and production results announcement likely reinforced investor confidence, contributing to the stock's monthly performance. The company reported substantial year-over-year revenue and net income growth, alongside improvements in natural gas and crude oil production. This positive financial momentum supported the company's upward price trajectory.

Canadian Natural Resources has 1 risk we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The recent gas supply agreement between Canadian Natural Resources and Cheniere Marketing could further strengthen the company's production and cash flow capabilities, aligning well with its strategic initiatives to enhance operational efficiency and expand production capacity. Such agreements are likely to have a positive impact on future revenue and earnings projections by securing long-term demand for its resources, which can support stable cash flows and potentially reduce earnings volatility.

Over the past five years, Canadian Natural Resources delivered an impressive total shareholder return of 312.93%, significantly outperforming recent one-year industry benchmarks. Despite underperforming the broader Canadian market by 13.9% over the past year, the company's sustained long-term growth highlights its capacity to generate robust returns through strategic operational initiatives and acquisitions.

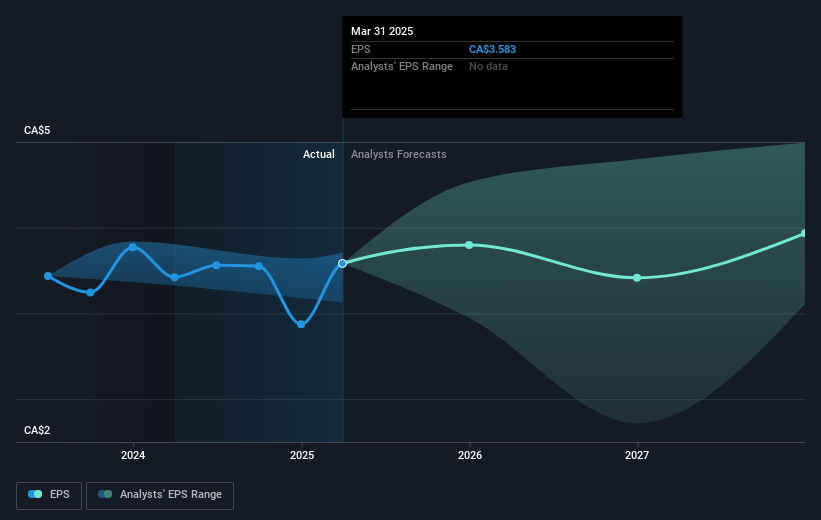

The recent share price movement, which brought the stock closer to the analyst consensus price target of CA$50.53 from its current CA$40.55, underscores investor confidence bolstered by positive news developments. However, to reach the consensus price target, Canadian Natural will need to maintain its earnings trajectory, balancing growth with industry-specific risks such as potential tariffs and regulatory changes. This scenario suggests that continued focus on cost management and operational efficiency will be critical to achieving these financial forecasts and sustaining long-term shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives