Can Mixed Fundamentals Have A Negative Impact on Ouro Fino Saúde Animal Participações S.A. (BVMF:OFSA3) Current Share Price Momentum?

Most readers would already be aware that Ouro Fino Saúde Animal Participações' (BVMF:OFSA3) stock increased significantly by 37% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Particularly, we will be paying attention to Ouro Fino Saúde Animal Participações' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Ouro Fino Saúde Animal Participações

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ouro Fino Saúde Animal Participações is:

10% = R$50m ÷ R$491m (Based on the trailing twelve months to March 2020).

The 'return' is the income the business earned over the last year. So, this means that for every R$1 of its shareholder's investments, the company generates a profit of R$0.10.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Ouro Fino Saúde Animal Participações' Earnings Growth And 10% ROE

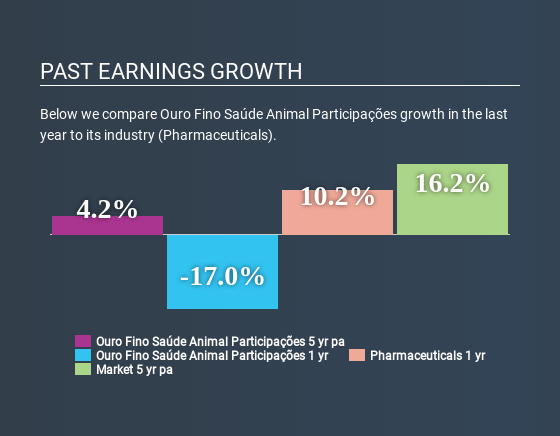

As you can see, Ouro Fino Saúde Animal Participações' ROE looks pretty weak. Further, we noted that the company's ROE is similar to the industry average of 11%. Thus, the low ROE certainly provides some context to Ouro Fino Saúde Animal Participações' very little net income growth of 4.2% seen over the past five years.

We then compared Ouro Fino Saúde Animal Participações' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 11% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Ouro Fino Saúde Animal Participações''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Ouro Fino Saúde Animal Participações Using Its Retained Earnings Effectively?

Ouro Fino Saúde Animal Participações doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business. However, this doesn't explain the low earnings growth the company has seen. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Summary

In total, we're a bit ambivalent about Ouro Fino Saúde Animal Participações' performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BOVESPA:OFSA3

Ouro Fino Saúde Animal Participações

Engages in the development, production, and sale of veterinary drugs, vaccines, and other products for production and companion animals primarily in Brazil.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)