- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (NYSE:BR) Expands Leadership Roles to Enhance Platform Evolution

Reviewed by Simply Wall St

Broadridge Financial Solutions (NYSE:BR) recently announced leadership changes, expanding roles to further its transition into a platform company, which comes as the company experienced a 1.21% price increase last week. This gain aligns with broader market trends as the major indices advanced, with the S&P 500 and Nasdaq showing resilience amid tech sector optimism and broader economic developments such as trade talks and fiscal policy discussions. Broadridge's removal from the Russell 1000 Dynamic Index attempted to counter this upward trend, but the company's leadership expansion appears to have strengthened investor confidence overall.

The recent leadership changes at Broadridge Financial Solutions are likely to reinforce its ongoing transformation into a platform-focused company, which aligns with its digitization and democratization strategies in wealth management and capital markets. The short-term share price increase of 1.21% last week could be a reflection of investor optimism about these strategic adjustments. However, the company's longer-term performance provides a broader context. Over the last five years, Broadridge's total shareholder return, including dividends, reached 109.28%, suggesting a significant appreciation compared to its more immediate gains.

Broadridge outperformed the US Professional Services industry over the past year, which returned 13.8%, while also surpassing the broader US market's 13.9% return. This strong performance suggests that the company's strategic initiatives and operational efficiencies are making a tangible impact. The leadership expansion announced could further drive revenue and earnings growth by fostering innovation and improving service delivery. However, uncertainties remain, particularly in revenue recognition and timing due to market volatility and currency fluctuations.

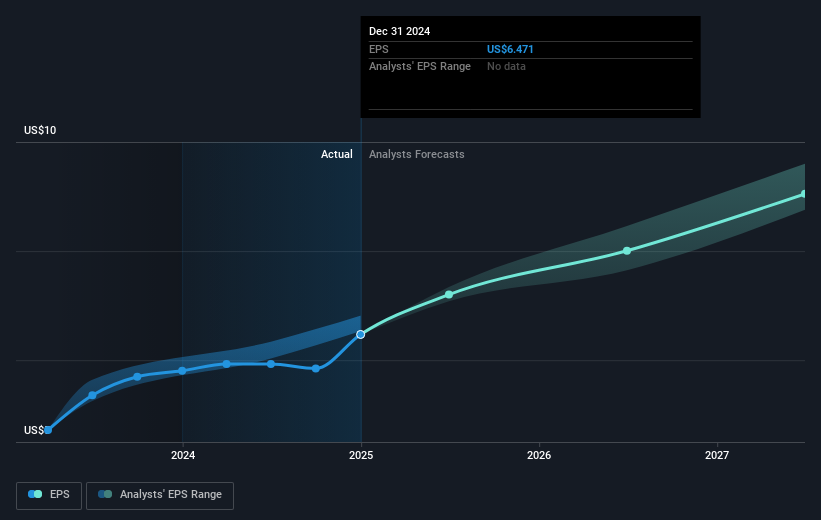

The current share price of US$233.57 is approximately 6.7% below the analyst consensus price target of US$250.26. This discrepancy indicates a general market belief that Broadridge is fairly valued, but there remains room for growth if the company meets the projected earnings of $1.1 billion and revenue growth targets. Analysts expecting higher revenue and profit margins align these forecasts with a projected PE ratio of 30.9x by 2028, which, if achieved, would validate the present price target while reflecting the company's strategic execution and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives