- United Kingdom

- /

- Insurance

- /

- AIM:PGH

Boku And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. In such a climate, investors often seek opportunities in smaller companies that might offer growth potential at lower price points. Penny stocks, although an older term, represent these opportunities by focusing on less-established firms that can provide value and growth when backed by strong financials. This article explores three UK penny stocks that may stand out for their financial strength and potential upside amid current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.68 | £523.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.20 | £258.52M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.36 | £150.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.4148 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.839 | £322.08M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.71 | £277.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.4345 | £123.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.1953 | £191.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £72.22M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Boku (AIM:BOKU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boku, Inc. and its subsidiaries offer local payment solutions for merchants across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of £673.47 million.

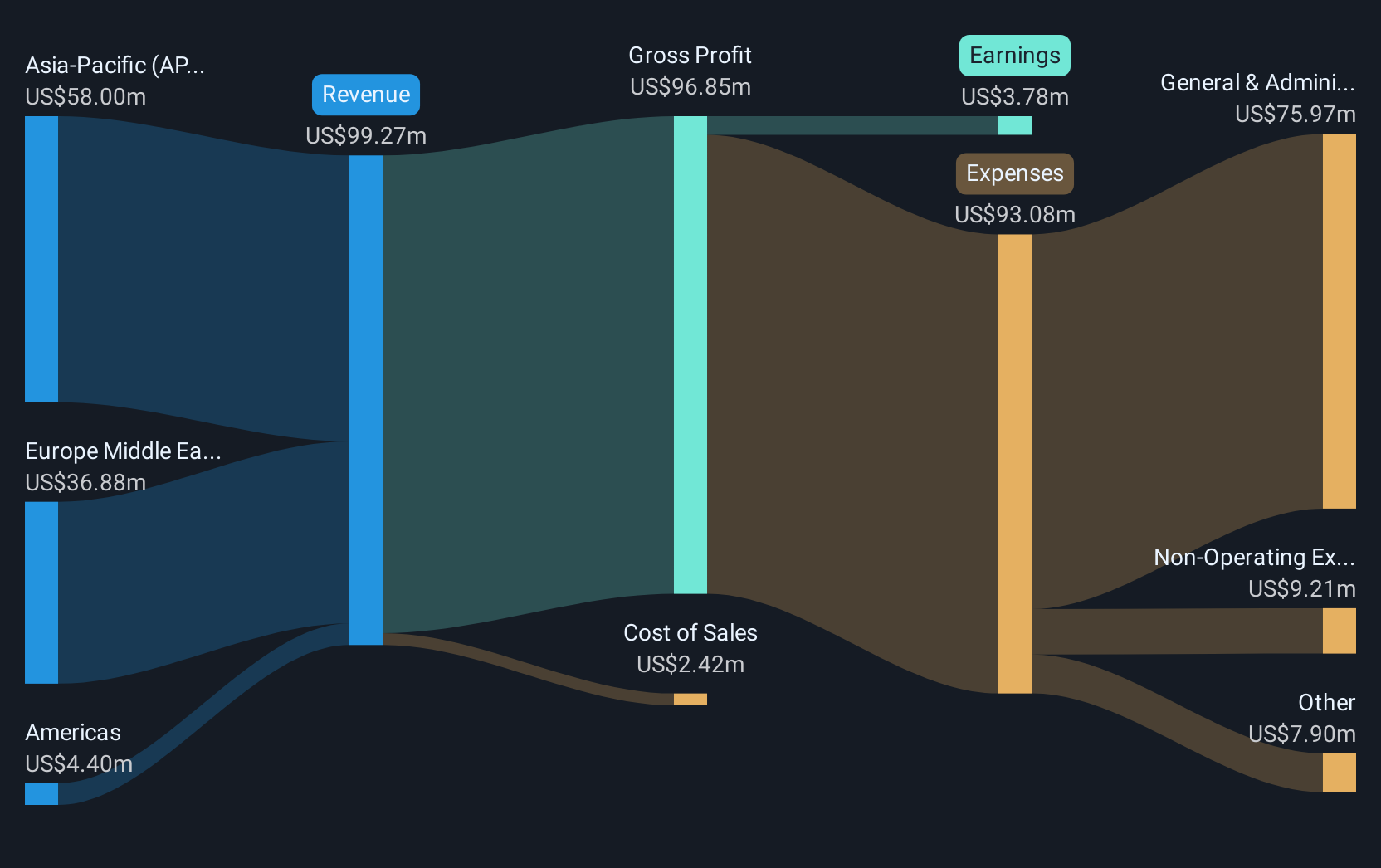

Operations: The company generates revenue from its Payments segment, totaling $99.27 million.

Market Cap: £673.47M

Boku has shown resilience as a penny stock with a market cap of £673.47 million and revenue from its Payments segment totaling US$99.27 million. The company's strategic partnership with Canva to expand in Asia and Europe highlights its potential for growth through innovative, localized payment solutions. Boku's recent Payment Institution license in Brazil positions it well within the evolving Open Finance ecosystem, enhancing its capabilities with Pix Automatico for seamless recurring payments. Despite low return on equity and inexperienced management, Boku remains debt-free with strong short-term asset coverage, indicating financial stability amidst expansion efforts.

- Click here to discover the nuances of Boku with our detailed analytical financial health report.

- Assess Boku's future earnings estimates with our detailed growth reports.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc provides employee services and salary sacrifice technology products in the United Kingdom, with a market cap of £116.38 million.

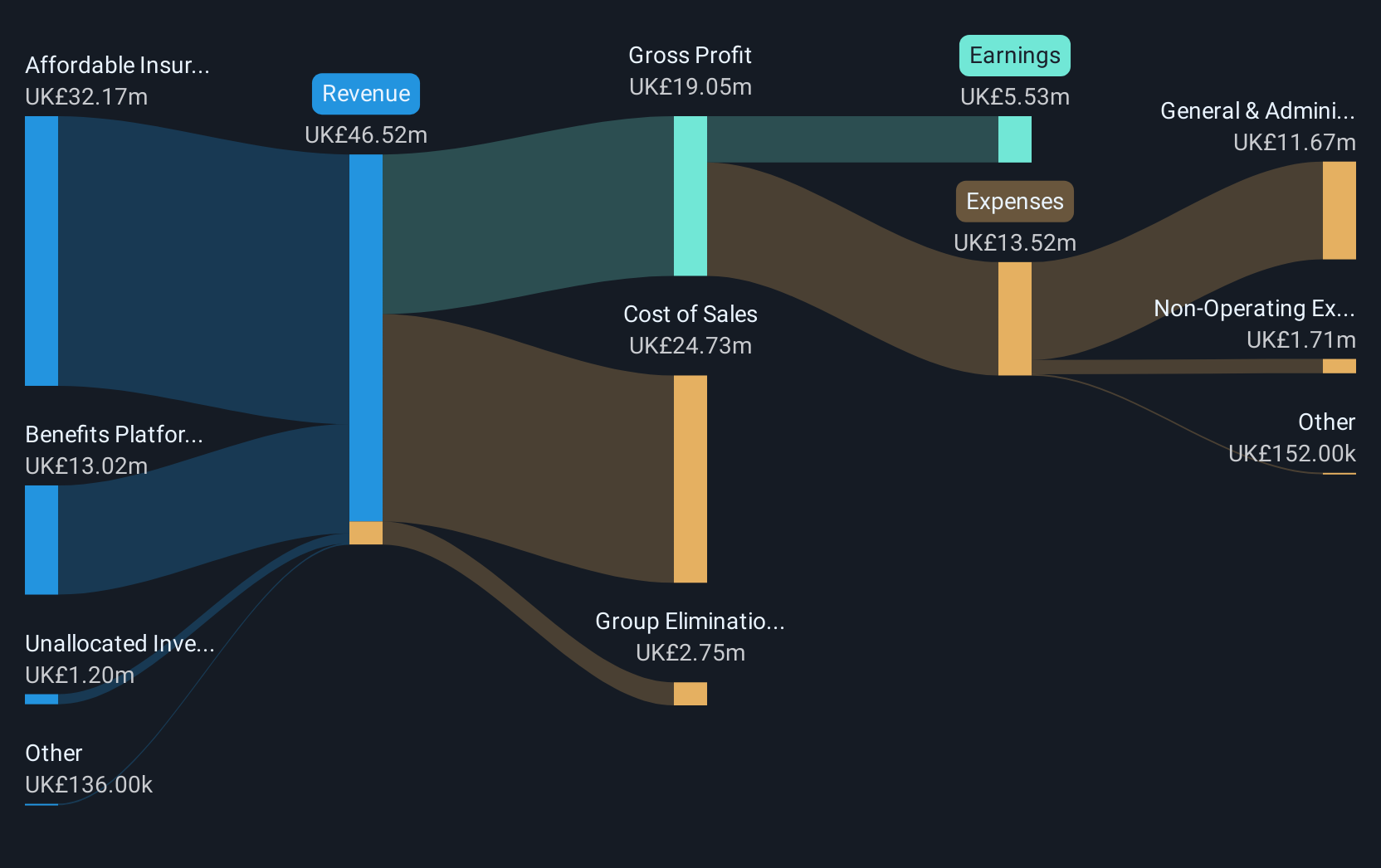

Operations: The company generates revenue through its Benefits Platform segment, which contributes £13.02 million, and its Affordable Insurance segment, which accounts for £32.17 million.

Market Cap: £116.38M

Personal Group Holdings, with a market cap of £116.38 million, shows potential as a penny stock through its solid revenue streams from the Benefits Platform (£13.02 million) and Affordable Insurance (£32.17 million) segments. Recent earnings growth of 32.3% surpasses its five-year average decline, indicating improved profitability alongside high-quality earnings and stable weekly volatility (4%). The company remains debt-free with short-term assets (£39.3M) exceeding liabilities, reflecting financial stability despite low return on equity (15.9%) and an unsustainable dividend coverage ratio of 5.36%. Management's experience further supports operational resilience in the current landscape.

- Click to explore a detailed breakdown of our findings in Personal Group Holdings' financial health report.

- Examine Personal Group Holdings' earnings growth report to understand how analysts expect it to perform.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £258.52 million, produces and sells cosmetics through its subsidiaries.

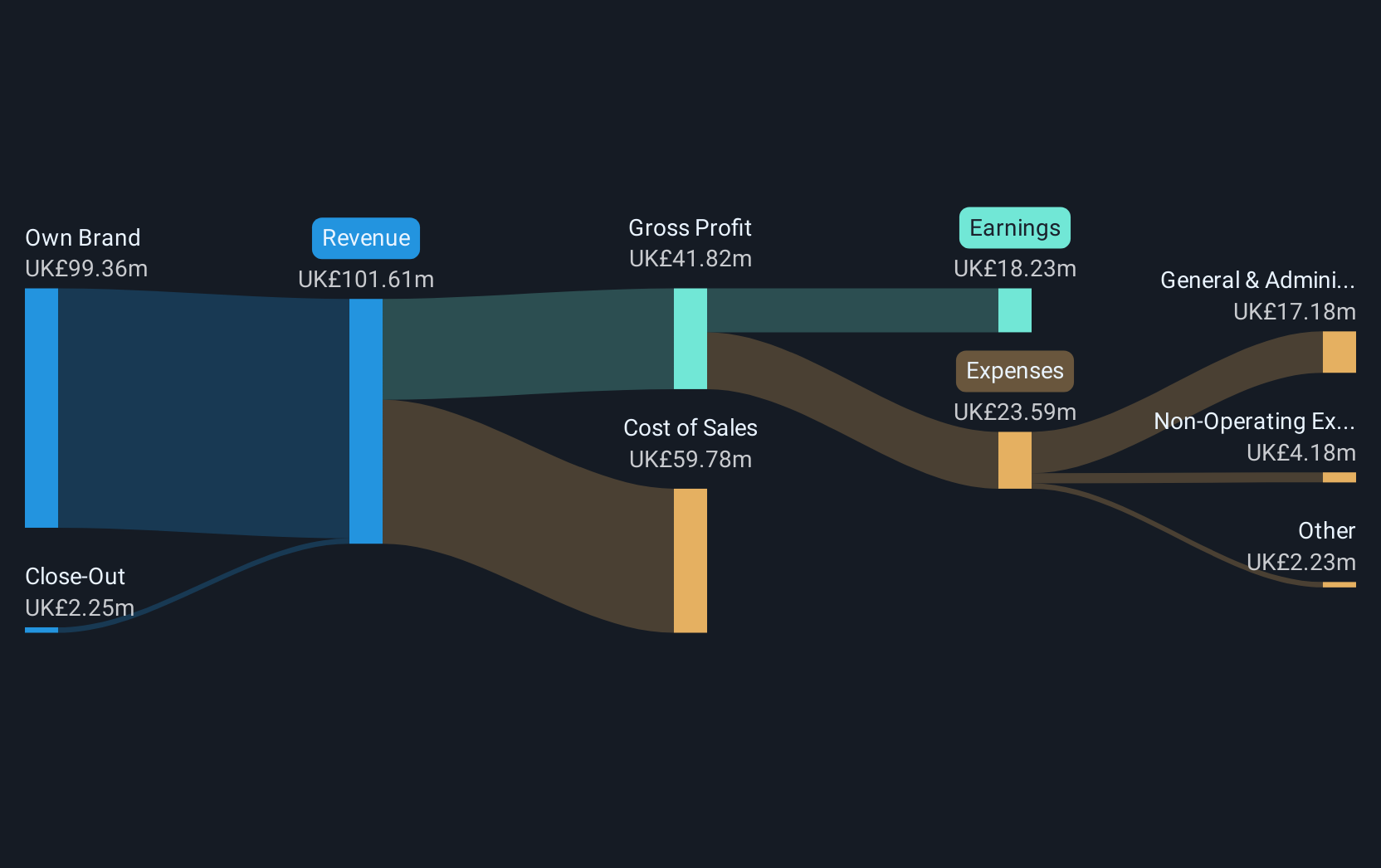

Operations: The company generates revenue through two main segments: Own Brand, which accounts for £99.36 million, and Close-Out, contributing £2.25 million.

Market Cap: £258.52M

Warpaint London PLC, with a market cap of £258.52 million, demonstrates strong financial health as a penny stock. Its debt-free status and substantial short-term assets (£71M) exceeding liabilities indicate stability. The company has experienced significant earnings growth of 31.2% over the past year, outpacing industry averages, though this is below its five-year average growth rate of 60.1%. Analysts anticipate a notable price increase potential at 39% below estimated fair value. Recent guidance suggests sales between £50 million and £52 million for the first half of 2025, despite US market challenges due to higher tariffs impacting margins positively overall.

- Dive into the specifics of Warpaint London here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Warpaint London's future.

Taking Advantage

- Click here to access our complete index of 298 UK Penny Stocks.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PGH

Personal Group Holdings

Engages in the provision of employee services and salary sacrifice technology products in the United Kingdom.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives