- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT) Sees Q2 2025 Earnings Turn Profit, Enhancing Investor Confidence

Reviewed by Simply Wall St

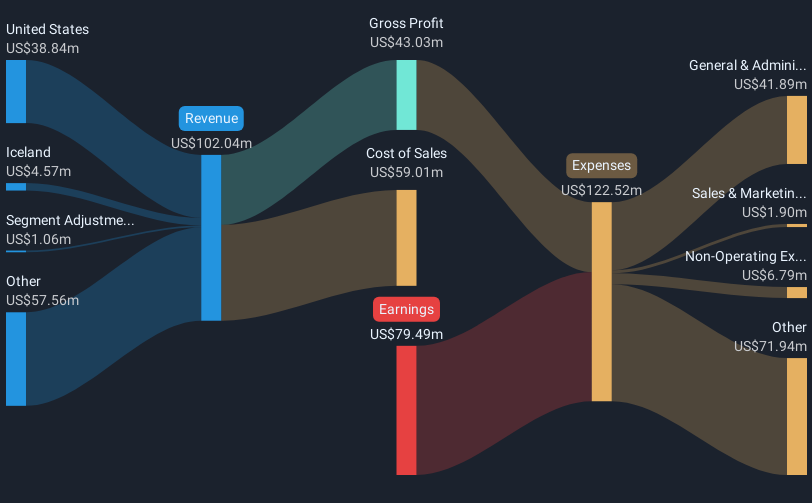

Bit Digital (BTBT) has seen a 19% increase in its share price over the last quarter, which could be linked to several recent company events and broader market conditions. Notably, Bit Digital's Q2 2025 earnings revealed improved net income, shifting from a net loss to a profit, possibly boosting investor sentiment. The appointment of Justin Zhu as Chief Accounting Officer might have added a measure of confidence for stakeholders. Additionally, the broader market trends, with the Nasdaq reaching record highs and expectations of a Federal Reserve rate cut, appear to align with the positive movement in the company’s stock. These events potentially provided support to Bit Digital's stock amidst overall market optimism.

The recent news surrounding Bit Digital, such as the appointment of Justin Zhu as Chief Accounting Officer and improved Q2 2025 earnings, has potentially bolstered investor confidence and aligns with the company's strategic shift towards Ethereum treasury and staking. This pivot is seen as a growth catalyst, potentially enhancing revenue forecasts and profit margins, especially as regulatory clarity supports broader institutional adoption.

Over the past three years, Bit Digital's total shareholder return, including share price and dividends, was 133.86%. However, in the shorter-term context of the past year, the company underperformed both the US market, which saw an 18.5% return, and the US Software industry, which returned 26.4%. This disparity may highlight the short-term market challenges faced by the company amid its strategic transition.

With a current share price of $2.97, the potential for price appreciation towards the analyst consensus price target of $5.7 suggests a significant upside. Analysts forecast revenue growth of 42.9% per year, underscoring the anticipated benefits of the company's new focus. However, achieving such growth will depend on Bit Digital's ability to mitigate risks associated with Ethereum volatility and increase its staking activities without substantial shareholder dilution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives