- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

Bank Of Sharjah P.J.S.C And 2 Other Promising Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown mixed results, influenced by fluctuating oil prices and expectations of a U.S. Federal Reserve rate cut. For investors looking beyond the major players, penny stocks—typically smaller or newer companies—offer intriguing possibilities that remain relevant despite the term's historical roots. This article explores three promising Middle Eastern penny stocks that stand out for their potential to provide both stability and growth opportunities in today's market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.80 | SAR2.14B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.61 | SAR1.44B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.75 | ₪337.29M | ✅ 3 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.90 | TRY1.35B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.12 | AED2.22B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.84 | AED12.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.842 | AED510.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.831 | ₪210.46M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED4.38 billion.

Operations: The company generates revenue primarily from its Commercial Banking segment, which accounts for AED373.76 million, and its Investment and Treasury operations, contributing AED342.43 million.

Market Cap: AED4.38B

Bank Of Sharjah P.J.S.C. has demonstrated significant earnings growth, with a recent year-over-year increase of AED 152.63 million in net income and an improved net profit margin of 67.3%. Despite this strong performance, the bank's return on equity remains low at 11.7%, and it faces challenges with a high level of non-performing loans at 6.6%. The management team is relatively new, which might affect strategic continuity. However, the bank maintains stable funding primarily through customer deposits (84% of liabilities) and offers good value with a price-to-earnings ratio below the market average.

- Get an in-depth perspective on Bank Of Sharjah P.J.S.C's performance by reading our balance sheet health report here.

- Examine Bank Of Sharjah P.J.S.C's past performance report to understand how it has performed in prior years.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, along with its subsidiaries, invests in education and healthcare companies both within the United Arab Emirates and internationally, with a market cap of AED2.83 billion.

Operations: The company's revenue is derived from two main segments: Education, contributing AED485.25 million, and Healthcare, generating AED365.18 million.

Market Cap: AED2.83B

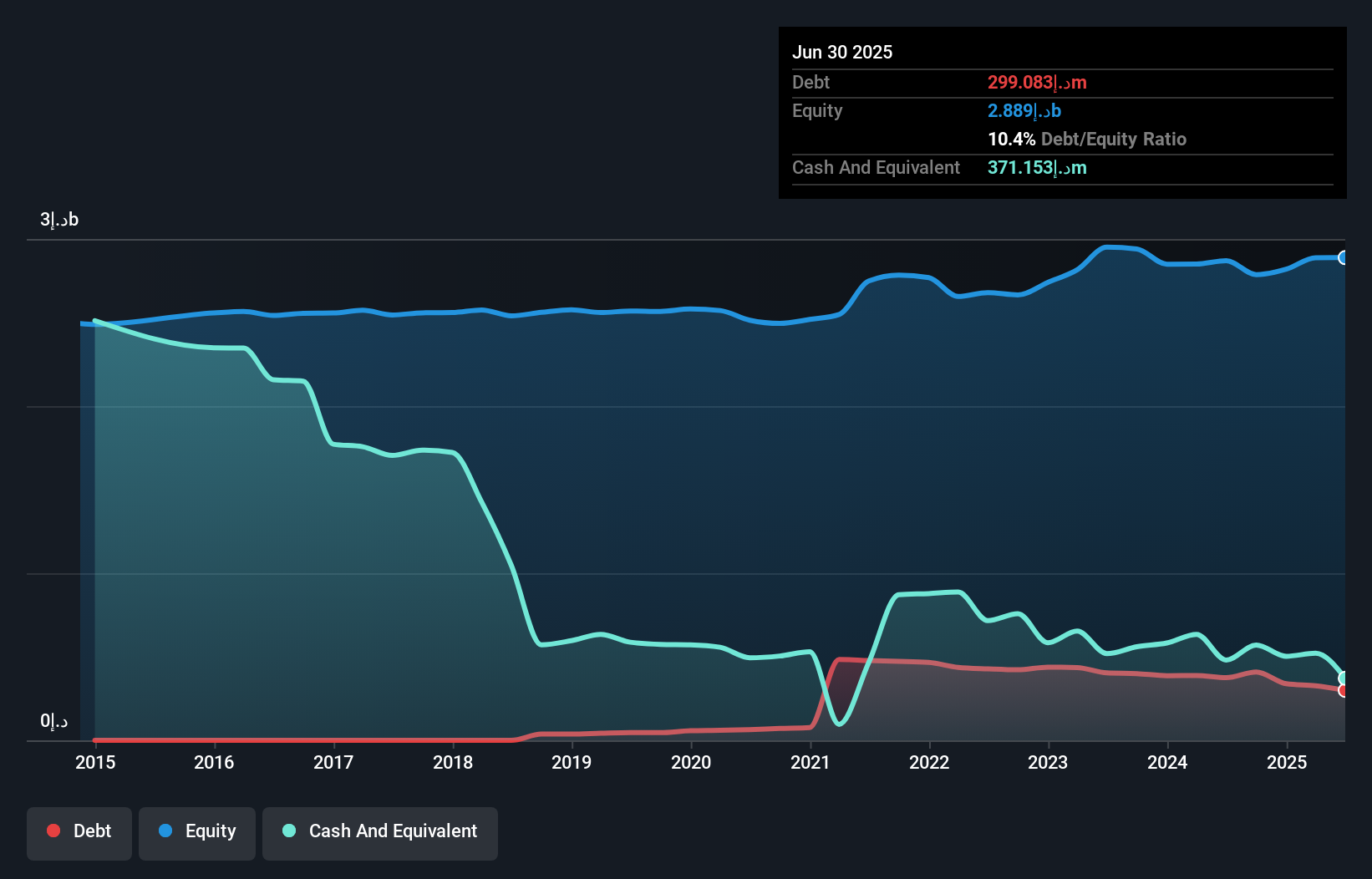

Amanat Holdings PJSC, with a market cap of AED2.83 billion, has shown robust earnings growth recently, marked by a 212.5% increase over the past year, significantly outpacing its industry peers. Despite this impressive growth and improved net profit margins from 6.6% to 17.5%, the company's return on equity remains low at 6.2%. The dividend yield of 4.04% is not fully covered by free cash flows, posing sustainability concerns. However, Amanat's financial stability is underpinned by strong coverage of debt through operating cash flow and more cash than total debt on its balance sheet.

- Jump into the full analysis health report here for a deeper understanding of Amanat Holdings PJSC.

- Review our historical performance report to gain insights into Amanat Holdings PJSC's track record.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates in the education sector by providing and investing in educational services within the United Arab Emirates, with a market cap of AED4.69 billion.

Operations: The company's revenue primarily comes from its school operations, which generated AED1.10 billion.

Market Cap: AED4.69B

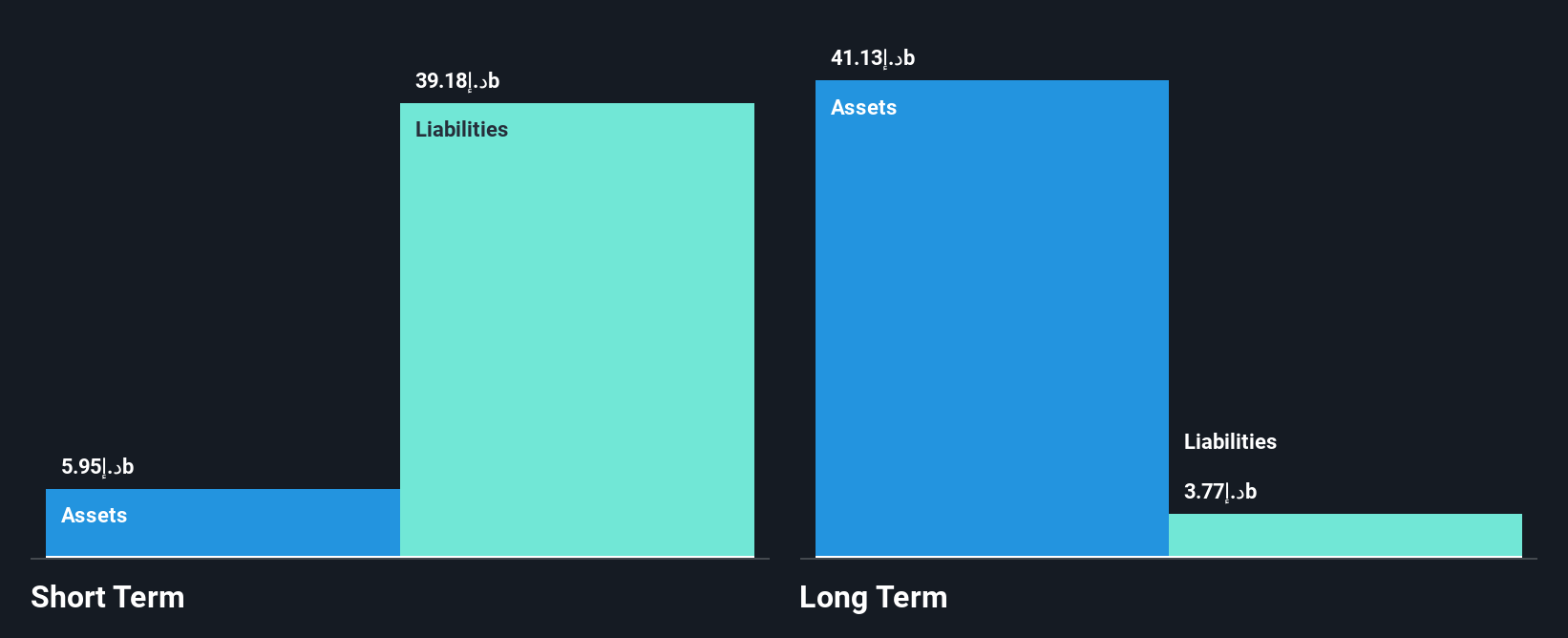

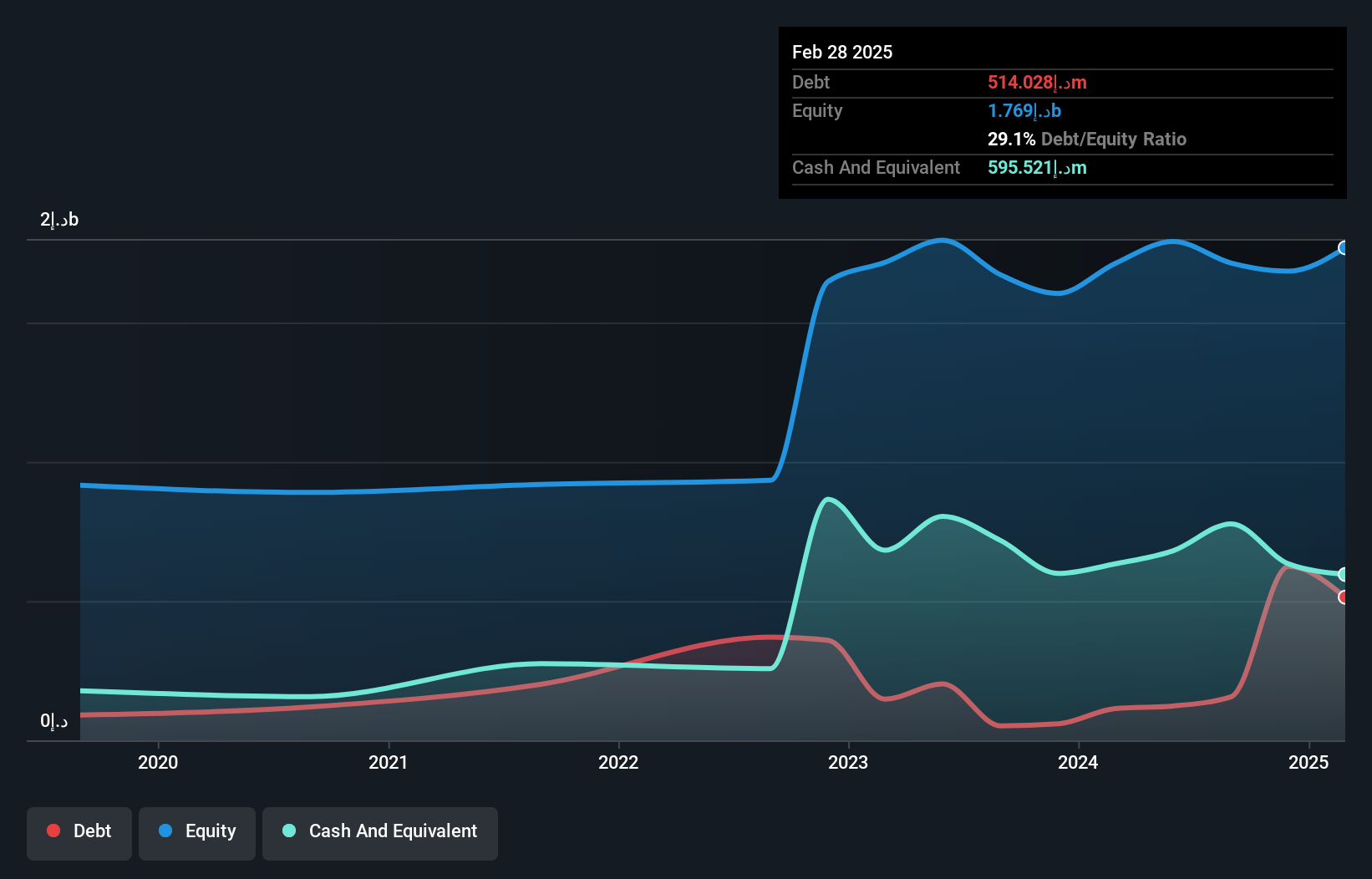

Taaleem Holdings PJSC, with a market cap of AED4.69 billion, has demonstrated steady earnings growth, although its recent 8.6% increase lags behind its five-year average of 20.9%. The company’s short-term assets surpass its short-term liabilities but fall short against long-term obligations. While the return on equity is low at 8.4%, Taaleem's debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT. Despite trading below fair value estimates and not diluting shareholders recently, profit margins have slightly decreased from last year’s figures amidst stable weekly volatility levels over the past year.

- Navigate through the intricacies of Taaleem Holdings PJSC with our comprehensive balance sheet health report here.

- Assess Taaleem Holdings PJSC's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 77 Middle Eastern Penny Stocks now.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives