- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Axon Enterprise (AXON) Sees Q2 Revenue Rise To US$669 Million

Reviewed by Simply Wall St

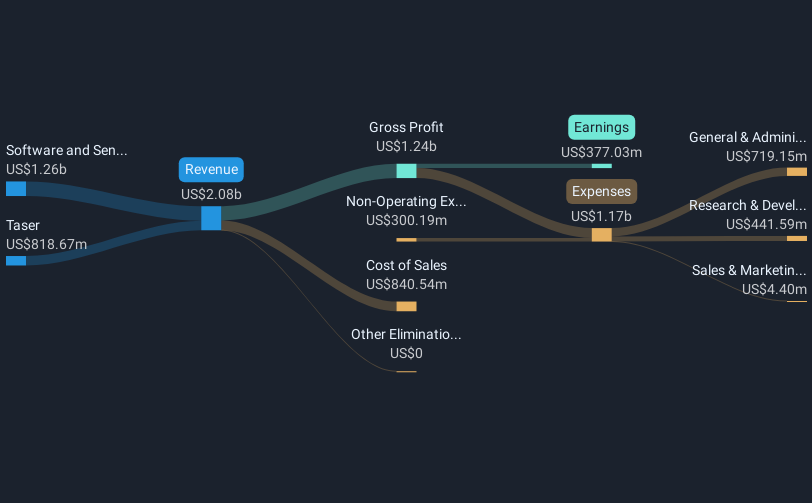

Axon Enterprise (AXON) recently reported its second-quarter 2025 earnings, showcasing a revenue growth to $669 million, up from $503 million a year ago, while net income experienced a decline to $36 million from $41 million. Concurrently, the company upgraded its full-year revenue guidance, suggesting optimistic future sales expectations. These events, coupled with a generally positive market environment, where the S&P 500 and Nasdaq Composite posted solid gains while digesting various earnings and global trade developments, likely provided a backdrop that supported the company’s 26% share price surge over the past quarter. The market’s robust performance perhaps added momentum to Axon’s share price movements, complementing the company’s adjusted forward guidance.

Find companies with promising cash flow potential yet trading below their fair value.

The recent earnings announcement and revenue guidance upgrade could enhance Axon's narrative by underscoring its potential for continued growth, particularly through international expansion and AI-driven products. Despite the quarterly net income decline, the revenue jump to US$669 million points to successful product rollouts and market demand, which may positively influence future revenue and earnings forecasts. However, political and competitive risks could still introduce volatility in their earnings potential.

Over the long term, Axon's shares have delivered a very large total return exceeding 982% over five years, suggesting significant value creation and growth beyond short-term fluctuations. This impressive performance contrasts with its one-year return, which exceeded the broader US market's 22.4% and the Aerospace & Defense industry's 40% return, highlighting Axon's robust market position.

With the stock currently priced at US$863.65, its alignment with the analyst price target of US$873.67 suggests limited immediate upside, reflecting a modest 1.16% discount to the price target. This relatively small difference indicates analysts believe Axon's shares are fairly priced, and future price movements may depend on the company meeting or exceeding revenue and earnings expectations spurred by current positive developments and strategic initiatives.

Assess Axon Enterprise's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives