- United States

- /

- Metals and Mining

- /

- NYSE:SXC

August 2025's Top Dividend Stocks For Steady Income

Reviewed by Simply Wall St

As the U.S. stock market retreats slightly from recent record highs, investors are keeping a close eye on inflation data and potential Federal Reserve rate cuts. In this climate of uncertainty, dividend stocks can offer a stable income stream, making them an appealing choice for those looking to balance risk with reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.27% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.48% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.87% | ★★★★★★ |

| Ennis (EBF) | 5.43% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.47% | ★★★★★☆ |

| Dillard's (DDS) | 4.75% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.31% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.51% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.40% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.26% | ★★★★★☆ |

Click here to see the full list of 126 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

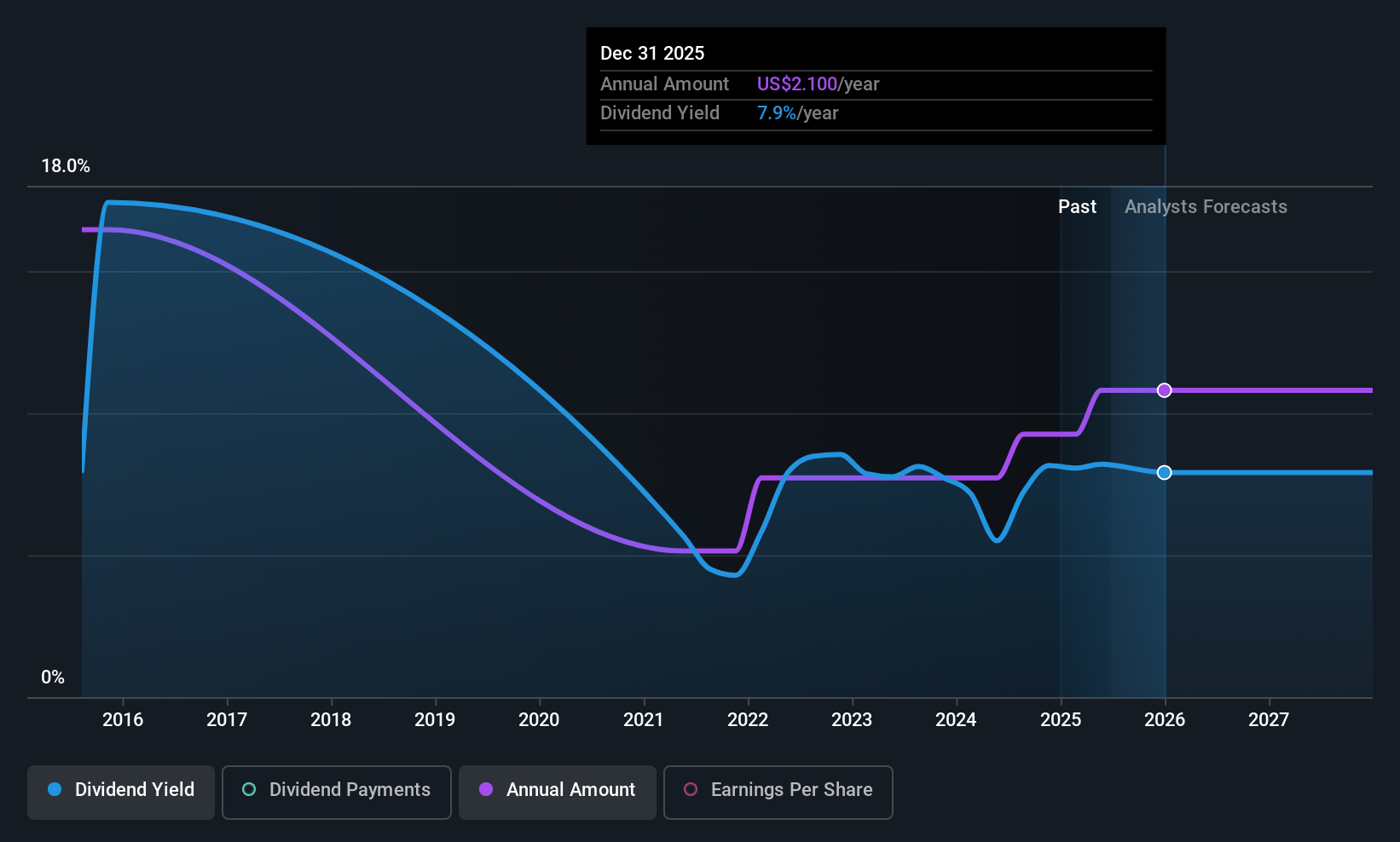

Global Ship Lease (GSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market cap of approximately $1.07 billion.

Operations: Global Ship Lease's revenue primarily comes from its transportation - shipping segment, generating approximately $730.28 million.

Dividend Yield: 7.0%

Global Ship Lease's dividend payments, with a payout ratio of 18.1%, are well covered by earnings and cash flows (52.6%). However, the company's dividend history has been volatile over the past decade, despite its attractive yield of 6.96%, placing it in the top 25% of US market payers. Recent earnings growth is evident with Q2 revenue at US$191.86 million and net income at US$95.44 million, supporting current dividend levels despite an unstable track record.

- Get an in-depth perspective on Global Ship Lease's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Global Ship Lease's current price could be quite moderate.

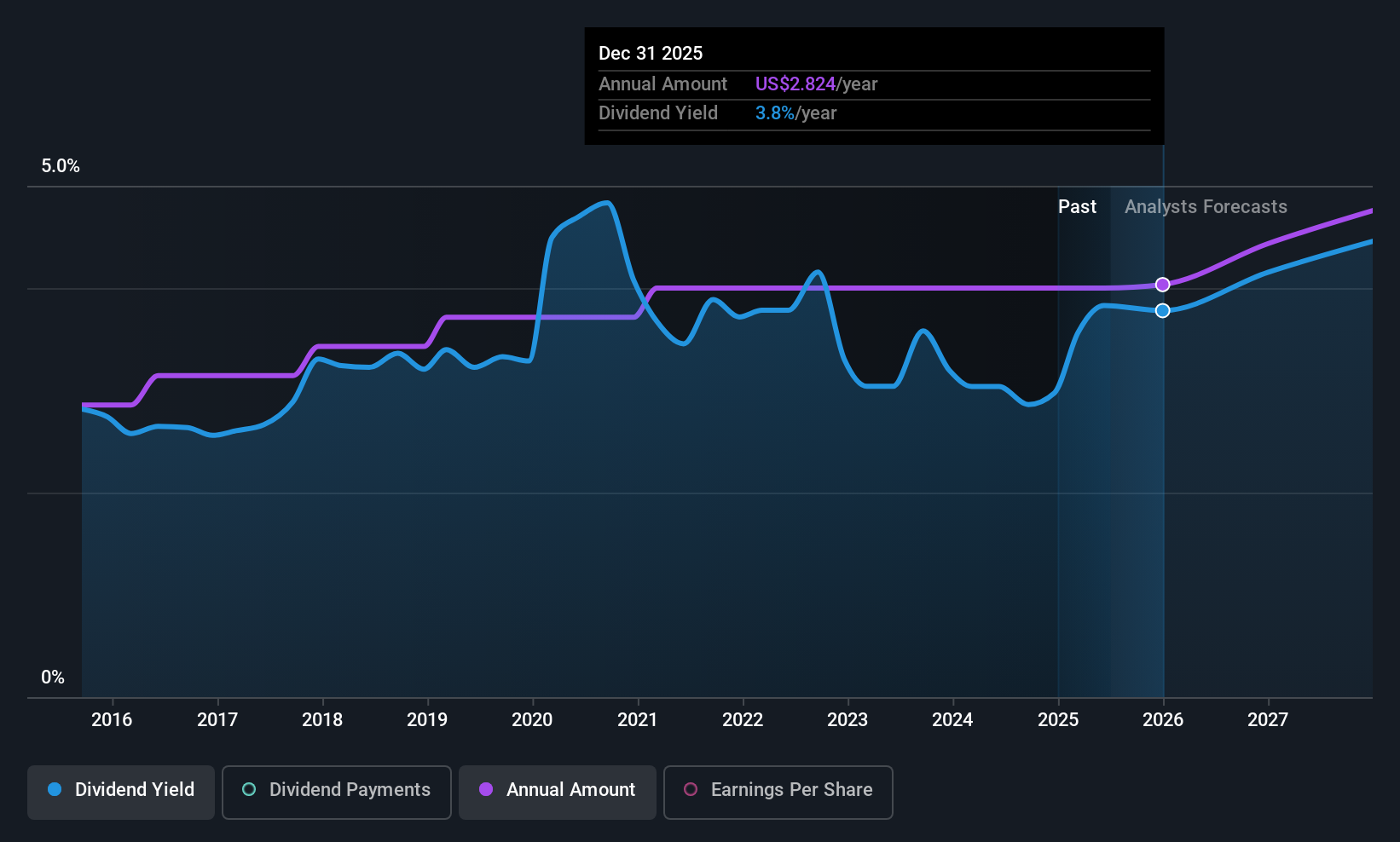

Omnicom Group (OMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services and has a market cap of approximately $15.20 billion.

Operations: Omnicom Group Inc. generates $15.91 billion from its advertising, marketing, and corporate communications services segment.

Dividend Yield: 3.6%

Omnicom Group's dividend payments are well covered by earnings and cash flows, with a payout ratio of 39.8% and a cash payout ratio of 30.7%. The dividend has grown steadily over the past decade, although its yield of 3.6% is below the top quartile in the US market. Despite high debt levels, Omnicom trades at good value compared to peers and significantly below its estimated fair value. Recent developments include a merger with IPG, involving complex debt financing arrangements.

- Navigate through the intricacies of Omnicom Group with our comprehensive dividend report here.

- Our valuation report here indicates Omnicom Group may be undervalued.

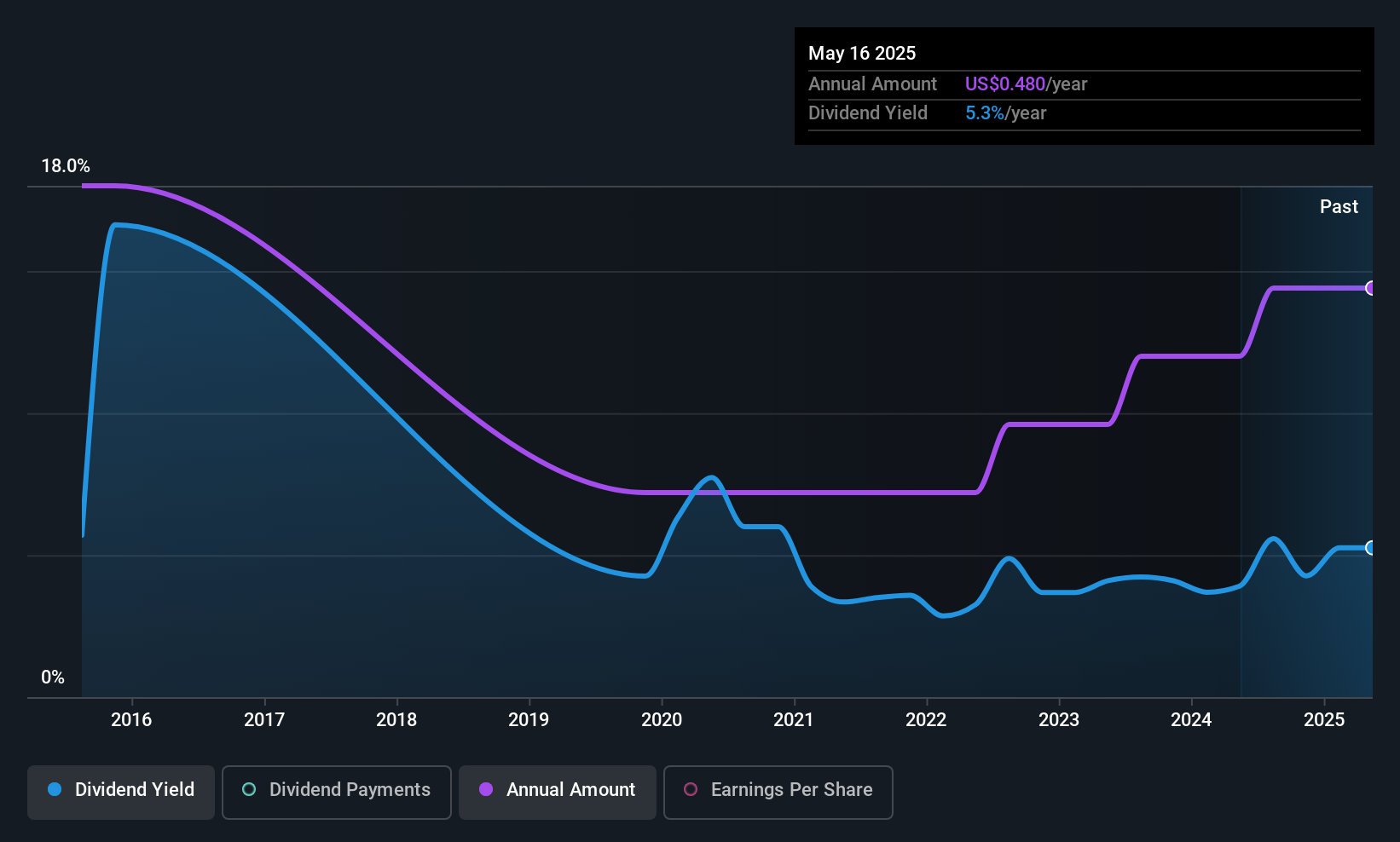

SunCoke Energy (SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke with operations in the Americas and Brazil, and has a market capitalization of approximately $634.14 million.

Operations: SunCoke Energy's revenue segments include $102.30 million from Logistics, $34.10 million from Brazil Coke, and $1.73 billion from Domestic Coke.

Dividend Yield: 6.3%

SunCoke Energy's dividend is covered by earnings and cash flows, with a payout ratio of 55.7% and a cash payout ratio of 26.4%. Despite being in the top 25% for yield at 6.32%, its dividend history is volatile and unstable over the past decade. Trading at significant value below estimated fair value, SunCoke faces declining earnings forecasts amidst high debt levels, recently amending its credit facility to extend maturity and reduce commitments to US$325 million.

- Unlock comprehensive insights into our analysis of SunCoke Energy stock in this dividend report.

- In light of our recent valuation report, it seems possible that SunCoke Energy is trading behind its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 126 Top US Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives