The Australian market has been relatively stable, with the ASX trading flat and recent discussions around potential tax reforms capturing investor attention. Amid these conditions, investors are increasingly looking for opportunities that balance value and growth potential. Penny stocks, though an outdated term, still represent a compelling area for investment by highlighting smaller or less-established companies that may offer significant upside when backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.05 | A$96.71M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.51M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$420.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.22 | A$2.53B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.69 | A$446.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.20 | A$753.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.07 | A$695.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.36 | A$159.43M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.76 | A$141.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

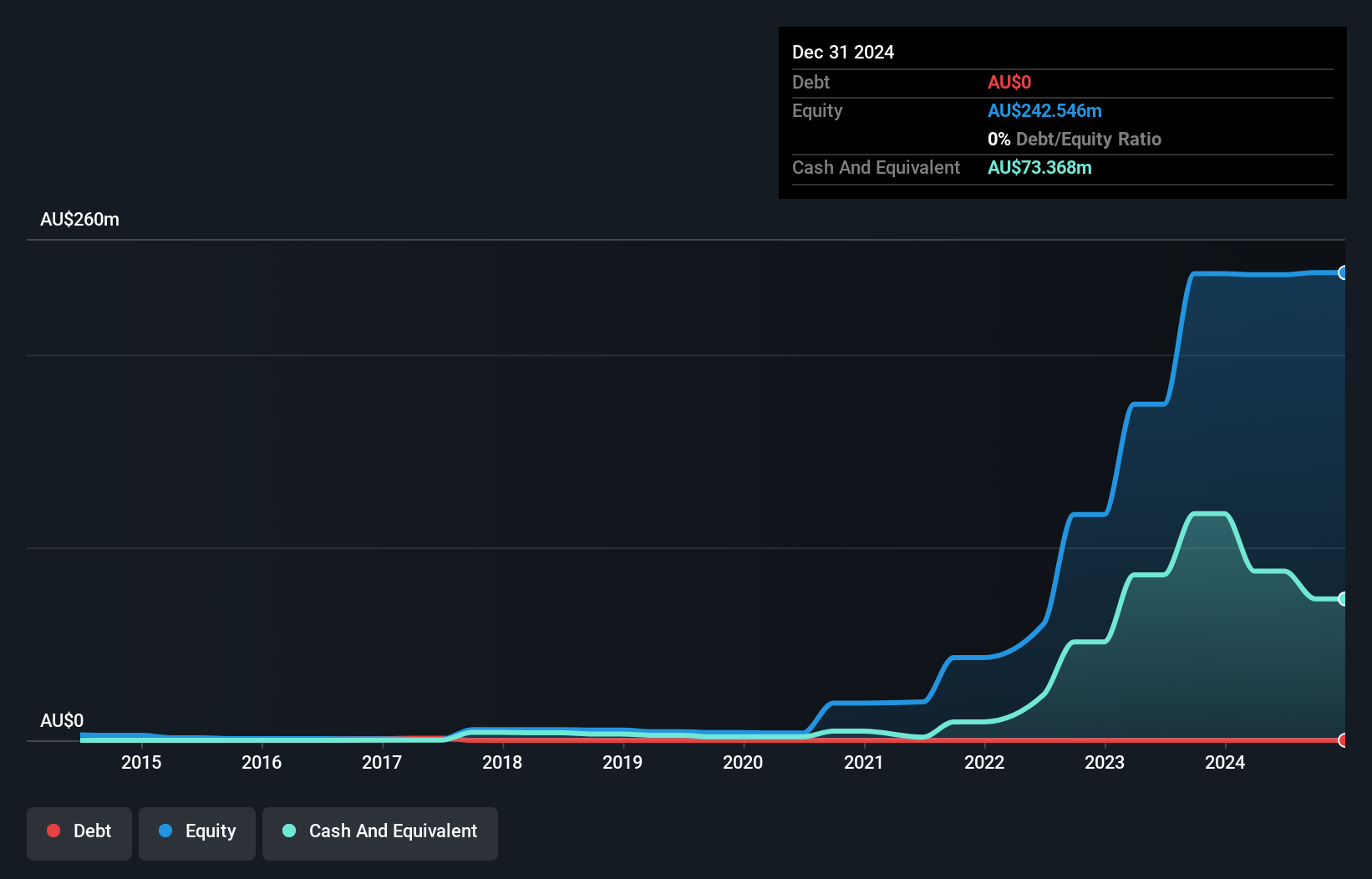

Overview: Delta Lithium Limited is engaged in the exploration and development of lithium and gold properties in Western Australia, with a market capitalization of A$136.14 million.

Operations: Delta Lithium Limited does not currently report any revenue segments.

Market Cap: A$136.14M

Delta Lithium Limited, with a market cap of A$136.14 million, is pre-revenue and debt-free. The company has a cash runway exceeding one year based on current free cash flow. Recent exploration updates reveal significant resource growth at the Yinnetharra Lithium and Tantalum Project, including a 140% increase in Indicated lithium resources at Malinda. Additionally, ongoing efforts at the Mt Ida Gold Project show promising results with high-grade gold intercepts and plans for further resource expansion. However, management's limited experience may be a concern for some investors as they navigate these developments.

- Unlock comprehensive insights into our analysis of Delta Lithium stock in this financial health report.

- Examine Delta Lithium's earnings growth report to understand how analysts expect it to perform.

Race Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★★

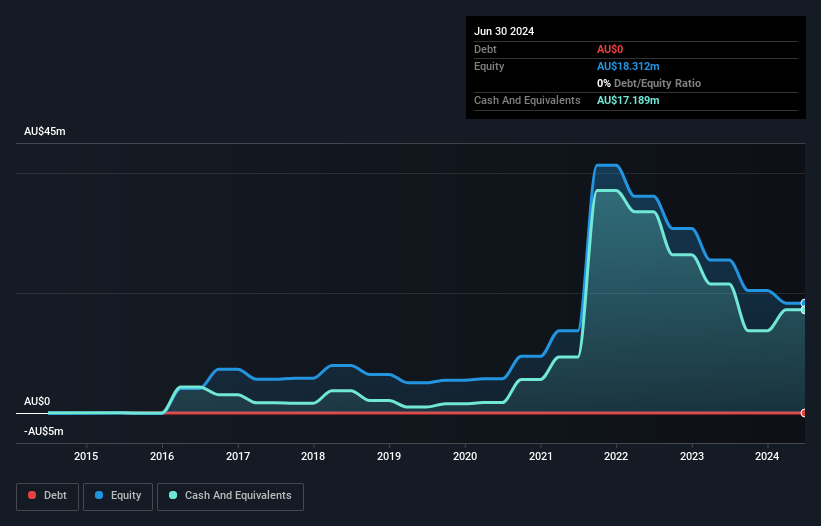

Overview: Race Oncology Limited is a clinical stage biopharmaceutical company dedicated to addressing the unmet needs of cancer patients with damaging treatments, with a market cap of A$220.64 million.

Operations: The company generates revenue from its operations in Australia, amounting to A$5.25 million.

Market Cap: A$220.64M

Race Oncology Limited, with a market cap of A$220.64 million, is pre-revenue and debt-free. The company recently appointed Dr. Jose Iglesias as Chief Medical Officer, enhancing its clinical leadership with his extensive oncology expertise. Race has initiated a Phase 1 trial for RC220 in combination with doxorubicin across multiple sites in Australia, Hong Kong, and South Korea to evaluate safety and efficacy in solid tumours. Despite being unprofitable with increasing losses over five years, Race maintains a cash runway exceeding three years based on current free cash flow levels while navigating these early-stage developments.

- Click here and access our complete financial health analysis report to understand the dynamics of Race Oncology.

- Review our growth performance report to gain insights into Race Oncology's future.

Service Stream (ASX:SSM)

Simply Wall St Financial Health Rating: ★★★★★★

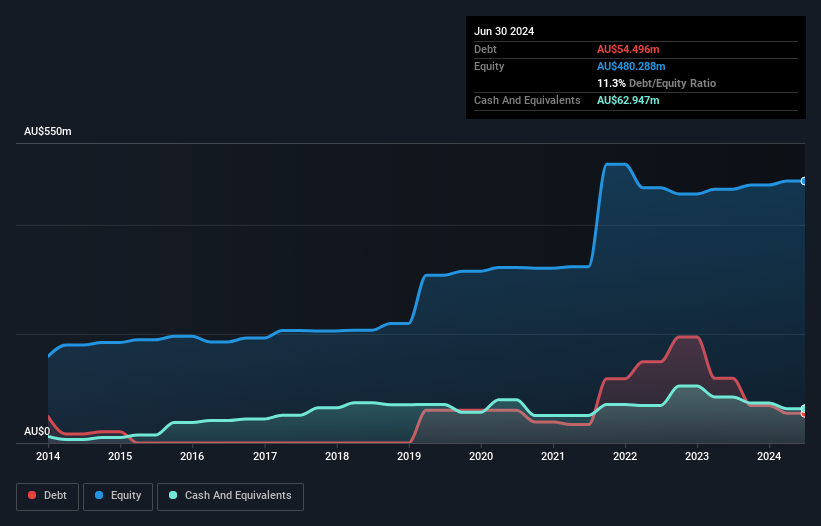

Overview: Service Stream Limited is an Australian company involved in the design, construction, operation, and maintenance of infrastructure networks in the telecommunications, utilities, and transport sectors, with a market cap of A$1.20 billion.

Operations: The company generates revenue from three main segments: Telecommunications (A$1.23 billion), Utilities (A$1.02 billion), and Transport (A$123.34 million).

Market Cap: A$1.2B

Service Stream Limited, with a market cap of A$1.20 billion, has experienced significant earnings growth of 124.7% over the past year, surpassing its five-year average decline. The company is trading at a substantial discount to its estimated fair value and remains debt-free, alleviating concerns about interest coverage or debt management. Short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability. However, insider selling in recent months may warrant caution for potential investors. Despite these challenges, Service Stream's profit margins have improved from last year and are projected to continue growing at 9.77% annually according to analyst forecasts.

- Take a closer look at Service Stream's potential here in our financial health report.

- Assess Service Stream's future earnings estimates with our detailed growth reports.

Summing It All Up

- Jump into our full catalog of 1,006 ASX Penny Stocks here.

- Curious About Other Options? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RAC

Racura Oncology

A clinical stage biopharmaceutical company, focuses on addressing the unmet needs of cancer patients for damaging treatments in Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion