- Australia

- /

- Consumer Services

- /

- ASX:3PL

ASX Penny Stock Highlights For September 2025

Reviewed by Simply Wall St

Australian shares have been striving to align with Wall Street's bullish trends, as evidenced by the ASX 200 futures showing a positive uptick heading into Friday. This momentum comes amid broader market gains in the U.S., where indices like the S&P 500 and Dow Jones have reached new highs despite recent economic data challenges. In this context, penny stocks—though often considered niche investments—continue to offer intriguing opportunities for investors willing to explore beyond mainstream options. These stocks, typically representing smaller or newer companies, can present significant potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.525 | A$150.46M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.19 | A$103.31M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.815 | A$50.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$422.13M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.40 | A$250.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.31M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.44 | A$365.61M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.795 | A$380.18M | ✅ 5 ⚠️ 2 View Analysis > |

| SKS Technologies Group (ASX:SKS) | A$3.09 | A$349.39M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 442 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

3P Learning (ASX:3PL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3P Learning Limited develops, markets, and sells educational software and e-books to schools and parents across various global regions, with a market capitalization of A$184.21 million.

Operations: The company's revenue is derived from two primary segments: Business-To-School ('B2B') generating A$65.63 million and Business-To-Consumer ('B2C') contributing A$43.45 million.

Market Cap: A$184.21M

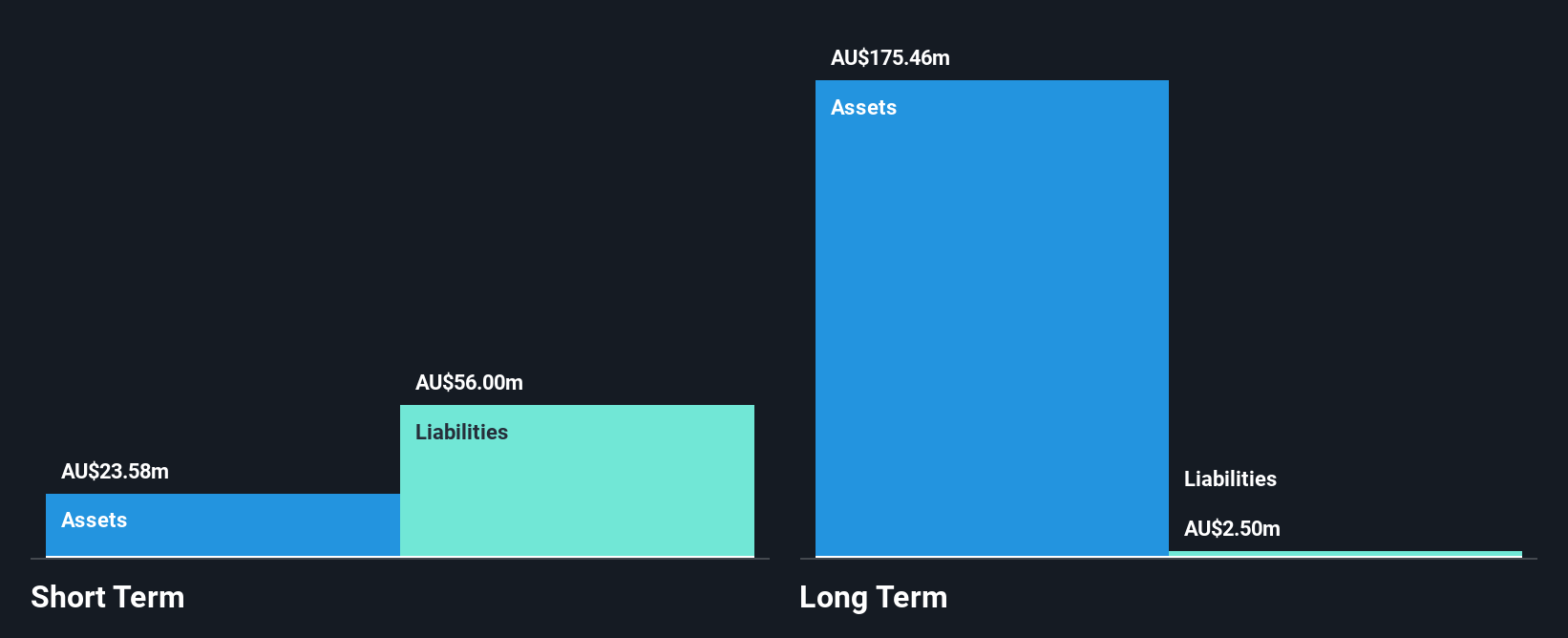

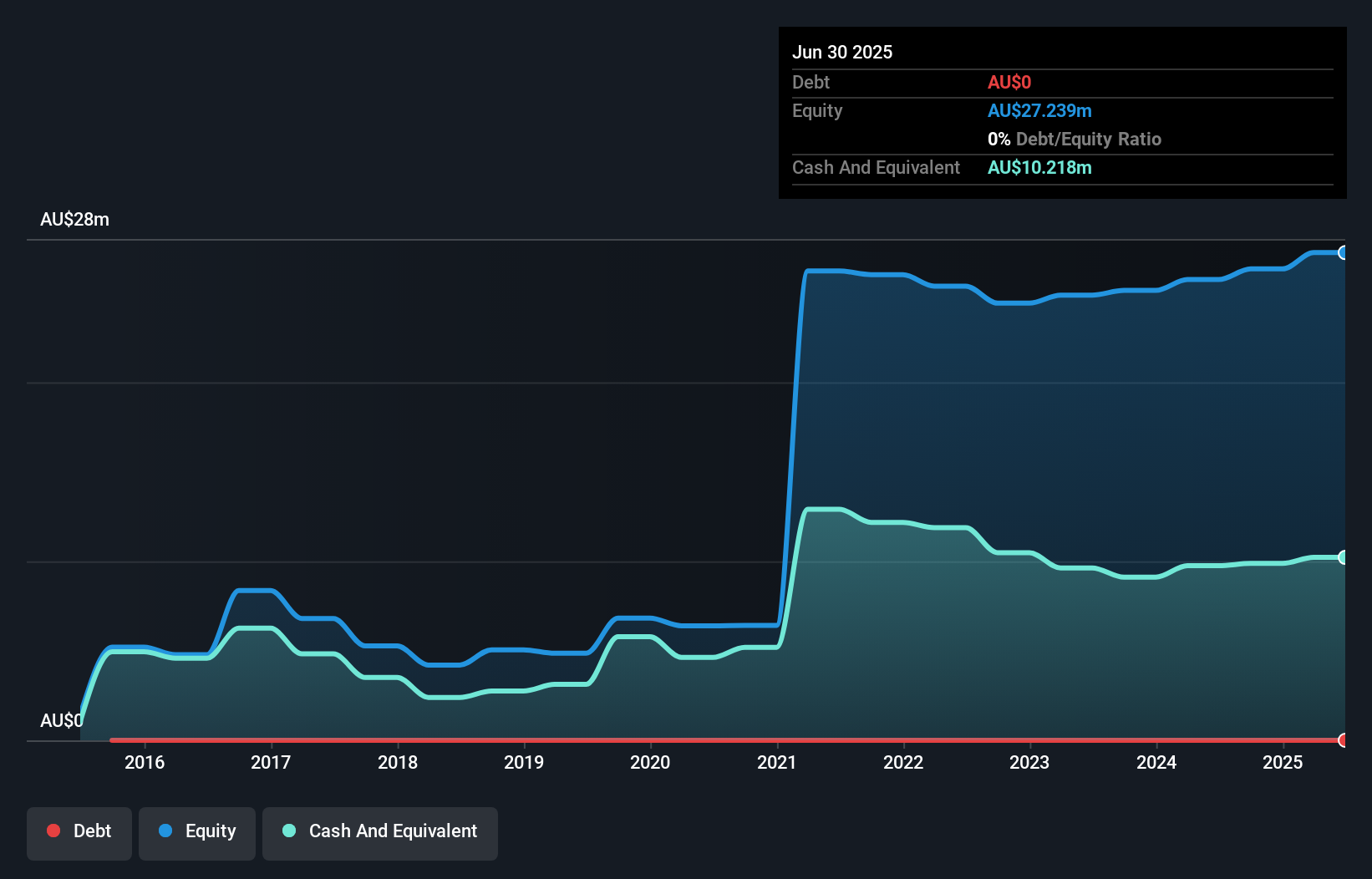

3P Learning has recently transitioned to profitability, reporting a net income of A$0.21 million for the year ending June 2025, compared to a significant loss the previous year. The company remains debt-free, which removes concerns over interest payments and debt coverage. However, its short-term liabilities exceed its short-term assets by A$32.4 million, indicating potential liquidity challenges. Despite trading at a substantial discount to estimated fair value and having experienced management and board teams, 3P Learning's return on equity is low at 0.1%. Earnings growth is forecasted at 54.62% annually but past earnings have been volatile due in part to large one-off losses impacting results.

- Dive into the specifics of 3P Learning here with our thorough balance sheet health report.

- Evaluate 3P Learning's prospects by accessing our earnings growth report.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd offers screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand with a market cap of A$131.86 million.

Operations: The company generates revenue of A$32.56 million from its screening and verification checks segment.

Market Cap: A$131.86M

Kinatico Ltd, with a market cap of A$131.86 million, has shown consistent revenue growth in its screening and verification checks segment, generating A$32.56 million annually. The company is debt-free, enhancing financial stability and eliminating interest payment concerns. Earnings have grown by 44.5% over the past year and are forecasted to increase by 48.12% annually, exceeding industry averages significantly. Despite a low return on equity of 4.1%, Kinatico's net profit margins improved from 2.7% to 3.5%. With experienced management and board teams, the company trades at a significant discount to its estimated fair value without shareholder dilution concerns recently reported earnings reflect positive momentum with increased sales and net income year-over-year.

- Navigate through the intricacies of Kinatico with our comprehensive balance sheet health report here.

- Understand Kinatico's earnings outlook by examining our growth report.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited, with a market cap of A$516.61 million, offers electrical, instrumentation, communications, security, fire, and maintenance services and products across Australia.

Operations: The company generates revenue of A$801.45 million from its electrical services segment across Australia.

Market Cap: A$516.61M

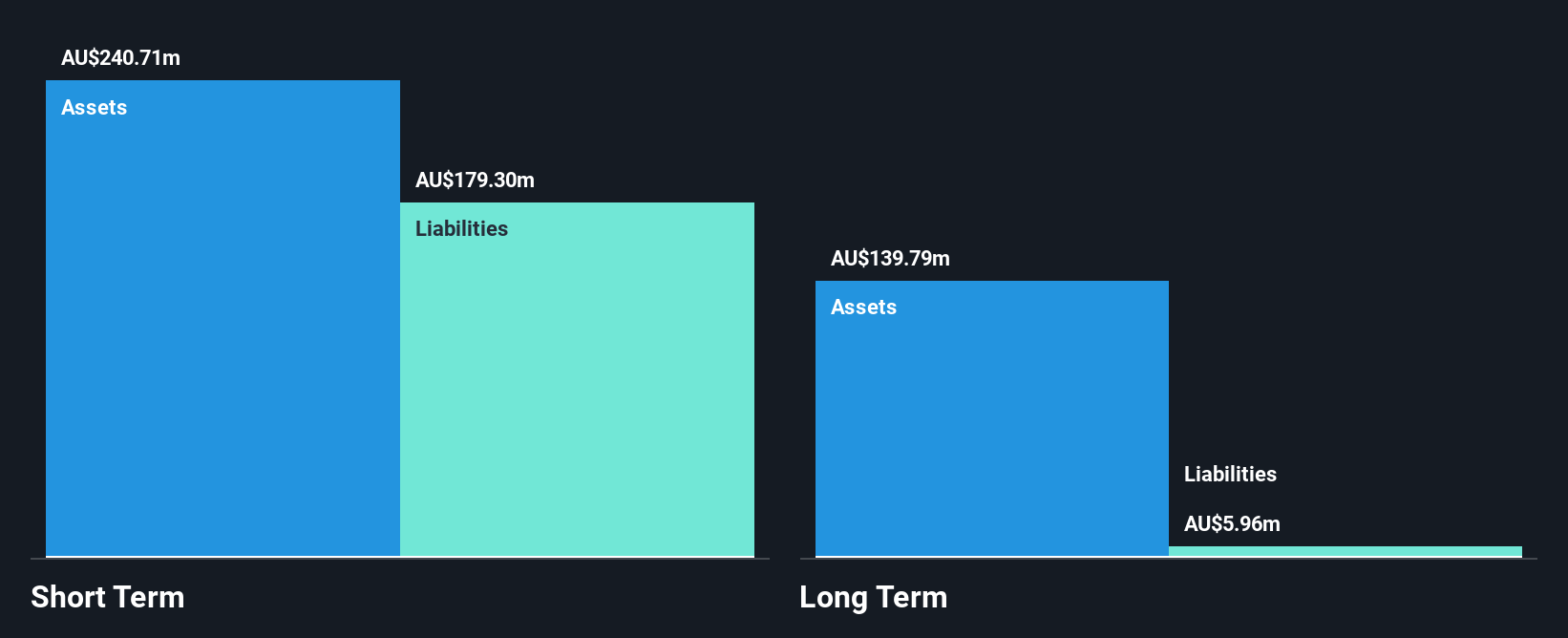

Southern Cross Electrical Engineering Limited, with a market cap of A$516.61 million, has demonstrated robust financial performance with sales reaching A$801.45 million and net income of A$31.67 million for the year ending June 2025. The company is debt-free, which enhances its financial stability and eliminates interest payment concerns. Earnings have grown significantly by 44.5% over the past year, outpacing industry averages, although its return on equity remains relatively low at 15.5%. The management team is experienced, averaging a tenure of 12.9 years, and the company seeks further growth through strategic acquisitions to enhance geographic diversification and capabilities.

- Click here and access our complete financial health analysis report to understand the dynamics of Southern Cross Electrical Engineering.

- Assess Southern Cross Electrical Engineering's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Discover the full array of 442 ASX Penny Stocks right here.

- Seeking Other Investments? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if 3P Learning might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:3PL

3P Learning

Engages in the development, marketing, and sale of educational software and e-books to schools and parents of school-aged students in the Asia-Pacific, North and South America, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)