As Australian shares align with U.S. trends, the ASX 200 is poised for a modest gain, reflecting Wall Street's buoyant performance as indices reach new highs. In this dynamic market environment, dividend stocks can offer a reliable income stream for investors looking to enhance their portfolio returns amidst global economic shifts.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.74% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.36% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.25% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.62% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.59% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.13% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.89% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.25% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.62% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

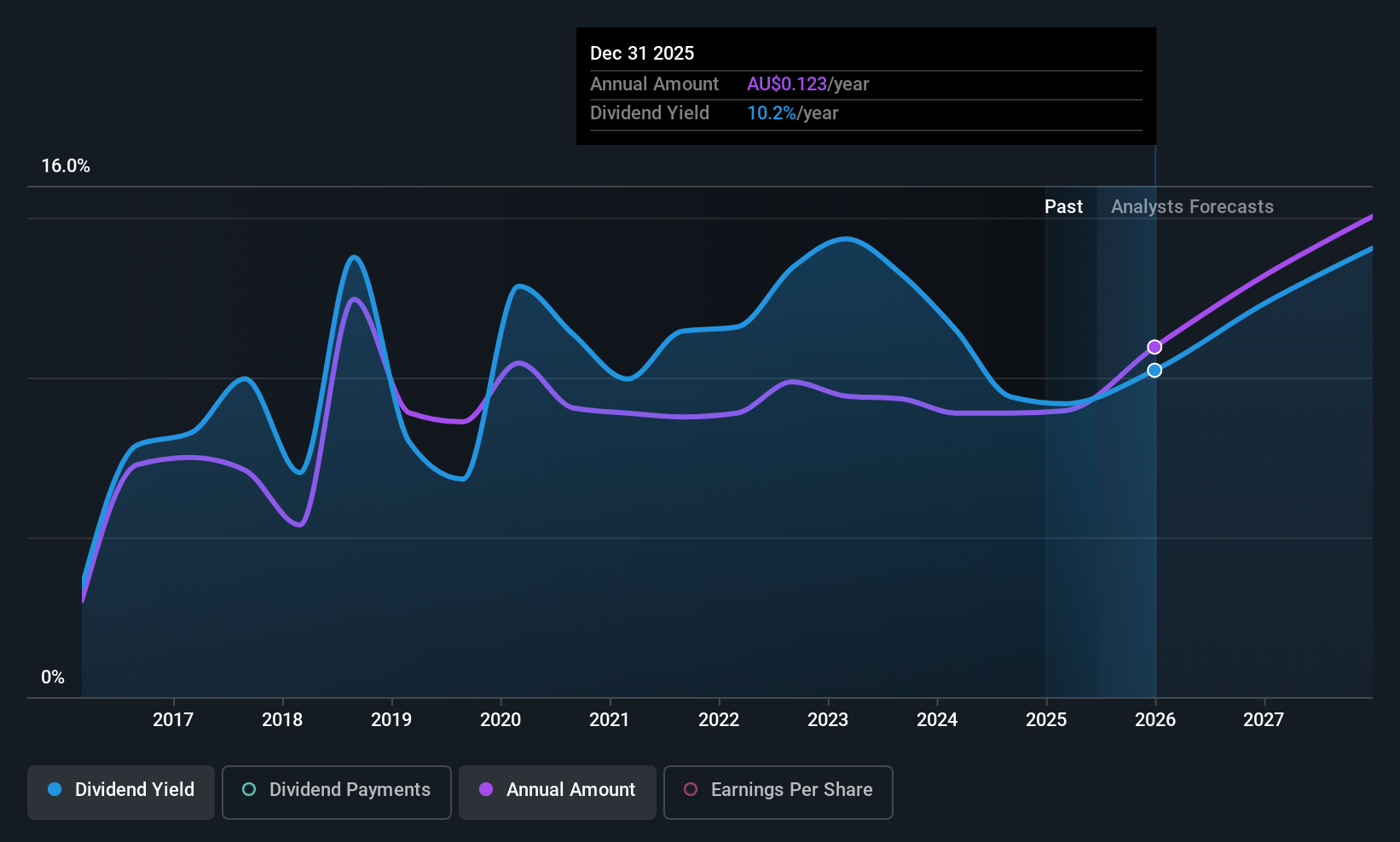

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$378.32 million.

Operations: Kina Securities Limited generates revenue through its Wealth Management segment, contributing PGK 47.36 million, and its Banking & Finance (Including Corporate) segment, which accounts for PGK 421.46 million.

Dividend Yield: 7.4%

Kina Securities offers a compelling dividend yield of 7.36%, placing it in the top quartile among Australian dividend payers. Its dividends are covered by earnings, with a payout ratio of 74.8%, expected to improve to 68.6% in three years. However, its dividend history is unstable and has been volatile over the past nine years. Additionally, Kina faces challenges with a high level of bad loans (11.1%), impacting its financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of Kina Securities.

- Upon reviewing our latest valuation report, Kina Securities' share price might be too pessimistic.

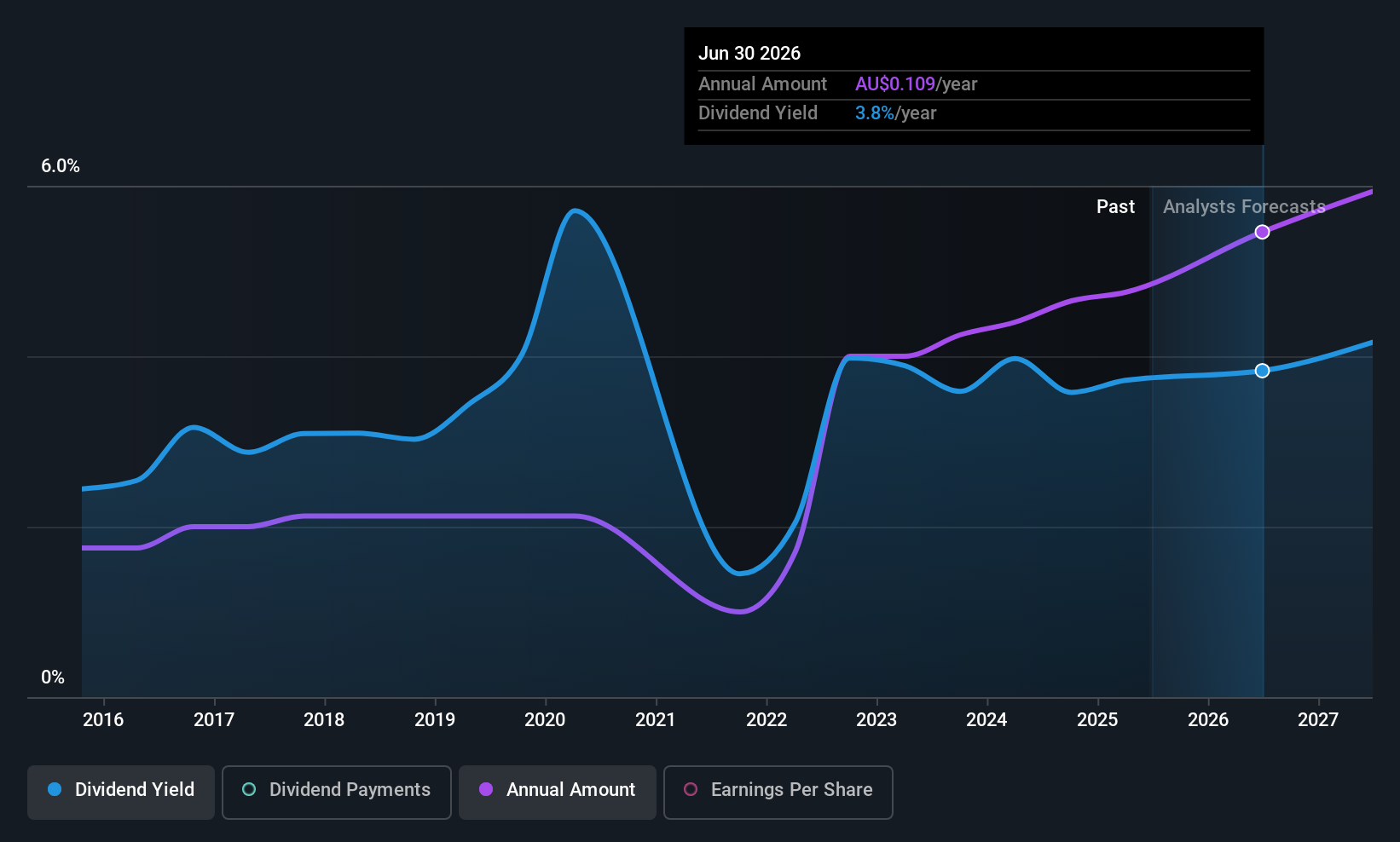

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited, with a market cap of A$1.06 billion, provides animal nutrition solutions in Australia through its subsidiaries.

Operations: Ridley Corporation Limited generates revenue from its animal nutrition solutions through two main segments: Bulk Stockfeeds, contributing A$894.26 million, and Packaged/Ingredients, adding A$389.70 million.

Dividend Yield: 3.4%

Ridley's dividend payments are covered by earnings and cash flows, with payout ratios of 75% and 41.6%, respectively, though its dividend history has been volatile over the past decade. Recent events include a planned CFO transition linked to the acquisition of Incitec Pivot Fertilisers' distribution business and a follow-on equity offering raising A$125.68 million, which may impact shareholder value due to dilution concerns from new share issuance.

- Click here to discover the nuances of Ridley with our detailed analytical dividend report.

- Our valuation report here indicates Ridley may be undervalued.

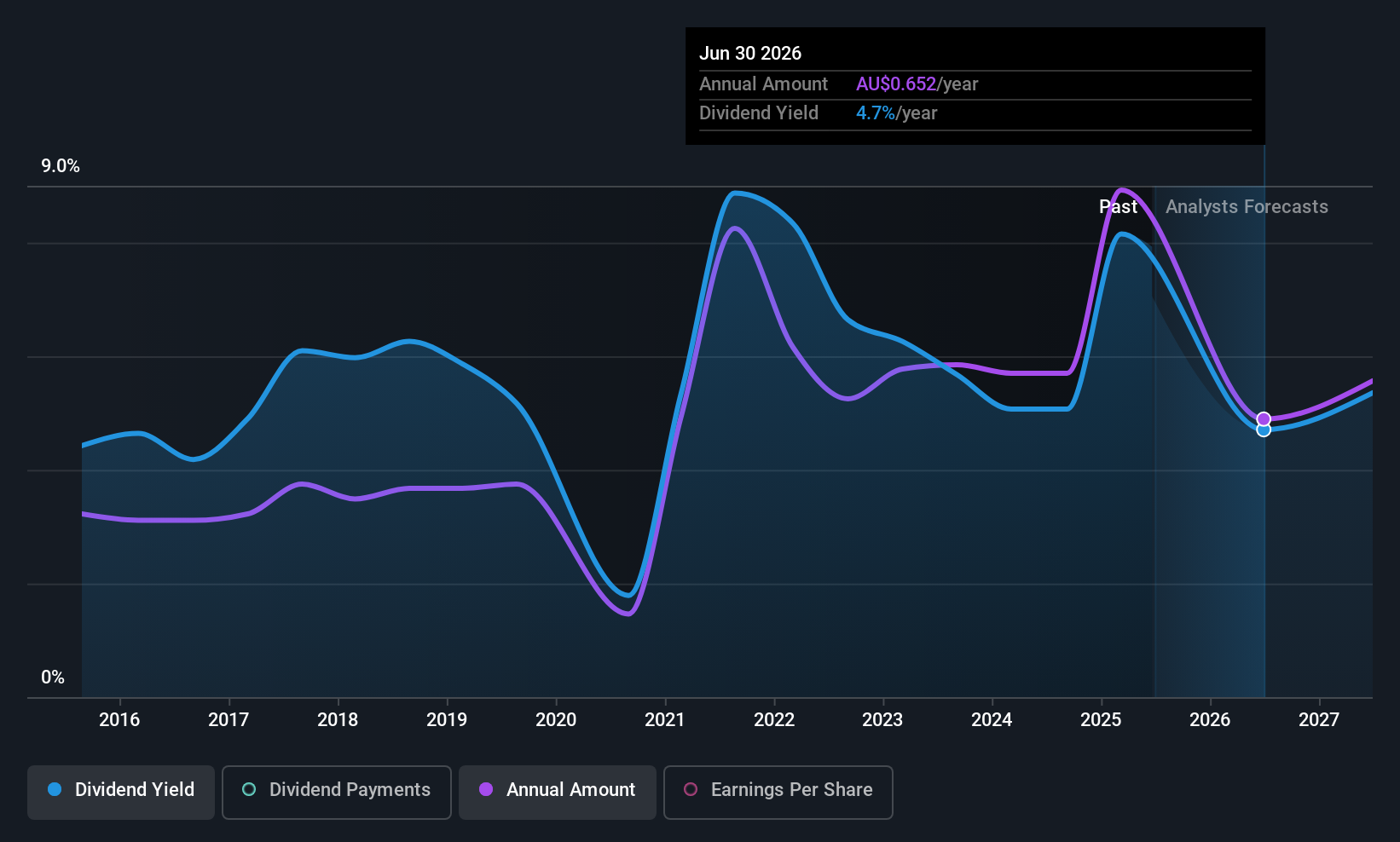

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of automotive, sports, and outdoor leisure products across Australia and New Zealand, with a market capitalization of A$3.47 billion.

Operations: Super Retail Group's revenue is derived from its segments: Super Cheap Auto with A$1.51 billion, Rebel at A$1.32 billion, Boating, Camping and Fishing (BCF) excluding Macpac at A$912.60 million, and Macpac contributing A$215.80 million.

Dividend Yield: 7.7%

Super Retail Group's dividends are supported by earnings and cash flows, with payout ratios of 68.8% and 68%, respectively, although the dividend history has been volatile over the past decade. The company offers a competitive dividend yield in the top 25% of Australian payers. Trading at a lower price-to-earnings ratio than the market average suggests good value. Recent sales data shows growth of over 4% for key periods in 2025, indicating positive business momentum.

- Take a closer look at Super Retail Group's potential here in our dividend report.

- The analysis detailed in our Super Retail Group valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 28 Top ASX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kina Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives