As the Asian markets navigate a period marked by economic slowdowns and potential stimulus measures, investors are keenly observing the opportunities that arise amidst these fluctuations. In this environment, identifying undervalued stocks becomes crucial as they may offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shanghai V-Test Semiconductor Tech (SHSE:688372) | CN¥85.63 | CN¥167.57 | 48.9% |

| Samyang Foods (KOSE:A003230) | ₩1508000.00 | ₩3006664.22 | 49.8% |

| NexTone (TSE:7094) | ¥2249.00 | ¥4453.46 | 49.5% |

| Kolmar Korea (KOSE:A161890) | ₩79100.00 | ₩155206.64 | 49% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥974.00 | ¥1929.26 | 49.5% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.42 | HK$18.80 | 49.9% |

| FP Partner (TSE:7388) | ¥2245.00 | ¥4425.25 | 49.3% |

| Dekon Food and Agriculture Group (SEHK:2419) | HK$81.50 | HK$159.75 | 49% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥29.89 | CN¥59.31 | 49.6% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.53 | CN¥96.79 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

Ushio (TSE:6925)

Overview: Ushio Inc. produces and sells light application products and industrial equipment both in Japan and internationally, with a market cap of ¥189.09 billion.

Operations: The company's revenue segments include the Visual Imaging Business at ¥81.63 billion, Industrial Process Business at ¥79.17 billion, Photonics Solution Business at ¥10.09 billion, and Life Science Business at ¥6.16 billion.

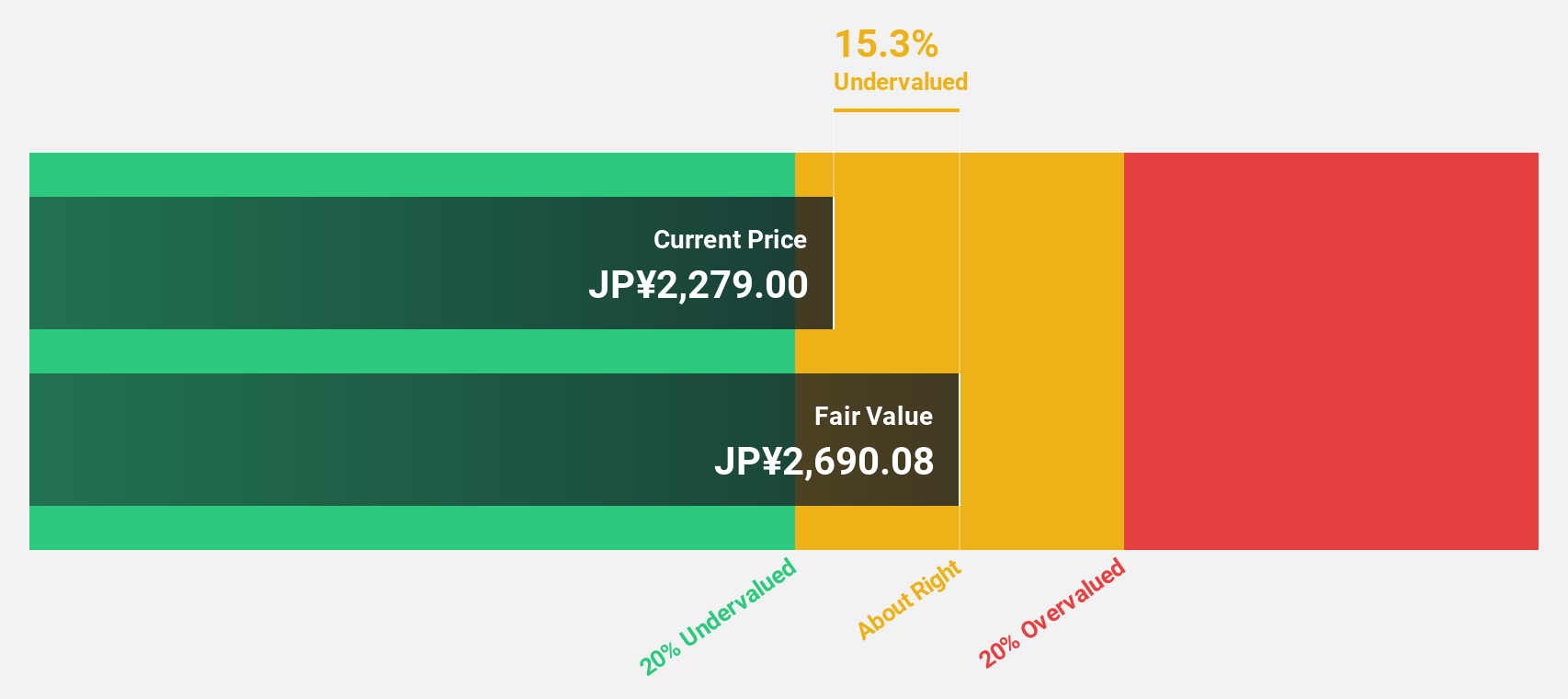

Estimated Discount To Fair Value: 12.7%

Ushio Inc. is trading at ¥2,328, below its estimated fair value of ¥2,667.37, indicating potential undervaluation based on cash flows. Despite a drop in profit margins from 5.2% to 2.1%, earnings are forecasted to grow significantly at 40.8% annually over the next three years, outpacing the Japanese market's growth rate of 8.3%. However, recent removal from the FTSE All-World Index and low dividend coverage may pose concerns for investors seeking stability.

- Upon reviewing our latest growth report, Ushio's projected financial performance appears quite optimistic.

- Dive into the specifics of Ushio here with our thorough financial health report.

Kinik (TWSE:1560)

Overview: Kinik Company engages in the production and sale of abrasives, cutting tools, and reclaimed wafers both in Taiwan and internationally, with a market cap of NT$49.68 billion.

Operations: The company's revenue is derived from two main segments: the Electronics Sector, contributing NT$3.73 billion, and the Traditional Sectors, accounting for NT$3.85 billion.

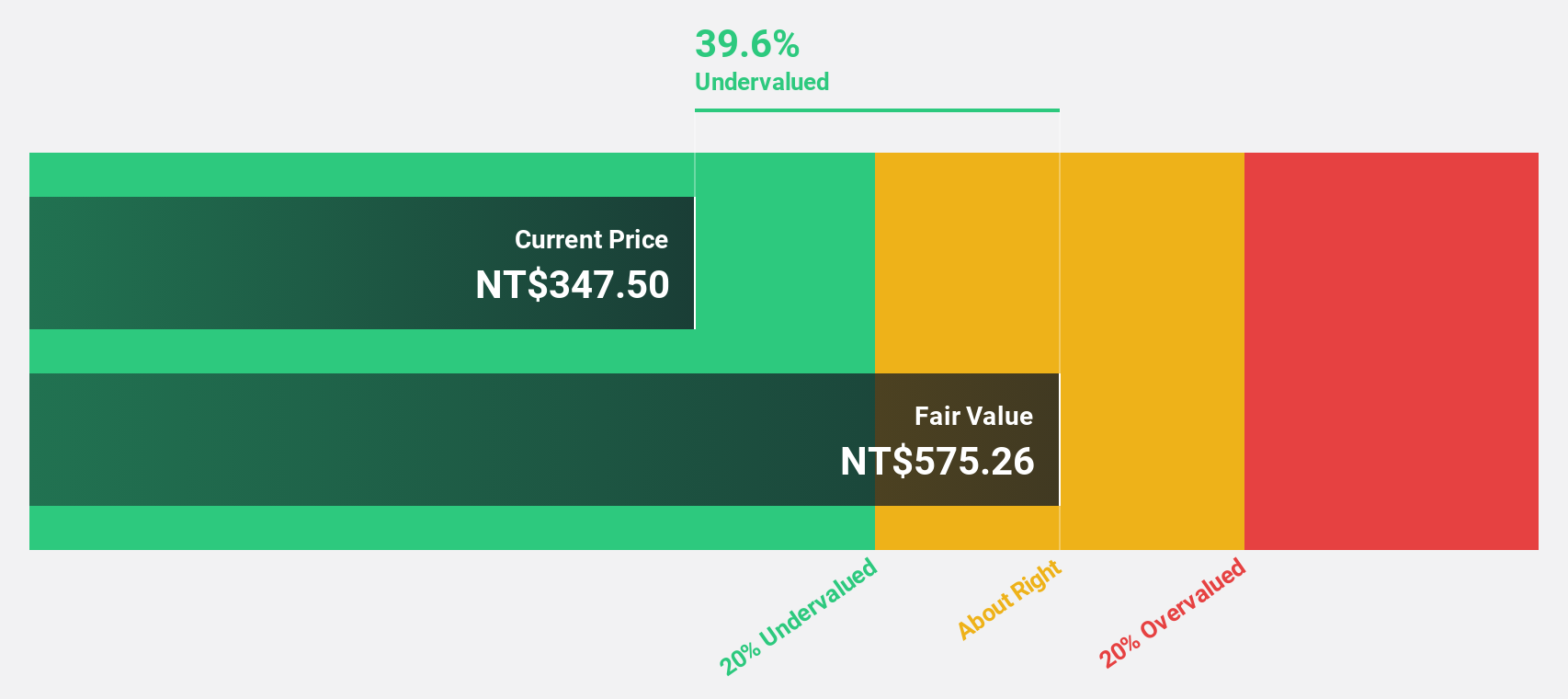

Estimated Discount To Fair Value: 40.9%

Kinik is trading at NT$339, significantly below its estimated fair value of NT$573.8, highlighting its undervaluation based on cash flows. Despite revenue growth forecasted at 18.9% annually—slower than the ideal 20%—earnings are expected to grow substantially by 32.69% per year, surpassing the Taiwan market's rate of 16.9%. Recent earnings reports show increased sales and net income for both Q2 and the first half of 2025, reinforcing its strong financial footing.

- In light of our recent growth report, it seems possible that Kinik's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Kinik stock in this financial health report.

Shin Zu Shing (TWSE:3376)

Overview: Shin Zu Shing Co., Ltd. specializes in the research, design, development, production, assembly, testing, manufacturing, and trading of precision springs and related components across Taiwan, Singapore, and China with a market cap of NT$46.40 billion.

Operations: The company's revenue is primarily derived from pivot products, contributing NT$12.31 billion, followed by turning and milling products at NT$114.83 million and MIM products at NT$103.70 million.

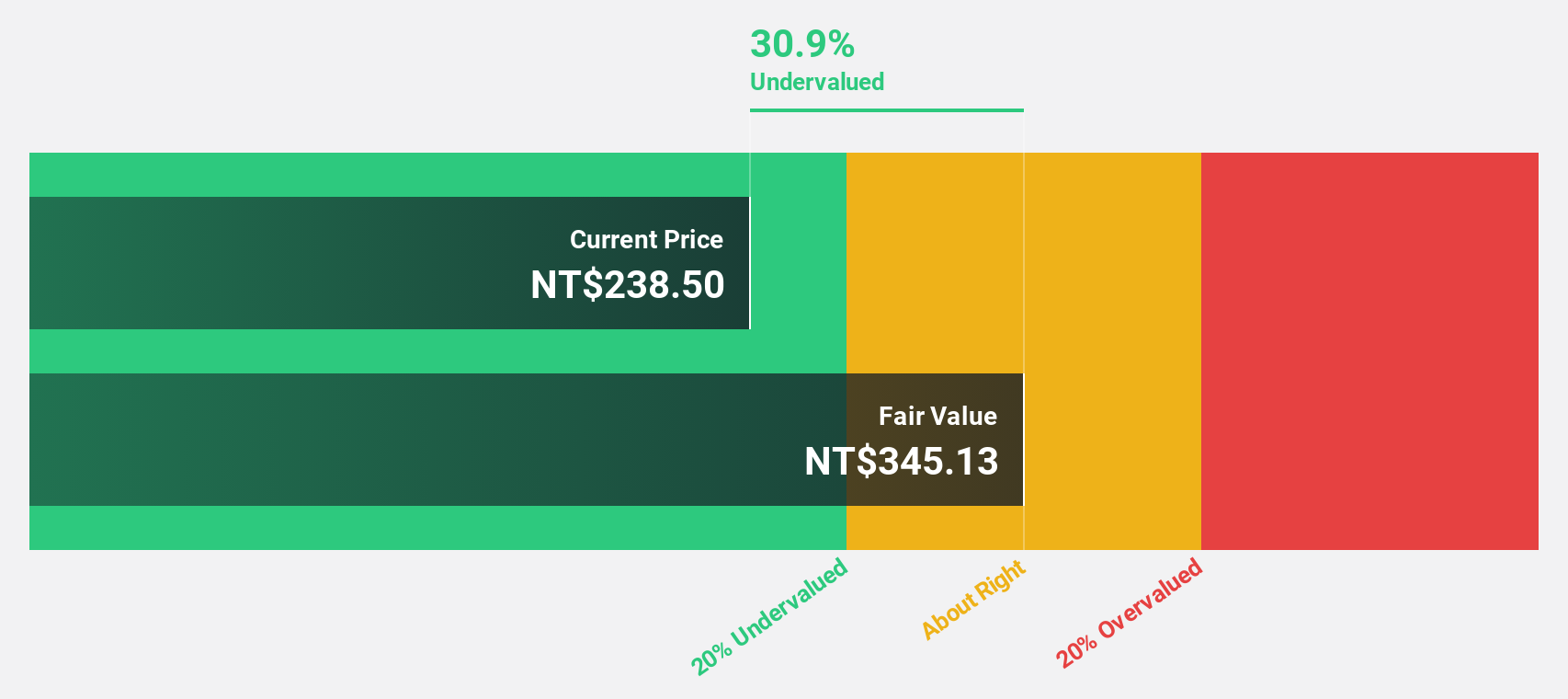

Estimated Discount To Fair Value: 31.2%

Shin Zu Shing is trading at NT$237, well below its estimated fair value of NT$344.25, underscoring its undervaluation based on cash flows. Despite recent declines in sales and net income for Q2 2025, the company’s earnings are forecast to grow significantly at 60.4% annually, outpacing the Taiwan market's growth rate. However, profit margins have decreased from 9.9% to 6%, and share price volatility remains high over the past three months.

- According our earnings growth report, there's an indication that Shin Zu Shing might be ready to expand.

- Take a closer look at Shin Zu Shing's balance sheet health here in our report.

Taking Advantage

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 278 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3376

Shin Zu Shing

Engages in the research, design, development, production, assembly, testing, manufacturing, and trading of various precision springs, stamping parts, hinge components, CNC lathes, and metal injection molding in Taiwan, Singapore, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives