- China

- /

- Metals and Mining

- /

- SZSE:000426

Asian Stocks Possibly Trading Below Estimated Values In July 2025

Reviewed by Simply Wall St

As July 2025 unfolds, the Asian stock markets are navigating a complex landscape shaped by recent U.S. tariff announcements and mixed economic signals from major economies like Japan and China. Amid these developments, investors are increasingly focused on identifying stocks that may be trading below their estimated values, offering potential opportunities for those who can discern intrinsic worth amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.30 | CN¥75.07 | 49% |

| Medy-Tox (KOSDAQ:A086900) | ₩163100.00 | ₩322233.66 | 49.4% |

| Jiangxi Rimag Group (SEHK:2522) | HK$13.92 | HK$27.27 | 49% |

| Giant Biogene Holding (SEHK:2367) | HK$57.00 | HK$113.05 | 49.6% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33400.00 | ₩66027.25 | 49.4% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥853.37 | 49.7% |

| BYD (SEHK:1211) | HK$120.10 | HK$236.21 | 49.2% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥26.75 | CN¥52.74 | 49.3% |

| Astroscale Holdings (TSE:186A) | ¥676.00 | ¥1347.21 | 49.8% |

| ALUX (KOSDAQ:A475580) | ₩11570.00 | ₩22701.83 | 49% |

Here's a peek at a few of the choices from the screener.

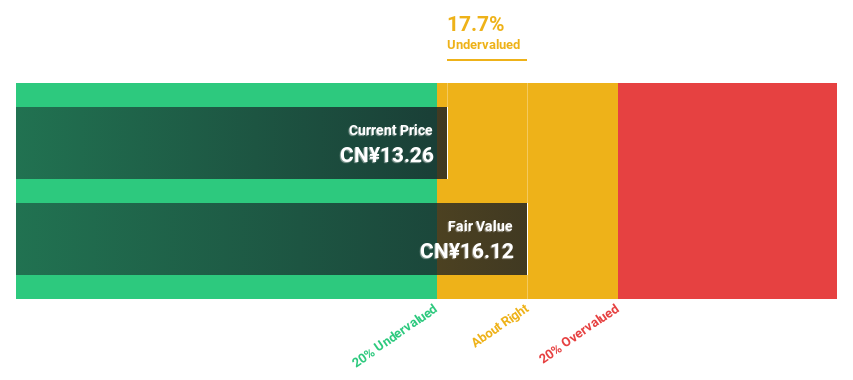

Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426)

Overview: Inner Mongolia Xingye Silver & Tin Mining Co., Ltd is involved in mining, extracting, and smelting non-ferrous and precious metals, with a market cap of CN¥31.46 billion.

Operations: The company generates revenue primarily from its mining industry segment, amounting to CN¥4.63 billion.

Estimated Discount To Fair Value: 11.4%

Inner Mongolia Xingye Silver & Tin Mining Ltd. is trading at CNY 17.72, below its estimated fair value of CNY 20, indicating potential undervaluation based on cash flows. The company's earnings grew by a substantial margin over the past year and are forecast to grow annually by over 20%, albeit slower than the broader Chinese market. Recent financial restructuring through a stake sale for CNY 1.47 billion aims to improve debt management and operational efficiency.

- The growth report we've compiled suggests that Inner Mongolia Xingye Silver &Tin MiningLtd's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Inner Mongolia Xingye Silver &Tin MiningLtd.

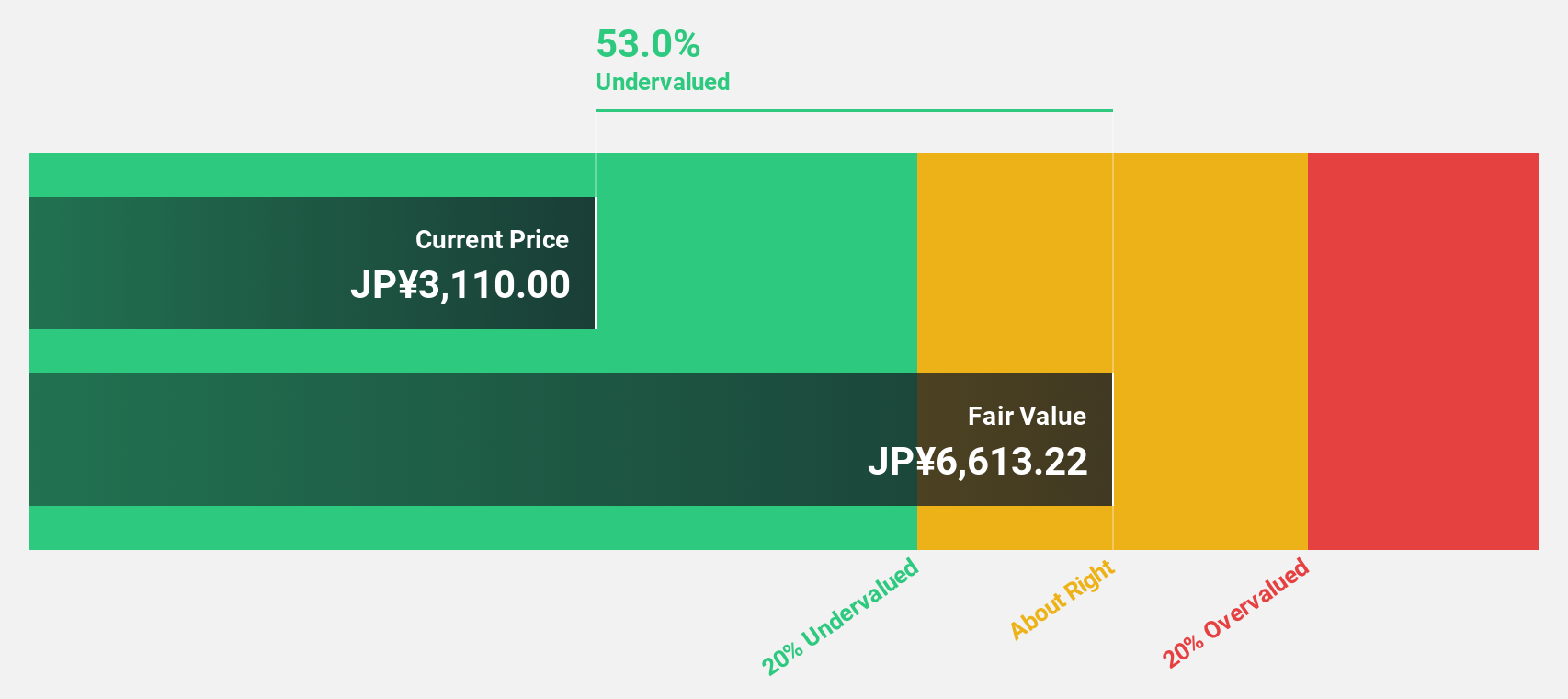

Medley (TSE:4480)

Overview: Medley, Inc. operates recruitment and medical business platforms in Japan and the United States with a market cap of ¥108.87 billion.

Operations: The company's revenue is derived from its Human Resource Platform Business, generating ¥22.67 billion, and its Medical Platform Business, contributing ¥7.72 billion.

Estimated Discount To Fair Value: 48.9%

Medley is trading at ¥3410, significantly below its estimated fair value of ¥6673.34, suggesting it might be undervalued based on cash flows. Despite a decline in profit margins from 12.1% to 7.2%, earnings are forecast to grow robustly by 26.89% annually, surpassing the Japanese market's average growth rate of 7.7%. Recent buybacks totaling ¥592.11 million could enhance shareholder value and reflect management's confidence in future performance improvements.

- In light of our recent growth report, it seems possible that Medley's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Medley stock in this financial health report.

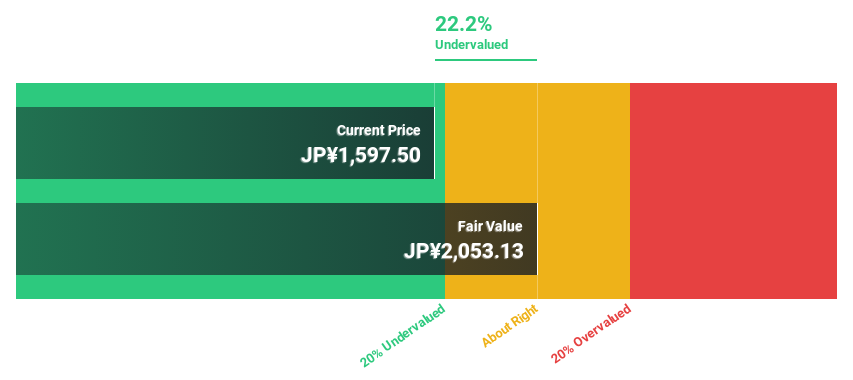

Chugin Financial GroupInc (TSE:5832)

Overview: Chugin Financial Group, Inc., operating through its subsidiary The Chugoku Bank, Limited, offers a range of financial services to both corporate and individual clients in Japan and has a market cap of ¥328 billion.

Operations: The company generates revenue through its subsidiary, The Chugoku Bank, Limited, by providing a variety of financial services to corporate and individual customers in Japan.

Estimated Discount To Fair Value: 12.4%

Chugin Financial Group is trading at ¥1840, below its fair value of ¥2101.33, indicating potential undervaluation based on cash flows. Earnings are forecast to grow at 14.3% annually, outpacing the JP market's 7.7%. The company recently completed a share buyback worth ¥1.13 billion and increased its dividend to ¥35.5 per share from retained earnings, reflecting efforts to enhance shareholder returns and improve capital efficiency through strategic capital management initiatives.

- Our earnings growth report unveils the potential for significant increases in Chugin Financial GroupInc's future results.

- Click here to discover the nuances of Chugin Financial GroupInc with our detailed financial health report.

Where To Now?

- Reveal the 268 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000426

Inner Mongolia Xingye Silver &Tin MiningLtd

Engages in mining, extracting, and smelting non-ferrous and precious metals.

High growth potential and good value.

Market Insights

Community Narratives