- Singapore

- /

- Real Estate

- /

- SGX:OYY

Asian Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by steady inflation and geopolitical tensions, Asian markets have shown resilience with notable stock performances. While the term 'penny stock' might seem outdated, it continues to signify potential opportunities in smaller or newer companies that can be overlooked gems. In this context, penny stocks with strong financial health may offer promising growth prospects for investors seeking hidden value in quality firms.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.90 | THB3.85B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.03 | HK$2.47B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.56 | HK$964.89M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.68 | SGD275.6M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.76 | THB2.86B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.07 | SGD12.08B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$133.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.72 | THB9.54B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD4.02 | SGD1.1B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 974 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Penguin International (SGX:BTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Penguin International Limited is an investment holding company that designs, builds, owns, and operates high-speed aluminum crafts across various regions including Singapore, East Asia, Africa, Europe, the Middle East, and Southeast Asia with a market cap of SGD279.62 million.

Operations: The company's revenue is primarily derived from its Shipbuilding, Ship Repairs and Maintenance segment at SGD306.47 million, followed by Vessel Chartering which contributes SGD52.26 million.

Market Cap: SGD279.62M

Penguin International has demonstrated substantial earnings growth, with a 130.4% increase over the past year, surpassing its five-year average of 23.6% annually. The company's recent half-year earnings report showed sales of SGD122.04 million and net income of SGD7.03 million, reflecting strong operational performance despite high share price volatility in the last three months. It maintains a low price-to-earnings ratio of 7x compared to the Singapore market average and has short-term assets exceeding both short-term and long-term liabilities, indicating solid financial health. However, its dividend yield is not well covered by free cash flows, suggesting potential sustainability concerns.

- Click to explore a detailed breakdown of our findings in Penguin International's financial health report.

- Gain insights into Penguin International's historical outcomes by reviewing our past performance report.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited is an investment holding company that provides real estate services in Singapore, with a market cap of SGD1.77 billion.

Operations: The company generates revenue primarily through agency services (SGD830.49 million), project marketing services (SGD352.77 million), training services (SGD4.24 million), and administrative support services (SGD2.36 million).

Market Cap: SGD1.77B

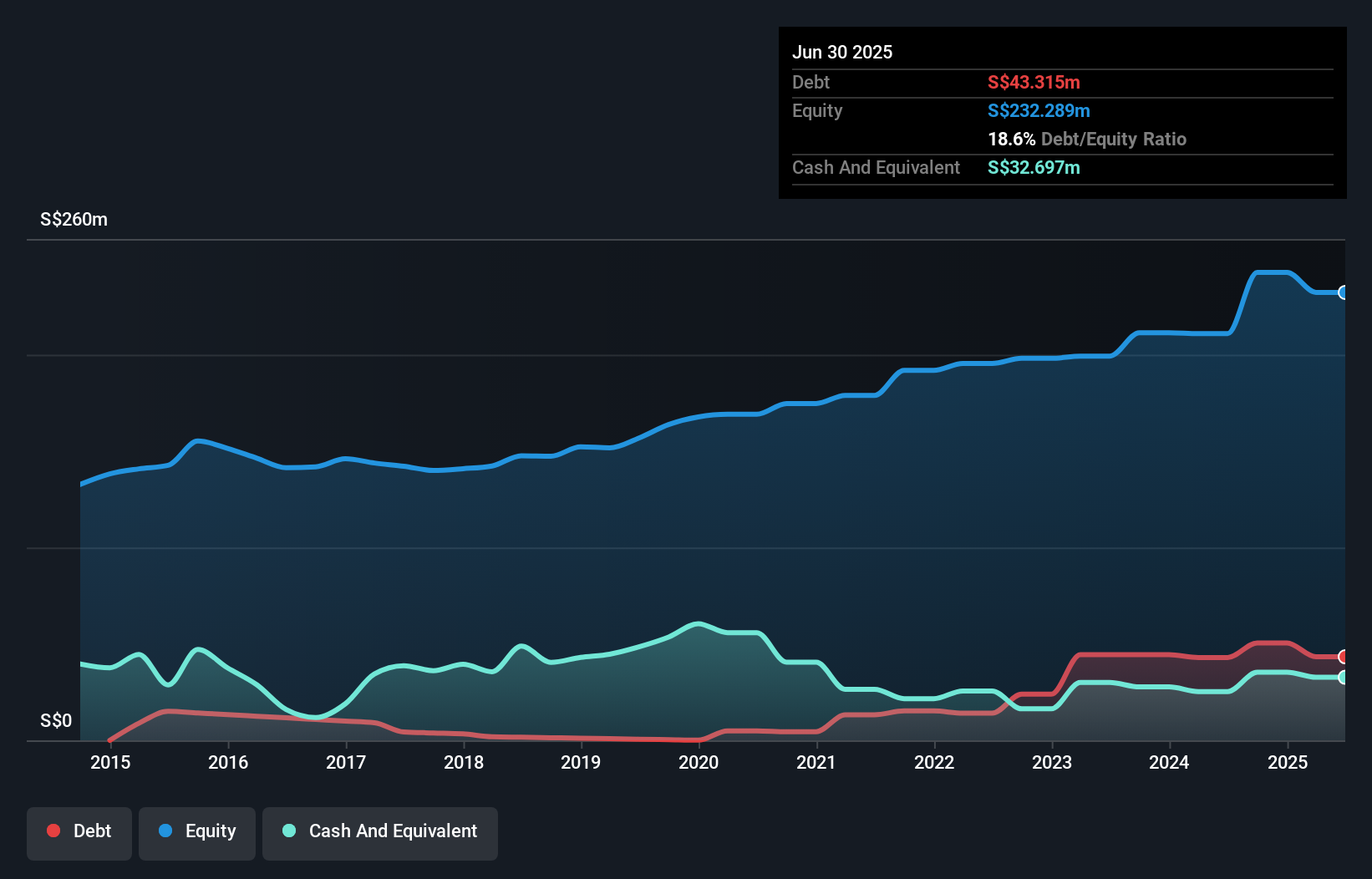

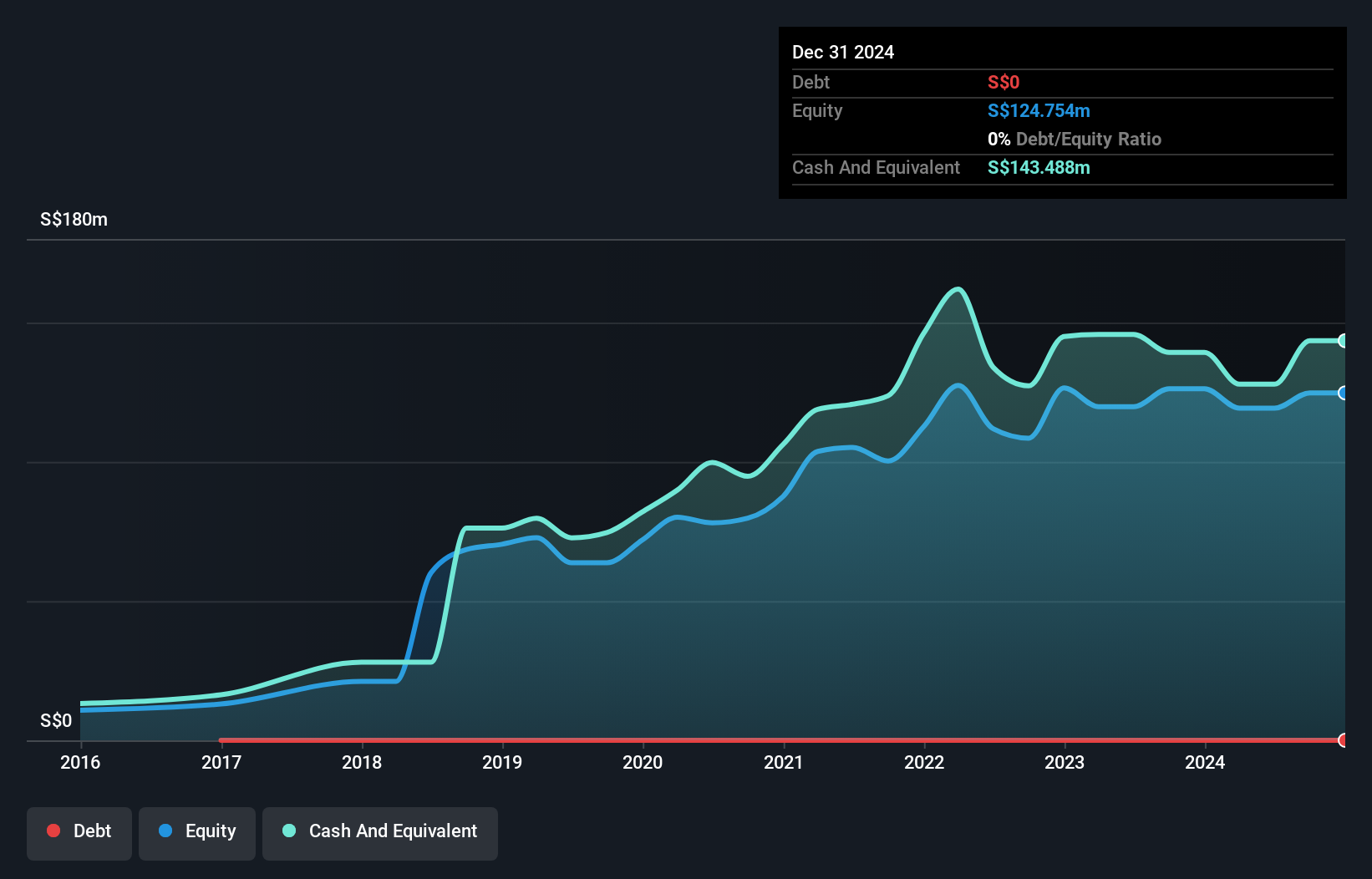

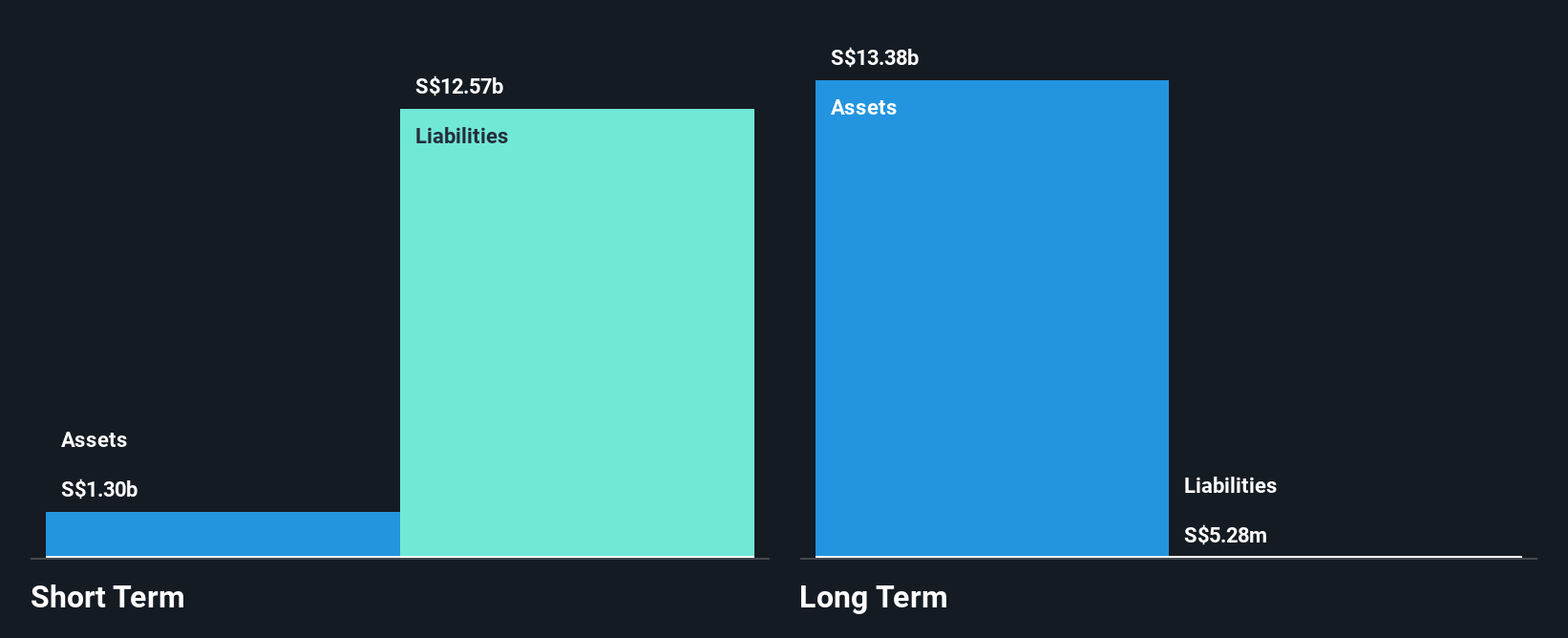

PropNex Limited has shown impressive earnings growth, with a recent half-year report revealing sales of SGD598.95 million and net income of SGD42.26 million, up significantly from the previous year. The company maintains a strong financial position, with short-term assets exceeding liabilities and no debt burden. Its return on equity is outstanding at 52.8%, indicating efficient profit generation relative to shareholder equity. PropNex's management transition sees Kelvin Fong as CEO, bringing over 20 years of industry experience to drive future strategies. Despite these strengths, investors should consider the relatively inexperienced management team in their assessments.

- Take a closer look at PropNex's potential here in our financial health report.

- Gain insights into PropNex's outlook and expected performance with our report on the company's earnings estimates.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial services company serving consumer and SME markets in Singapore, with a market cap of SGD1.16 billion.

Operations: The company generates revenue through its Financing Business segment, which reported SGD214.37 million.

Market Cap: SGD1.16B

Hong Leong Finance Limited, with a market cap of SGD1.16 billion, faces challenges as recent earnings results show a decline in net interest income to SGD89.23 million and net income to SGD32.22 million for the half-year ended June 2025. The company's loans-to-assets ratio is appropriate at 80%, supported by low-risk customer deposit funding, yet its return on equity remains low at 4%. Despite high-quality past earnings and an experienced management team averaging 8.3 years of tenure, the company has reduced its interim dividend from last year, reflecting an unstable dividend track record amidst declining profit margins.

- Navigate through the intricacies of Hong Leong Finance with our comprehensive balance sheet health report here.

- Assess Hong Leong Finance's previous results with our detailed historical performance reports.

Make It Happen

- Dive into all 974 of the Asian Penny Stocks we have identified here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 23 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OYY

PropNex

An investment holding company, provides real estate services in Singapore.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives