As Asia's markets continue to navigate a landscape influenced by global economic shifts and regional policy developments, investors are exploring diverse opportunities for growth. Penny stocks, despite being an older term, remain a relevant area of interest due to their potential for significant returns when backed by solid financials. This article will explore three penny stocks that combine strong balance sheets with promising growth prospects, offering investors the chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.77 | HK$2.26B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.63 | HK$2.18B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.00 | NZ$252.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

New Silkroad Culturaltainment (SEHK:472)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Silkroad Culturaltainment Limited is an investment holding company that offers property management services in the People’s Republic of China, with a market capitalization of approximately HK$1.17 billion.

Operations: The company's revenue is primarily derived from property management services, contributing HK$413.85 million, and a smaller portion from wine sales at HK$0.07 million.

Market Cap: HK$1.17B

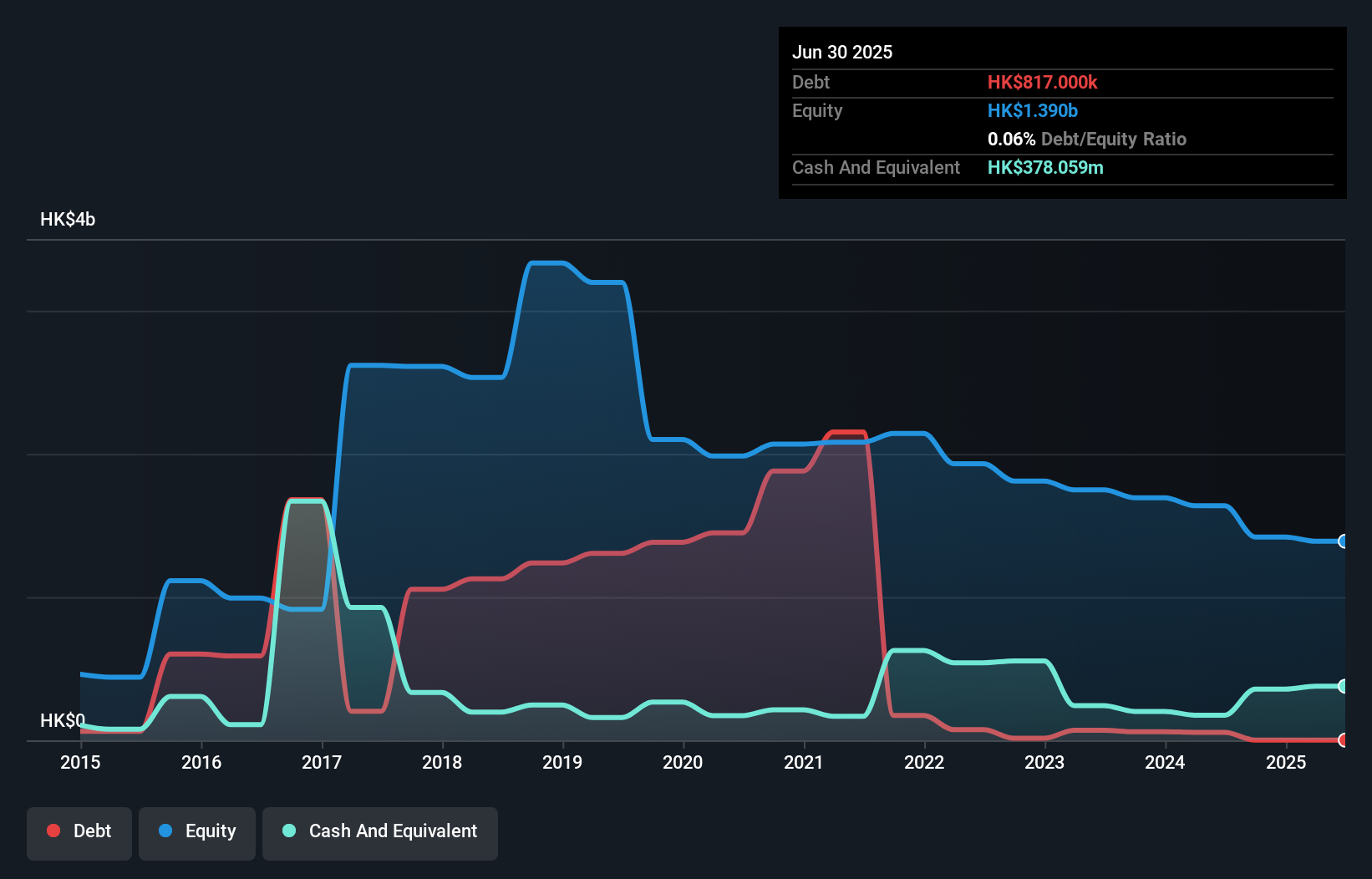

New Silkroad Culturaltainment Limited, with a market cap of HK$1.17 billion, primarily generates revenue from property management services in China. Despite being unprofitable, the company boasts a strong financial position with more cash than debt and sufficient cash runway for over three years due to positive free cash flow. Recent board changes include the appointment of Prof. Richard Visser as an independent director, enhancing governance expertise. The company's share price has been highly volatile recently and its management team is relatively new, which may impact strategic stability in the short term.

- Click here to discover the nuances of New Silkroad Culturaltainment with our detailed analytical financial health report.

- Examine New Silkroad Culturaltainment's past performance report to understand how it has performed in prior years.

Sino-Entertainment Technology Holdings (SEHK:6933)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino-Entertainment Technology Holdings Limited is an investment holding company that develops, publishes, and operates mobile games in the People's Republic of China, with a market cap of approximately HK$0.35 billion.

Operations: The company generates revenue primarily from its mobile game business, which contributes CN¥23.54 million.

Market Cap: HK$350.96M

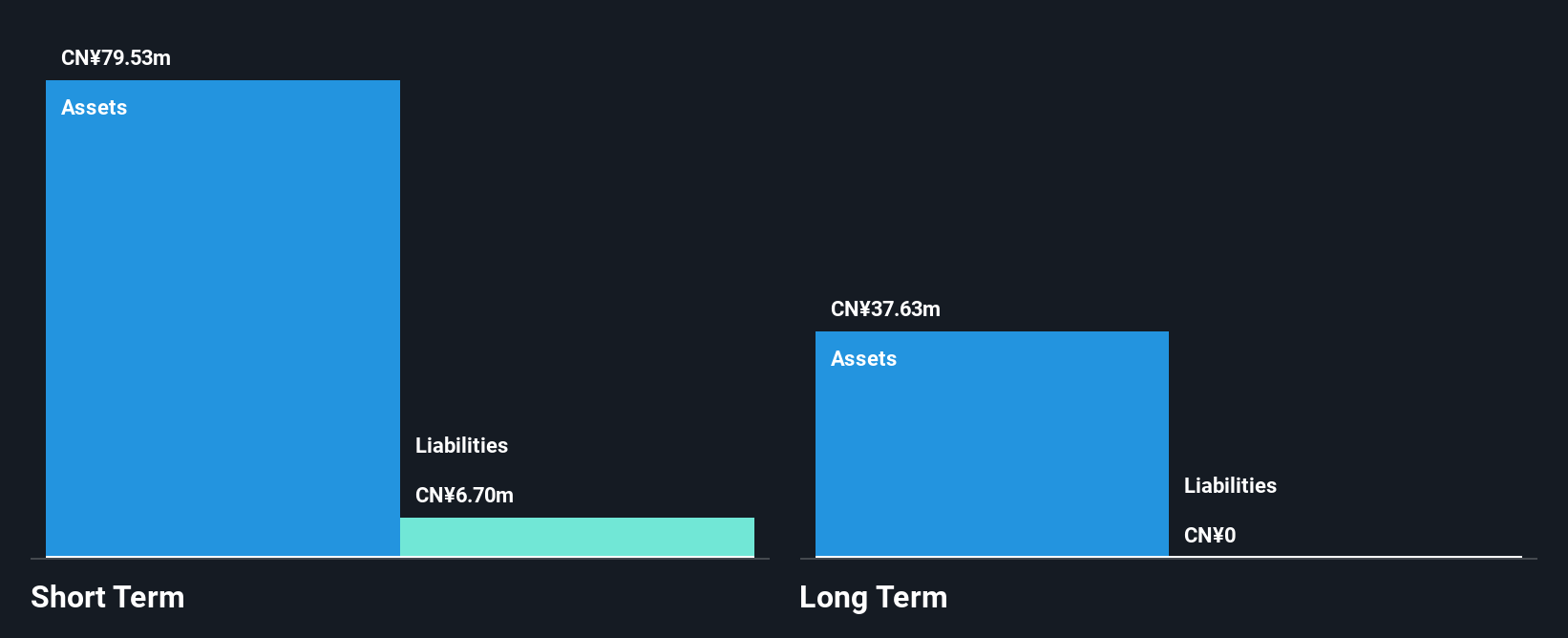

Sino-Entertainment Technology Holdings, with a market cap of HK$0.35 billion, primarily derives revenue from its mobile game business in China, totaling CN¥23.54 million. The company faces financial challenges with less than a year of cash runway and has been unprofitable, experiencing increased losses over the past five years at 47.3% annually. Despite having no debt and covering short-term liabilities with assets (CN¥79.5M vs CN¥6.7M), its share price remains highly volatile and earnings have consistently declined, suggesting potential risks for investors seeking stability in penny stocks within the Asian market.

- Take a closer look at Sino-Entertainment Technology Holdings' potential here in our financial health report.

- Review our historical performance report to gain insights into Sino-Entertainment Technology Holdings' track record.

Thai Beverage (SGX:Y92)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thai Beverage Public Company Limited operates in the production and distribution of alcoholic and non-alcoholic beverages, as well as food products across Thailand, Vietnam, Malaysia, Myanmar, Singapore, and internationally with a market cap of SGD11.69 billion.

Operations: The company's revenue is primarily derived from its Spirits segment at THB119.41 billion, followed by Beer at THB123.56 billion, Non-Alcoholic Beverages contributing THB65.04 billion, and Food generating THB22.04 billion.

Market Cap: SGD11.69B

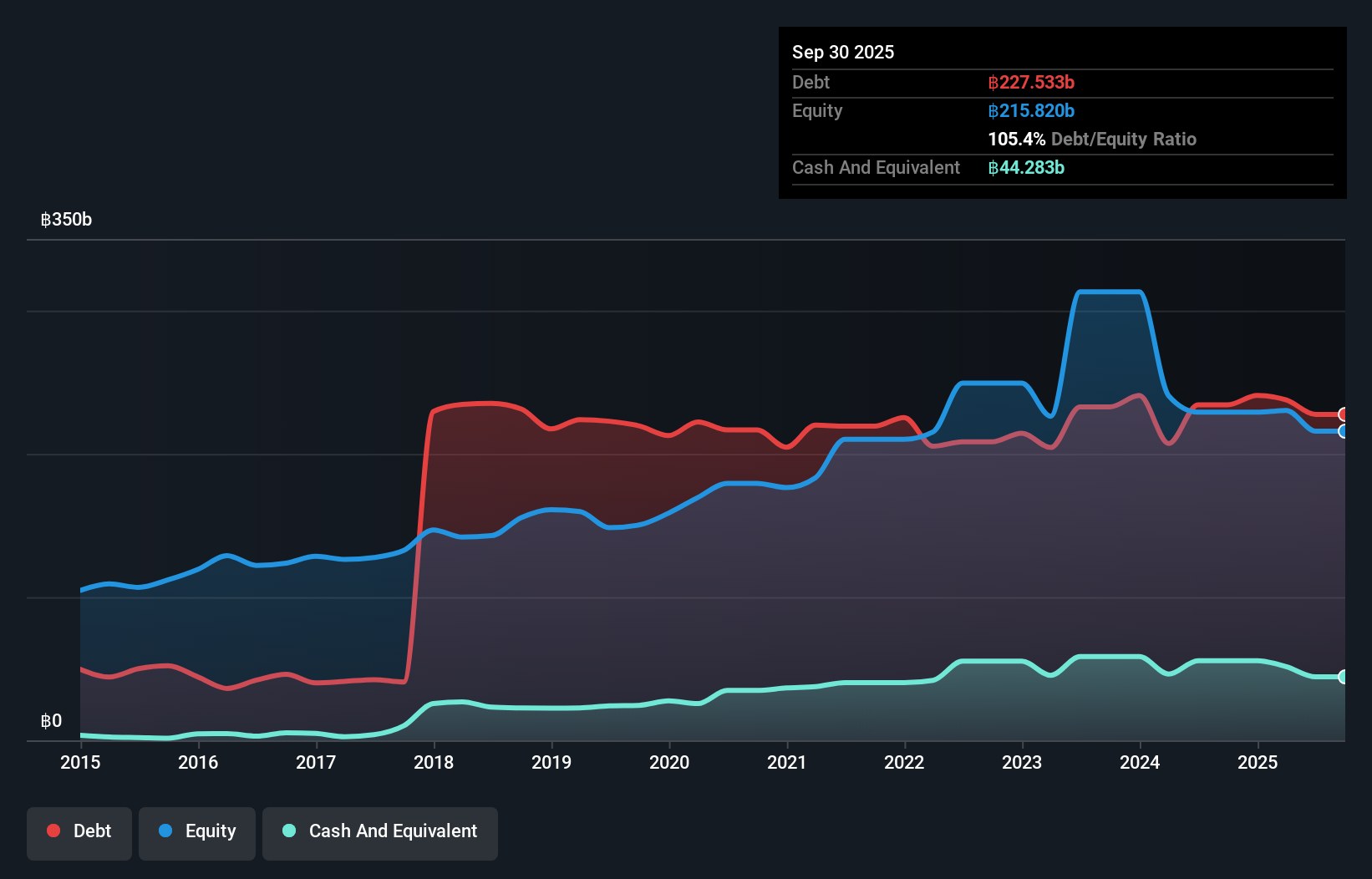

Thai Beverage, with a market cap of S$11.69 billion, faces challenges typical of penny stocks despite its size. The company's revenue is led by its Beer and Spirits segments, contributing THB123.56 billion and THB119.41 billion respectively, but recent earnings have declined slightly. Its debt levels are high with a net debt to equity ratio of 84.9%, though interest payments are well covered by EBIT at 5.3 times coverage. Recent leadership changes could influence strategic direction as Dr. Paitoon Wongsasutthikul steps into key roles focusing on sustainability and risk management within the company’s operations across Asia and beyond.

- Click here and access our complete financial health analysis report to understand the dynamics of Thai Beverage.

- Evaluate Thai Beverage's prospects by accessing our earnings growth report.

Make It Happen

- Gain an insight into the universe of 958 Asian Penny Stocks by clicking here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thai Beverage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Y92

Thai Beverage

Produces and distributes alcoholic and non-alcoholic beverages, and food products in Thailand, Vietnam, Malaysia, Myanmar, Singapore, and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)