- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Asian Market's Estimated Value Stocks For August 2025

Reviewed by Simply Wall St

As the Asian markets navigate a landscape influenced by global economic shifts, including potential rate cuts and evolving trade dynamics, investors are keenly observing opportunities for value investments. In this context, identifying stocks that are perceived as undervalued can be particularly appealing, offering potential for growth amid broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$29.50 | HK$58.66 | 49.7% |

| Sunjin Beauty ScienceLtd (KOSDAQ:A086710) | ₩10670.00 | ₩20977.90 | 49.1% |

| Matsuya R&DLtd (TSE:7317) | ¥720.00 | ¥1425.84 | 49.5% |

| Kolmar Korea (KOSE:A161890) | ₩79100.00 | ₩157557.58 | 49.8% |

| KeePer Technical Laboratory (TSE:6036) | ¥3445.00 | ¥6838.84 | 49.6% |

| Jiangxi Rimag Group (SEHK:2522) | HK$19.11 | HK$37.65 | 49.2% |

| Faraday Technology (TWSE:3035) | NT$149.00 | NT$293.73 | 49.3% |

| EROAD (NZSE:ERD) | NZ$2.32 | NZ$4.61 | 49.7% |

| Cosmax (KOSE:A192820) | ₩213000.00 | ₩422224.18 | 49.6% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.57 | ₱7.10 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

Simcere Pharmaceutical Group (SEHK:2096)

Overview: Simcere Pharmaceutical Group Limited is an investment holding company that focuses on the research, development, manufacture, and sale of pharmaceutical products within China, with a market cap of approximately HK$34.89 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to CN¥7.11 billion.

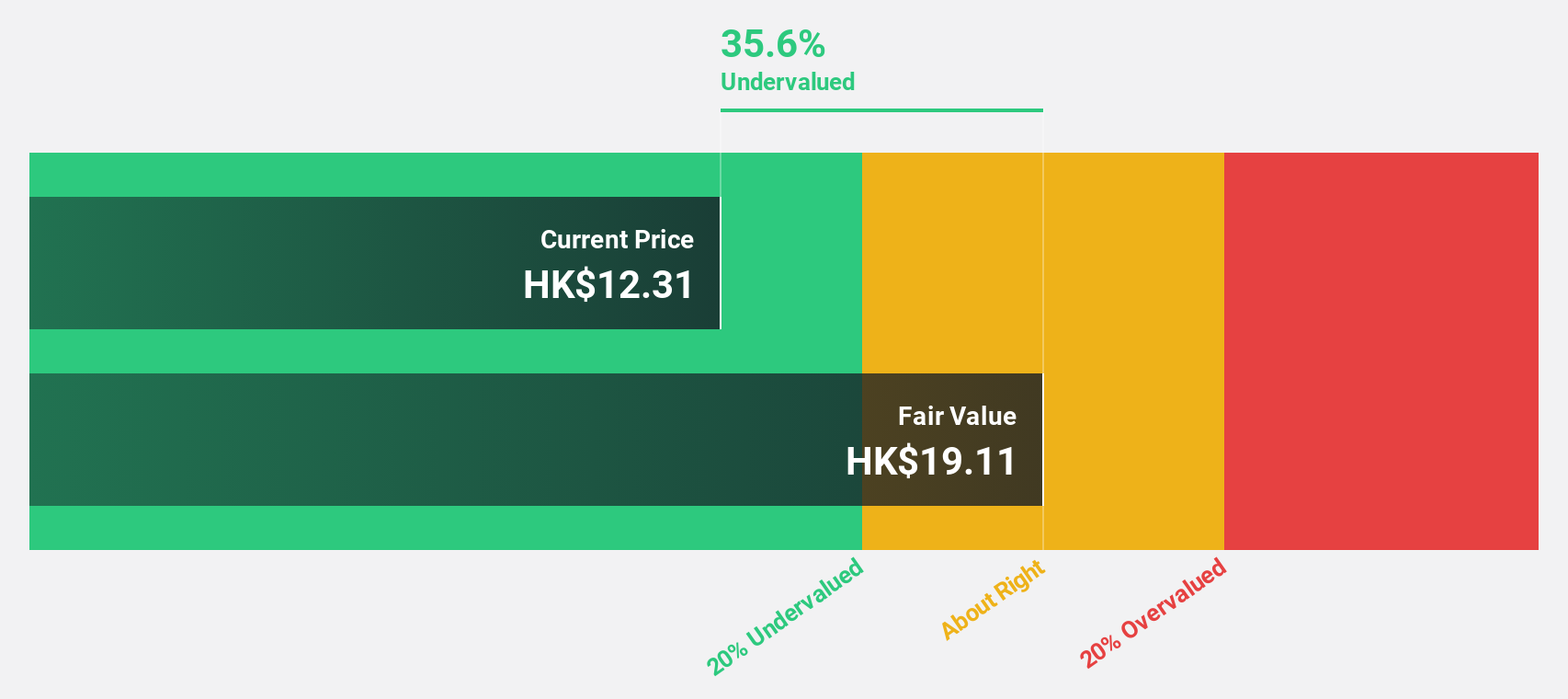

Estimated Discount To Fair Value: 26.1%

Simcere Pharmaceutical Group, trading at HK$14.1, is significantly undervalued compared to its fair value estimate of HK$19.08. Recent earnings show a solid performance with sales rising to CNY 3.58 billion and net income increasing to CNY 603.61 million for the first half of 2025, reflecting strong cash flow potential. The company's strategic collaborations and new drug approvals could further enhance revenue streams, supporting forecasts of significant earnings growth over the next three years.

- Insights from our recent growth report point to a promising forecast for Simcere Pharmaceutical Group's business outlook.

- Unlock comprehensive insights into our analysis of Simcere Pharmaceutical Group stock in this financial health report.

Chugai Pharmaceutical (TSE:4519)

Overview: Chugai Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals both in Japan and internationally with a market cap of ¥10.32 trillion.

Operations: Chugai Pharmaceutical Co., Ltd. generates revenue through its involvement in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals across Japan and international markets.

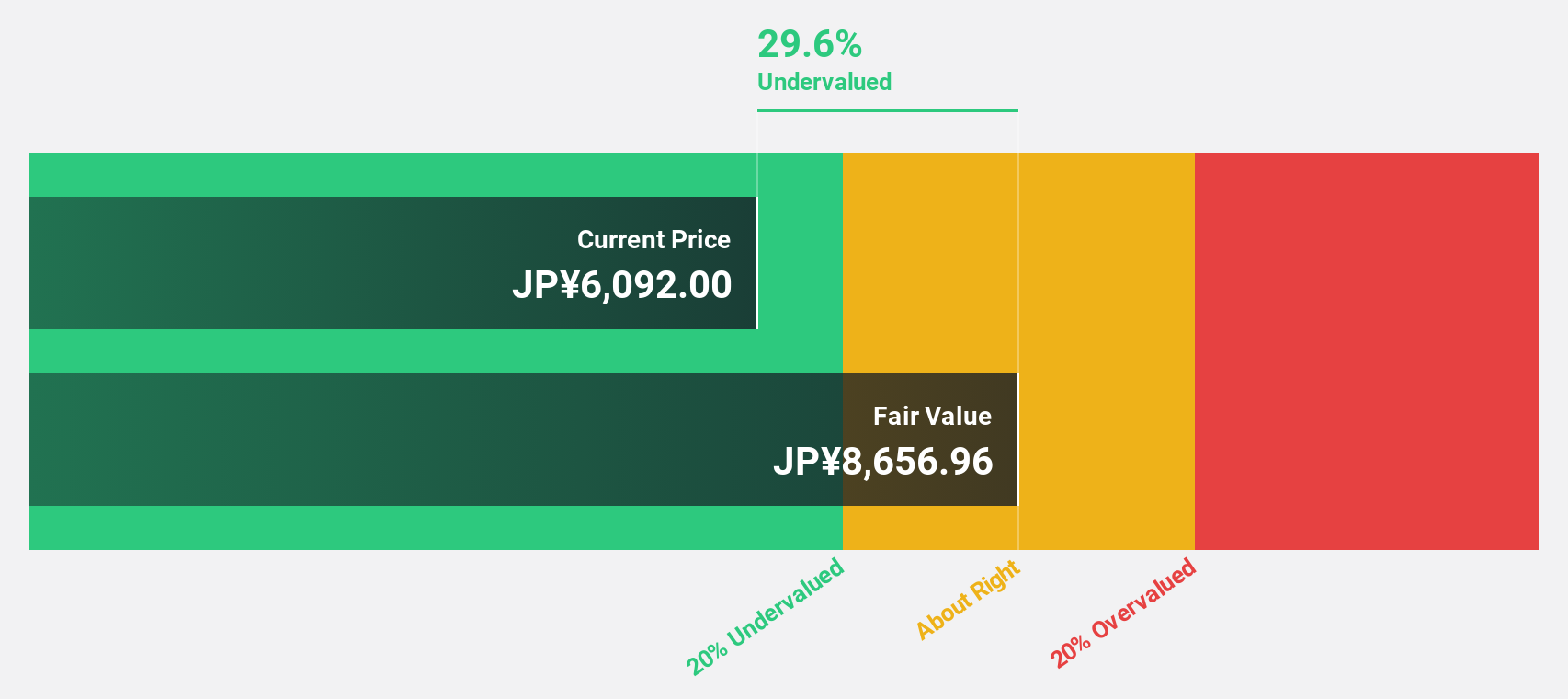

Estimated Discount To Fair Value: 29.3%

Chugai Pharmaceutical, trading at ¥6,270, is undervalued relative to its estimated fair value of ¥8,867.05. Despite a volatile share price recently, the company shows promising cash flow potential with earnings projected to grow 8.28% annually, outpacing the Japanese market's average growth. Recent strategic moves include a new lab for enhanced drug development and a partnership with Gero PTE for novel therapies, potentially bolstering future revenue streams without impacting current financial forecasts.

- According our earnings growth report, there's an indication that Chugai Pharmaceutical might be ready to expand.

- Take a closer look at Chugai Pharmaceutical's balance sheet health here in our report.

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components globally, with a market capitalization of approximately ¥366.96 billion.

Operations: The company's revenue primarily comes from its Electronic Components Business, generating ¥345.11 billion.

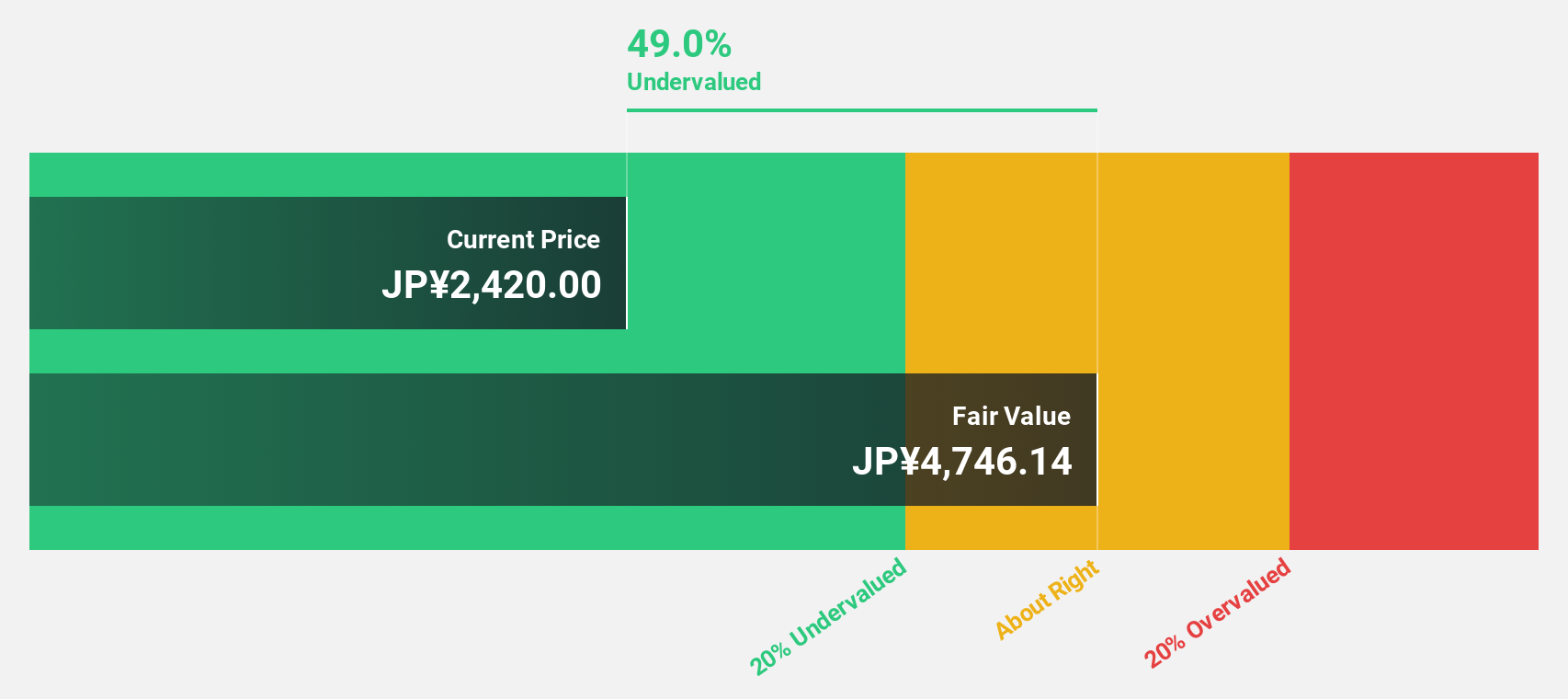

Estimated Discount To Fair Value: 36.5%

Taiyo Yuden is trading at ¥2,942, significantly below its estimated fair value of ¥4,629.84. Despite recent share price volatility, the company demonstrates strong cash flow potential with earnings expected to grow 45.09% annually over the next few years. While revenue growth is forecasted at 4.9% per year—above the market average—its return on equity remains low at a projected 7.6%. Recent board decisions include disposing of treasury stock for remuneration purposes.

- The growth report we've compiled suggests that Taiyo Yuden's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Taiyo Yuden's balance sheet health report.

Make It Happen

- Get an in-depth perspective on all 269 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, North America, China, Europe, Hong Kong, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives