As Asian markets navigate a landscape marked by trade negotiations and economic policy shifts, investors are keenly observing the region's dividend stocks for potential opportunities. In this environment, a good dividend stock is often characterized by its ability to maintain stable payouts despite market volatility, making them an attractive option for income-focused investors looking to weather economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.39% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| en-japan (TSE:4849) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

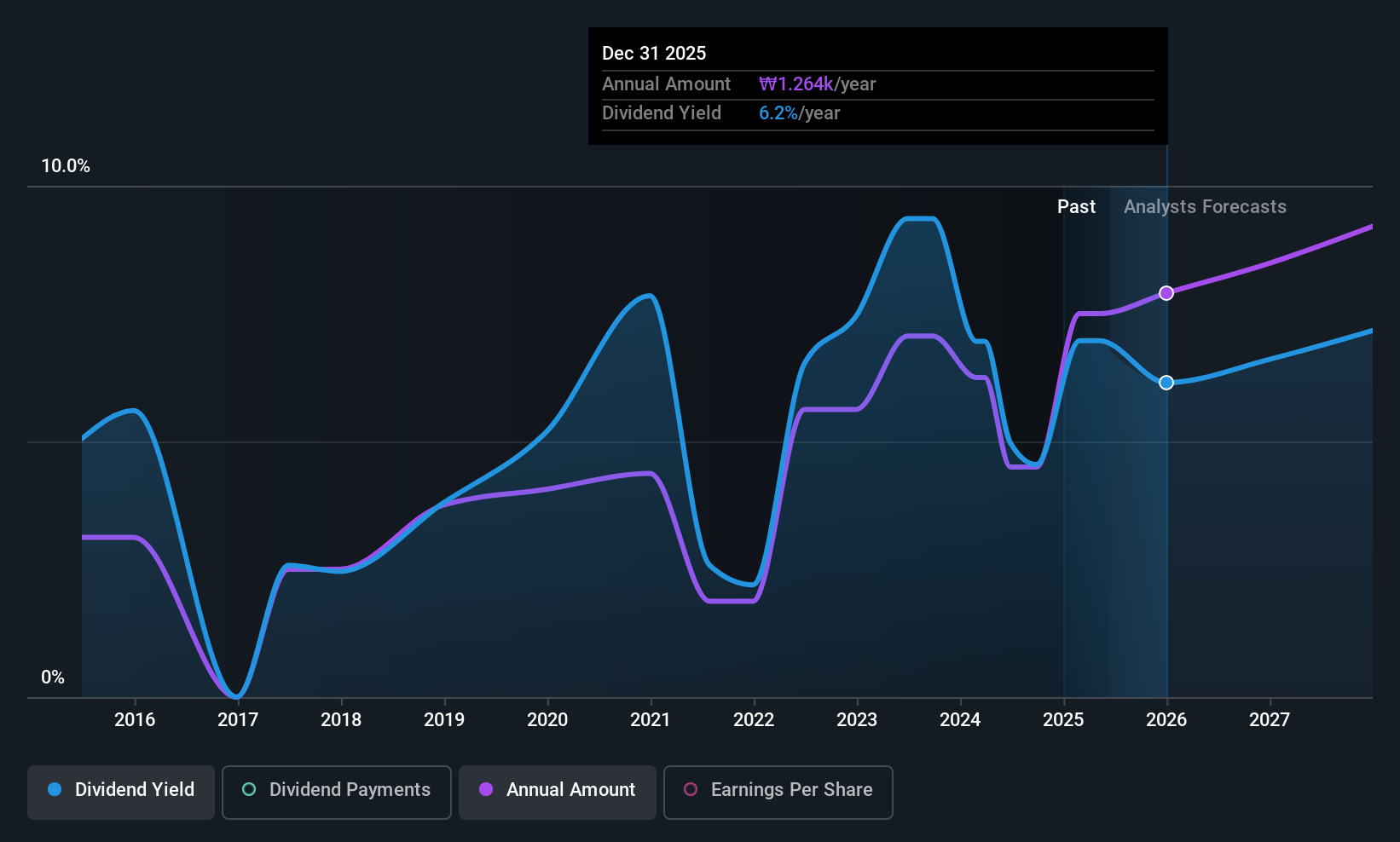

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc. operates as a commercial bank offering a variety of financial services to individual, business, and institutional clients in Korea, with a market cap of approximately ₩14.90 trillion.

Operations: Woori Financial Group Inc.'s revenue segments include Banking at ₩7.81 billion, Capital at ₩291.32 million, Credit Cards at ₩520.77 million, and Investment Securities at ₩66.84 million.

Dividend Yield: 5.9%

Woori Financial Group's dividend yield ranks in the top 25% of Korean market payers, supported by a low payout ratio of 33.2%, indicating dividends are well-covered by earnings. However, its dividend track record is volatile over the past decade, with recent decreases. The company trades at a significant discount to its estimated fair value and has completed a share buyback worth KRW 25.64 billion, reflecting efforts to enhance shareholder value amid fluctuating earnings performance.

- Dive into the specifics of Woori Financial Group here with our thorough dividend report.

- Our valuation report here indicates Woori Financial Group may be undervalued.

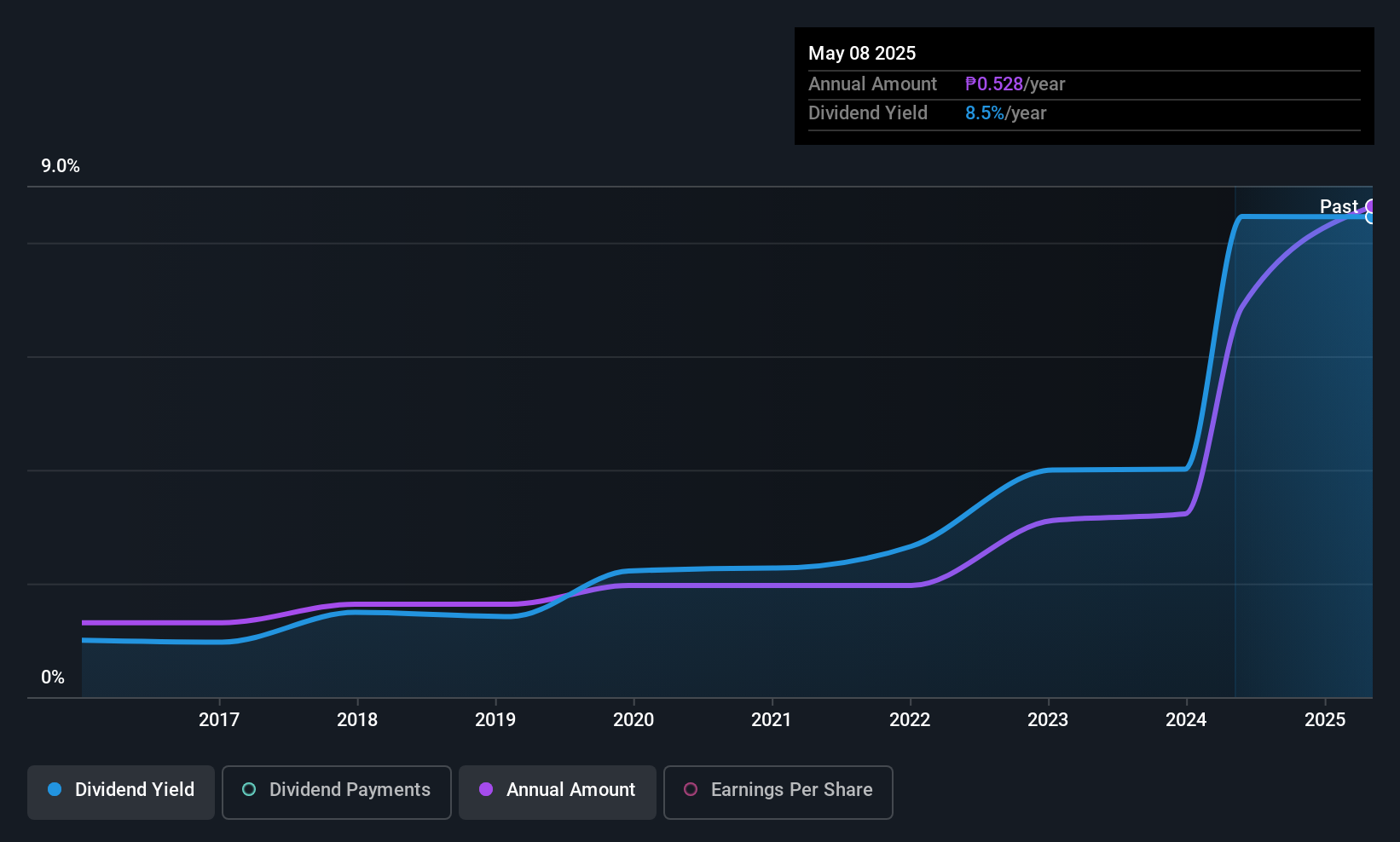

Cosco Capital (PSE:COSCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosco Capital, Inc. operates in the Philippines through its subsidiaries across various sectors including retail, real estate, liquor distribution, oil and mineral exploration, and specialty retail businesses with a market cap of ₱48.75 billion.

Operations: Cosco Capital, Inc.'s revenue is primarily derived from its grocery retail segment at ₱224.27 billion, followed by liquor distribution at ₱19.23 billion, real estate and property leasing at ₱2.04 billion, specialty retail at ₱2.09 billion, and energy and minerals exploration contributing ₱534.44 million in the Philippines.

Dividend Yield: 7.6%

Cosco Capital's dividend yield is among the top 25% in the Philippine market, with a low cash payout ratio of 20.7%, ensuring dividends are well-supported by cash flows. Despite this financial strength, its dividend history over the past decade has been volatile and unreliable. The company trades at a favorable valuation compared to peers and has demonstrated recent earnings growth. A special cash dividend of PHP 0.132 per share was announced for September 2025, alongside regular dividends totaling PHP 1.86 billion for June payment.

- Unlock comprehensive insights into our analysis of Cosco Capital stock in this dividend report.

- According our valuation report, there's an indication that Cosco Capital's share price might be on the cheaper side.

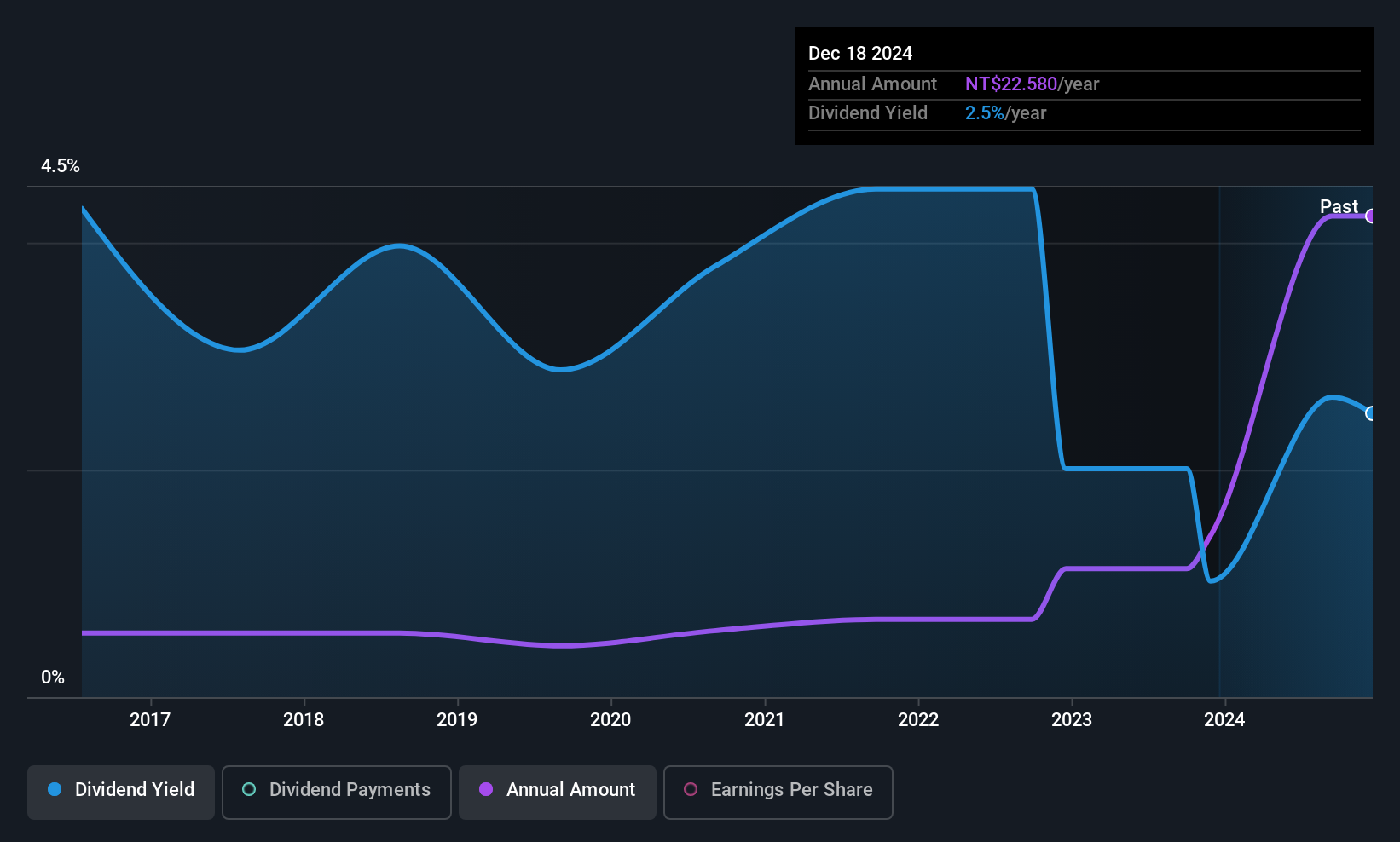

Jinan Acetate Chemical (TWSE:4763)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinan Acetate Chemical Co., Ltd. operates in the research, development, production, and sale of cellulose acetate products across multiple continents and has a market cap of NT$92.88 billion.

Operations: Jinan Acetate Chemical Co., Ltd. generates revenue primarily from the research and development and manufacturing of fiber acetate products, amounting to NT$16.25 billion.

Dividend Yield: 5.3%

Jinan Acetate Chemical offers a dividend yield in the top 25% of Taiwan's market, with dividends covered by earnings (56.9% payout ratio) and cash flows (80.1% cash payout ratio). However, its dividend history is unstable, having been paid for less than a decade with volatility. The company's shares trade significantly below estimated fair value and recent earnings report shows growth in sales to TWD 4.15 billion for Q1 2025, though net income slightly declined year-over-year.

- Click to explore a detailed breakdown of our findings in Jinan Acetate Chemical's dividend report.

- Our expertly prepared valuation report Jinan Acetate Chemical implies its share price may be lower than expected.

Summing It All Up

- Discover the full array of 1231 Top Asian Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4763

Jinan Acetate Chemical

Engages in the research and development, production, and sale of cellulose acetate tows, cellulose acetates, and cellulose anhydrides in Asia, Europe, America, and Africa.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives