- Taiwan

- /

- Specialty Stores

- /

- TPEX:5312

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets face volatility due to renewed tariff threats and economic uncertainties, Asian economies are navigating these challenges with varying degrees of resilience. In this environment, dividend stocks in Asia can offer investors a measure of stability and potential income, as they typically represent companies with strong cash flows and solid financial foundations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.32% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.02% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.23% | ★★★★★★ |

| Daicel (TSE:4202) | 4.94% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.72% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1251 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products and has a market cap of NT$9.91 billion.

Operations: Formosa Optical Technology Co., Ltd. generates revenue through its eyecare product offerings in Taiwan.

Dividend Yield: 4.5%

Formosa Optical Technology Ltd. has a stable dividend history over the past decade, with consistent growth and reliability. However, its current dividend yield of 4.55% falls short compared to top-tier payers in Taiwan's market. The dividends are not well covered by earnings due to a high payout ratio of 91%, but they are supported by cash flows with an 85.5% cash payout ratio. Recent earnings show a slight decline, which may impact future payouts if trends continue.

- Delve into the full analysis dividend report here for a deeper understanding of Formosa Optical TechnologyLtd.

- Upon reviewing our latest valuation report, Formosa Optical TechnologyLtd's share price might be too optimistic.

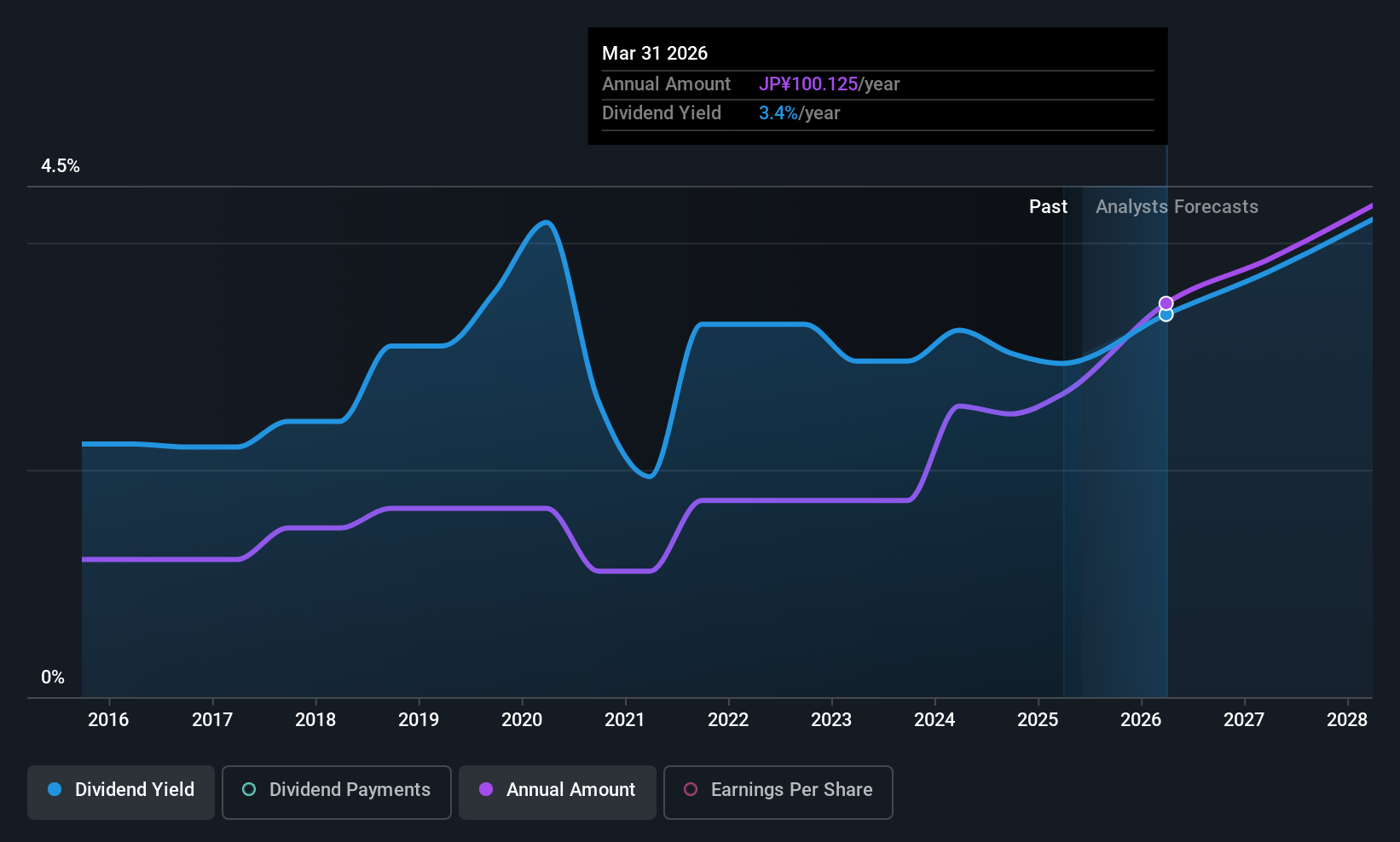

Sumitomo Electric Industries (TSE:5802)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Electric Industries, Ltd. is a global manufacturer and seller of electric wires and cables, with a market cap of ¥2.23 trillion.

Operations: Sumitomo Electric Industries, Ltd. generates revenue from several segments including Automotive (¥2.73 billion), Electronics (¥377.25 million), Infocommunications (¥223.28 million), Environment & Energy (¥1.08 billion), and Industrial Materials & Others (¥372.67 million).

Dividend Yield: 3.5%

Sumitomo Electric Industries has shown a volatile dividend history, yet recent increases suggest a positive shift. The company declared a year-end dividend of ¥61 per share for FY2025 and plans to pay ¥50 per share for the second quarter of FY2026. While the payout ratio remains sustainable at 39%, ensuring dividends are covered by earnings and cash flows, its yield is relatively low in Japan's market. Recent strategic alliances may bolster future growth prospects.

- Click here to discover the nuances of Sumitomo Electric Industries with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Sumitomo Electric Industries shares in the market.

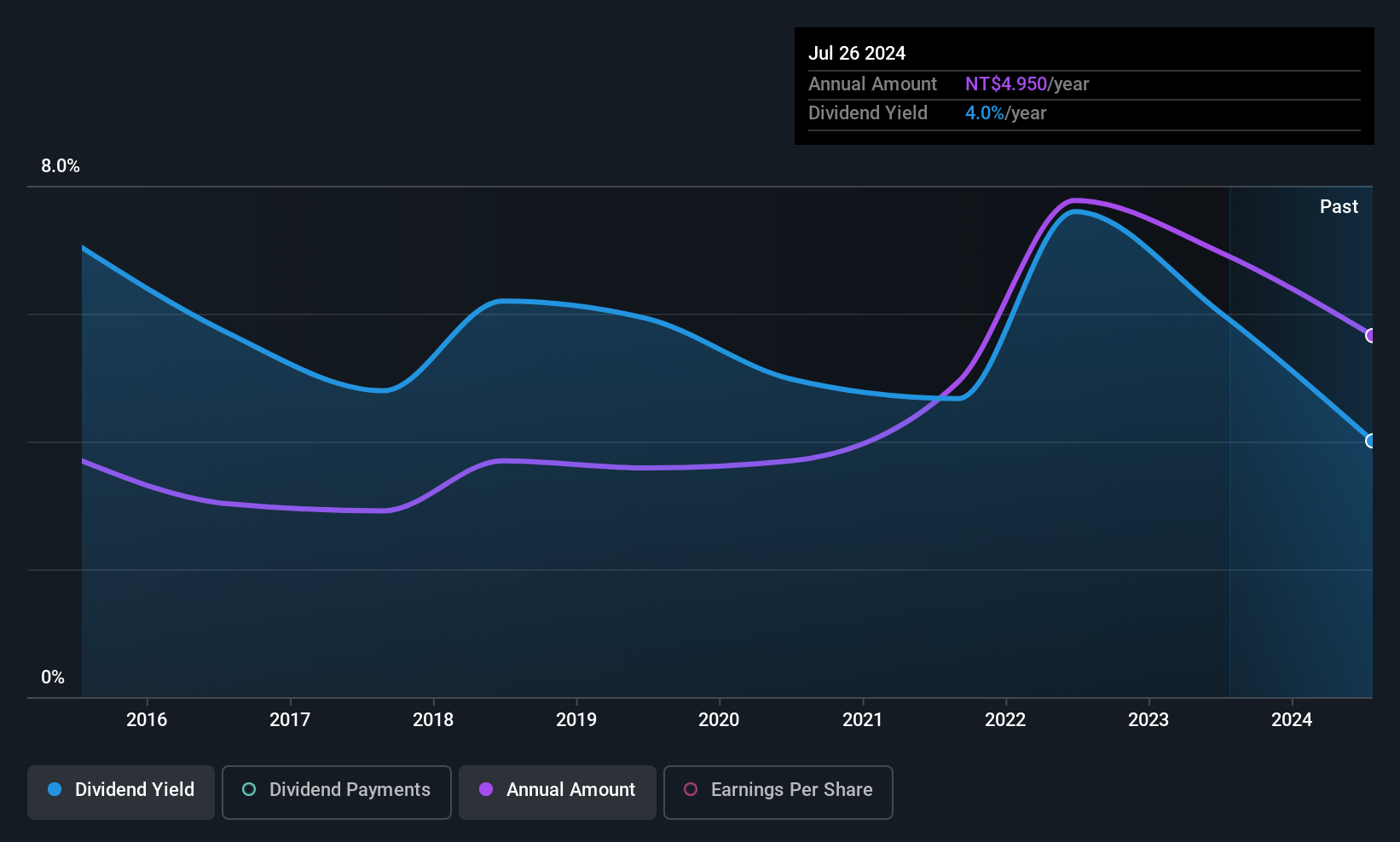

Wah Lee Industrial (TWSE:3010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wah Lee Industrial Corporation operates in Taiwan, focusing on the manufacturing of materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards, with a market cap of NT$27.50 billion.

Operations: Wah Lee Industrial Corporation generates revenue through its diverse operations, including the production of engineering and functional plastics, semiconductor process materials, and printed circuit boards.

Dividend Yield: 4.7%

Wah Lee Industrial's dividend strategy appears robust, with a payout ratio of 56.2% ensuring dividends are covered by earnings and cash flows. Recent adjustments increased the annual dividend to TWD 5.3 per share, distributing TWD 1.38 billion to shareholders for 2024. Despite a yield of 4.72%, which is below Taiwan's top tier, the company maintains stable and reliable dividends over the past decade, supported by consistent earnings growth and favorable price-to-earnings valuation at 11.8x.

- Dive into the specifics of Wah Lee Industrial here with our thorough dividend report.

- Our valuation report here indicates Wah Lee Industrial may be overvalued.

Seize The Opportunity

- Embark on your investment journey to our 1251 Top Asian Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5312

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives