- United States

- /

- Software

- /

- NYSE:PLAN

Analysts Have Been Trimming Their Anaplan, Inc. (NYSE:PLAN) Price Target After Its Latest Report

There's been a major selloff in Anaplan, Inc. (NYSE:PLAN) shares in the week since it released its yearly report, with the stock down 21% to US$28.39. Revenues came in at US$348m, in line with forecasts and the company reported a statutory loss of US$1.15 per share, roughly in line with expectations. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Anaplan

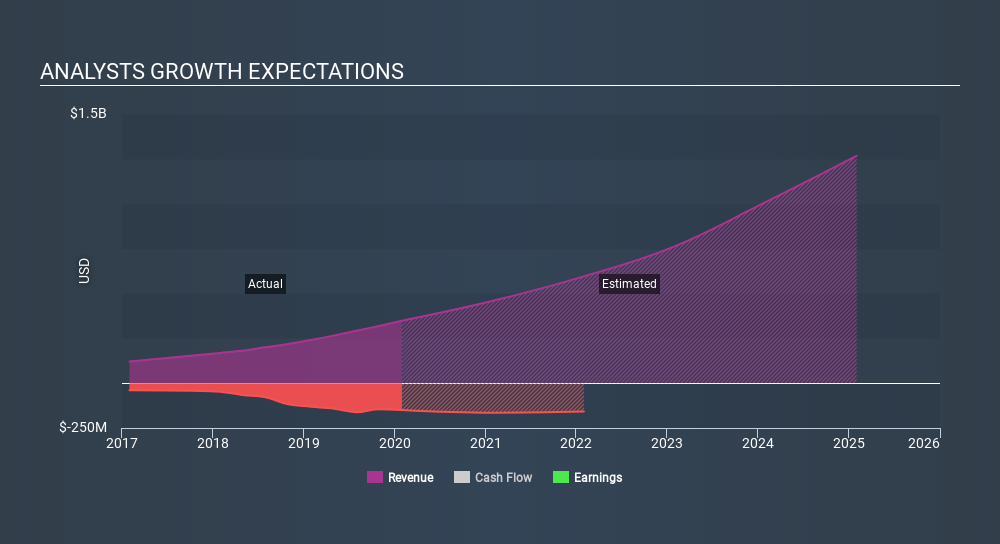

Taking into account the latest results, the most recent consensus for Anaplan from 15 analysts is for revenues of US$459.1m in 2021 which, if met, would be a sizeable 32% increase on its sales over the past 12 months. Per-share losses are predicted to creep up to US$1.20. Before this latest report, the consensus had been expecting revenues of US$464.2m and US$1.20 per share in losses.

As a result, it's unexpected to see that the consensus price target fell 5.2% to US$53.72, with the analysts seemingly becoming more concerned about ongoing losses, despite making no major changes to their forecasts. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Anaplan at US$71.00 per share, while the most bearish prices it at US$35.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We can infer from the latest estimates that forecasts expect a continuation of Anaplan'shistorical trends, as next year's 32% revenue growth is roughly in line with 33% annual revenue growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 12% per year. So although Anaplan is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Anaplan's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Anaplan. Long-term earnings power is much more important than next year's profits. We have forecasts for Anaplan going out to 2025, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Anaplan (at least 2 which make us uncomfortable) , and understanding them should be part of your investment process.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:PLAN

Anaplan

Anaplan, Inc. provides a cloud-based connected planning platform to connect organizations and people in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives