- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Launches New Partnerships Enhancing Product Reach And Employee Rewards

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) experienced an 18% increase in its share price over the past month, influenced by several developments. The launch of Edible Garden's Kick. Sports Nutrition product line on Amazon may have highlighted the platform's potential for market expansion, contributing positively to its valuation. Similarly, Audientes' initiative to distribute its hearable product, Companion, through Amazon in Europe likely added to this growth narrative. Meanwhile, Innovation Minds' integration of Amazon Business supports the company's ongoing diversification strategies. Despite the broader market experiencing varied performances, these initiatives from Amazon entities likely fortified investor confidence, aligning with the upward stock movement amidst overall market optimism.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

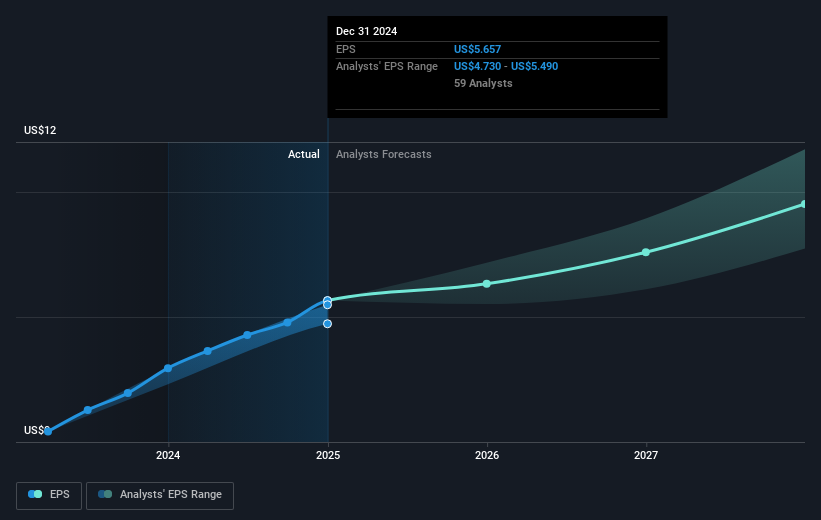

The recent developments highlighted in the introduction signify Amazon's robust efforts to widen its market reach, potentially bolstering revenue forecasts. The introduction of new product lines through its platform underscores Amazon's ability to leverage its expansive retail network, which may positively influence anticipated revenue and earnings growth figures. Over a three-year period, the company's total shareholder returns were substantial at 96.03%, indicating strong performance and substantial investor gains. This longer-term growth provides context for the recent one-year return where Amazon underperformed the US Multiline Retail industry, which saw a rise of 12.5%. The short-term share price increase of 18% may partially reflect these strategic advancements.

In terms of future outlook, the price target of US$239.33 suggests a promising potential for share price appreciation, especially considering the current trading price of US$185.01 reflects a substantial discount to this target. This gap indicates an expectation of further growth aligned with optimism surrounding Amazon's operational efficiencies and expansion in AWS and advertising, both anticipated to drive earnings. However, uncertainties in tariffs, market competition, and high operational costs remain critical factors for the company's performance. Investors should consider these aspects in conjunction with the analysts' revenue and profit margin projections when evaluating the potential trajectory of Amazon's stock.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Amazon.com, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives