- United Kingdom

- /

- Airlines

- /

- LSE:EZJ

ActiveOps Leads The Pack With These 3 UK Penny Stocks

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often seek opportunities in less conventional areas like penny stocks. Although the term may seem outdated, these smaller or newer companies can offer significant growth potential when backed by solid financials, providing a chance to uncover hidden value.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.595 | £514.44M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.12 | £171.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.775 | £11.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.485 | £71.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.898 | £716.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific, with a market cap of £153.46 million.

Operations: The company generates revenue through its SaaS offerings, which account for £26.77 million, and its Training & Implementation services, contributing £3.69 million.

Market Cap: £153.46M

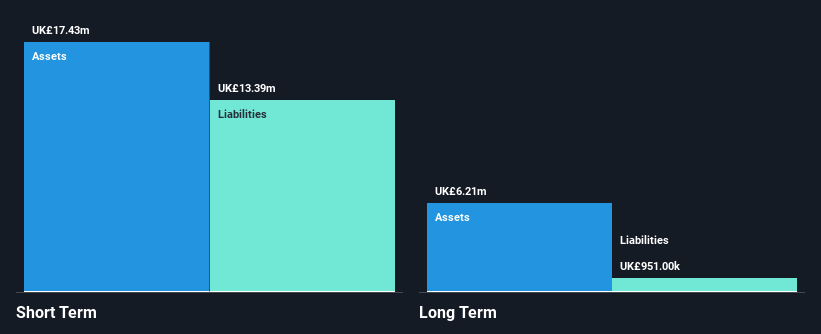

ActiveOps Plc, with a market cap of £153.46 million, has demonstrated strong financial health through its SaaS and Training & Implementation revenue streams totaling £30.46 million. The company is debt-free, with short-term assets exceeding both short and long-term liabilities. Although its earnings growth of 30.7% last year outpaced the industry average, it remains below its five-year average growth rate of 69.4%. Recent client contract renewals have bolstered confidence in product value, despite high share price volatility and a low return on equity at 11.2%. Earnings are forecasted to grow significantly by 40.69% annually.

- Navigate through the intricacies of ActiveOps with our comprehensive balance sheet health report here.

- Assess ActiveOps' future earnings estimates with our detailed growth reports.

Premier Miton Group (AIM:PMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Premier Miton Group plc is a publicly owned investment manager with a market cap of £92.97 million.

Operations: The company generates its revenue from Asset Management, totaling £66.22 million.

Market Cap: £92.97M

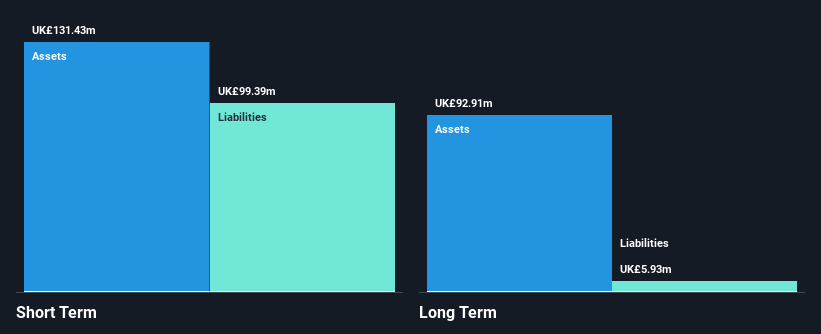

Premier Miton Group plc, with a market cap of £92.97 million, demonstrates solid financial health through its asset management revenue of £66.22 million and is debt-free. Its short-term assets of £166.8 million comfortably cover both short and long-term liabilities, enhancing financial stability. Despite a decline in earnings by 25.8% annually over the past five years, recent performance shows improvement with a 12.2% growth over the last year, surpassing industry averages. However, the dividend yield of 10.17% is not well supported by earnings, and return on equity remains low at 2%. Earnings are projected to grow significantly by 59.66% annually according to analyst forecasts.

- Unlock comprehensive insights into our analysis of Premier Miton Group stock in this financial health report.

- Review our growth performance report to gain insights into Premier Miton Group's future.

easyJet (LSE:EZJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: easyJet plc operates as a low-cost airline carrier in Europe with a market capitalization of approximately £3.61 billion.

Operations: The company's revenue is primarily derived from its Airline segment, generating £8.35 billion, and its Holidays segment, contributing £1.64 billion.

Market Cap: £3.61B

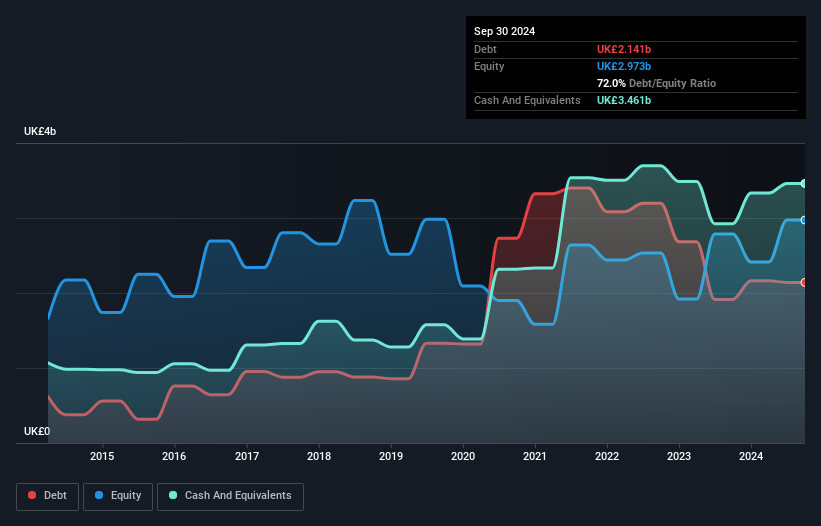

easyJet plc, with a market cap of £3.61 billion, shows a mixed financial picture. Its revenue streams from the Airline (£8.35 billion) and Holidays (£1.64 billion) segments are robust, yet its management team is relatively inexperienced with an average tenure of 0.8 years. The company's Return on Equity at 15.5% is low compared to industry standards, and recent earnings growth (10.2%) lags behind the broader Airlines sector (15.2%). Despite this, easyJet's debt is well managed with operating cash flow covering it by 79.9%, and its short-term assets exceed long-term liabilities by £1.4 billion, indicating sound liquidity management despite short-term liabilities exceeding short-term assets.

- Dive into the specifics of easyJet here with our thorough balance sheet health report.

- Explore easyJet's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Explore the 292 names from our UK Penny Stocks screener here.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EZJ

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives