- United States

- /

- IT

- /

- NYSE:ACN

Accenture (NYSE:ACN) Expands Partnership With OP Financial To Transform Insurance Services

Reviewed by Simply Wall St

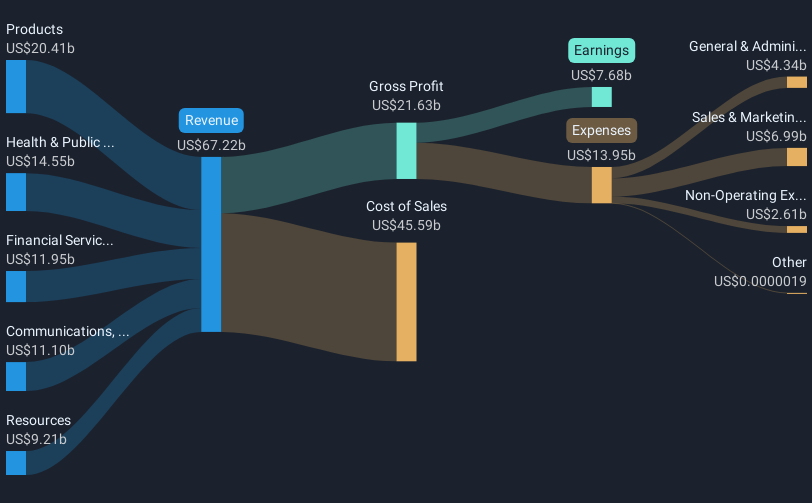

Accenture (NYSE:ACN) recently expanded its partnership with OP Financial Group, enhancing Pohjola Insurance's digital capabilities, further aligning with ongoing tech advancement trends. This collaboration, coupled with Accenture's other initiatives like the AI solution partnership with Dell and NVIDIA, reflects the company's commitment to tech innovation. Over the past month, Accenture's stock rose 14%, experiencing a brighter trajectory compared to a 1% decline in broader markets, as major tech stocks moved higher. This suggests Accenture’s strategic moves may have bolstered its price performance, aligning with overall positive tech sector trends.

Buy, Hold or Sell Accenture? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent expansion of Accenture's partnership with OP Financial Group aligns with the company's core focus on digital innovation, potentially boosting its growth narrative. This collaboration could strengthen Accenture's position within tech advancements, thereby supporting future revenue growth and enhancing earnings forecasts. These strategic moves align with the company's aims to drive transformation through investments in AI and Industry X, which are expected to facilitate long-term performance improvements despite potential challenges like margin pressures and geopolitical uncertainties.

Over a five-year period, Accenture's total shareholder return reached 71.17%, indicating robust performance, especially when viewed against the broader US market's annual growth. However, in the past year, the company's stock underperformed the US market, with the market returning 9.1%, whereas Accenture's return was lower. Yet, Accenture outshined the US IT industry over the same period, with its earnings growth surpassing the industry's average of 3.3%.

With a current share price of US$303.80 and an analyst price target of US$354.83, Accenture is trading at roughly a 14.4% discount to the price target. This discount may reflect confidence in the company's potential to increase its earnings to US$9.9 billion in the coming years through ongoing strategic initiatives and robust shareholder return programs, despite forecast challenges.

Unlock comprehensive insights into our analysis of Accenture stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives