- United Kingdom

- /

- Specialty Stores

- /

- AIM:VIC

3 UK Stocks That May Be Trading Below Their Estimated Value In June 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces downward pressure due to weak trade data from China, investors are closely monitoring market conditions that have impacted sectors tied to global demand. In such a fluctuating environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on undervaluation amidst broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.456 | £10.85 | 40.5% |

| Topps Tiles (LSE:TPT) | £0.352 | £0.61 | 42.2% |

| LSL Property Services (LSE:LSL) | £3.11 | £5.68 | 45.2% |

| Jubilee Metals Group (AIM:JLP) | £0.035 | £0.065 | 45.7% |

| Informa (LSE:INF) | £7.978 | £14.49 | 45% |

| Hostelworld Group (LSE:HSW) | £1.365 | £2.60 | 47.4% |

| Gooch & Housego (AIM:GHH) | £6.06 | £10.55 | 42.6% |

| Franchise Brands (AIM:FRAN) | £1.475 | £2.56 | 42.5% |

| Deliveroo (LSE:ROO) | £1.758 | £3.06 | 42.5% |

| AstraZeneca (LSE:AZN) | £101.44 | £178.07 | 43% |

Let's take a closer look at a couple of our picks from the screened companies.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc operates in franchising and related activities across the United Kingdom, Ireland, North America, and Continental Europe with a market cap of £283.99 million.

Operations: The company's revenue segments include Azura (£0.81 million), Pirtek (£63.91 million), B2C Division (£5.75 million), Filta International (£25.60 million), and Water & Waste Services (£46.05 million).

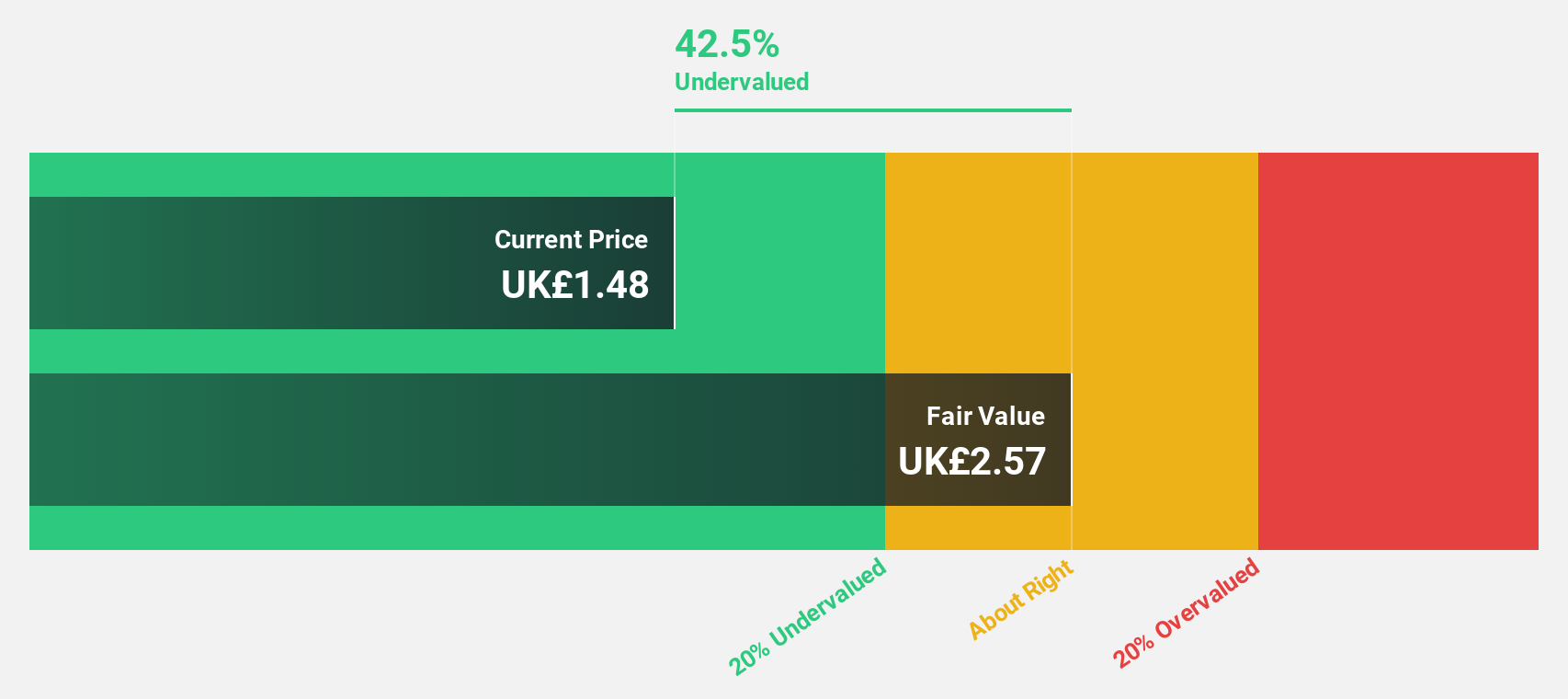

Estimated Discount To Fair Value: 42.5%

Franchise Brands plc appears undervalued, trading at £1.48, significantly below its estimated fair value of £2.56. The company reported substantial earnings growth, with net income rising from £2.99 million to £7.28 million in 2024 and earnings per share increasing markedly year-over-year. Earnings are forecasted to grow at 29.4% annually, outpacing the UK market's 14.3% projection, while revenue is expected to increase by 7.4% per year.

- The growth report we've compiled suggests that Franchise Brands' future prospects could be on the up.

- Navigate through the intricacies of Franchise Brands with our comprehensive financial health report here.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £261.98 million.

Operations: Revenue segments for the company include online retail sales of bathroom products and accessories to both consumer and trade markets in the UK.

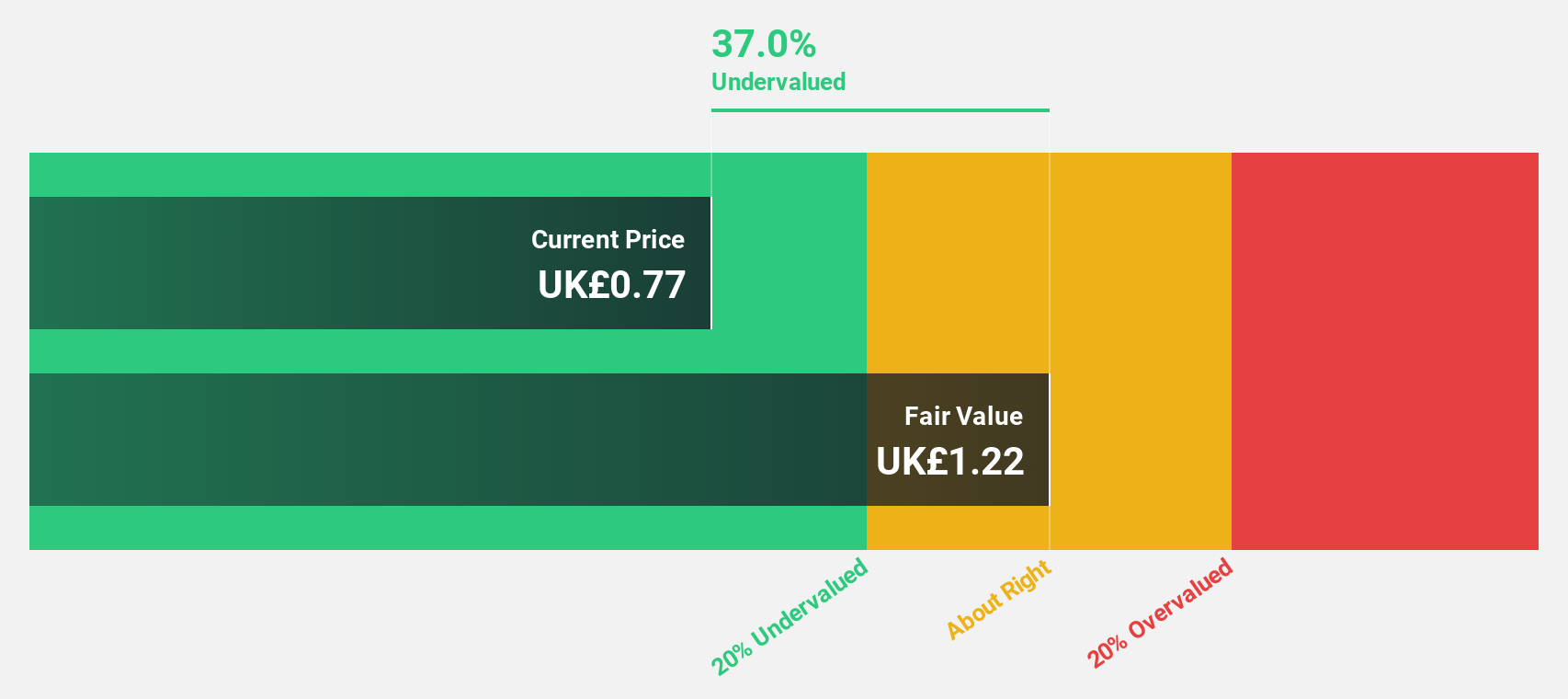

Estimated Discount To Fair Value: 35%

Victorian Plumbing Group is trading at £0.8, significantly below its estimated fair value of £1.23, presenting a potential undervaluation based on cash flows. Despite recent volatility and insider selling, the company forecasts robust earnings growth of 29.7% annually, surpassing market expectations. Recent interim dividend increases and stable revenue growth projections between £308 million to £313 million for 2025 further support its financial health amidst improved earnings per share from continuing operations over the past year.

- Our earnings growth report unveils the potential for significant increases in Victorian Plumbing Group's future results.

- Dive into the specifics of Victorian Plumbing Group here with our thorough financial health report.

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform for the commercial road transportation industry in Europe, with a market cap of £576.89 million.

Operations: The company generates revenue through its Payment Solutions segment, which accounts for €185 million, and its Mobility Solutions segment, contributing €128 million.

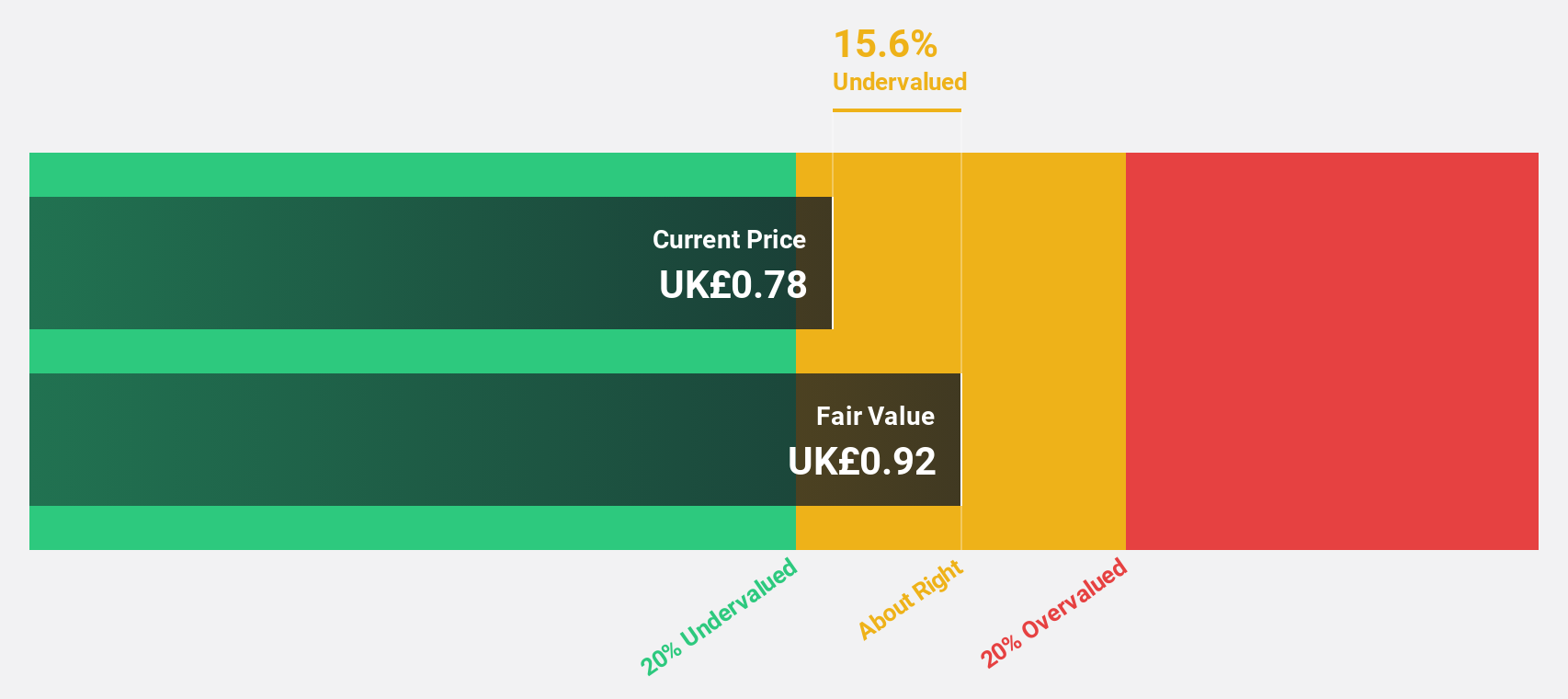

Estimated Discount To Fair Value: 11.2%

W.A.G Payment Solutions is trading at £0.84, slightly below its estimated fair value of £0.94, indicating potential undervaluation based on cash flows. While earnings are forecast to grow significantly at 34.7% annually, surpassing UK market expectations, revenue is expected to increase by 9.51% per year over the next three years. The company's high return on equity forecast and analyst consensus for a stock price rise offer positive notes despite volatile share prices and insufficient interest coverage by earnings.

- Upon reviewing our latest growth report, W.A.G payment solutions' projected financial performance appears quite optimistic.

- Get an in-depth perspective on W.A.G payment solutions' balance sheet by reading our health report here.

Seize The Opportunity

- Click through to start exploring the rest of the 48 Undervalued UK Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VIC

Victorian Plumbing Group

Operates as an online retailer of bathroom products and accessories for B2C and trade customers in the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives