- United Kingdom

- /

- Beverage

- /

- AIM:NICL

3 UK Stocks Estimated To Be 29.8% To 42.4% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market, particularly the FTSE 100 index, has recently faced challenges due to weak trade data from China, highlighting concerns about global economic recovery. Amid this uncertain environment, identifying undervalued stocks becomes crucial for investors seeking potential opportunities; these are stocks trading below their intrinsic value despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aptitude Software Group (LSE:APTD) | £2.78 | £5.13 | 45.8% |

| Informa (LSE:INF) | £7.87 | £15.23 | 48.3% |

| Victrex (LSE:VCT) | £7.82 | £15.42 | 49.3% |

| SDI Group (AIM:SDI) | £0.72 | £1.37 | 47.3% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 45.4% |

| Franchise Brands (AIM:FRAN) | £1.44 | £2.50 | 42.4% |

| Huddled Group (AIM:HUD) | £0.0305 | £0.06 | 49.1% |

| Vistry Group (LSE:VTY) | £5.902 | £11.29 | 47.7% |

| Entain (LSE:ENT) | £7.316 | £13.66 | 46.4% |

| Burberry Group (LSE:BRBY) | £9.618 | £16.80 | 42.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc operates in franchising and related activities across the United Kingdom, Ireland, North America, and Continental Europe with a market capitalization of £277.25 million.

Operations: The company's revenue segments consist of Azura (£0.81 million), Pirtek (£63.91 million), B2C Division (£5.75 million), Filta International (£25.60 million), and Water & Waste Services (£46.05 million).

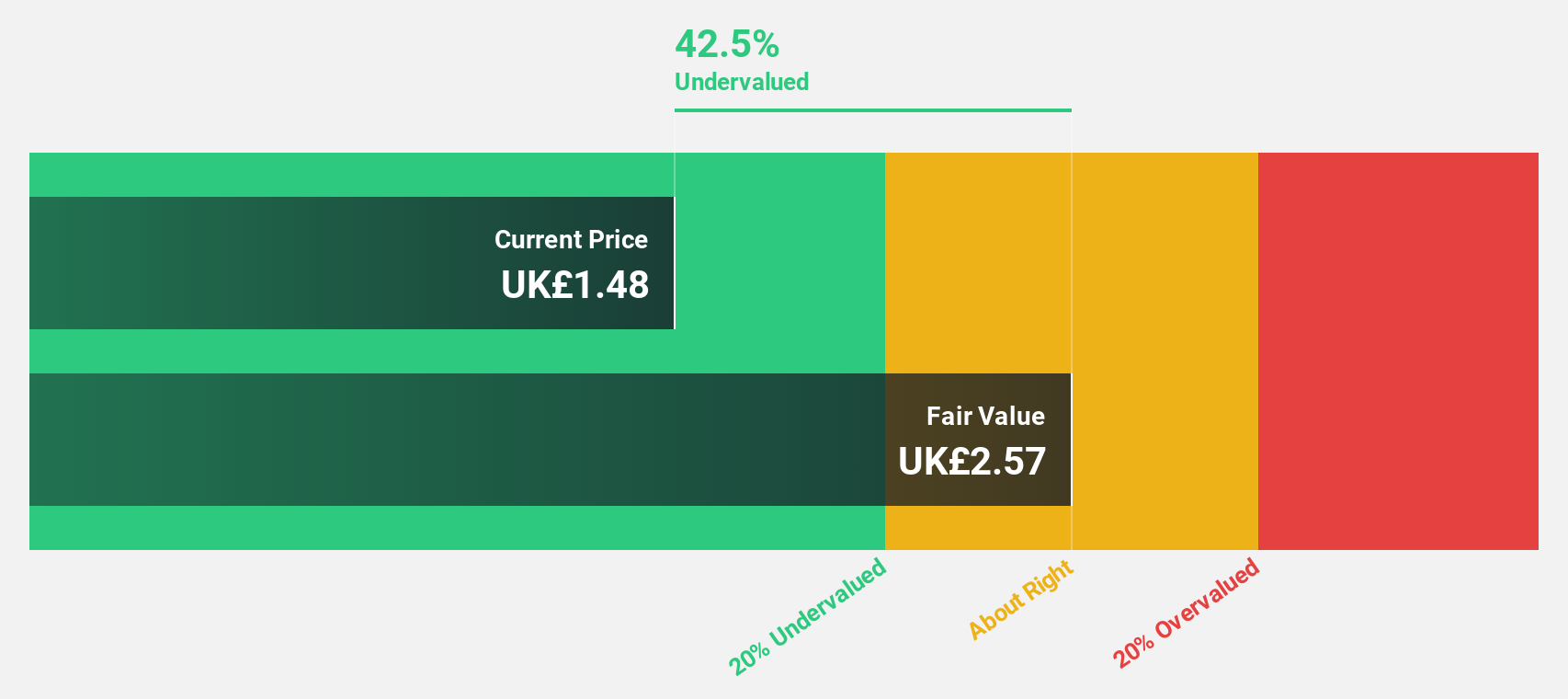

Estimated Discount To Fair Value: 42.4%

Franchise Brands appears undervalued, trading at £1.44, significantly below its estimated fair value of £2.5. Recent earnings reports show a robust net income increase to £7.28 million from the previous year's £2.99 million, with earnings per share also more than doubling. While revenue growth is moderate at 7.4% annually, profit growth outpaces the UK market with forecasts of 29.4% per year over the next three years, highlighting strong cash flow potential despite slower revenue expansion relative to profit increases.

- According our earnings growth report, there's an indication that Franchise Brands might be ready to expand.

- Dive into the specifics of Franchise Brands here with our thorough financial health report.

Nichols (AIM:NICL)

Overview: Nichols plc, with a market cap of £465.76 million, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally including regions such as the Middle East and Africa.

Operations: The company's revenue is primarily derived from its Packaged segment, which accounts for £132.82 million, and its Out of Home segment, contributing £39.99 million.

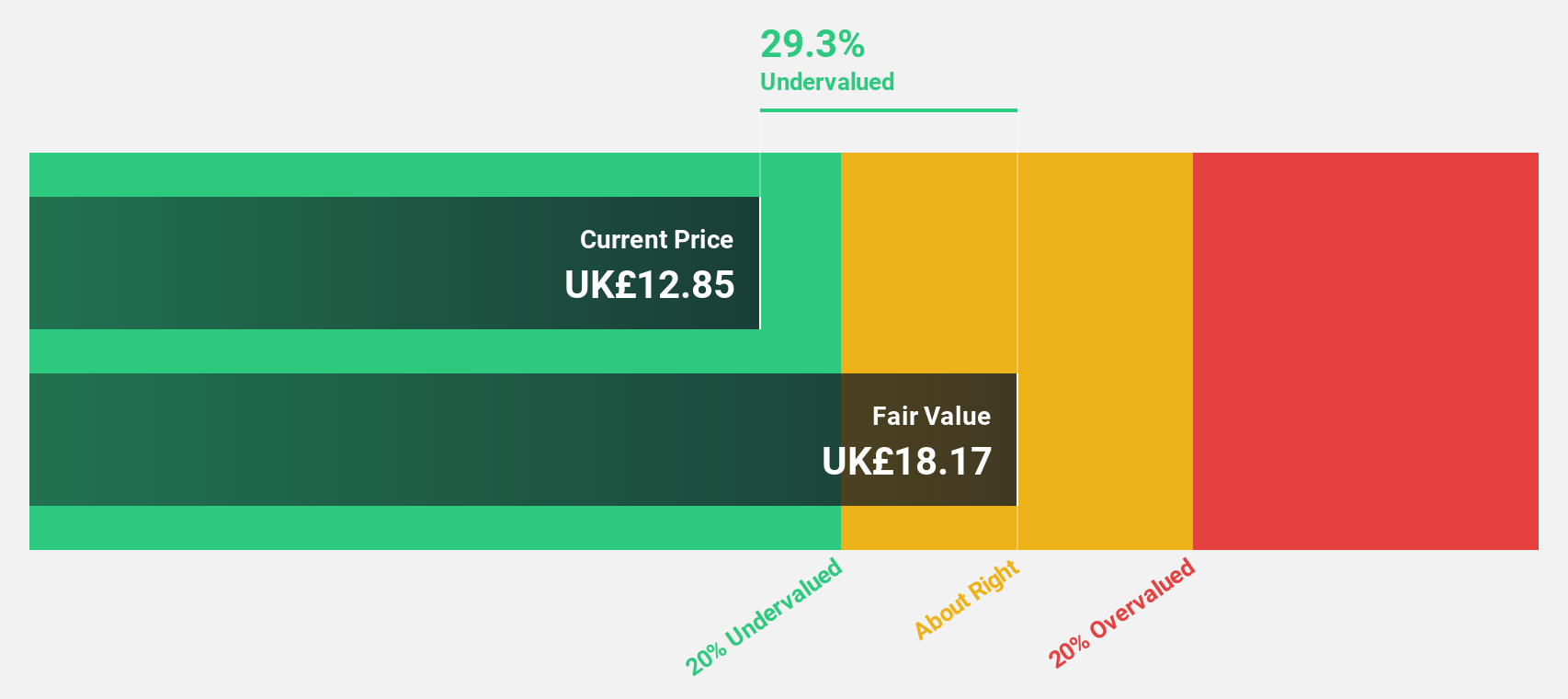

Estimated Discount To Fair Value: 29.8%

Nichols is trading at £12.75, well below its estimated fair value of £18.17, indicating potential undervaluation based on cash flows. Despite a modest revenue increase to £39.3 million in Q1 2025, Nichols' earnings are expected to grow faster than the UK market at 14.8% annually, supported by strategic shifts and the strength of its Vimto brand. However, challenges include an unstable dividend history and recent executive changes affecting leadership stability.

- The analysis detailed in our Nichols growth report hints at robust future financial performance.

- Navigate through the intricacies of Nichols with our comprehensive financial health report here.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £256.59 million.

Operations: Victorian Plumbing Group plc generates revenue by selling bathroom products and accessories online to both consumer and trade markets within the UK.

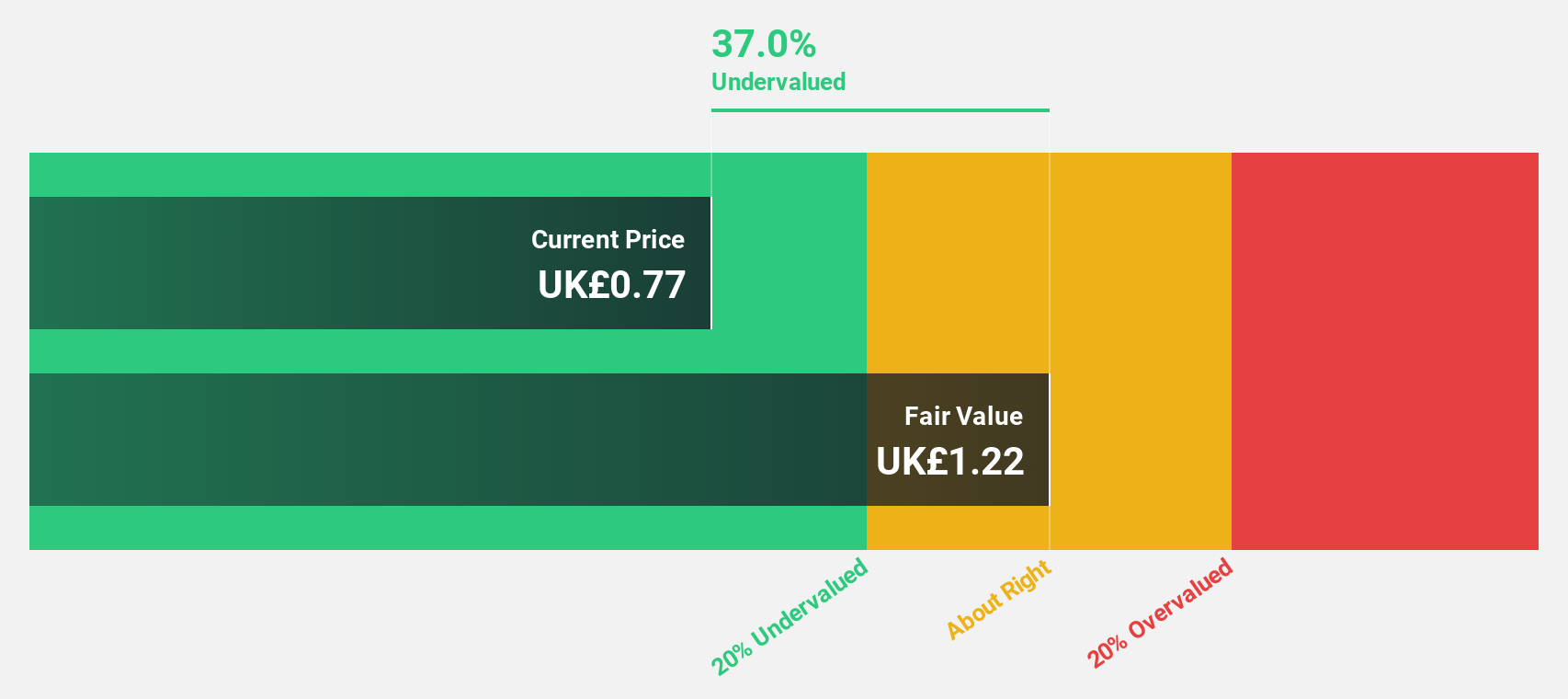

Estimated Discount To Fair Value: 35.4%

Victorian Plumbing Group is trading at £0.78, below its estimated fair value of £1.21, highlighting potential undervaluation based on cash flows. Recent earnings showed a sales increase to £152.7 million for H1 2025, though net income slightly decreased to £4.1 million from the previous year. Despite this, earnings are forecast to grow significantly at 29.9% annually over the next three years, outpacing market averages and supported by strong future revenue growth expectations and high return on equity forecasts.

- In light of our recent growth report, it seems possible that Victorian Plumbing Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Victorian Plumbing Group.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 51 Undervalued UK Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichols might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NICL

Nichols

Engages in supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries in the United Kingdom, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives