- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

3 UK Penny Stocks With Over £200M Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating markets, identifying stocks with strong financial foundations becomes crucial for investors seeking stability and potential growth. Despite being an older term, penny stocks continue to attract interest as they often represent smaller or newer companies that can offer significant opportunities when backed by solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.30 | £333.28M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.815 | £12.3M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.466 | £177.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.48 | £71.47M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £179.44M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market cap of approximately $392.40 million.

Operations: The company's revenue is primarily generated from Egypt (EGP 5614.74 million), with additional contributions from Jordan (EGP 1005.21 million), Nigeria (EGP 101.12 million), and Saudi Arabia (EGP 39.45 million).

Market Cap: $392.4M

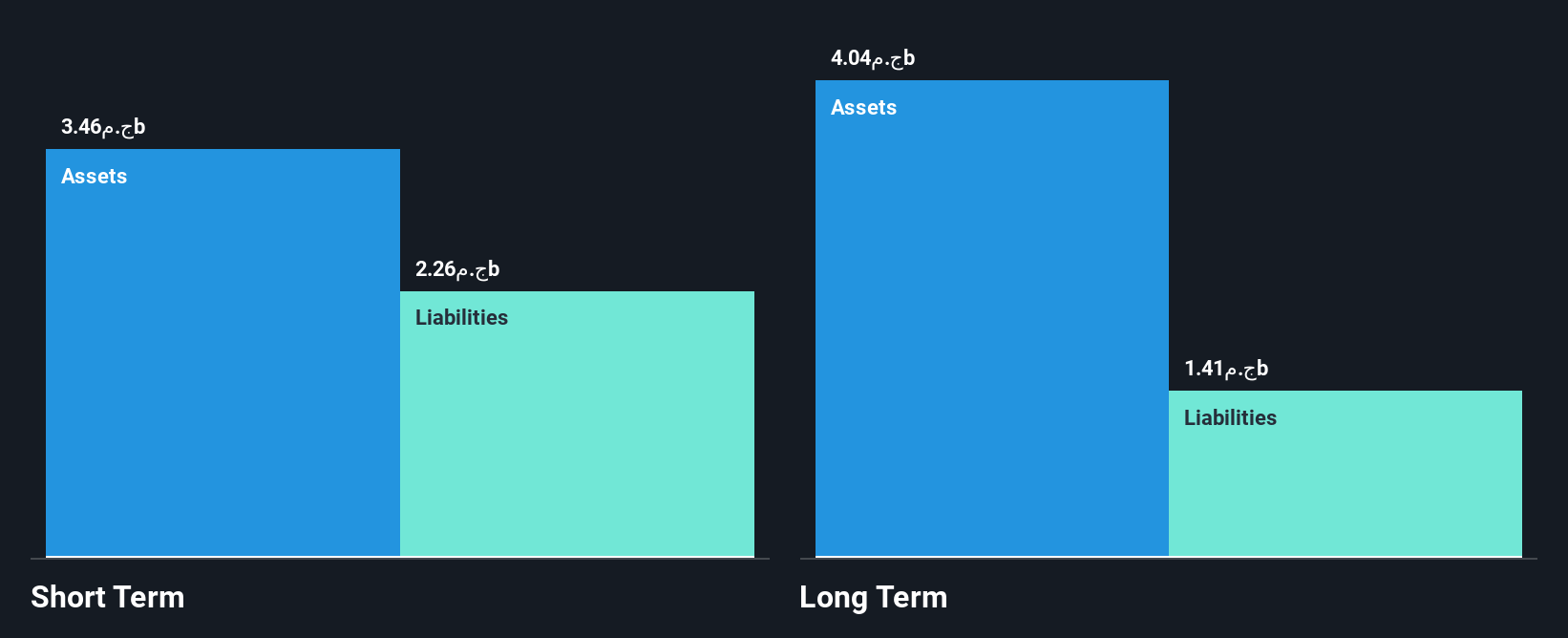

Integrated Diagnostics Holdings plc is a consumer healthcare company with a market cap of approximately $392.40 million, primarily generating revenue from Egypt and other regions like Jordan and Nigeria. The company's earnings have shown significant growth, rising by 34.3% over the past year, surpassing industry averages. It trades at 75.4% below its estimated fair value, suggesting potential undervaluation in the market. Despite high share price volatility recently, IDHC maintains strong financial health with cash exceeding total debt and robust operating cash flow coverage of debt (842.3%). However, its dividend track record remains unstable despite stable profit margins.

- Click to explore a detailed breakdown of our findings in Integrated Diagnostics Holdings' financial health report.

- Review our growth performance report to gain insights into Integrated Diagnostics Holdings' future.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, operating in the United Kingdom and Isle of Man, offers software and services to clients and UK financial advisers, with a market cap of £1.17 billion.

Operations: IntegraFin Holdings does not report specific revenue segments.

Market Cap: £1.17B

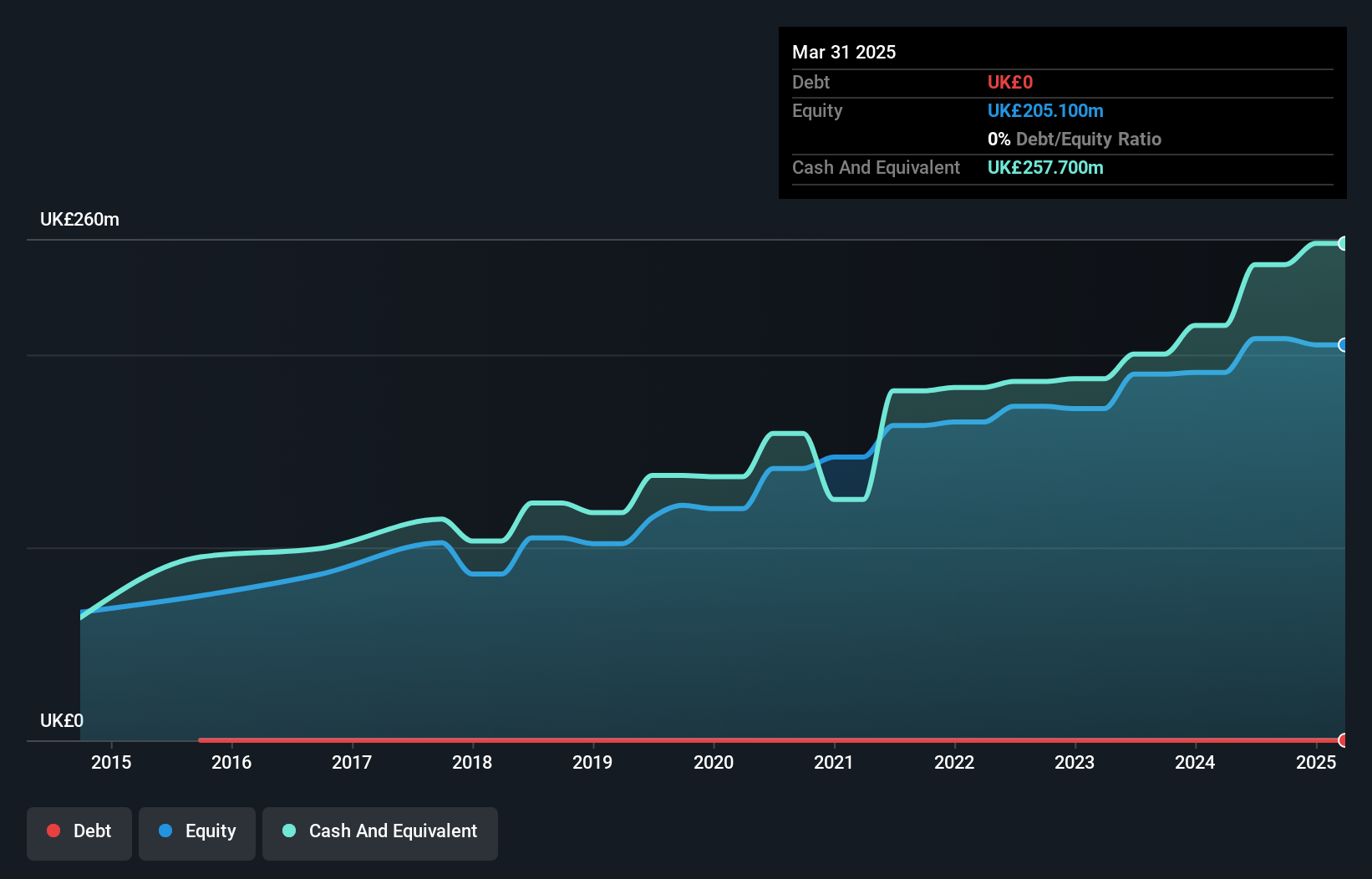

IntegraFin Holdings plc, with a market cap of £1.17 billion, demonstrates financial stability with short-term assets exceeding both short and long-term liabilities, and no debt on its balance sheet. Despite experiencing a negative earnings growth of -6.5% over the past year, it maintains high-quality earnings and a robust return on equity at 23.8%. Recent financial results show sales growth to £156.8 million for the year ending September 2025, although net income slightly declined to £51.3 million compared to the previous year. The board's experience and stable weekly volatility add resilience amidst an unstable dividend track record.

- Click here and access our complete financial health analysis report to understand the dynamics of IntegraFin Holdings.

- Learn about IntegraFin Holdings' future growth trajectory here.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Luceco plc manufactures and distributes wiring accessories, LED lighting, and portable power products across various regions including the United Kingdom, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £204.35 million.

Operations: The company's revenue is derived from three main segments: £78.8 million from LED Lighting, £58.8 million from Portable Power, and £121 million from Wiring Accessories.

Market Cap: £204.35M

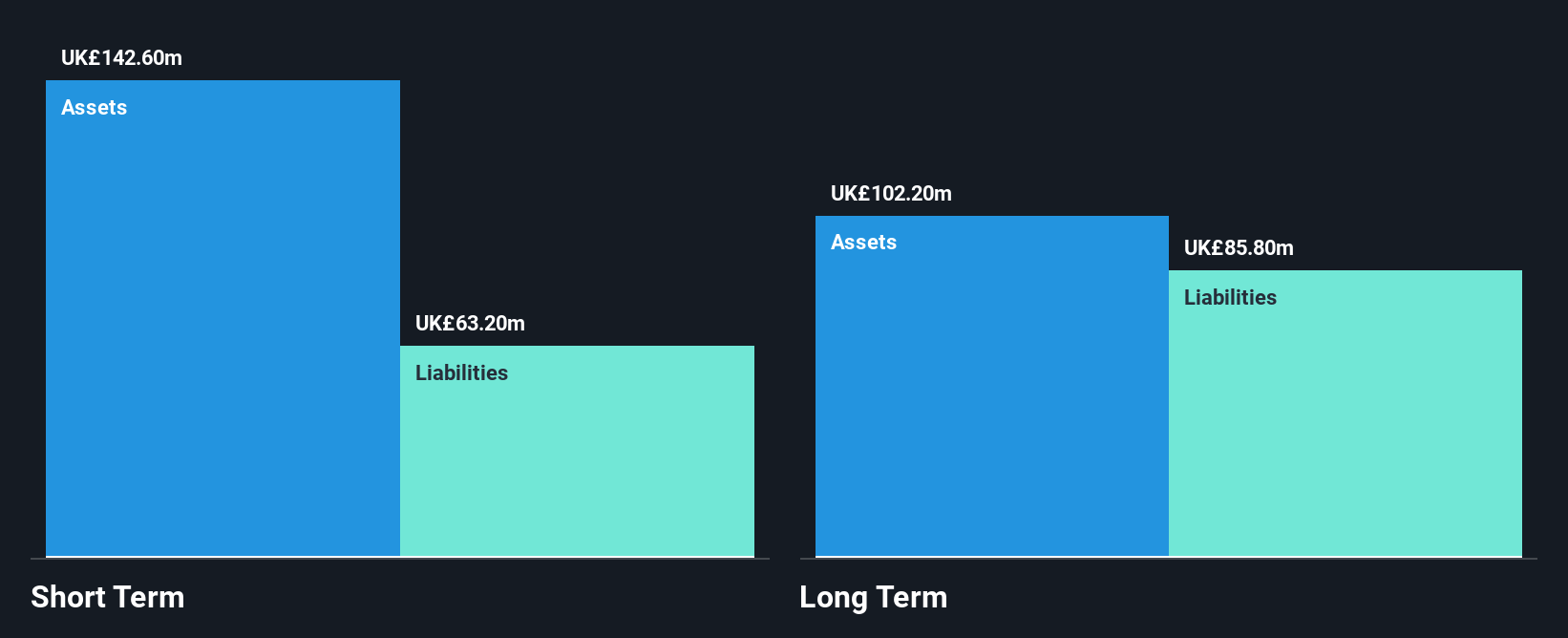

Luceco plc, with a market cap of £204.35 million, has experienced financial challenges, including declining earnings over the past five years and negative growth in the last year. Despite this, its short-term assets surpass both short and long-term liabilities, indicating solid liquidity. The company trades at a value below its estimated fair value and analysts expect potential price appreciation. However, Luceco faces high debt levels with a net debt to equity ratio of 73.1%. Recent board changes include the appointment of Martyn Coffey as Non-Executive Director, adding significant industry expertise to the company's governance structure.

- Jump into the full analysis health report here for a deeper understanding of Luceco.

- Evaluate Luceco's prospects by accessing our earnings growth report.

Key Takeaways

- Unlock our comprehensive list of 306 UK Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IHP

IntegraFin Holdings

Provides software and services for clients and UK financial advisers in the United Kingdom and Isle of Man.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion