- United Kingdom

- /

- Capital Markets

- /

- LSE:AJB

3 UK Penny Stocks With Market Caps Under £2B

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced some turbulence, with indices like the FTSE 100 and FTSE 250 closing lower amid concerns over weak trade data from China. In such fluctuating market conditions, investors often seek opportunities that combine affordability with growth potential. Penny stocks, despite their somewhat outdated label, continue to attract interest for their capacity to offer value through smaller or newer companies that demonstrate robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £3.965 | £445.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.55 | £367.58M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.44 | £183.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.912 | £1.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.775 | £65.21M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.345 | £418.91M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.08 | £172.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.24 | £69.96M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bango (AIM:BGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bango PLC, with a market cap of £71.84 million, develops and markets technology that facilitates the marketing and sale of products and services to mobile phone users.

Operations: The company's revenue is derived entirely from its Internet Software & Services segment, totaling $53.37 million.

Market Cap: £71.84M

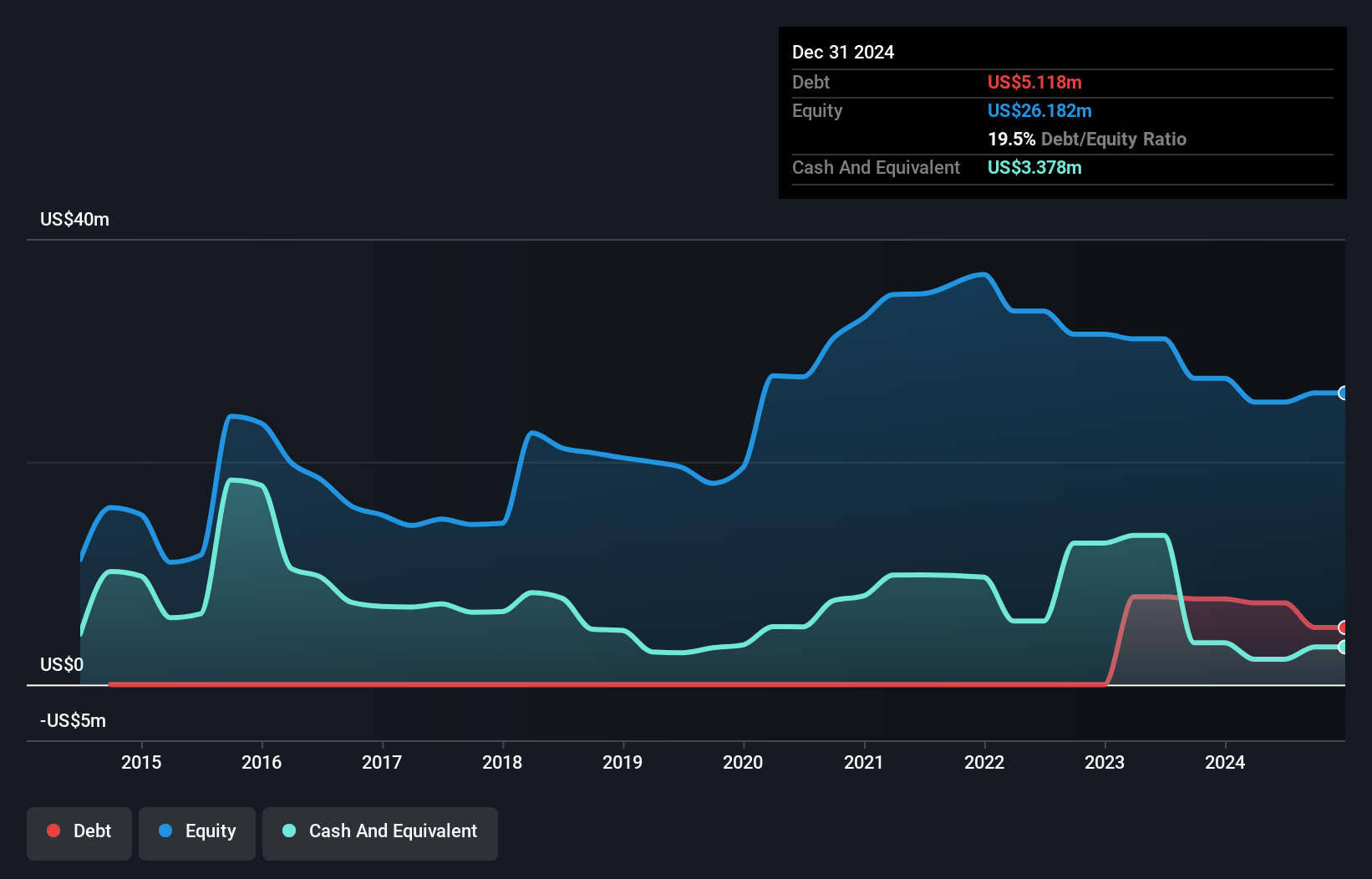

Bango PLC, with a market cap of £71.84 million and revenue of US$53.37 million, remains unprofitable but shows potential in the penny stock landscape through strategic partnerships and financial maneuvers. Recent collaborations with KT in Korea and Optimum in the US highlight Bango's expanding footprint into new markets using its Digital Vending Machine technology. Despite a volatile share price, Bango has secured additional funding through a new loan agreement and revolving credit facility to bolster its balance sheet. While losses have increased over five years, forecasts suggest significant earnings growth ahead, supported by an experienced management team.

- Jump into the full analysis health report here for a deeper understanding of Bango.

- Gain insights into Bango's outlook and expected performance with our report on the company's earnings estimates.

AJ Bell (LSE:AJB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AJ Bell plc operates investment platforms in the United Kingdom and has a market cap of £1.99 billion.

Operations: The company's revenue is primarily derived from its Investment Services segment, totaling £290.47 million.

Market Cap: £1.99B

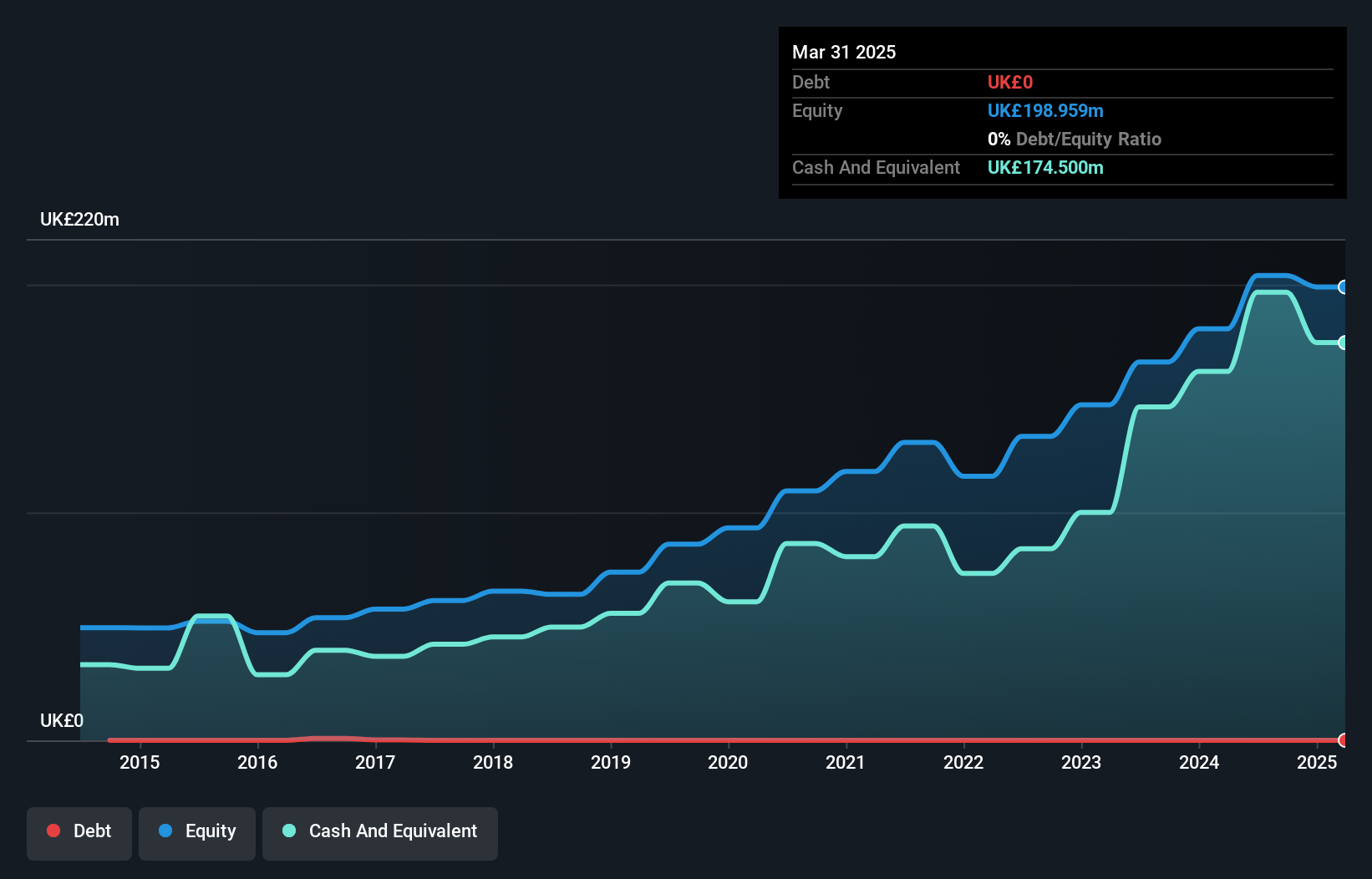

AJ Bell plc, with a market cap of £1.99 billion, stands out in the investment platform sector due to its solid financial performance and strategic initiatives. The company reported a net income of £51.16 million for H1 2025, reflecting steady growth from the prior year. AJ Bell's financial health is robust, with no debt and short-term assets comfortably covering liabilities. Recent insider selling might raise concerns; however, the company continues to reward shareholders through increased dividends and share buybacks totaling £30.21 million. Despite some volatility in profit margins, AJ Bell's return on equity remains outstanding at 45%.

- Get an in-depth perspective on AJ Bell's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into AJ Bell's future.

Playtech (LSE:PTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Playtech plc is a technology company providing gambling software, services, content, and platform technologies across various regions including Italy, Mexico, the UK, Europe, Latin America, and internationally with a market cap of approximately £999.41 million.

Operations: The company's revenue segments include Gaming B2B at €754.3 million and B2C operations, comprising HAPPYBET at €18.9 million and Sun Bingo along with other B2C activities at €78.9 million.

Market Cap: £999.41M

Playtech plc, with a market cap of approximately £999.41 million, has faced challenges as it remains unprofitable with increasing losses over the past five years. However, the company's financial structure shows improvement; its debt-to-equity ratio has significantly reduced from 76.6% to 24.7%, and short-term assets exceed liabilities by a substantial margin (€1.6 billion versus €963.4 million). Recent strategic moves include redeeming €150 million in senior secured notes using proceeds from the Snaitech sale and distributing a special dividend between €1.7 billion and €1.8 billion, reflecting efforts to enhance shareholder value amidst volatility concerns.

- Click to explore a detailed breakdown of our findings in Playtech's financial health report.

- Examine Playtech's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Click here to access our complete index of 409 UK Penny Stocks.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AJB

AJ Bell

Through its subsidiaries, operates investment platforms in the United Kingdom.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives