- United Kingdom

- /

- Oil and Gas

- /

- AIM:AET

3 UK Penny Stocks With Market Caps Larger Than £100M

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China, highlighting the interconnectedness of global markets. Despite such challenges, investors continue to seek opportunities that align with current market conditions. Penny stocks, while often associated with speculative trading, can still present intriguing possibilities when supported by robust financial health and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.225 | £303.86M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.06 | £315.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.725 | £133.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.23 | £196.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.80 | £11.01M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.15 | £66.43M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.19 | £826.86M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Afentra plc, with a market cap of £116.24 million, operates as an upstream oil and gas company primarily focused on Africa.

Operations: The company generates revenue of $180.86 million from its oil and gas exploration and production activities.

Market Cap: £116.24M

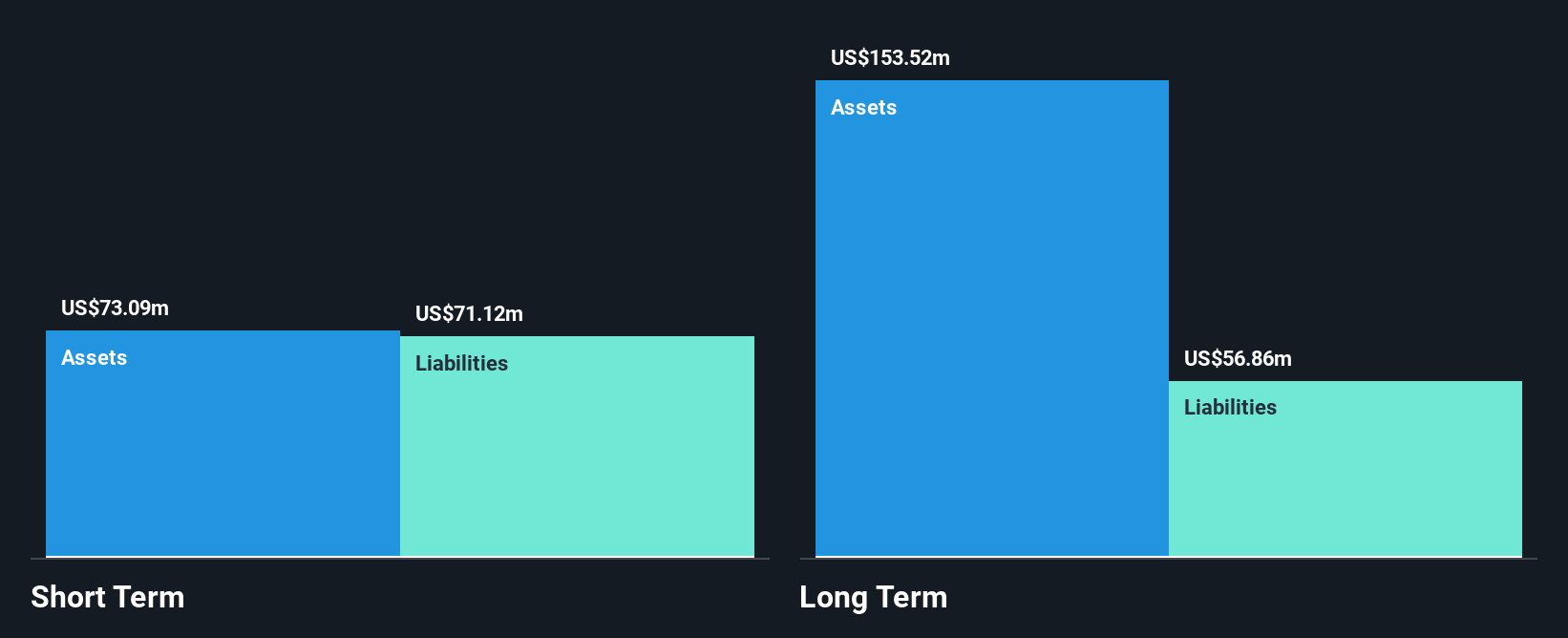

Afentra plc, with a market cap of £116.24 million, has shown significant financial growth, reporting US$180.86 million in revenue for 2024 and turning profitable with a net income of US$52.35 million from a prior loss. The company maintains strong financial health with more cash than debt and operating cash flow covering its debt well. Its return on equity is outstanding at 53.1%, indicating efficient management of shareholder funds. Despite an increase in the debt-to-equity ratio over five years, Afentra trades at good value compared to peers and remains below analyst price targets by 75.7%.

- Get an in-depth perspective on Afentra's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Afentra's future.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market capitalization of £207.35 million.

Operations: The company generates revenue from three main segments: Diversified Services ($10.69 million), Government Relations ($102.46 million), and Public Affairs Consulting ($36.41 million).

Market Cap: £207.35M

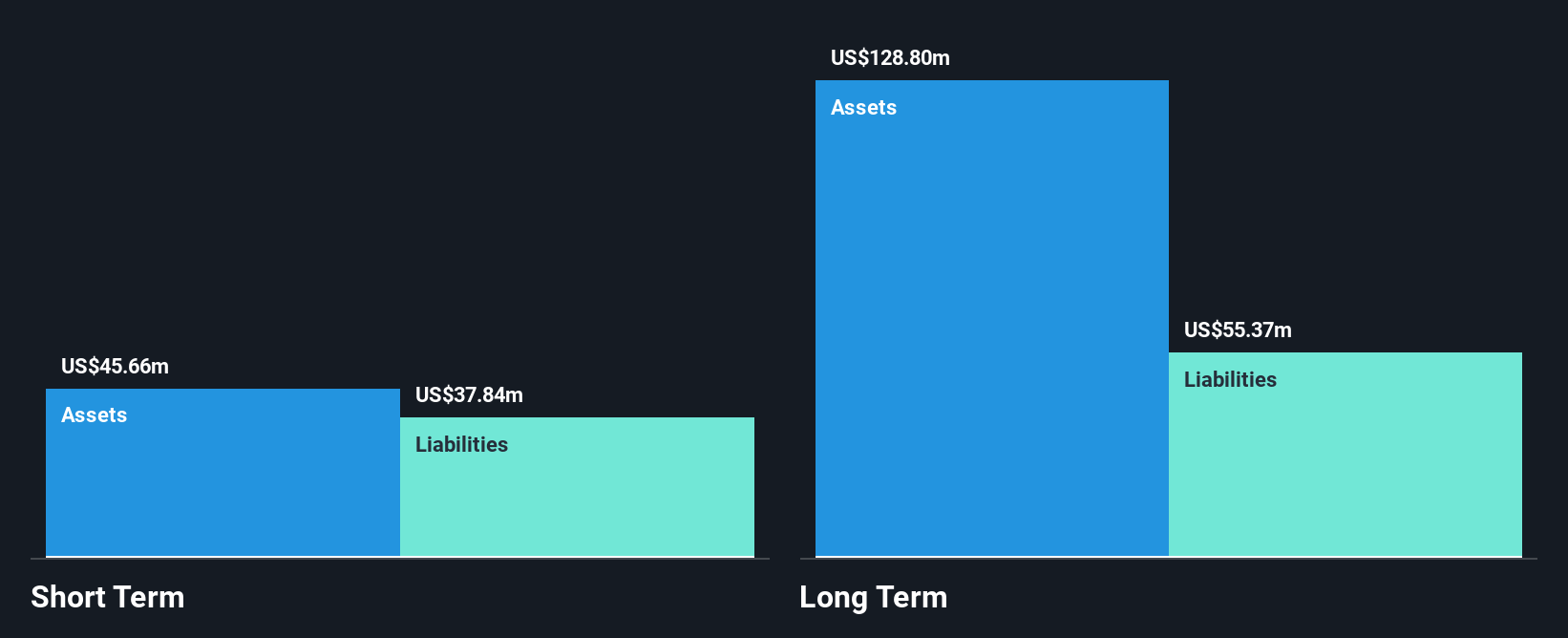

Public Policy Holding Company, Inc., with a market cap of £207.35 million, operates across three revenue-generating segments: Diversified Services (US$10.69 million), Government Relations (US$102.46 million), and Public Affairs Consulting (US$36.41 million). Despite being unprofitable, the company maintains a satisfactory net debt to equity ratio of 21.5% and has more than three years' cash runway due to positive free cash flow growth at 41% annually. Trading significantly below its estimated fair value by 71.7%, analysts agree on potential price appreciation of 50.9%. However, its board and management team are relatively inexperienced, impacting strategic stability.

- Click here to discover the nuances of Public Policy Holding Company with our detailed analytical financial health report.

- Explore Public Policy Holding Company's analyst forecasts in our growth report.

Playtech (LSE:PTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across various regions including Italy, Mexico, the UK, Europe, Latin America, and internationally with a market cap of £1.17 billion.

Operations: The company generates revenue from its Gaming B2B segment (€754.3 million) and B2C operations, including HAPPYBET (€18.9 million) and Sun Bingo along with other B2C activities (€78.9 million).

Market Cap: £1.17B

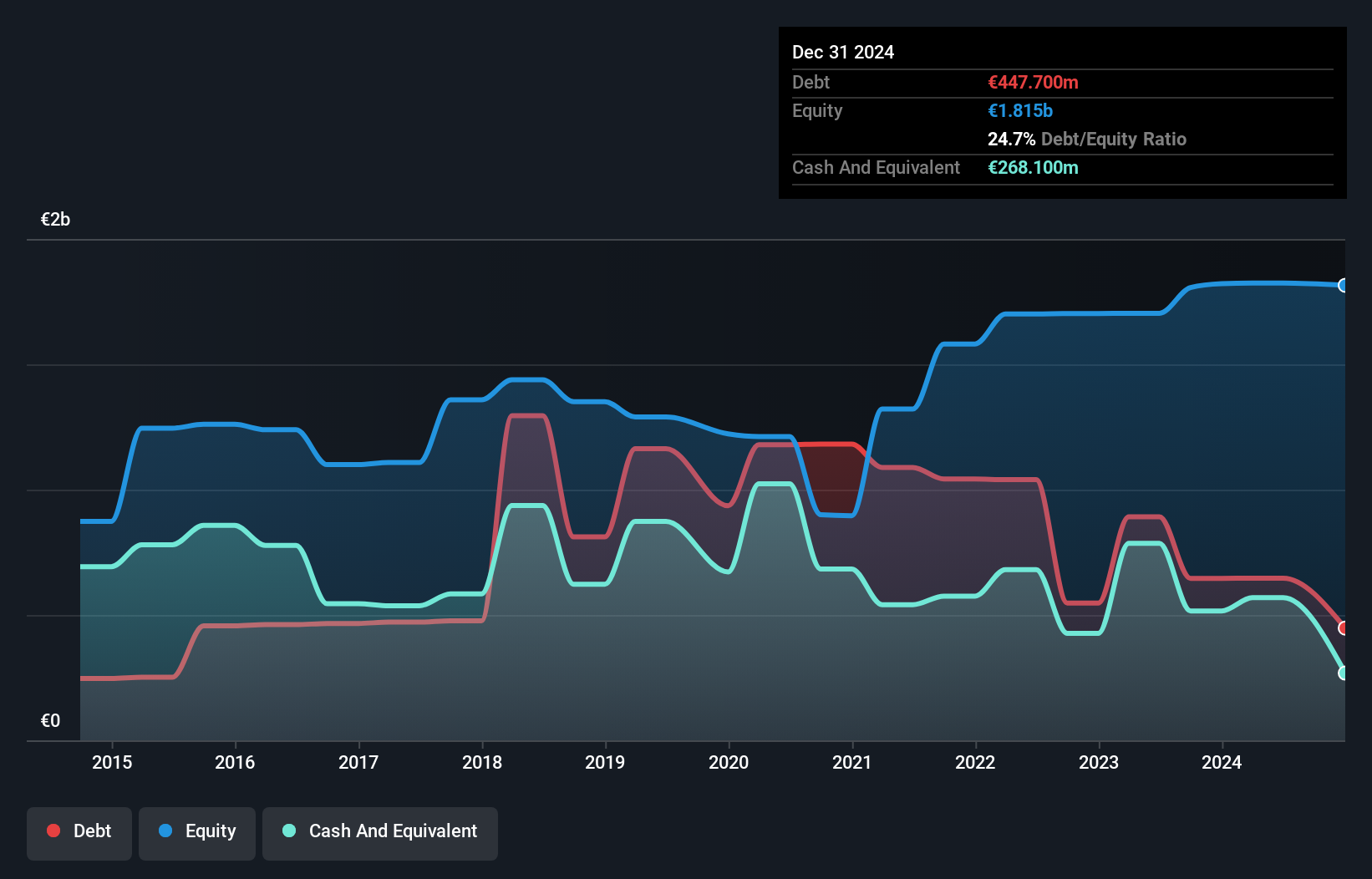

Playtech plc, with a market cap of £1.17 billion, operates in gambling software and services across various regions. Despite being unprofitable and experiencing increased losses over five years, its short-term assets (€1.6 billion) exceed both short-term (€963.4 million) and long-term liabilities (€519.4 million), indicating financial stability amidst volatility. The company is reducing debt levels effectively, redeeming €150 million senior secured notes using proceeds from the Snaitech sale. Recent board changes include John Gleasure as Chair, succeeding Brian Mattingley. Playtech's special dividend reflects shareholder returns strategy amid ongoing restructuring efforts and anticipated earnings growth of 61% annually.

- Jump into the full analysis health report here for a deeper understanding of Playtech.

- Evaluate Playtech's prospects by accessing our earnings growth report.

Seize The Opportunity

- Embark on your investment journey to our 293 UK Penny Stocks selection here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AET

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives