- United Kingdom

- /

- Machinery

- /

- AIM:LSC

3 UK Dividend Stocks To Consider With Up To 5.9% Yield

Reviewed by Simply Wall St

The UK stock market has recently experienced volatility, with the FTSE 100 index slipping due to weak trade data from China, signaling ongoing challenges for companies with exposure to global markets. In such an environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking reliable returns amid broader market uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.06% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.09% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.93% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.05% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.42% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.32% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.41% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.76% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.78% | ★★★★★★ |

Click here to see the full list of 51 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

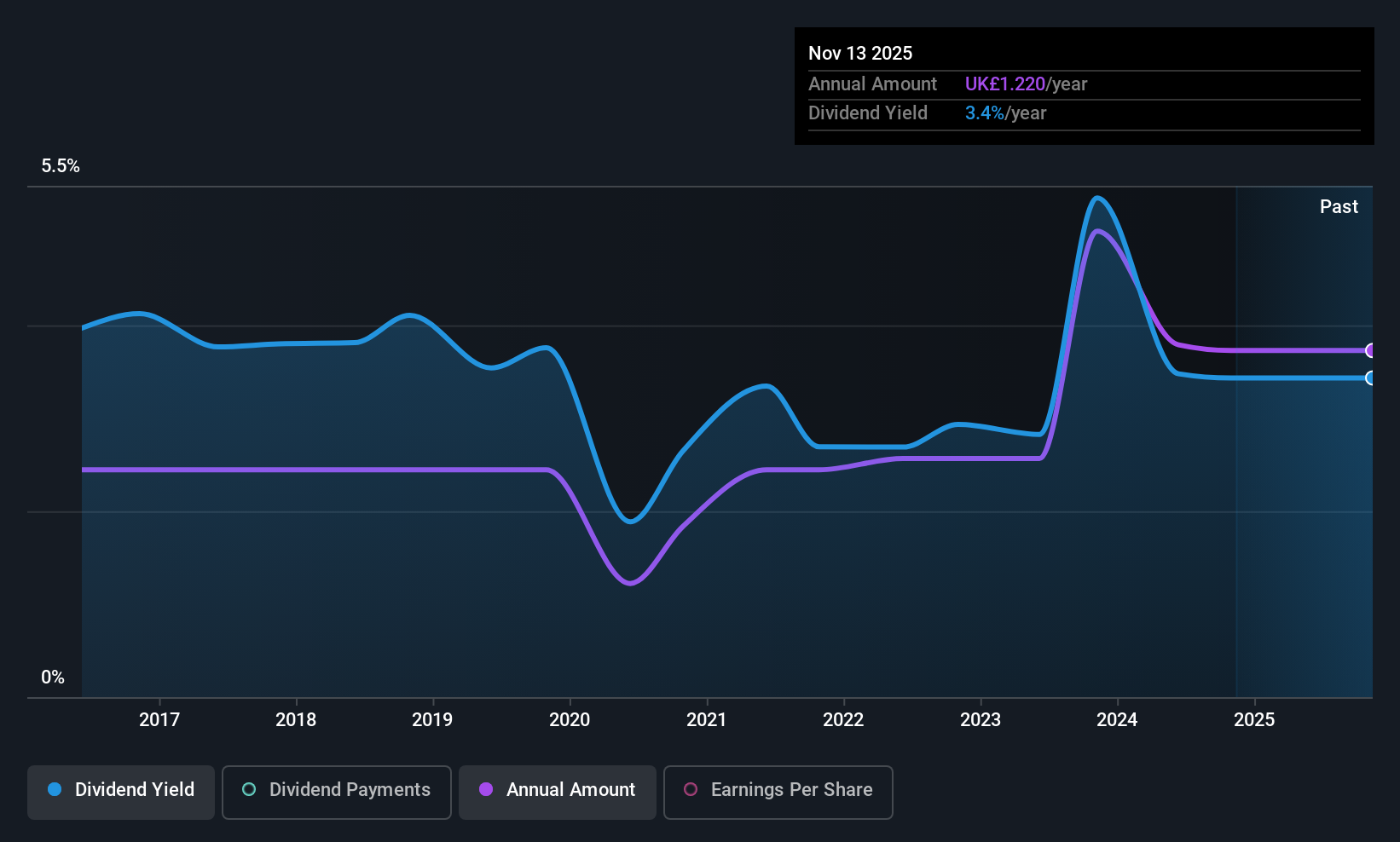

London Security (AIM:LSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries with a market cap of £422.97 million.

Operations: London Security plc generates revenue of £226.71 million from the provision and maintenance of fire protection and security equipment across its operational regions.

Dividend Yield: 3.5%

London Security's dividend payments have been volatile over the past decade, with a history of unreliability. Despite this, dividends are well covered by earnings (payout ratio: 24.8%) and cash flows (cash payout ratio: 74.4%). While the dividend yield of 3.54% is below top-tier UK payers, its price-to-earnings ratio of 20.4x suggests reasonable valuation relative to industry peers. Recent earnings showed sales growth to £116.92 million, though net income slightly declined to £8.69 million.

- Click here to discover the nuances of London Security with our detailed analytical dividend report.

- According our valuation report, there's an indication that London Security's share price might be on the expensive side.

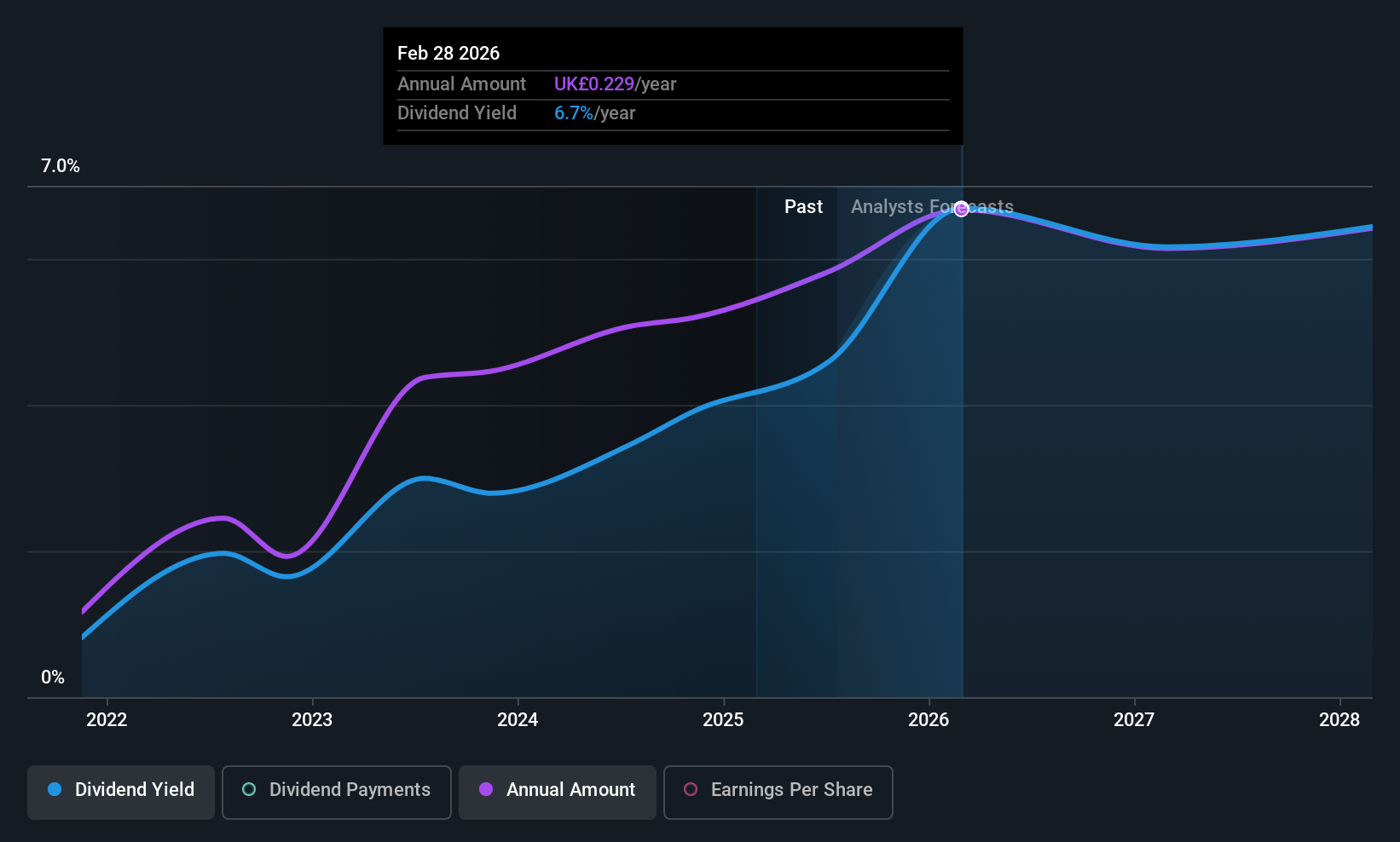

Bytes Technology Group (LSE:BYIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bytes Technology Group plc provides software, security, AI, and cloud services across the UK, Europe, and globally with a market cap of £875.07 million.

Operations: Bytes Technology Group plc generates revenue of £219.74 million from its IT Solutions Provider segment.

Dividend Yield: 5.5%

Bytes Technology Group's dividend yield of 5.49% ranks in the top 25% of UK dividend payers, supported by a reasonable payout ratio of 45.6%. Although dividends have grown, they remain unstable with only four years of payments. Recent interim dividend increased to 3.2 pence per share, totaling £7.6 million due in November 2025. Despite earnings growth slowing to an annual rate of 5.69%, the company trades at a good value and has initiated a share buyback program worth £5 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Bytes Technology Group.

- Our expertly prepared valuation report Bytes Technology Group implies its share price may be lower than expected.

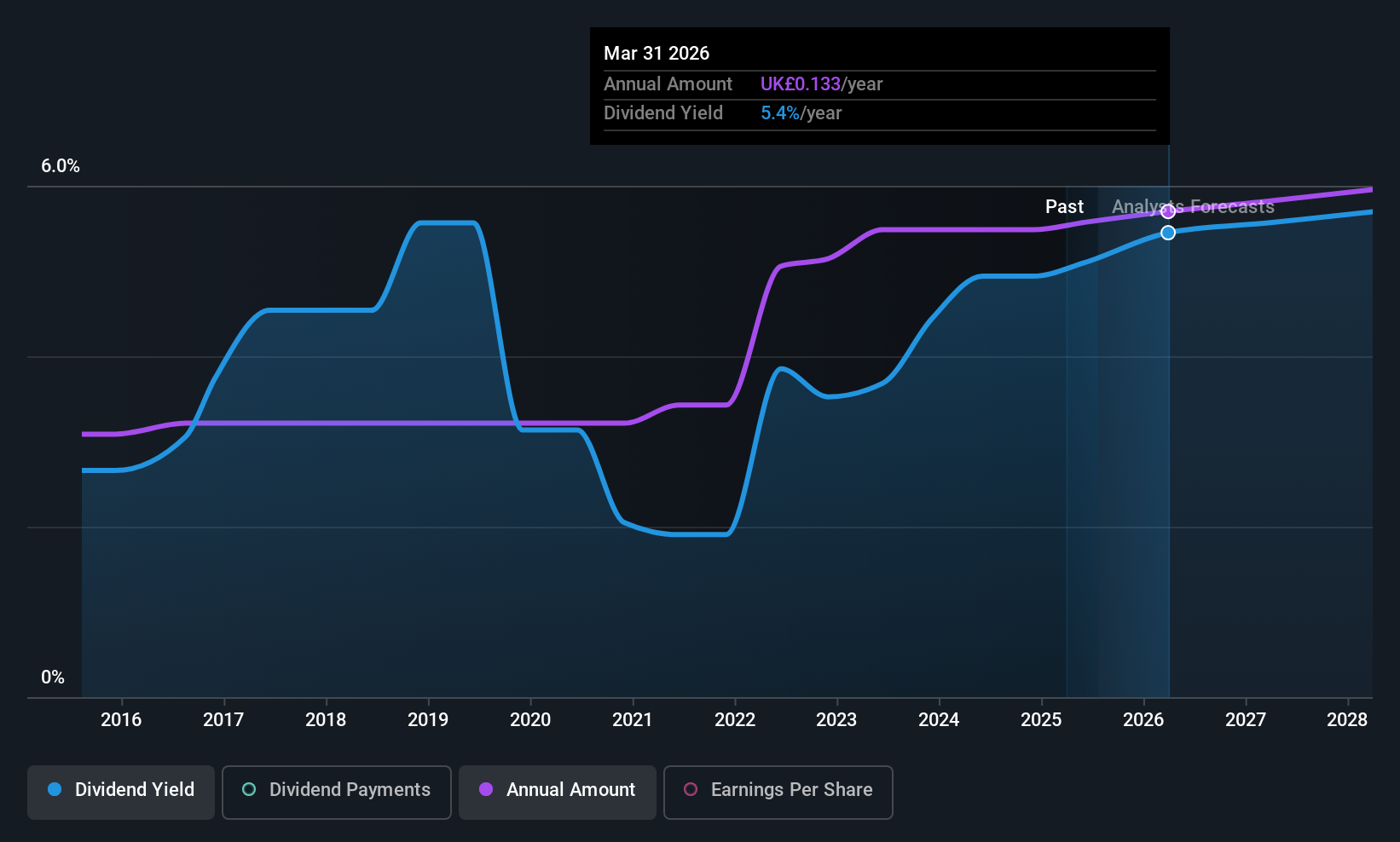

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Pets at Home Group Plc operates as an omnichannel retailer of pet food, related products, and accessories in the United Kingdom, with a market cap of £984.42 million.

Operations: Pets at Home Group Plc generates revenue from its Retail segment, amounting to £1.31 billion, and its Vet Group segment, contributing £175.30 million.

Dividend Yield: 5.9%

Pets at Home Group offers a high and stable dividend yield of 5.93%, ranking in the top 25% of UK dividend payers, with dividends well-covered by both earnings (68.3% payout ratio) and cash flows (34.5% cash payout ratio). Over the past decade, dividends have grown consistently without volatility. Despite recent executive changes, including CEO departure, the company maintains a favorable price-to-earnings ratio of 11.2x compared to the UK market average of 16.6x.

- Delve into the full analysis dividend report here for a deeper understanding of Pets at Home Group.

- Our valuation report here indicates Pets at Home Group may be overvalued.

Key Takeaways

- Embark on your investment journey to our 51 Top UK Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LSC

London Security

An investment holding company, manufactures, sells, and rents fire protection equipment in the United Kingdom, Belgium, the Netherlands, Austria, France, Germany, Denmark, and Luxembourg.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives