- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Stocks Estimated To Be Trading At A Discount Of Up To 49.2%

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of global trade tensions and fluctuating economic policies, investors are increasingly focused on identifying opportunities that may arise from these conditions. In this environment, stocks perceived as undervalued can offer potential for growth, particularly when they demonstrate resilience against external pressures such as tariffs and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$43.21 | CA$86.25 | 49.9% |

| TerraVest Industries (TSX:TVK) | CA$161.32 | CA$314.45 | 48.7% |

| Teck Resources (TSX:TECK.B) | CA$51.50 | CA$89.62 | 42.5% |

| Propel Holdings (TSX:PRL) | CA$36.12 | CA$67.46 | 46.5% |

| OceanaGold (TSX:OGC) | CA$19.20 | CA$37.81 | 49.2% |

| Magna Mining (TSXV:NICU) | CA$1.79 | CA$3.41 | 47.6% |

| Lithium Royalty (TSX:LIRC) | CA$5.68 | CA$8.81 | 35.5% |

| K92 Mining (TSX:KNT) | CA$14.83 | CA$22.04 | 32.7% |

| Ivanhoe Mines (TSX:IVN) | CA$10.86 | CA$18.44 | 41.1% |

| Exchange Income (TSX:EIF) | CA$65.94 | CA$102.69 | 35.8% |

We're going to check out a few of the best picks from our screener tool.

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates globally in aerospace and aviation services, equipment, and manufacturing sectors with a market cap of CA$3.40 billion.

Operations: The company generates revenue from two primary segments: Aerospace & Aviation, contributing CA$1.66 billion, and Manufacturing, which accounts for CA$1.07 billion.

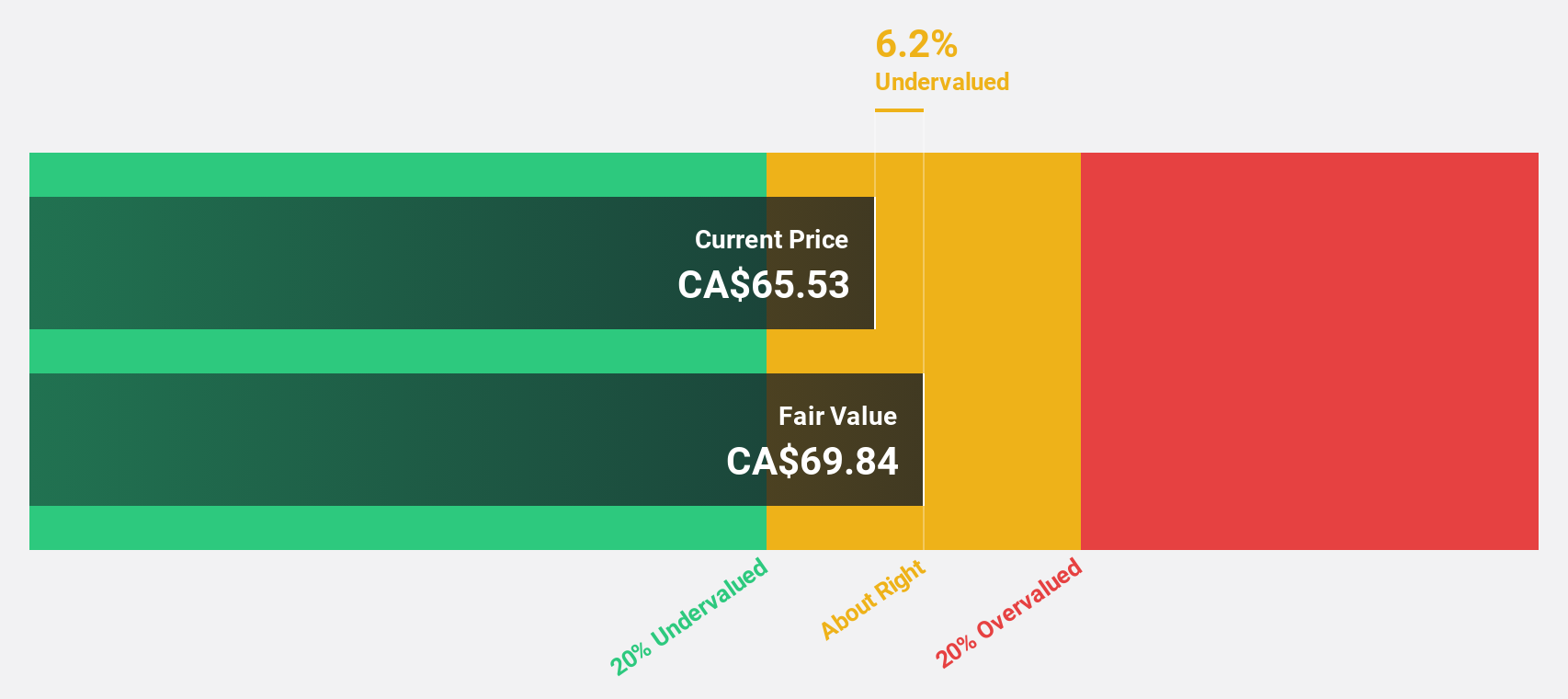

Estimated Discount To Fair Value: 35.8%

Exchange Income Corporation, trading at CA$65.94, is undervalued based on discounted cash flow analysis with a fair value estimate of CA$102.69. The company has demonstrated strong earnings growth of 22.2% annually over the past five years and forecasts suggest continued robust earnings growth at 24.47% per year, outpacing the Canadian market's average. However, its dividend yield of 4% is not well covered by earnings or free cash flows and interest payments are not well covered by current earnings levels.

- According our earnings growth report, there's an indication that Exchange Income might be ready to expand.

- Navigate through the intricacies of Exchange Income with our comprehensive financial health report here.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd., along with its subsidiaries, is involved in the mining, development, and exploration of minerals and precious metals in Africa, with a market capitalization of CA$14.14 billion.

Operations: Ivanhoe Mines Ltd. operates in the mining, development, and exploration of minerals and precious metals across Africa.

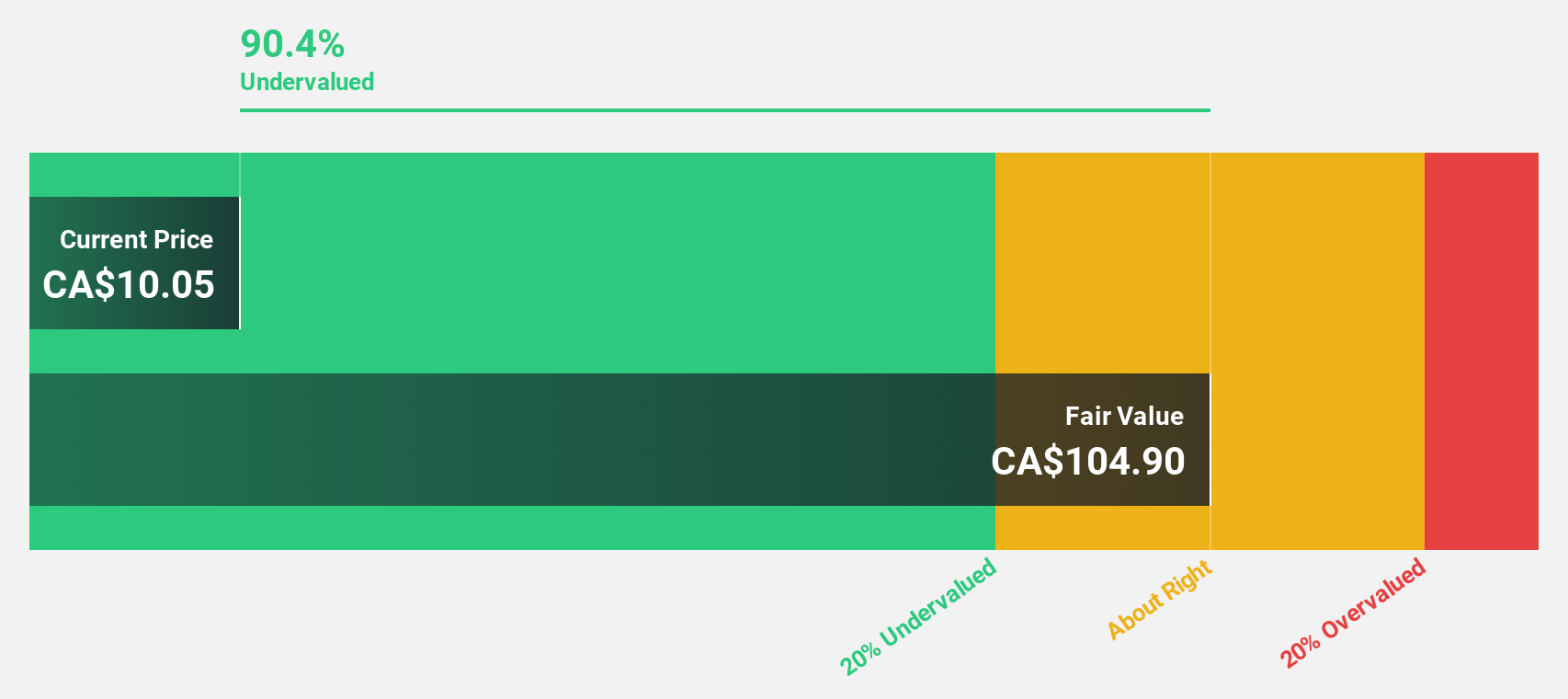

Estimated Discount To Fair Value: 41.1%

Ivanhoe Mines, trading at CA$10.86, is significantly undervalued with a fair value estimate of CA$18.44 based on discounted cash flow analysis. Despite recent operational challenges at the Kamoa-Kakula Copper Complex, including seismic activity affecting production guidance for 2026, Ivanhoe's earnings are projected to grow substantially over the next three years, outpacing market averages. The company’s revenue growth forecast of 34.1% annually also surpasses Canadian market expectations significantly.

- Our earnings growth report unveils the potential for significant increases in Ivanhoe Mines' future results.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties across the United States, the Philippines, and New Zealand with a market cap of CA$4.45 billion.

Operations: OceanaGold's revenue segments include Haile at $591.70 million, Waihi at $161.20 million, Didipio at $330.10 million, and Macraes at $300.60 million.

Estimated Discount To Fair Value: 49.2%

OceanaGold, trading at CA$19.2, is significantly undervalued with a fair value estimate of CA$37.81 based on discounted cash flow analysis. The company's earnings are projected to grow substantially over the next three years, outpacing Canadian market averages. Despite recent insider selling and a stock split, OceanaGold's revenue growth forecast remains robust at 11.9% per year, supported by promising exploration results from its Wharekirauponga project in New Zealand.

- In light of our recent growth report, it seems possible that OceanaGold's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in OceanaGold's balance sheet health report.

Seize The Opportunity

- Get an in-depth perspective on all 28 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives