- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

3 Top UK Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China that highlighted ongoing challenges in global economic recovery. With the London markets feeling the impact of these international developments, investors may find stability in dividend stocks, which can offer a consistent income stream even amid market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.75% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.83% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.51% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.04% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.97% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.22% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.81% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.10% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.44% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.01% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £189.25 million.

Operations: City of London Investment Group PLC generates its revenue primarily from its asset management segment, which amounts to $72.64 million.

Dividend Yield: 8%

City of London Investment Group offers an attractive dividend yield of 8%, placing it in the top 25% of UK dividend payers. However, the sustainability is questionable due to a high payout ratio of 111.6% and volatility over the past decade. Despite recent earnings growth, dividends aren't fully covered by earnings or cash flows. Recent leadership changes, including Mike Edmonds as Chief Investment Officer, could influence future strategic directions and potentially impact dividend reliability.

- Click to explore a detailed breakdown of our findings in City of London Investment Group's dividend report.

- The valuation report we've compiled suggests that City of London Investment Group's current price could be inflated.

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions across the Republic of Ireland, the United Kingdom, France, the United States, and other international markets with a market cap of approximately £4.71 billion.

Operations: DCC plc generates revenue through its two main segments: DCC Energy, contributing £13.37 billion, and DCC Technology, adding £4.64 billion.

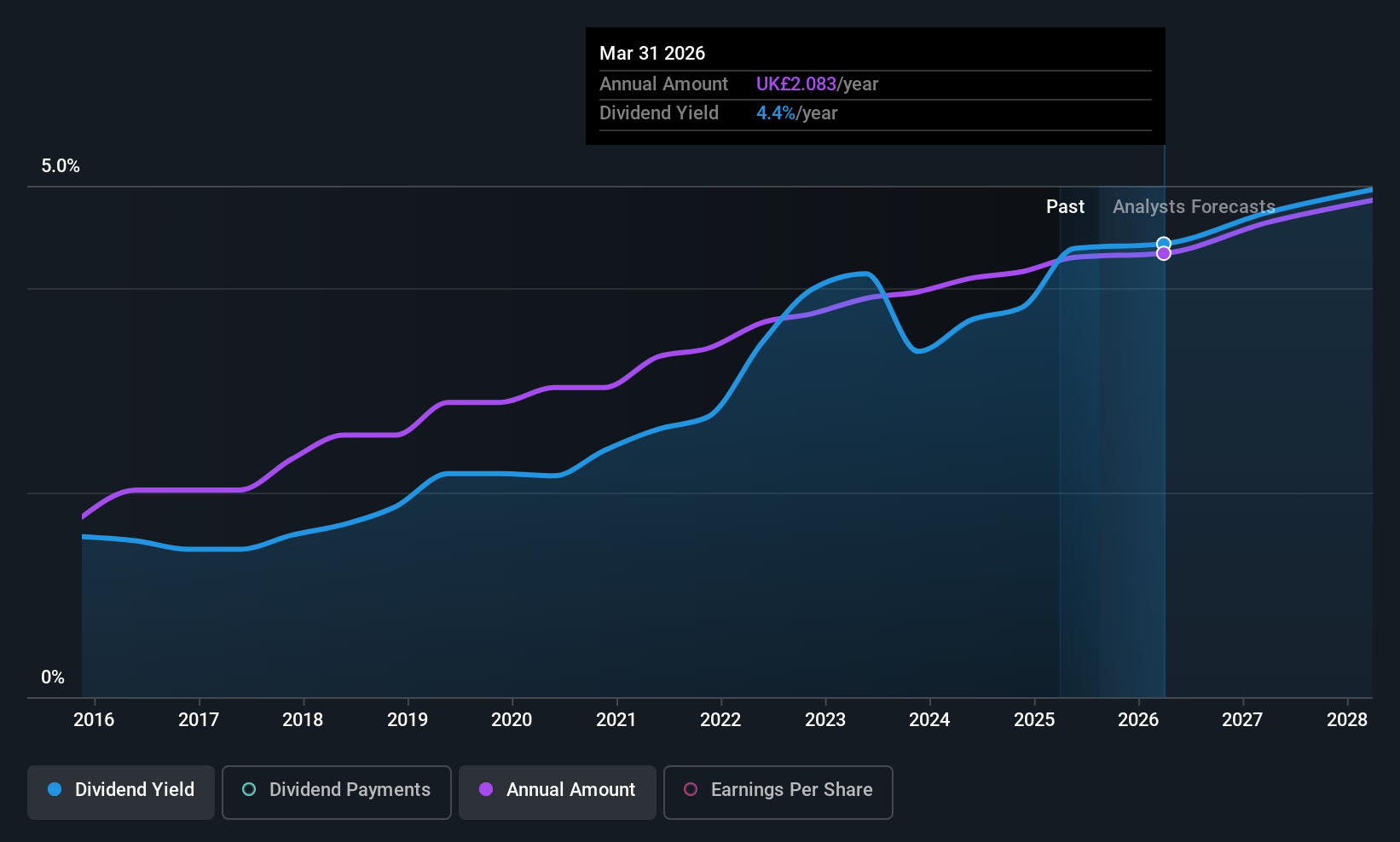

Dividend Yield: 4.3%

DCC has shown consistent dividend growth over the past decade, supported by stable payments. However, its high payout ratio of 98.1% suggests dividends aren't well covered by earnings, raising sustainability concerns despite a cash payout ratio of 54.7%. The dividend yield is lower than top-tier UK stocks at 4.26%. Recent strategic moves include a £100 million share buyback to return capital from the DCC Healthcare sale and anticipated profit growth for FY2026.

- Click here and access our complete dividend analysis report to understand the dynamics of DCC.

- In light of our recent valuation report, it seems possible that DCC is trading behind its estimated value.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom with a market cap of £774.26 million.

Operations: ME Group International plc generates revenue of £311.32 million from its Personal Services segment.

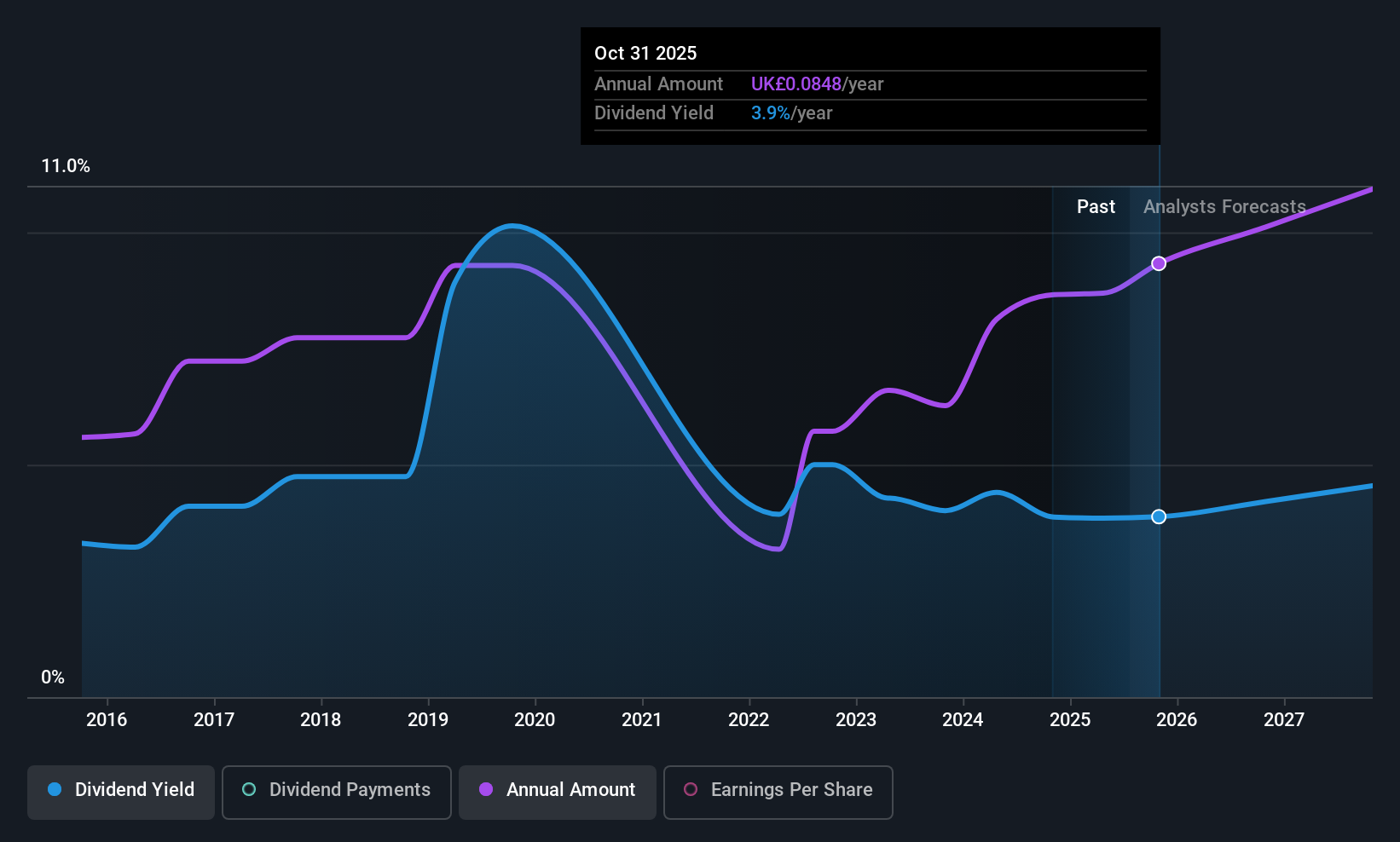

Dividend Yield: 3.9%

ME Group International recently increased its interim dividend by 11.6% to 3.85 pence per share, totaling a £14.5 million return to shareholders, yet the yield remains below top-tier UK dividend stocks at 3.85%. While dividends are covered by both earnings and cash flows with payout ratios of 54.8% and 82.8%, respectively, the track record is volatile over the past decade. Recent earnings growth supports future payouts amid strategic evaluations for shareholder value enhancement.

- Unlock comprehensive insights into our analysis of ME Group International stock in this dividend report.

- Our valuation report unveils the possibility ME Group International's shares may be trading at a discount.

Next Steps

- Access the full spectrum of 54 Top UK Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives