As the Canadian market navigates through global economic uncertainties and trade negotiations, investors are focusing on diversification and resilience in their portfolios. In this context, dividend stocks stand out as a compelling choice for those seeking stable income and potential growth, offering an opportunity to balance risk amidst fluctuating market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 3.88% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.92% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.43% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 8.77% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.61% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.36% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.23% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.01% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.48% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.55% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acadian Timber Corp., along with its subsidiaries, operates in the forest products sector in Eastern Canada and the Northeastern United States, with a market cap of CA$318.37 million.

Operations: Acadian Timber Corp.'s revenue is primarily derived from its New Brunswick Timberlands segment, which contributes CA$77.31 million, and its Maine Timberlands segment, contributing CA$15.24 million.

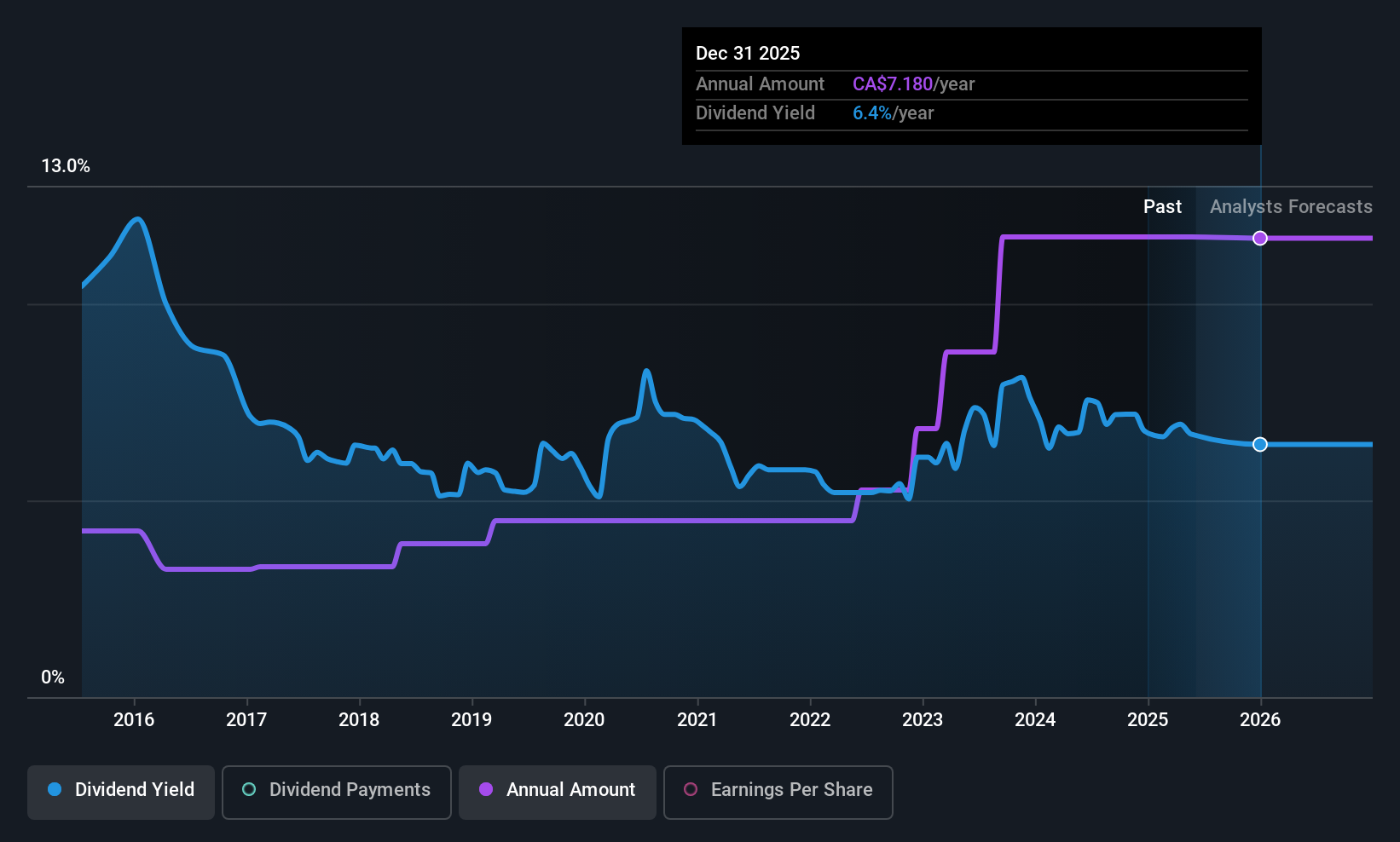

Dividend Yield: 6.6%

Acadian Timber's dividend yield of 6.55% ranks in the top 25% of Canadian payers, with stable growth over the past decade. However, its dividends are not covered by earnings due to a high payout ratio of 106%, though cash flows do cover them at an 87.2% ratio. Recent Q1 results showed a decline in sales and net income compared to last year, yet the company affirmed its quarterly dividend of CAD 0.29 per share payable on July 15, 2025.

- Navigate through the intricacies of Acadian Timber with our comprehensive dividend report here.

- Our expertly prepared valuation report Acadian Timber implies its share price may be too high.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olympia Financial Group Inc., with a market cap of CA$287.92 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc.'s revenue segments include Health at CA$10.28 million, Corporate at CA$0.04 million, Exempt Edge (EE) at CA$1.51 million, Investment Account Services (IAS) at CA$79.09 million, Currency and Global Payments (CGP) at CA$6.80 million, and Corporate and Shareholder Services (CSS) at CA$5.12 million.

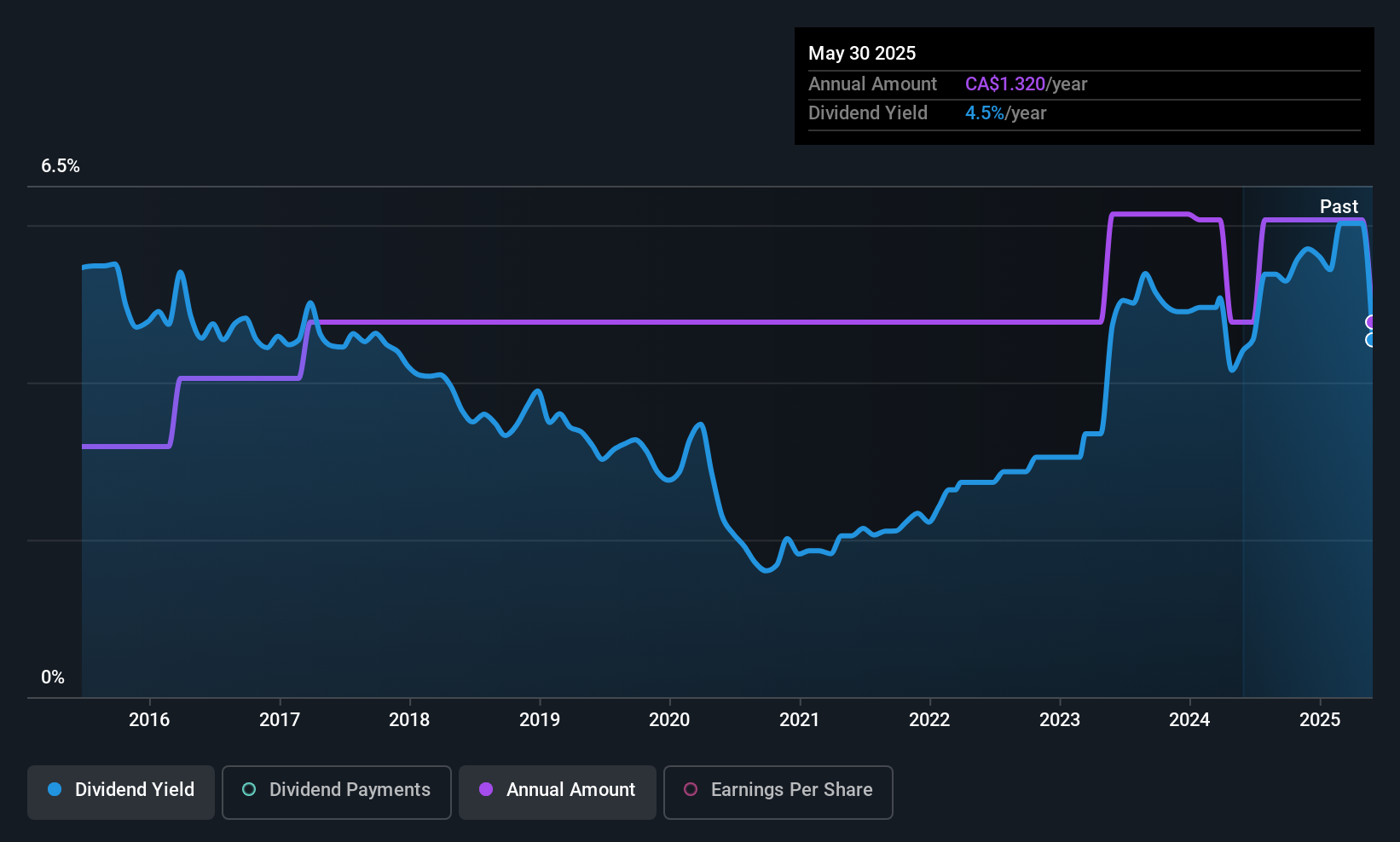

Dividend Yield: 6%

Olympia Financial Group's dividend yield is slightly below the top 25% of Canadian payers. Despite a reasonable payout ratio with earnings and cash flows covering dividends, its track record is unstable with past volatility. Recent Q1 results indicate stable revenue but a slight decline in net income year-over-year. The company affirmed its monthly CAD 0.60 dividend, payable June 30, 2025, which remains consistent despite historical unreliability in payments.

- Click to explore a detailed breakdown of our findings in Olympia Financial Group's dividend report.

- Upon reviewing our latest valuation report, Olympia Financial Group's share price might be too pessimistic.

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Richards Packaging Income Fund, operating in North America, focuses on designing, manufacturing, and distributing packaging containers and healthcare supplies with a market cap of CA$360.09 million.

Operations: Richards Packaging Income Fund generates revenue primarily through its wholesale miscellaneous segment, which accounts for CA$410.61 million.

Dividend Yield: 4%

Richards Packaging Income Fund's dividend yield is lower than the top Canadian payers, yet its dividends are well covered by earnings and cash flows. Despite a history of volatility, dividends have grown over 10 years. Recent Q1 results show increased sales but decreased net income year-over-year. The company affirmed a monthly CAD 0.11 dividend for June 2025, maintaining consistency despite past instability in payments and trading below estimated fair value enhances its appeal for value-focused investors.

- Take a closer look at Richards Packaging Income Fund's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Richards Packaging Income Fund is priced lower than what may be justified by its financials.

Taking Advantage

- Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 24 more companies for you to explore.Click here to unveil our expertly curated list of 27 Top TSX Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives